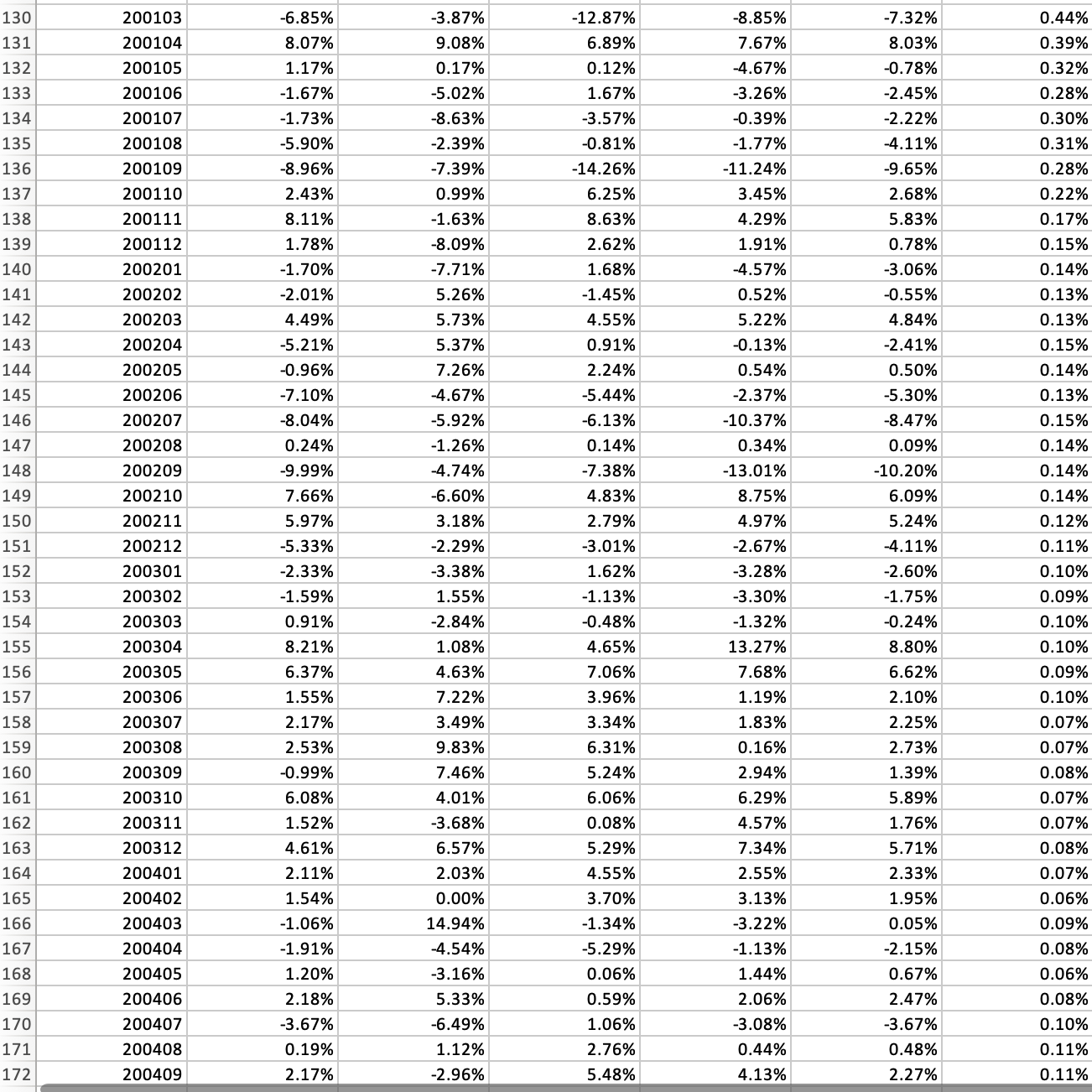

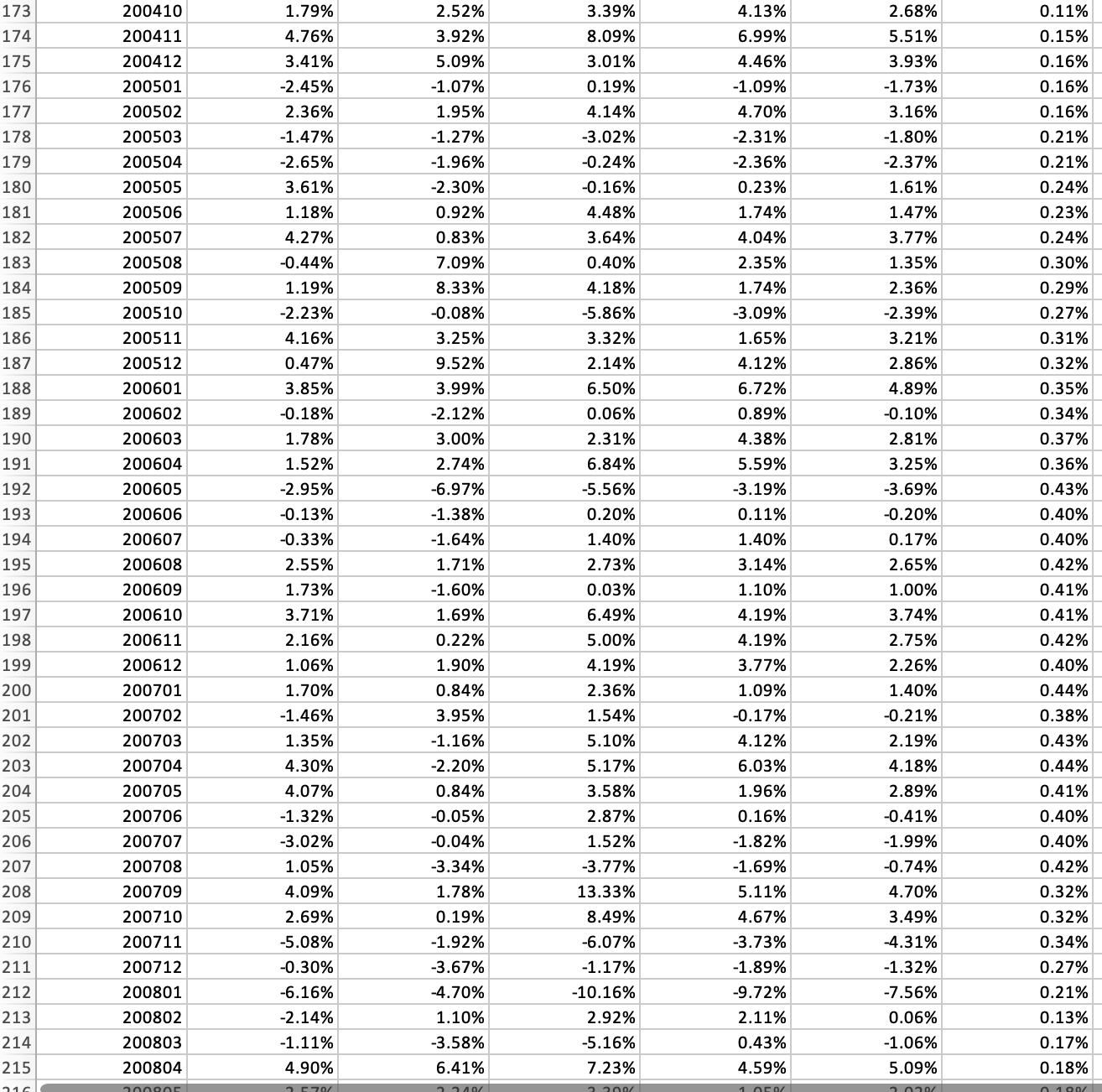

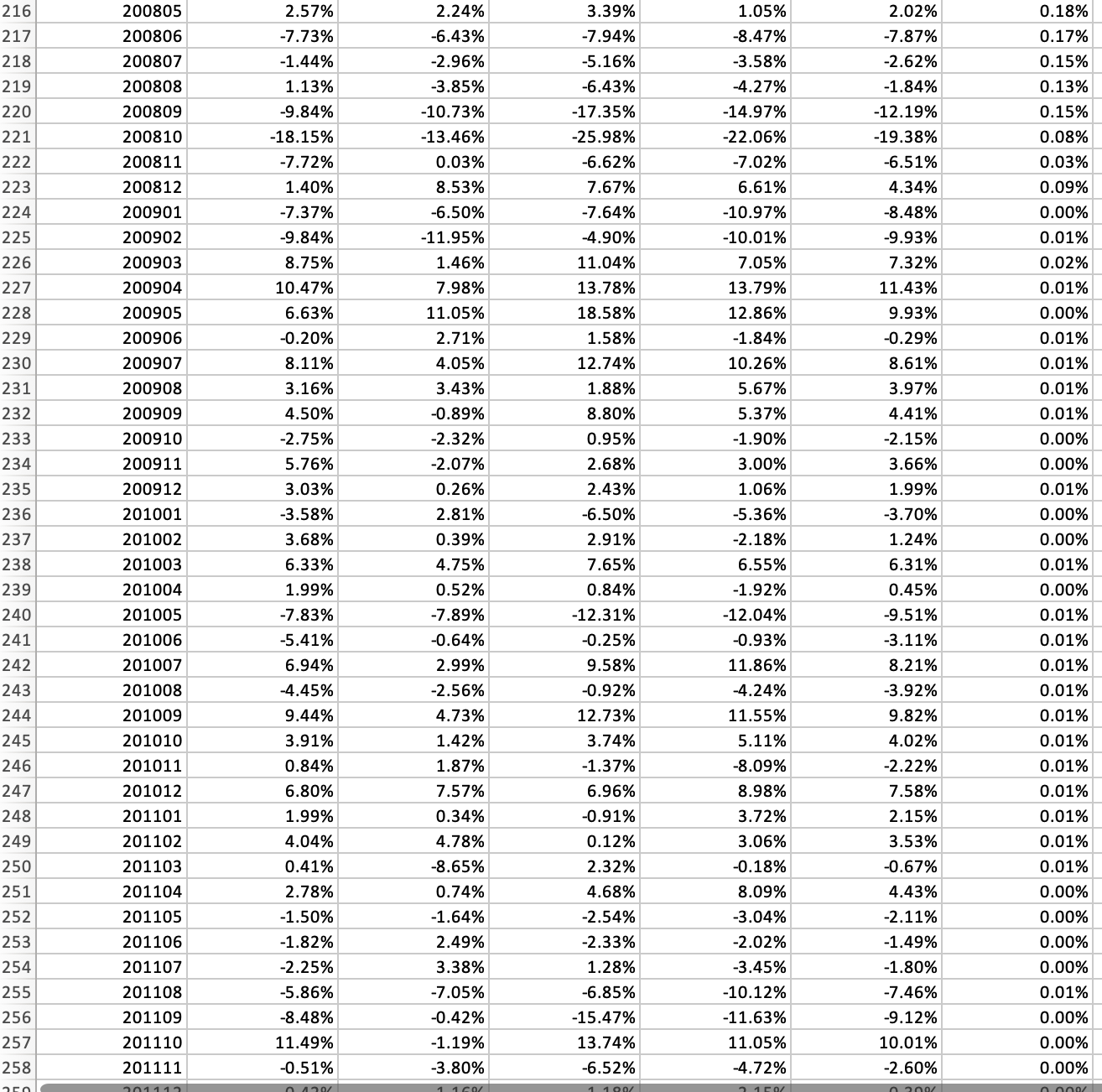

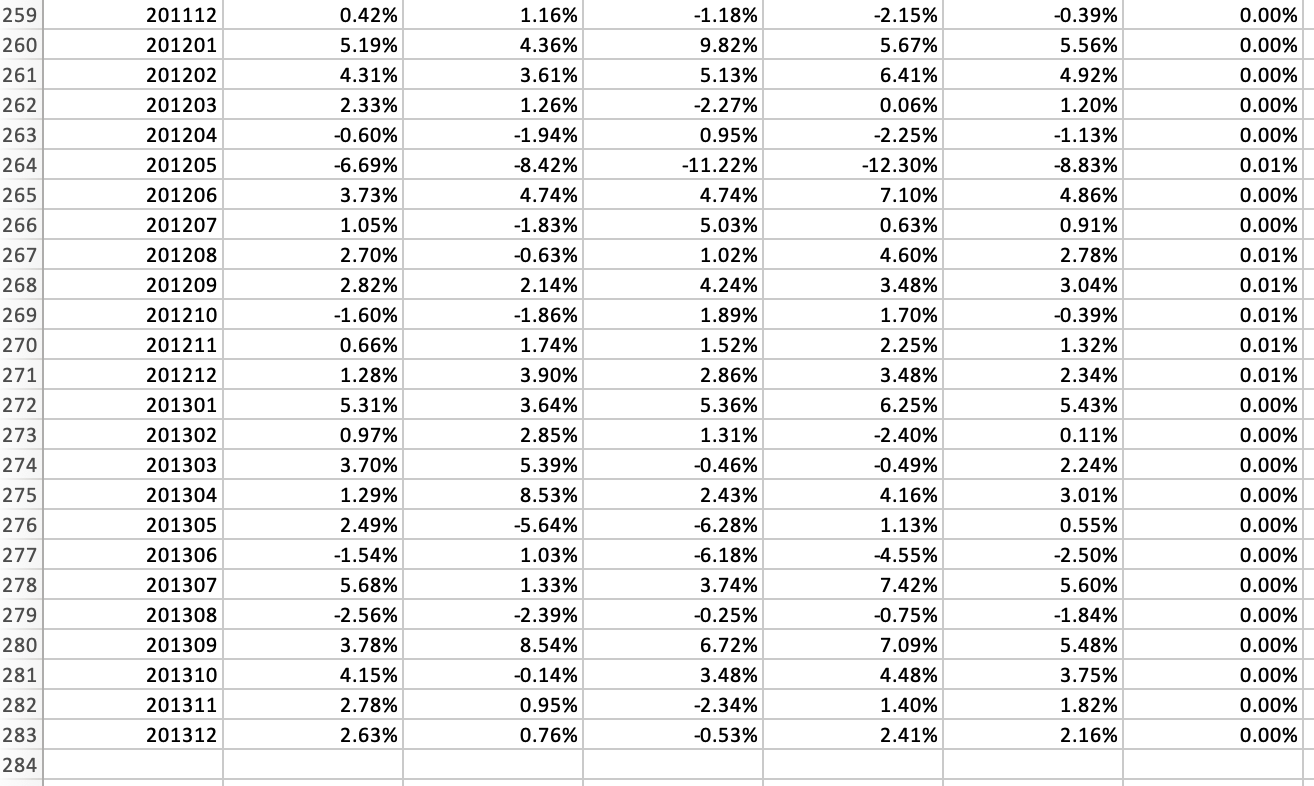

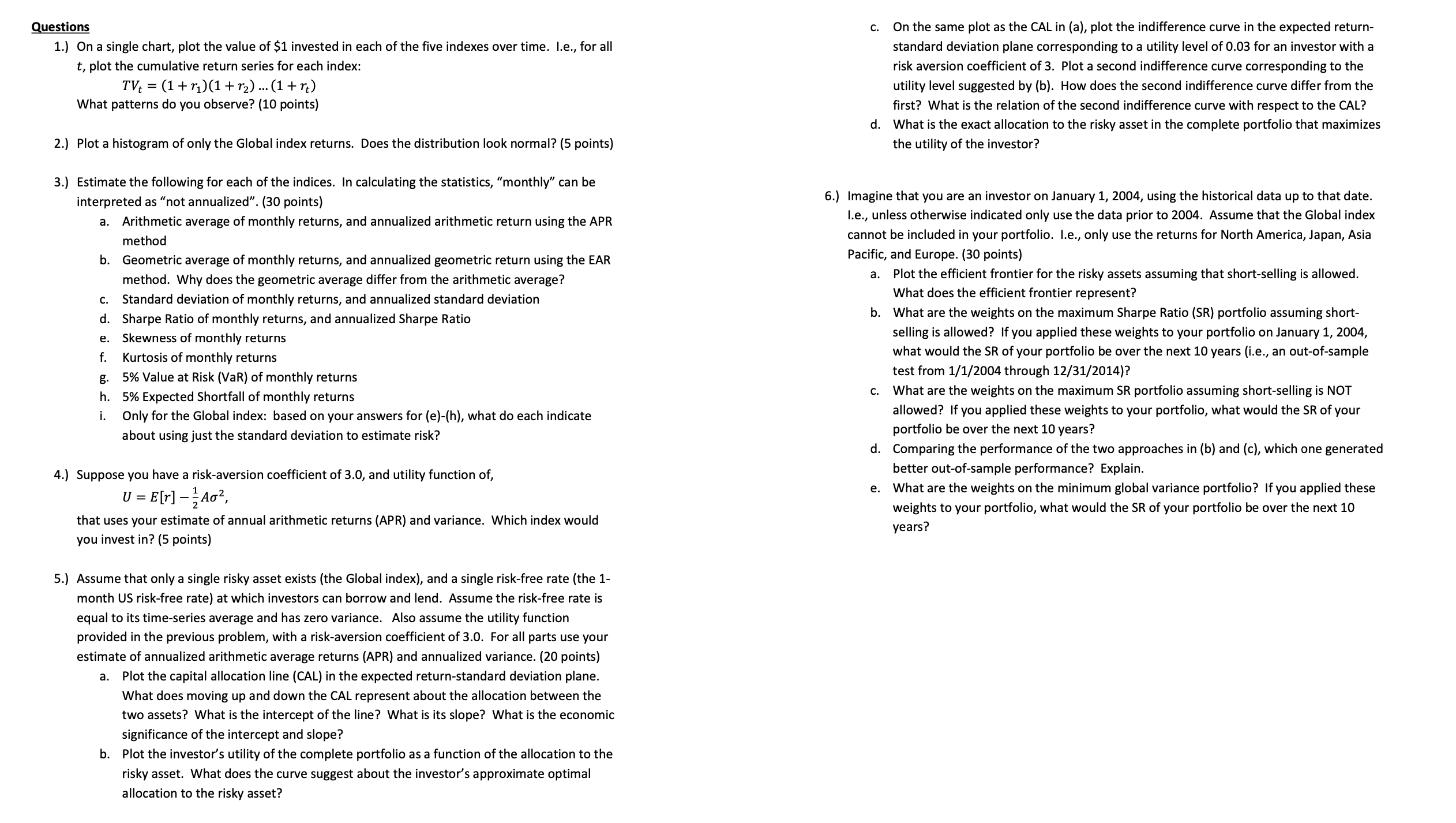

\f\f87 199708 -3.71% -9.38% -8.00% -4.80% -5.16% 0.41% 88 199709 5.86% 2.55% 4.41% 9.16% 5.40% 0.44% 89 199710 3.33% -7.67% -21.72% 4.14% -5.03% 0.42% 90 199711 2.96% 8.04% -0.87% 1.09% 0.68% 0.39% 91 199712 1.84% 7.59% -1.04% 2.73% 0.77% 0.48% 92 199801 0.47% 10.98% -7.33% 3.73% 2.48% 0.43% 93 199802 7.41% 1.23% 11.76% 7.72% 6.83% 0.39% 94 199803 5.19% 6.54% -1.45% 7.32% 4.16% 0.39% 95 199804 1.27% 1.89% -5.07% 2.72% 1.18% 0.43% 96 199805 2.41% 4.50% 10.47% 2.72% -1.20% 0.40% 97 199806 3.30% 0.69% -5.33% 0.11% 1.64% 0.41% 98 199807 -2.30% 