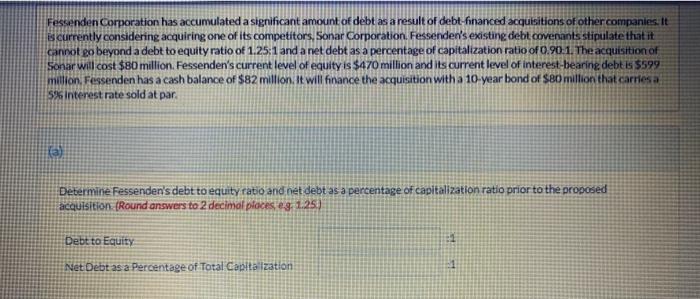

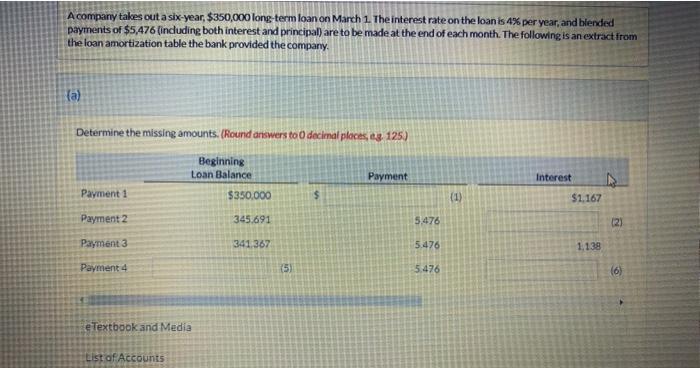

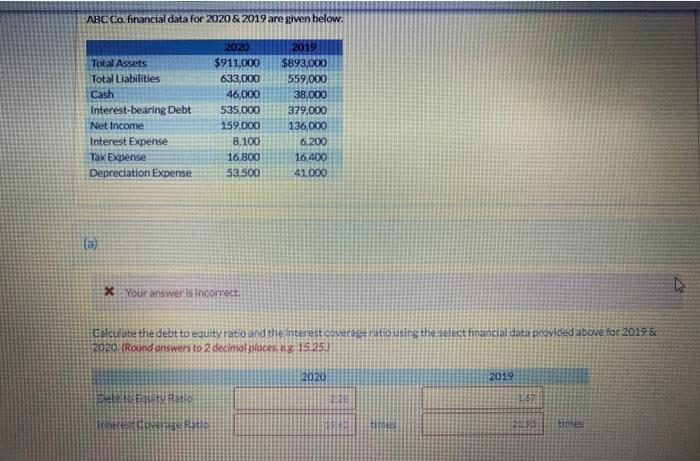

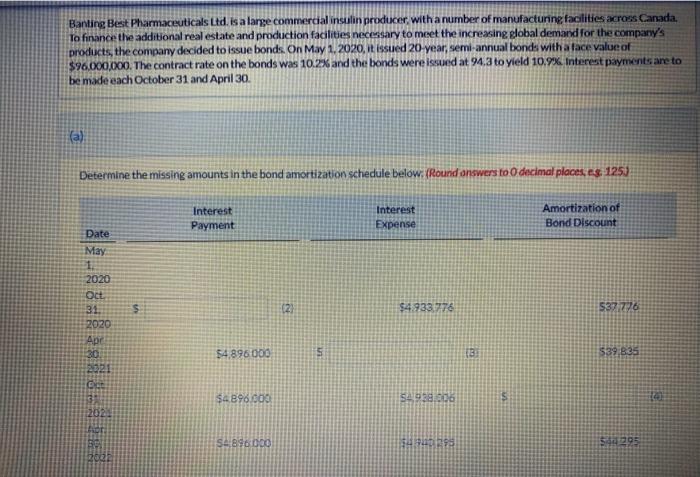

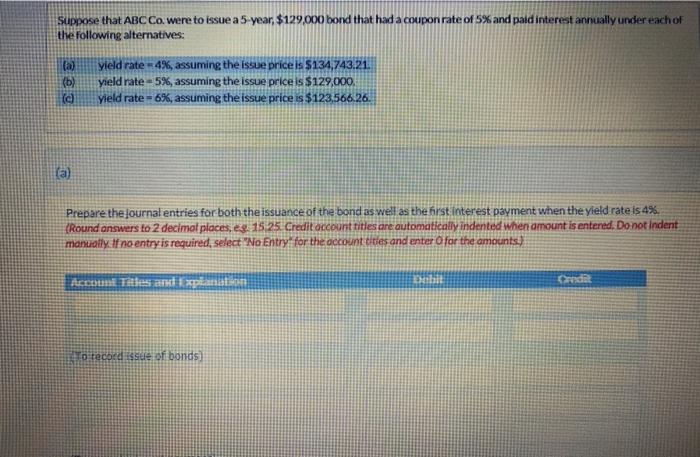

Fessenden Corporation has accumulated a significant amount of debt as a result of debt-financed acquisitions of other companies. It s currently considering acquiring one of its competitors, Sonar Corporation. Fessenden's existing debt covenants stipulate that it cannot go beyond a debt to equity ratio of 1.25:1 and a net debt as a percentage of capitalization ratio of 0.90-1. The acquisition of Sonar will cost $80 million. Fessenden's current level of equity is $470 million and its current level of interest-bearing debt is 5599 million, Fessenden has a cash balance of $82 million. It will finance the acquisition with a 10-year bond of SBO million that carriesa 5% interest rate sold at par (a) Determine Fessenden's debt to equity ratio and net debt as a percentage of capitalization ratio prior to the proposed acquisition (Round answers to 2 decimal places eg. 1.25) Debt to Equity Net Debt as a Percentage of Total Capitalization A company takes out a six-year, $350,000 long-term loan on March 1. The interest rate on the loan is 4% per year, and blended payments of $5,476 (including both interest and principal) are to be made at the end of each month. The following is an extract from the loan amortization table the bank provided the company (a) Determine the missing amounts. (Round answers to decimal places, s 125) Beginning Loan Balance $350,000 Payment Interest Payment 1 $ (1) $1.167 Payment 2 345,691 5.476 Payment 3 341 367 5.476 1.138 Payment 4 (5) 5.476 (6) e Textbook and Media List of Accounts ABC Cofinancial data for 2020 & 2019 are given below. Total Assets Total Liabilities Cash Interest-bearing Debt Net Income Interest Expense