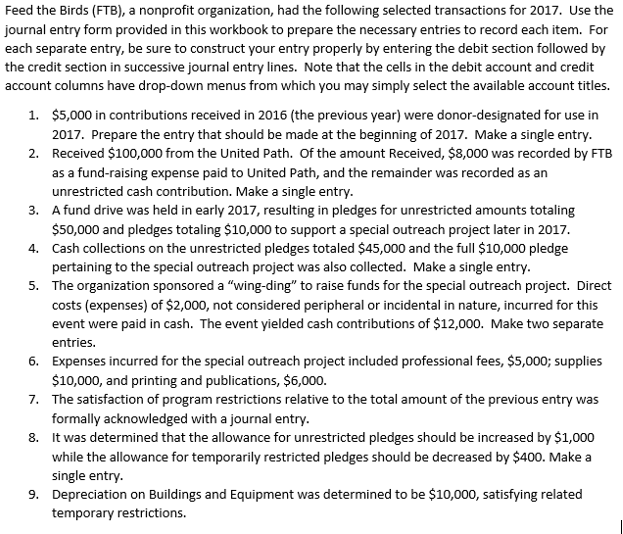

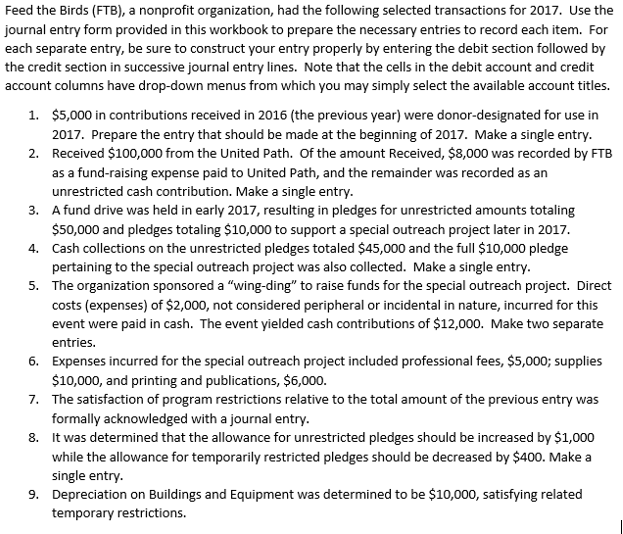

Feed the Birds (FTB), a nonprofit organization, had the following selected transactions for 2017. Use the journal entry form provided in this workbook to prepare the necessary entries to record each item. For each separate entry, be sure to construct your entry properly by entering the debit section followed by the credit section in successive journal entry lines. Note that the cells in the debit account and credit account columns have drop-down menus from which you may simply select the available account titles. $5,000 in contributions received in 2016 (the previous year) were donor-designated for use in 2017. Prepare the entry that should be made at the beginning of 2017. Make a single entry. Received $100,000 from the United Path. Of the amount Received, $8,000 was recorded by FTB as a fund-raising expense paid to United Path, and the remainder was recorded as an unrestricted cash contribution. Make a single entry. A fund drive was held in early 2017, resulting in pledges for unrestricted amounts totaling $50,000 and pledges totaling $10,000 to support a special outreach project later in 2017. Cash collections on the unrestricted pledges totaled $45,000 and the full $10,000 pledge pertaining to the special outreach project was also collected. Make a single entry. The organization sponsored a "wing-ding" to raise funds for the special outreach project. Direct costs (expenses) of $2,000, not considered peripheral or incidental in nature, incurred for this event were paid in cash. The event yielded cash contributions of $12,000. Make two separate entries. Expenses incurred for the special outreach project included professional fees, $5,000; supplies $10,000, and printing and publications, $6,000. The satisfaction of program restrictions relative to the total amount of the previous entry was formally acknowledged with a journal entry. It was determined that the allowance for unrestricted pledges should be increased by $1,000 while the allowance for temporarily restricted pledges should be decreased by $400. Make a single entry. Depreciation on Buildings and Equipment was determined to be $10,000, satisfying related temporary restrictions. Feed the Birds (FTB), a nonprofit organization, had the following selected transactions for 2017. Use the journal entry form provided in this workbook to prepare the necessary entries to record each item. For each separate entry, be sure to construct your entry properly by entering the debit section followed by the credit section in successive journal entry lines. Note that the cells in the debit account and credit account columns have drop-down menus from which you may simply select the available account titles. $5,000 in contributions received in 2016 (the previous year) were donor-designated for use in 2017. Prepare the entry that should be made at the beginning of 2017. Make a single entry. Received $100,000 from the United Path. Of the amount Received, $8,000 was recorded by FTB as a fund-raising expense paid to United Path, and the remainder was recorded as an unrestricted cash contribution. Make a single entry. A fund drive was held in early 2017, resulting in pledges for unrestricted amounts totaling $50,000 and pledges totaling $10,000 to support a special outreach project later in 2017. Cash collections on the unrestricted pledges totaled $45,000 and the full $10,000 pledge pertaining to the special outreach project was also collected. Make a single entry. The organization sponsored a "wing-ding" to raise funds for the special outreach project. Direct costs (expenses) of $2,000, not considered peripheral or incidental in nature, incurred for this event were paid in cash. The event yielded cash contributions of $12,000. Make two separate entries. Expenses incurred for the special outreach project included professional fees, $5,000; supplies $10,000, and printing and publications, $6,000. The satisfaction of program restrictions relative to the total amount of the previous entry was formally acknowledged with a journal entry. It was determined that the allowance for unrestricted pledges should be increased by $1,000 while the allowance for temporarily restricted pledges should be decreased by $400. Make a single entry. Depreciation on Buildings and Equipment was determined to be $10,000, satisfying related temporary restrictions