1.24% -3.10% 1.95% 0.78% 0.40% 99 199808 15.79% 8.82% -12.90% -11.64% -13.58% 0.43% 100 199809 6.48% 3.44% 10.89% 4.34% 1.71% 0.46% 101 199810 7.39% 16.49% 18.07% 6.78% 8.40% 0.32% 102 199811 6.08% 3.91% 5.09% 4.50% 5.29% 0.31% 103 199812 6.30% 3.14% 2.17% 3.25% 4.71% 0.38% 104 199901 3.63% 1.14% 0.23% 0.29% 2.20% 0.35% 105 199902 3.77% -2.26% -0.98% 1.94% -2.96% 0.35% 106 199903 3.85% 14.01% 8.39% 0.27% 3.96% 0.43% 107 199904 4.63% 5.04% 16.91% 3.20% 4.60% 0.37% 108 199905 -1.81% 4.96% -5.13% 3.38% -2.77% 0.34% 109 199906 5.08% 10.80% 9.29% 2.03% 5.00% 0.40% 110 199907 2.98% 10.30% 1.79% 1.52% 0.05% 0.38% 111 199908 -0.92% 3.26% -2.01% 1.75% 0.43% 0.39% 112 199909 -2.31% 7.21% -1.87% 0.08% 0.21% 0.39% 113 199910 6.04% 6.66% 1.55% 2.10% 4.79% 0.39% 114 