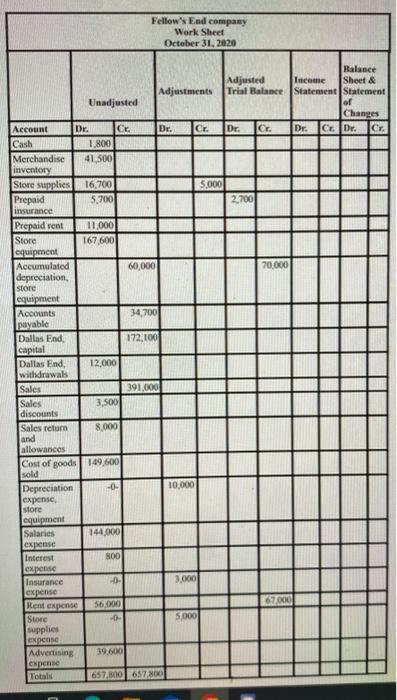

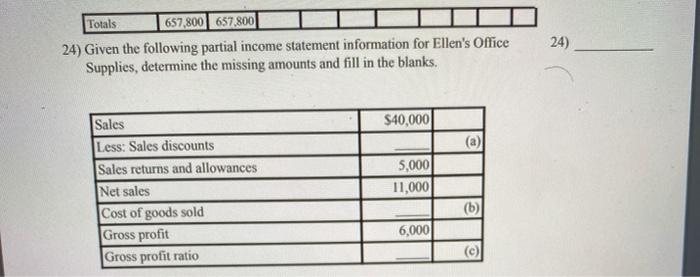

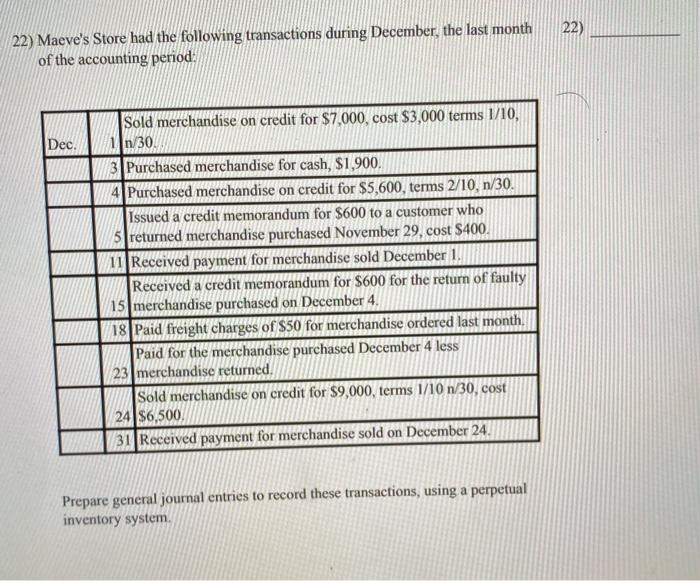

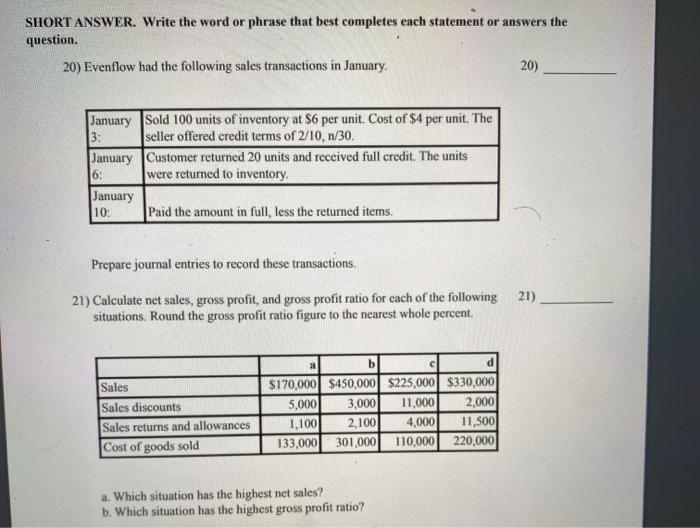

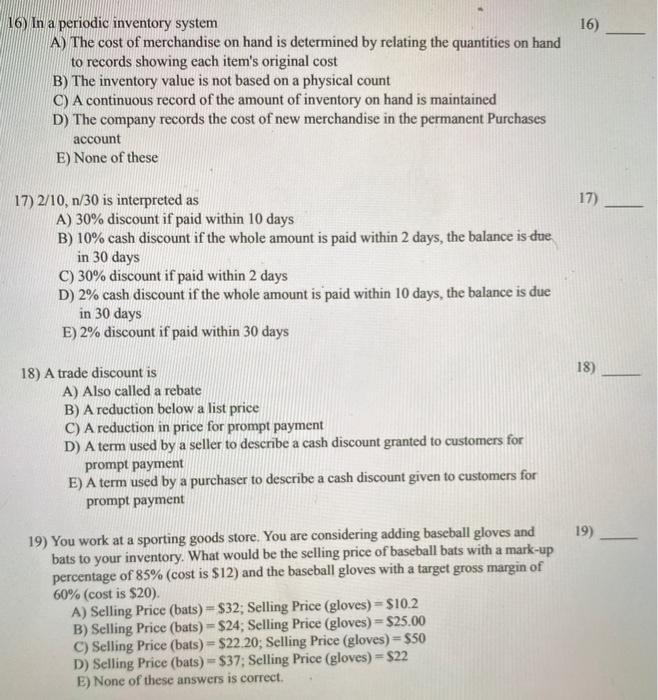

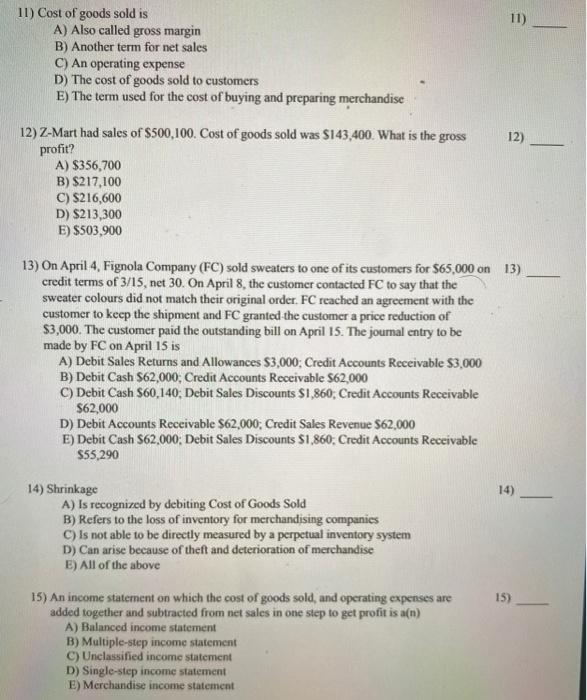

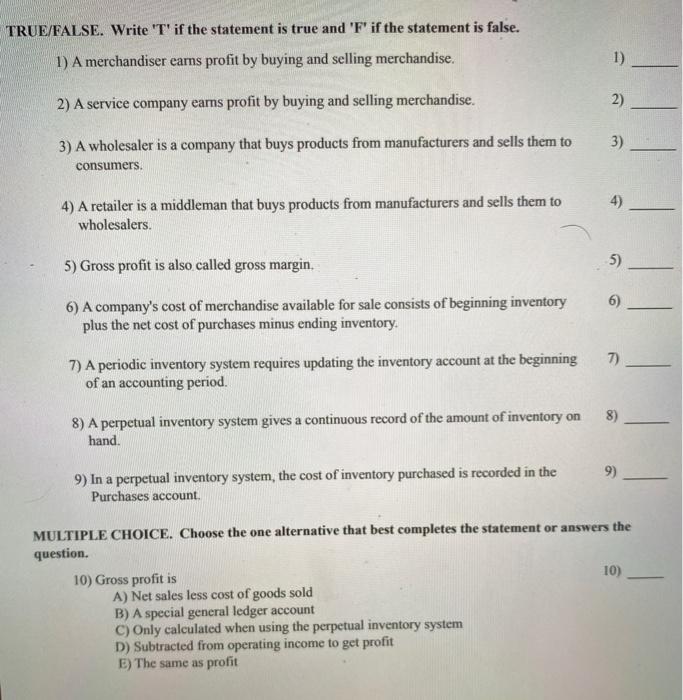

Fellow's End company Work Sheet October 31, 2020 CE Dr. Balance Adjusted Income Sheet & Adjustments Trial Balance Statement Statement Unadjusted of Changes Account Dr. Cr Dr. Dr. CE C. Dr. Cr. Cash 1.800 Merchandise 41.500 inventory Store Supplies 16.700 5,000 Prepaid 5,700 2.700 insurance Prepaid rent 11,000 Store 167,600 equipment Accumulated 60,000 70.000 depreciation store equipment Accounts 34,700 payable Dallas End, 172.100 capital Dallas End, 12.000 withdrawals Sales 391,000 Sales 3.500 discounts Sales return 8,000 and allowances Cost of goods 149,600 Isold Depreciation -0- 10,000 expense, store equipment Salaries 144.000 expense Interest expense Insurance -0- 3.000 expense Rent expense 56,000 67.000 Store -0- 5.000 supplies expense Advertising 39.600 Total 657.100657800 800 Totals 657,800 657,800 24) Given the following partial income statement information for Ellen's Office Supplies, determine the missing amounts and fill in the blanks. 24) $40,000 Sales Less: Sales discounts Sales returns and allowances Net sales Cost of goods sold Gross profit Gross profit ratio 5,000 11,000 (b) 6,000 22) 22) Maeve's Store had the following transactions during December, the last month of the accounting period: Dec. Sold merchandise on credit for $7,000, cost $3,000 terms 1/10, 1n/30 3 Purchased merchandise for cash, $1,900. 4 Purchased merchandise on credit for $5,600, terms 2/10, n/30. Issued a credit memorandum for $600 to a customer who 5 returned merchandise purchased November 29, cost $400. 