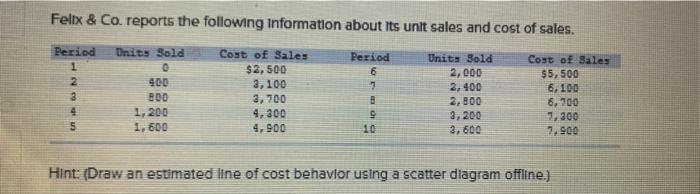

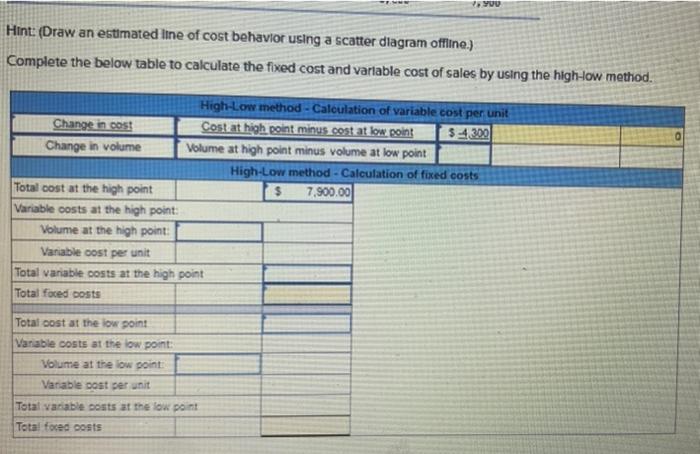

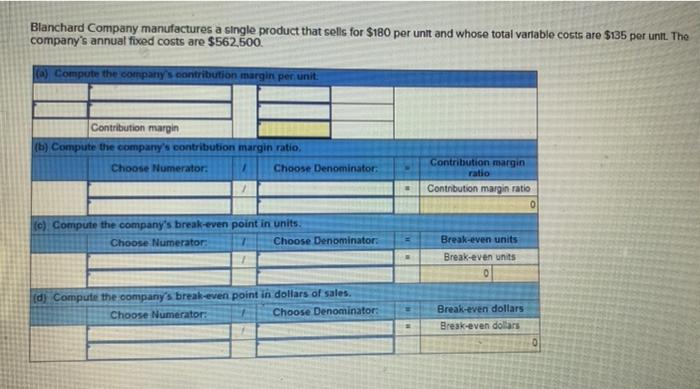

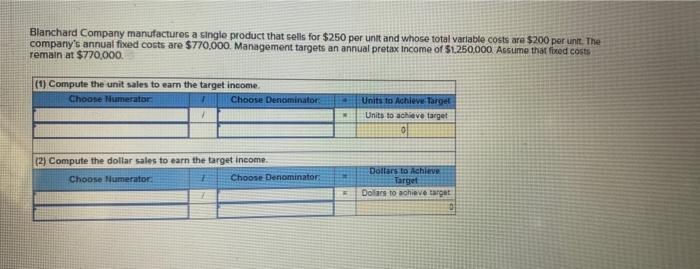

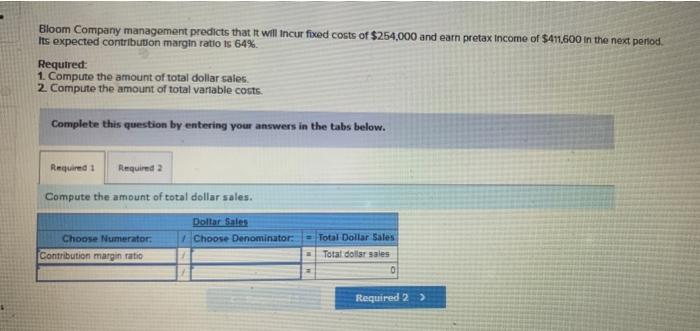

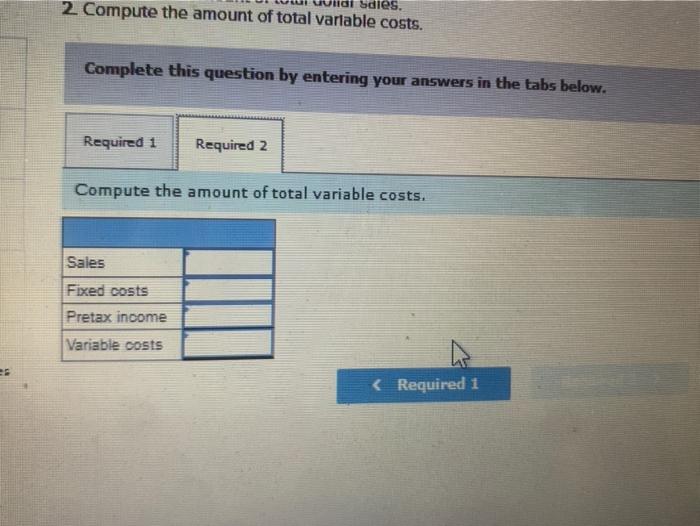

Feltx & Co. reports the following information about its unit sales and cost of sales. Period 1 2 3 4 5 Units Sold 0 400 BDO 1,200 1.600 Cost of Sales $2,500 3, 100 3,700 4,300 4,900 Period 6 -7 Units Bold 2,000 2,400 2.800 3,200 3.600 Cost of Sales $5,500 6.100 6, 700 7.300 7.900 9 10 Hint: (Draw an estimated line of cost behavior using a scatter diagram offline.) YU Hint: (Draw an estimated line of cost behavior using a scatter diagram offline.) Complete the below table to calculate the fixed cost and variable cost of sales by using the high-low method. High-Low method - Calculation of variable cost per unit Change in cost Cost at high point minus cost at low point 3 4300 Change in volume Volume at high point minus volume at low point High-Low method - Calculation of fixed costs Total cost at the high point 7,900.00 Variable costs at the high point: Volume at the high point Variable cost per unit Total variable costs at the high point Total faced costs Total cost at the low point Variable costs at the low point: Volume at the low point Vanable post per unit Total variable costs at the low point Total foced costs Blanchard Company manufactures a single product that sells for $180 per unit and whose total variable costs are $135 per unit. The company's annual fixed costs are $562,500. () Compute the company's contribution margir per unit: Contribution margin (b) Compute the company's