Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Feet First plc (FF) manufactures an iconic brand of footwear in the UK. FF has a financial year ending 31 December 2022. In March

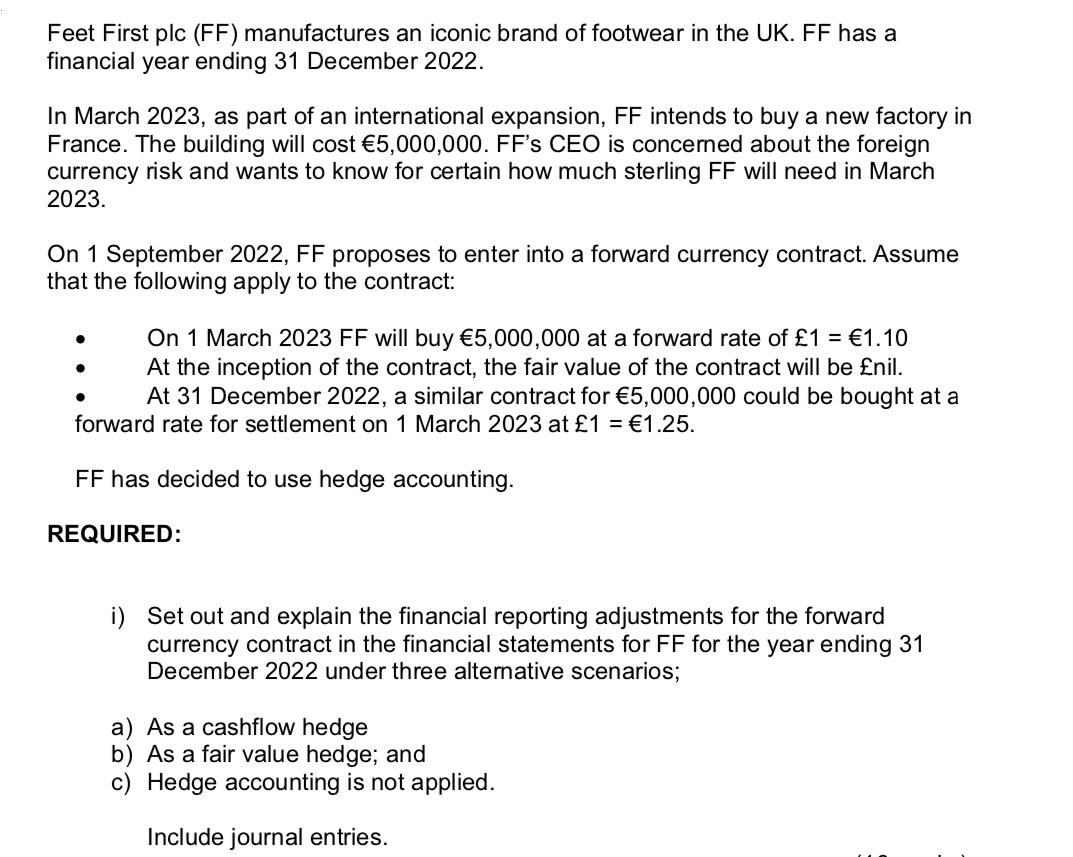

Feet First plc (FF) manufactures an iconic brand of footwear in the UK. FF has a financial year ending 31 December 2022. In March 2023, as part of an international expansion, FF intends to buy a new factory in France. The building will cost 5,000,000. FF's CEO is concerned about the foreign currency risk and wants to know for certain how much sterling FF will need in March 2023. On 1 September 2022, FF proposes to enter into a forward currency contract. Assume that the following apply to the contract: On 1 March 2023 FF will buy 5,000,000 at a forward rate of 1 = 1.10 At the inception of the contract, the fair value of the contract will be nil. At 31 December 2022, a similar contract for 5,000,000 could be bought at a forward rate for settlement on 1 March 2023 at 1 = 1.25. FF has decided to use hedge accounting. REQUIRED: i) Set out and explain the financial reporting adjustments for the forward currency contract in the financial statements for FF for the year ending 31 December 2022 under three alternative scenarios; a) As a cashflow hedge b) As a fair value hedge; and c) Hedge accounting is not applied. Include journal entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a As a cash flow hedge ANS WER The financial reporting adjustments for the forward currency contract in the financial statements for FF for the year e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started