11 Received payment for merchandise sold December 1. Received a credit memorandum for $600 for the return of faulty 15 merchandise purchased on December 4 18 Paid freight charges of $50 for merchandise ordered last month, Paid for the merchandise purchased December 4 less 23 merchandise returned. Sold merchandise on credit for $9,000, terms 1/10 n/30, cost 24 $6,500 31 Received payment for merchandise sold on December 24. Prepare general journal entries to record these transactions, using a perpetual inventory system SHORT ANSWER. Write the word or phrase that best completes each statement or answers the question. 20) Evenflow had the following sales transactions in January 20) January Sold 100 units of inventory at $6 per unit. Cost of $4 per unit. The 3: seller offered credit terms of 2/10,n/30. January Customer returned 20 units and received full credit. The units 6: were returned to inventory. January 10: Paid the amount in full, less the returned items. Prepare journal entries to record these transactions 21) Calculate net sales, gross profit, and gross profit ratio for each of the following 21) situations. Round the gross profit ratio figure to the nearest whole percent Sales Sales discounts Sales returns and allowances Cost of goods sold a b $170,000 $450,000 $225,000 $330,000 5,000 3,000 11,000 2,000 1.100 2,100 4,000 11,500 133,000 301.000 110,000 220,000 a. Which situation has the highest net sales? b. Which situation has the highest gross profit ratio? 16) 16) In a periodic inventory system A) The cost of merchandise on hand is determined by relating the quantities on hand to records showing each item's original cost B) The inventory value is not based on a physical count C) A continuous record of the amount of inventory on hand is maintained D) The company records the cost of new merchandise in the permanent Purchases account E) None of these 17) 17) 2/10, n/30 is interpreted as A) 30% discount if paid within 10 days B) 10% cash discount if the whole amount is paid within 2 days, the balance is due in 30 days C) 30% discount if paid within 2 days D) 2% cash discount if the whole amount is paid within 10 days, the balance is