Question

Fern Corporation plans to produce and sell 18,000 pet hair dryers at $48 each in July 2021. Product costs are estimated as follows: Direct

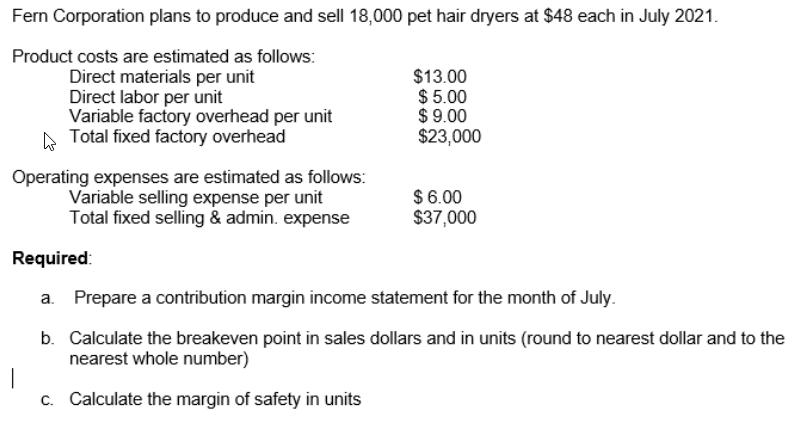

Fern Corporation plans to produce and sell 18,000 pet hair dryers at $48 each in July 2021. Product costs are estimated as follows: Direct materials per unit Direct labor per unit Variable factory overhead per unit Total fixed factory overhead $13.00 $ 5.00 $ 9.00 $23,000 Operating expenses are estimated as follows: Variable selling expense per unit Total fixed selling & admin. expense $ 6.00 $37,000 Required: a. Prepare a contribution margin income statement for the month of July. b. Calculate the breakeven point in sales dollars and in units (round to nearest dollar and to the nearest whole number) c. Calculate the margin of safety in units

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Dave inc Variable costing Income Statement Sales 18000 x 48 864000 Less ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Managerial Accounting Concepts

Authors: Edmonds, Tsay, olds

6th Edition

71220720, 78110890, 9780071220729, 978-0078110894

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App