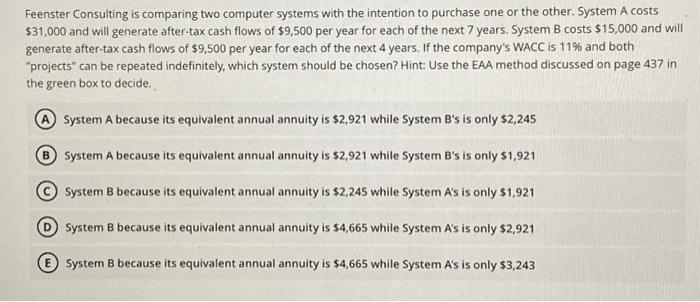

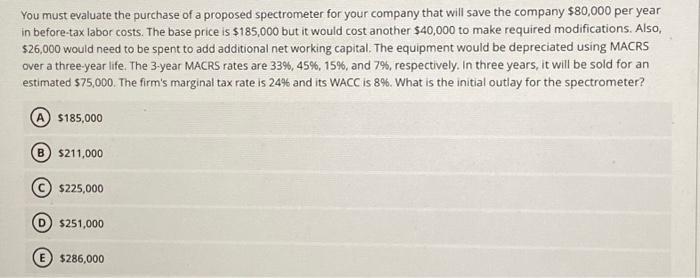

Feenster Consulting is comparing two computer systems with the intention to purchase one or the other. System A costs $31,000 and will generate after-tax cash flows of $9,500 per year for each of the next 7 years. System B costs $15,000 and will generate after-tax cash flows of $9,500 per year for each of the next 4 years. If the company's WACC is 11% and both "projects" can be repeated indefinitely, which system should be chosen? Hint: Use the EAA method discussed on page 437 in the green box to decide. System A because its equivalent annual annuity is $2,921 while System B's is only $2,245 (B) System A because its equivalent annual annuity is $2,921 while System B's is only $1,921 System B because its equivalent annual annuity is $2,245 while System A's is only $1,921 (D) System B because its equivalent annual annuity is $4,665 while System A 's is only $2,921 System B because its equivalent annual annuity is $4,665 while System A's is only $3,243 You must evaluate the purchase of a proposed spectrometer for your company that will save the company $80,000 per year in before-tax labor costs. The base price is $185,000 but it would cost another $40,000 to make required modifications. Also, $26,000 would need to be spent to add additional net working capital. The equipment would be depreciated using MACRS over a three-year life. The 3-year MACRS rates are 33%,45%,15%, and 7%, respectively. In three years, it will be sold for an estimated $75,000. The firm's marginal tax rate is 24% and its WACC is 8%. What is the initial outlay for the spectrometer? (A) $185,000 (B) $211,000 (C) $225,000 (D) $251,000 (E) $286,000 Feenster Consulting is comparing two computer systems with the intention to purchase one or the other. System A costs $31,000 and will generate after-tax cash flows of $9,500 per year for each of the next 7 years. System B costs $15,000 and will generate after-tax cash flows of $9,500 per year for each of the next 4 years. If the company's WACC is 11% and both "projects" can be repeated indefinitely, which system should be chosen? Hint: Use the EAA method discussed on page 437 in the green box to decide. System A because its equivalent annual annuity is $2,921 while System B's is only $2,245 (B) System A because its equivalent annual annuity is $2,921 while System B's is only $1,921 System B because its equivalent annual annuity is $2,245 while System A's is only $1,921 (D) System B because its equivalent annual annuity is $4,665 while System A 's is only $2,921 System B because its equivalent annual annuity is $4,665 while System A's is only $3,243 You must evaluate the purchase of a proposed spectrometer for your company that will save the company $80,000 per year in before-tax labor costs. The base price is $185,000 but it would cost another $40,000 to make required modifications. Also, $26,000 would need to be spent to add additional net working capital. The equipment would be depreciated using MACRS over a three-year life. The 3-year MACRS rates are 33%,45%,15%, and 7%, respectively. In three years, it will be sold for an estimated $75,000. The firm's marginal tax rate is 24% and its WACC is 8%. What is the initial outlay for the spectrometer? (A) $185,000 (B) $211,000 (C) $225,000 (D) $251,000 (E) $286,000