contribution margin ratio, Choose Numerator: Choose Denominator: Contribution margin ratio Contnbution margin ratio (c) Compute the company's break-even point in units. Choose Numerator Choose Denominator Break-even units Break-even units 0 (d) Compute the company's break-even point in dollars of sales. Choose Numerator Choose Denominator: Break-even dollars Bresk-even dollars Blanchard Company manufactures a single product that sells for $250 per unit and whose total variable costs are $200 per unit. The company's annual fixed costs are $770,000. Management targets an annual pretax income of $1.250,000 Assume that fixed costs remain at $770,000. (1) Compute the unit sales to earn the target income. Choose Numerator Choose Denominator Units to Achieve Target Units to achieve target (2) Compute the dollar sales to earn the target income. Choose Numerator Choose Denominator: Dollars to Achieve Target Dolans to achieve target Bloom Company management predicts that it will incur fixed costs of $254,000 and earn pretax income of $411,600 in the next period. Its expected contribution margin ratio is 64% Required: 1. Compute the amount of total dollar sales 2. Compute the amount of total variable costs. Complete this question by entering your answers in the tabs below. Required: Required 2 2 Compute the amount of total dollar sales. Dollar Sales Choose Numerator: Choose Denominator: Total Dollar Sales Contribution margin ratio Total dollar sales Required 2 > 2. Compute the amount of total variable costs. Sdies. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the amount of total variable costs. Sales Fixed costs Pretax income Variable costs