Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Felicia, Jackson and Elizabeth are in Partnership Sharing Profits and Losses in the ratio of 5:3:2 respectively. According to the Partnership Agreement, Partners Capital

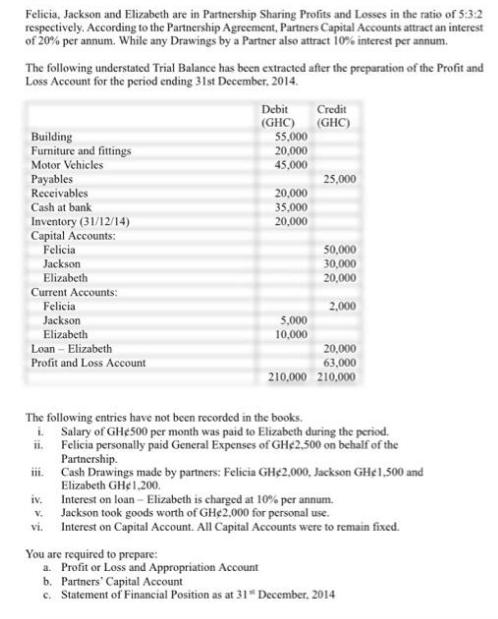

Felicia, Jackson and Elizabeth are in Partnership Sharing Profits and Losses in the ratio of 5:3:2 respectively. According to the Partnership Agreement, Partners Capital Accounts attract an interest of 20% per annum. While any Drawings by a Partner also attract 10% interest per annum. The following understated Trial Balance has been extracted after the preparation of the Profit and Loss Account for the period ending 31st December, 2014. Building Furniture and fittings Motor Vehicles Payables Receivables Cash at bank Inventory (31/12/14) Capital Accounts: Felicia Jackson Elizabeth Current Accounts: Felicia Jackson Elizabeth Loan - Elizabeth Profit and Loss Account 11. Debit (GHC) 111. 55,000 20,000 45,000 20,000 35,000 20,000 5,000 10,000 The following entries have not been recorded in the books. i. Credit (GHC) 25,000 50,000 30,000 20,000 2,000 20,000 63,000 210,000 210,000 Salary of GHe 500 per month was paid to Elizabeth during the period. Felicia personally paid General Expenses of GHe2,500 on behalf of the Partnership. Cash Drawings made by partners: Felicia GH2,000, Jackson GH1,500 and Elizabeth GHe 1,200. Interest on loan - Elizabeth is charged at 10% per annum. Jackson took goods worth of GHe2,000 for personal use. iv. v. vi. Interest on Capital Account. All Capital Accounts were to remain fixed. You are required to prepare: a. Profit or Loss and Appropriation Account b. Partners Capital Account c. Statement of Financial Position as at 31 December, 2014

Step by Step Solution

★★★★★

3.44 Rating (189 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started