due in 30 days E) 2% discount if paid within 30 days 18) 18) A trade discount is A) Also called a rebate B) A reduction below a list price C) A reduction in price for prompt payment D) A term used by a seller to describe a cash discount granted to customers for prompt payment E) A term used by a purchaser to describe a cash discount given to customers for prompt payment 19) 19) You work at a sporting goods store. You are considering adding baseball gloves and bats to your inventory. What would be the selling price of baseball bats with a mark-up percentage of 85% (cost is $12) and the baseball gloves with a target gross margin of 60% (cost is $20) A) Selling Price (bats) = $32, Selling Price (gloves) = $10.2 B) Selling Price (bats) = $24; Selling Price (gloves) = $25.00 C) Selling Price (bats) = $22. 20; Selling Price (gloves) = $50 D) Selling Price (bats) = $37; Selling Price (gloves) = $22 E) None of these answers is correct. 11) 11) Cost of goods sold is A) Also called gross margin B) Another term for net sales C) An operating expense D) The cost of goods sold to customers E) The term used for the cost of buying and preparing merchandise 12) 12) Z-Mart had sales of $500,100. Cost of goods sold was $143,400. What is the gross profit? A) $356,700 B) $217,100 C) $216,600 D) $213,300 E) $503,900 13) On April 4, Fignola Company (FC) sold sweaters to one of its customers for $65,000 on 13) credit terms of 3/15, net 30. On April 8, the customer contacted FC to say that the sweater colours did not match their original order. FC reached an agreement with the customer to keep the shipment and FC granted the customer a price reduction of $3,000. The customer paid the outstanding bill on April 15. The journal entry to be made by FC on April 15 is A) Debit Sales Returns and Allowances $3,000; Credit Accounts Receivable $3,000 B) Debit Cash $62,000; Credit Accounts Receivable 562,000 C) Debit Cash S60,140; Debit Sales Discounts $1,860; Credit Accounts Receivable $62,000 