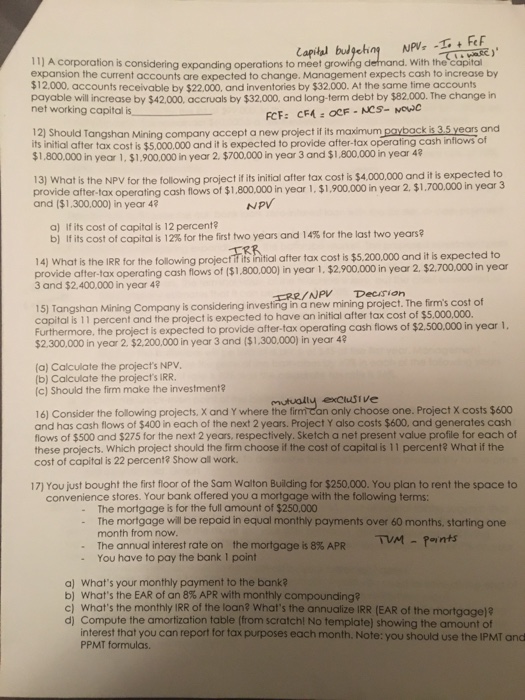

Fef 11) A corporation is considering expanding operations to meet growi expansion the current accounts are expected to change. Management expects cash to increase by $12.000, accounts receivable by $22.000, and inventories by $32.000. At the same time accounts payable will increase by $42,000, accruals by $32.000, and long-term debt by $82.000. The change in net working capital is With the capital 12) Should Tangshan Mining company accept a new project if its maximum payback is 35 years and its initial after tax cost is $5,000,000 and it is expected to provide after-tax operating cash inflows $1.,800,000 in year 1, $1.900000 in year 2. $700.000 in year 3 and $1,800,000 in year 4 13) What is the NPV for the following project if its initial after tax cost is $4,000,000 and it is expected to provide after-tax operating cash flows of $1,800,000 in year 1. $1,900.000 in year 2. $1,700.000 in year 3 and ($1.300.000) in year 4? NPV a) If its cost of capital is 12 percent? b) if its cost of capital is 12% for the first two years and 14% for the last two years 14 what is the IRR for the folowing projal ter ax cos is $5 20000 and it s expected to its initial after tax cost is $5.200,000 and it is expected to 14) What is the IRR for the following projecfif provide after-tax operating cash flows of ($1,800.000) in year 1. $2.900.000 in year 2, $2.700,000 in year 3 and $2.400.000 in year 4? ERR/NPV Decsion 15) Tangshan Mining Company is considering investing in a new mining project. The firm's cost of copital is 11 percent and the project is expected to have an initial after tax cost of $5.000,000. Furthermore, the project is expected to provide after-tax operating cash flows of $2,500.000 in year 1 2.300,000 in year 2. $2,200,000 in year 3 and ($1,300,000) in year 4 (a) Calculate the project's NPV (b) Calculate the projects IRR (c) Should the firm make the investment? mutually excluSive on only choose one. Project X costs $600 16) Consider the following projects, X and Y where the and has cash flows of $400 in each of the next 2 years. Project Y also costs $600, and generates cash flows of $500 and $275 for the next 2 years, respectively. Sketch a net present value profile for each of these projects. Which project should the firm choose if the cost of capital is 11 percent? What if the cost of capital is 22 percent? Show all work. 17) You just bought the first floor of the Sam Walton Building for $250,000. You plan to rent the space to convenience stores. Your bank offered you a mortgage with the following terms: The mortgage is for the full amount of $250,000 The mortgage will be repaid in equal monthly payments over 60 months, starting one month from now The annual interest rate on the mortgage is 8% APR /M-points You have to pay the bank 1 point . a) What's your monthly payment to the bank? b) c) What's the monthly IRR of the loan? What's the annualize IRR (EAR of the mortgage)? d) Compute the amortization table (from scratchl No template) showing What's the EAR of an 8% APR with monthly compounding? interest that you can report for tax purposes each month. Note: you should use the IPMT and PPMT formulas