Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Felvegi Company has developed the folloving standards for one of its products Direct labor hours is the driverused to assign overhead costs to products Direct

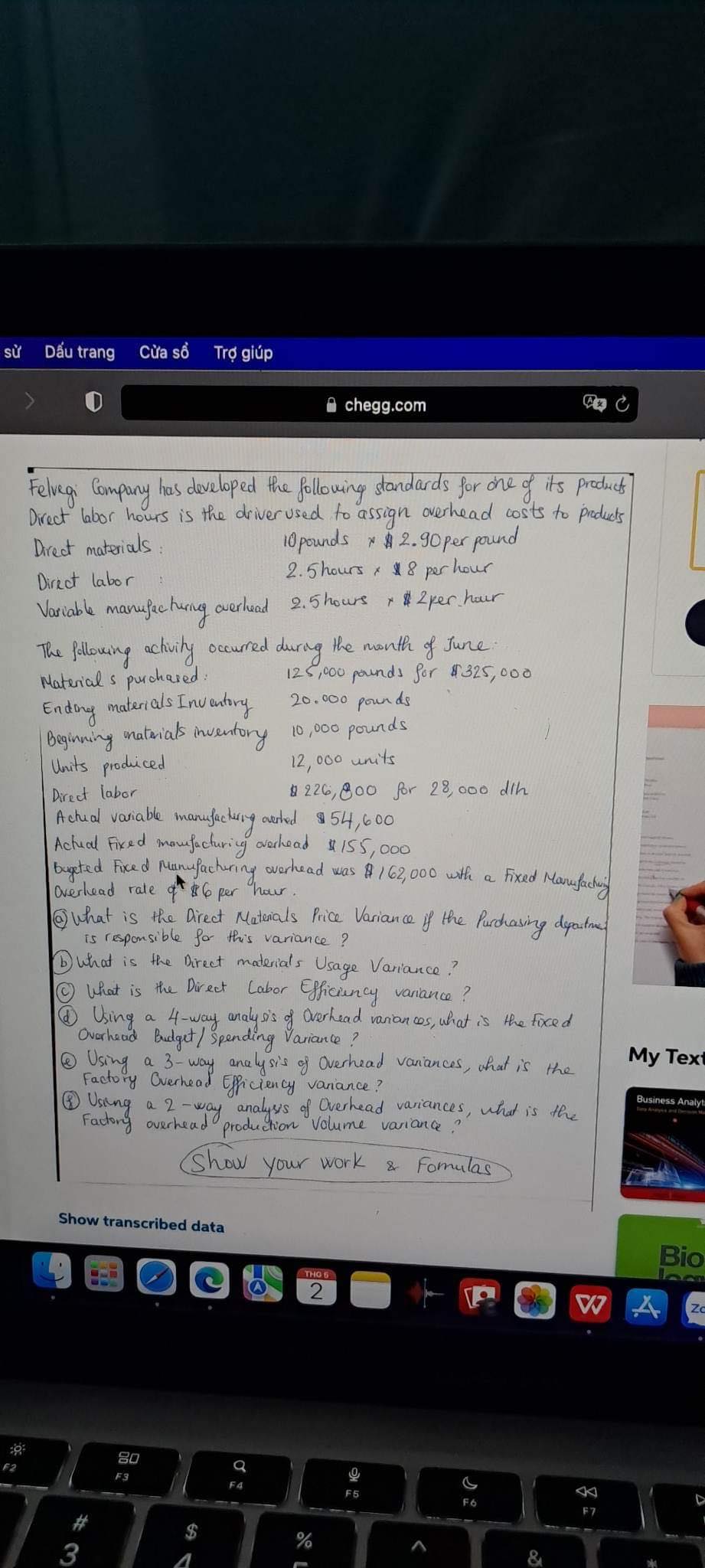

Felvegi Company has developed the folloving standards for one of its products Direct labor hours is the driverused to assign overhead costs to products Direct materials: 10 pounds $2.90 per pound Direct labor 2.5hours \& \$8 per hour Variable manufachurng ceerluad 2.5 hours + \$2per hour The follouing activity occurred during the month of June: Materials purchased: 125,000 pounds for 8325,000 Ending materials Inventory 20.000 pounds Beginning materials inventory 10,000 pounds Units prodiced 12,000 units Direct labor $226,800 for 28,000 dih Achual variable manufacturing ourhed \$54,600 Actual Fixed moufacturing averhead \$155,000 bugeted Fixed Mumufachuring overhead was \$162,000 with a Fixed Marufacturg averlead rale of $6 per hour. (a) What is the Direct Materials Price Variance of the Purchasing depaitne is responsible for this variance? (b) What is the Direct materials Usage Variance? (C) What is the Direct Labor Efficiency variance? (d) Using a 4-way eralysis of Dverhead variances, what is the Fixed Ovarhead Budget/ spending Variance? (2) Using a 3-way analysis of Overhead variances, hhat is the Factory Overhead Efficiency variance? (1) Using a 2-way analysss of Overhead variances, what is the Factory overhead production volume variance? Show your work \& fomulas Felvegi Company has developed the folloving standards for one of its products Direct labor hours is the driverused to assign overhead costs to products Direct materials: 10 pounds $2.90 per pound Direct labor 2.5hours \& \$8 per hour Variable manufachurng ceerluad 2.5 hours + \$2per hour The follouing activity occurred during the month of June: Materials purchased: 125,000 pounds for 8325,000 Ending materials Inventory 20.000 pounds Beginning materials inventory 10,000 pounds Units prodiced 12,000 units Direct labor $226,800 for 28,000 dih Achual variable manufacturing ourhed \$54,600 Actual Fixed moufacturing averhead \$155,000 bugeted Fixed Mumufachuring overhead was \$162,000 with a Fixed Marufacturg averlead rale of $6 per hour. (a) What is the Direct Materials Price Variance of the Purchasing depaitne is responsible for this variance? (b) What is the Direct materials Usage Variance? (C) What is the Direct Labor Efficiency variance? (d) Using a 4-way eralysis of Dverhead variances, what is the Fixed Ovarhead Budget/ spending Variance? (2) Using a 3-way analysis of Overhead variances, hhat is the Factory Overhead Efficiency variance? (1) Using a 2-way analysss of Overhead variances, what is the Factory overhead production volume variance? Show your work \& fomulas

