Answered step by step

Verified Expert Solution

Question

1 Approved Answer

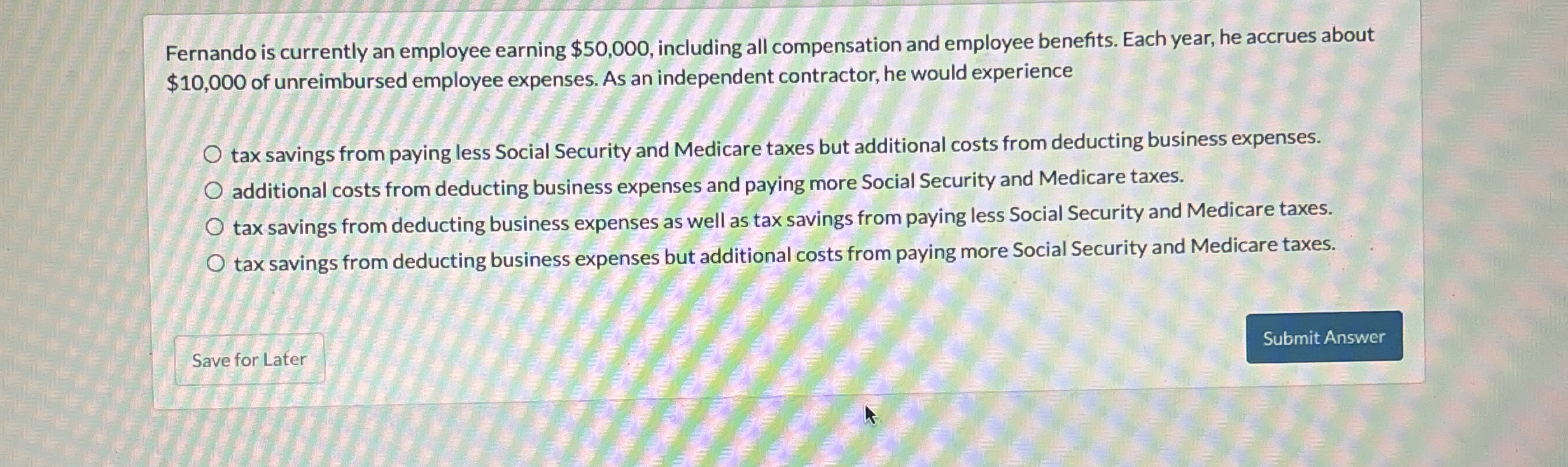

Fernando is currently an employee earning $ 5 0 , 0 0 0 , including all compensation and employee benefits. Each year, he accrues about

Fernando is currently an employee earning $ including all compensation and employee benefits. Each year, he accrues about

$ of unreimbursed employee expenses. As an independent contractor, he would experience

tax savings from paying less Social Security and Medicare taxes but additional costs from deducting business expenses.

additional costs from deducting business expenses and paying more Social Security and Medicare taxes.

tax savings from deducting business expenses as well as tax savings from paying less Social Security and Medicare taxes.

tax savings from deducting business expenses but additional costs from paying more Social Security and Medicare taxes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started