199911 3.21% 7.55% 7.40% 3.07% 3.97% 0.36% 115 199912 7.29% 4.06% 9.12% 9.66% 7.52% 0.44% 116 200001 -3.94% 4.99% 6.76% 6.78% -5.05% 0.41% 117 200002 1.96% 1.33% -0.58% 6.30% 2.64% 0.43% 118 200003 7.51% 6.63% 0.87% 1.15% 5.24% 0.47% 119 200004 4.31% 8.61% -5.77% 5.16% 5.27% 0.46% 120 200005 2.97% 7.06% -8.00% 0.45% -2.73% 0.50% 121 200006 4.08% 6.29% 11.23% 1.11% 3.69% 0.40% 122 200007 -1.65% -11.68% -0.17% -1.15% -2.84% 0.48% 123 200008 7.52% 6.95% 2.56% 1.07% 4.64% 0.50% 124 200009 4.85% 4.32% -6.97% 4.44% -4.72% 0.51% 125 200010 2.28% -6.95% -5.44% 2.16% -2.93% 0.56% 126 200011 9.71% 2.50% 0.53% 3.99% -6.88% 0.51% 127 200012 2.05% 9.35% 4.44% 6.28% 1.92% 0.50% 128 200101 3.72% -0.30% 3.32% 0.76% 2.30% 0.54% 129 200102 9.44% -5.16% -3.37% 8.19% -8.37% 