Felvegi Company has developed the folloving standards for one of its products Direct labor hours is the driverused to assign overhead costs to products Direct materials: 10 pounds $2.90 per pound Direct labor 2.5hours \& \$8 per hour Variable manufachurng ceerluad 2.5 hours + \$2per hour The follouing activity occurred during the month of June: Materials purchased: 125,000 pounds for 8325,000 Ending materials Inventory 20.000 pounds Beginning materials inventory 10,000 pounds Units prodiced 12,000 units Direct labor $226,800 for 28,000 dih Achual variable manufacturing ourhed \$54,600 Actual Fixed moufacturing averhead \$155,000 bugeted Fixed Mumufachuring overhead was \$162,000 with a Fixed Marufacturg averlead rale of $6 per hour. (a) What is the Direct Materials Price Variance of the Purchasing depaitne is responsible for this variance? (b) What is the Direct materials Usage Variance? (C) What is the Direct Labor Efficiency variance? (d) Using a 4-way eralysis of Dverhead variances, what is the Fixed Ovarhead Budget/ spending Variance? (2) Using a 3-way analysis of Overhead variances, hhat is the Factory Overhead Efficiency variance? (1) Using a 2-way analysss of Overhead variances, what is the Factory overhead production volume variance? Show your work \& fomulas Felvegi Company has developed the folloving standards for one of its products Direct labor hours is the driverused to assign overhead costs to products Direct materials: 10 pounds $2.90 per pound Direct labor 2.5hours \& \$8 per hour Variable manufachurng ceerluad 2.5 hours + \$2per hour The follouing activity occurred during the month of June: Materials purchased: 125,000 pounds for 8325,000 Ending materials Inventory 20.000 pounds Beginning materials inventory 10,000 pounds Units prodiced 12,000 units Direct labor $226,800 for 28,000 dih Achual variable manufacturing ourhed \$54,600 Actual Fixed moufacturing averhead \$155,000 bugeted Fixed Mumufachuring overhead was \$162,000 with a Fixed Marufacturg averlead rale of $6 per hour. (a) What is the Direct Materials Price Variance of the Purchasing depaitne is responsible for this variance? (b) What is the Direct materials Usage Variance? (C) What is the Direct Labor Efficiency variance? (d) Using a 4-way eralysis of Dverhead variances, what is the Fixed Ovarhead Budget/ spending Variance? (2) Using a 3-way analysis of Overhead variances, hhat is the Factory Overhead Efficiency variance? (1) Using a 2-way analysss of Overhead variances, what is the Factory overhead production volume variance? Show your work \& fomulas Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started