D) Debit Accounts Receivable $62,000; Credit Sales Revenue $62,000 E) Debit Cash S62.000: Debit Sales Discounts S1,860: Credit Accounts Receivable $55,290 14) 1 14) Shrinkage A) Is recognized by debiting Cost of Goods Sold B) Refers to the loss of inventory for merchandising companies C) Is not able to be directly measured by a perpetual inventory system D) Can arise because of theft and deterioration of merchandise E) All of the above 15) 15) An income statement on which the cost of goods sold, and operating expenses are added together and subtracted from net sales in one step to get profit is a(n) A) Balanced income statement B) Multiple-step income statement C) Unclassified income statement D) Single-step income statement E) Merchandise income statement TRUE/FALSE. Write 'T' if the statement is true and 'F' if the statement is false. 1) A merchandiser earns profit by buying and selling merchandise. 1) 2) A service company ears profit by buying and selling merchandise. 2) 3) A wholesaler is a company that buys products from manufacturers and sells them to 3) consumers. 4) 4) A retailer is a middleman that buys products from manufacturers and sells them to wholesalers. 5) Gross profit is also called gross margin. 5) 6) 6) A company's cost of merchandise available for sale consists of beginning inventory plus the net cost of purchases minus ending inventory. 7) 7) A periodic inventory system requires updating the inventory account at the beginning of an accounting period. 8) A perpetual inventory system gives a continuous record of the amount of inventory on hand. 9) 9) In a perpetual inventory system, the cost of inventory purchased is recorded in the Purchases account MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question. 10) Gross profit is 10) A) Net sales less cost of goods sold B) A special general ledger account C) Only calculated when using the perpetual inventory system D) Subtracted from operating income to get profit E) The same as profit