Tax Expense Depreciation Expense 2020 $911,000 633,000 46,000 535.000 159,000 8.100 16,800 53.500 2019 $893,000 559,000 38,000 379,000 136,000 6.200 16,400 41.000 a * Your answer incorrect Calculate the debt to equity ratio and the interest coverage ratio using the select financial data provided above for 2019.& 2020. Round answers to 2 decimal places, eg, 15. 25. 2020 2019 Debto quity Ratio HE 165 Interest Rate Banting Best Pharmaceuticals Ltd. is a large commercial insulin producer with a number of manufacturing facilities across Canada To finance the additional real estate and production facilities necessary to meet the increasing global demand for the company's products, the company decided to issue bonds. On May 1, 2020, it issued 20 year, semi-annual bonds with a face value of $96.000,000. The contract rate on the bonds was 10.2% and the bonds were issued at 94.3 to yield 10.9% Interest payments are to be made each October 31 and April 30. (a) Determine the missing amounts in the bond amortization schedule below. (Round answers to decimal places, s. 125) Interest Payment Interest Expense Amortization of Bond Discount Date May 1. 2020 Oct 31 2020 Apr 30 221 $ (2) $4.933.776 537776 54896 000 5 13 $39,835 $4.896.000 SA28208 54890 000 SP 50205 Suppose that ABC Co. were to issue a 5-year $129,000 bond that had a coupon rate of 5% and paid interest annually under each of the following alternatives: (b) yield rate=4%, assuming the issue price is $134,743.21. yield rate - 5%, assuming the issue price is $129,000. yield rate = 6%, assuming the issue price is $123,566.26. a) Prepare the journal entries for both the issuance of the bond as well as the first interest payment when the yield rate is 4%. {Round answers to 2 decimal places, eg: 15.25 Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts: A Tales and instant bil Hotecoed issue of bonds)