0.38%130 200103 -6.85% -3.87% -12.87% 8.85% -7.32% 0.44% 131 200104 8.07% 9.08% 6.89% 7.67% 8.03% 0.39% 132 200105 1.17% 0.17% 0.12% 4.67% 0.78% 0.32% 133 200106 -1.67% 5.02% 1.67% 3.26% -2.45% 0.28% 134 200107 -1.73% 8.63% 3.57% 0.39% 2.22% 0.30% 135 200108 5.90% 2.39% -0.81% -1.77% 4.11% 0.31% 136 200109 -8.96% -7.39% -14.26% -11.24% -9.65% 0.28% 137 200110 2.43% 0.99% 6.25% 3.45% 2.68% 0.22% 138 200111 8.11% 1.63% 8.63% 4.29% 5.83% 0.17% 139 200112 1.78% -8.09% 2.62% 1.91% 0.78% 0.15% 140 200201 -1.70% 7.71% 1.68% 4.57% 3.06% 0.14% 141 200202 -2.01% 5.26% -1.45% 0.52% -0.55% 0.13% 142 200203 4.49% 5.73% 4.55% 5.22% 4.84% 0.13% 143 200204 5.21% 5.37% 0.91% 0.13% -2.41% 0.15% 144 200205 0.96% 7.26% 2.24% 0.54% 0.50% 0.14% 145 200206 7.10% 