Answered step by step

Verified Expert Solution

Question

1 Approved Answer

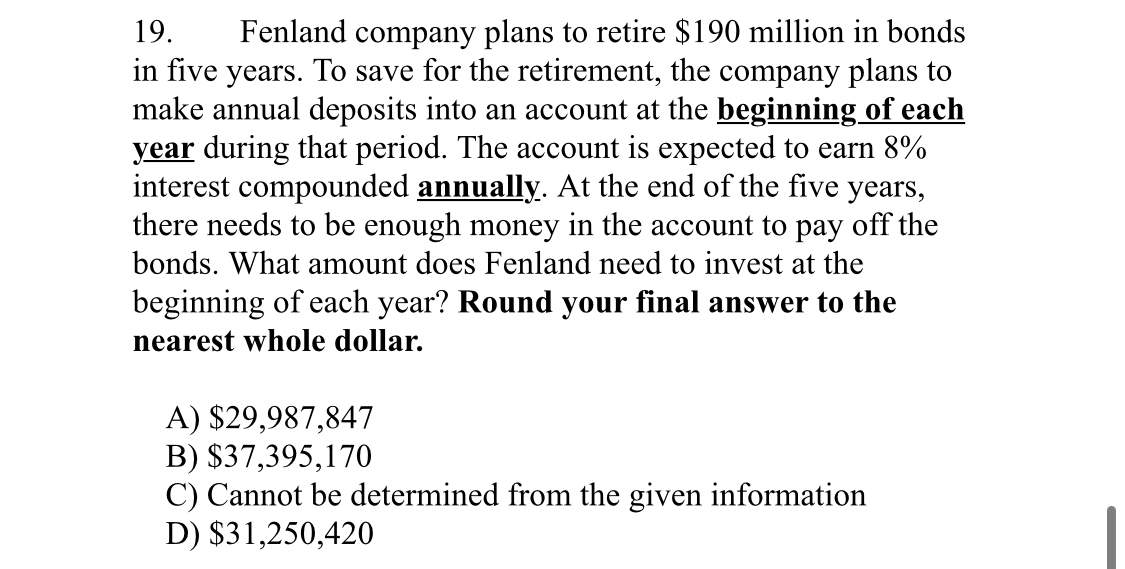

Fenland company plans to retire $ 1 9 0 million in bonds in five years. To save for the retirement, the company plans to make

Fenland company plans to retire $ million in bonds in five years. To save for the retirement, the company plans to make annual deposits into an account at the beginning of each year during that period. The account is expected to earn interest compounded annually. At the end of the five years, there needs to be enough money in the account to pay off the bonds. What amount does Fenland need to invest at the beginning of each year? Round your final answer to the nearest whole dollar.

A $

B $

C Cannot be determined from the given information

D $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started