Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fern Inc. manufacturers custom furniture for both residential and commercial clients. Fern has a December 31 year-end. On September 1, Fern had two jobs

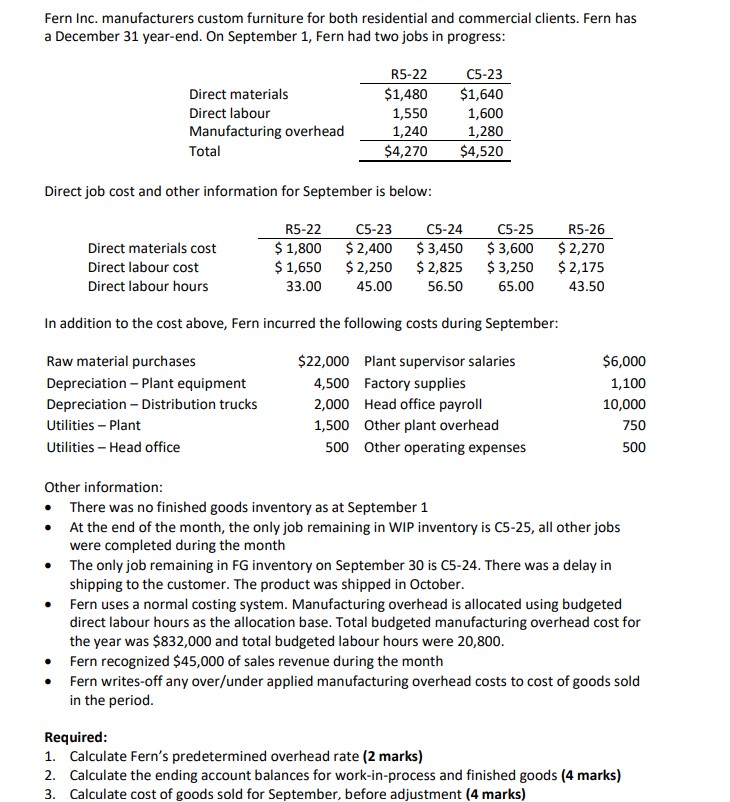

Fern Inc. manufacturers custom furniture for both residential and commercial clients. Fern has a December 31 year-end. On September 1, Fern had two jobs in progress: Direct materials Direct labour Manufacturing overhead Total R5-22 $1,480 C5-23 $1,640 1,550 1,600 1,240 1,280 $4,270 $4,520 Direct job cost and other information for September is below: R5-22 C5-23 C5-24 C5-25 R5-26 Direct materials cost $1,800 $2,400 $3,450 $3,600 $2,270 Direct labour cost $1,650 $2,250 $2,825 $3,250 $2,175 Direct labour hours 33.00 45.00 56.50 65.00 43.50 In addition to the cost above, Fern incurred the following costs during September: Raw material purchases $22,000 Plant supervisor salaries $6,000 Depreciation - Plant equipment 4,500 Factory supplies 1,100 Depreciation - Distribution trucks 2,000 Head office payroll 10,000 Utilities - Plant 1,500 Other plant overhead 750 Utilities - Head office 500 Other operating expenses 500 Other information: There was no finished goods inventory as at September 1 At the end of the month, the only job remaining in WIP inventory is C5-25, all other jobs were completed during the month The only job remaining in FG inventory on September 30 is C5-24. There was a delay in shipping to the customer. The product was shipped in October. Fern uses a normal costing system. Manufacturing overhead is allocated using budgeted direct labour hours as the allocation base. Total budgeted manufacturing overhead cost for the year was $832,000 and total budgeted labour hours were 20,800. Fern recognized $45,000 of sales revenue during the month Fern writes-off any over/under applied manufacturing overhead costs to cost of goods sold in the period. Required: 1. Calculate Fern's predetermined overhead rate (2 marks) 2. Calculate the ending account balances for work-in-process and finished goods (4 marks) 3. Calculate cost of goods sold for September, before adjustment (4 marks)

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the cost of goods manufactured and cost of goods sold for Fern Inc for the month ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started