4.67% -5.44% -2.37% -5.30% 0.13% 146 200207 8.04% 5.92% 6.13% -10.37% -8.47% 0.15% 147 200208 0.24% 1.26% 0.14% 0.34% 0.09% 0.14% 148 200209 9.99% 4.74% 7.38% 13.01% -10.20% 0.14% 149 200210 7.66% 6.60% 4.83% 8.75% 6.09% 0.14% 150 200211 5.97% 3.18% 2.79% 4.97% 5.24% 0.12% 151 200212 5.33% 2.29% 3.01% 2.67% 4.11% 0.11% 152 200301 2.33% 3.38% 1.62% -3.28% -2.60% 0.10% 153 200302 -1.59% 1.55% -1.13% -3.30% -1.75% 0.09% 154 200303 0.91% 2.84% 0.48% -1.32% 0.24% 0.10% 155 200304 8.21% 1.08% 4.65% 13.27% 8.80% 0.10% 156 200305 6.37% 4.63% 7.06% 7.68% 6.62% 0.09% 157 200306 1.55% 7.22% 3.96% 1.19% 2.10% 0.10% 158 200307 2.17% 3.49% 3.34% 1.83% 2.25% 0.07% 159 200308 2.53% 9.83% 6.31% 0.16% 2.73% 0.07% 160 200309 -0.99% 7.46% 5.24% 2.94% 1.39% 0.08% 161 200310 6.08% 4.01% 6.06% 6.29% 5.89% 0.07% 162 200311 1.52% -3.68% 0.08% 4.57% 1.76% 0.07% 163 200312 4.61% 6.57% 5.29% 7.34% 5.71% 0.08% 164 200401 2.11% 2.03% 4.55% 2.55% 2.33% 0.07% 165 200402 1.54% 0.00% 3.70% 3.13% 1.95% 0.06% 166 200403 -1.06% 14.94% -1.34% 3.22% 0.05% 0.09% 167 200404 -1.91% 4.54% -5.29% 1.13% -2.15% 0.08% 168 200405 1.20% 3.16% 0.06% 1.44% 0.67% 0.06% 169 200406 2.18% 5.33% 0.59% 2.06% 2.47% 0.08% 170 200407 3.67% .6.49% 1.06% .3.08% 3.67% 0.10% 171 200408 0.19% 1.12% 2.76% 0.44% 0.48% 0.11% 172 200409 2.17% -2.96% 5.48% 4.13% 2.27% 0.11%\f\f\fQuestions 1.) On a single chart, plot the value of $1 invested in each of the five indexes over time. l.e., for all t, plot the cumulative return series for each index: TV, = (1 + r1)(1 + r2) (1 + 7\