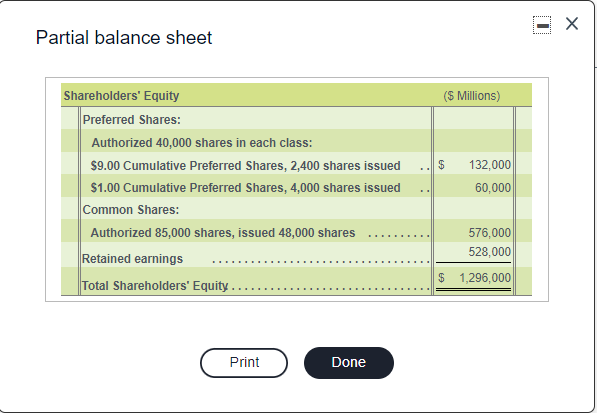

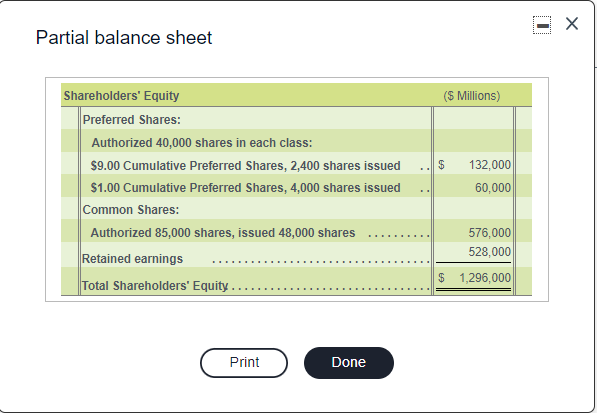

Feelsafe Security Inc. included the following shareholders' equity on its balance sheet at December 31, 2020: B (Click the icon to view the partial balance sheet.) Requirements 1. Identify the different issues of shares Feelsafe Security has outstanding. 2. What was the value at which the $1.00 Cumulative Preferred Shares were issued? 3. Suppose Feelsafe decided not to pay its preferred dividends for one year. Would the company have to pay these dividends in arrears before paying dividends to the common shareholders? Why? 4. What amount of preferred dividends must Feelsafe declare and pay each year to avoid having preferred dividends in arrears? 5. Assume preferred dividends are in arrears for 2019. Journalize the declaration of a $80,000 cash dividend for 2020. No explanation is needed. Requirement 1. Identify the different issues of shares Feelsafe Security has outstanding. (Select all that apply.) A. Common Shares B. $1.00 Non-cumulative Preferred Shares C. $9.00 Non-cumulative Preferred Shares D. $9.00 Cumulative Preferred Shares E. $1.00 Cumulative Preferred Shares F. Cumulative Common Shares Requirement 2. What was the value at which the $1.00 Cumulative Preferred Shares were issued? Feelsafe Security issued the $1.00 Cumulative Preferred Shares at sper share. Requirement 3. Suppose Feelsafe passed its preferred dividends for one year. Would the company have to pay these dividends in arrears before paying dividends to the common shareholders? Why? Feelsafe have to pay preferred dividends in arrears before paying dividends to the common shareholders because the preferred shares are Requirement 4. What amount of preferred dividends must Feelsafe declare and pay each year to avoid having preferred dividends in arrears? Feelsafe must declare and pay preferred dividends of each year to avoid having preferred dividends in arrears. Requirement 5. Assume preferred dividends are in arrears for 2019. Journalize the declaration of a $80,000 cash dividend for 2020. No explanation is needed. (Record debits first, then credits. Explanations are not required.) Date Accounts Debit Credit Partial balance sheet ($ Millions) $ Shareholders' Equity Preferred Shares: Authorized 40,000 shares in each class: $9.00 Cumulative Preferred Shares, 2,400 shares issued $1.00 Cumulative Preferred Shares, 4,000 shares issued Common Shares: Authorized 85,000 shares, issued 48,000 shares Retained earnings Total Shareholders' Equity.. 132,000 60,000 576,000 528,000 $ 1,296,000 Print Done