FFinance

FFinance

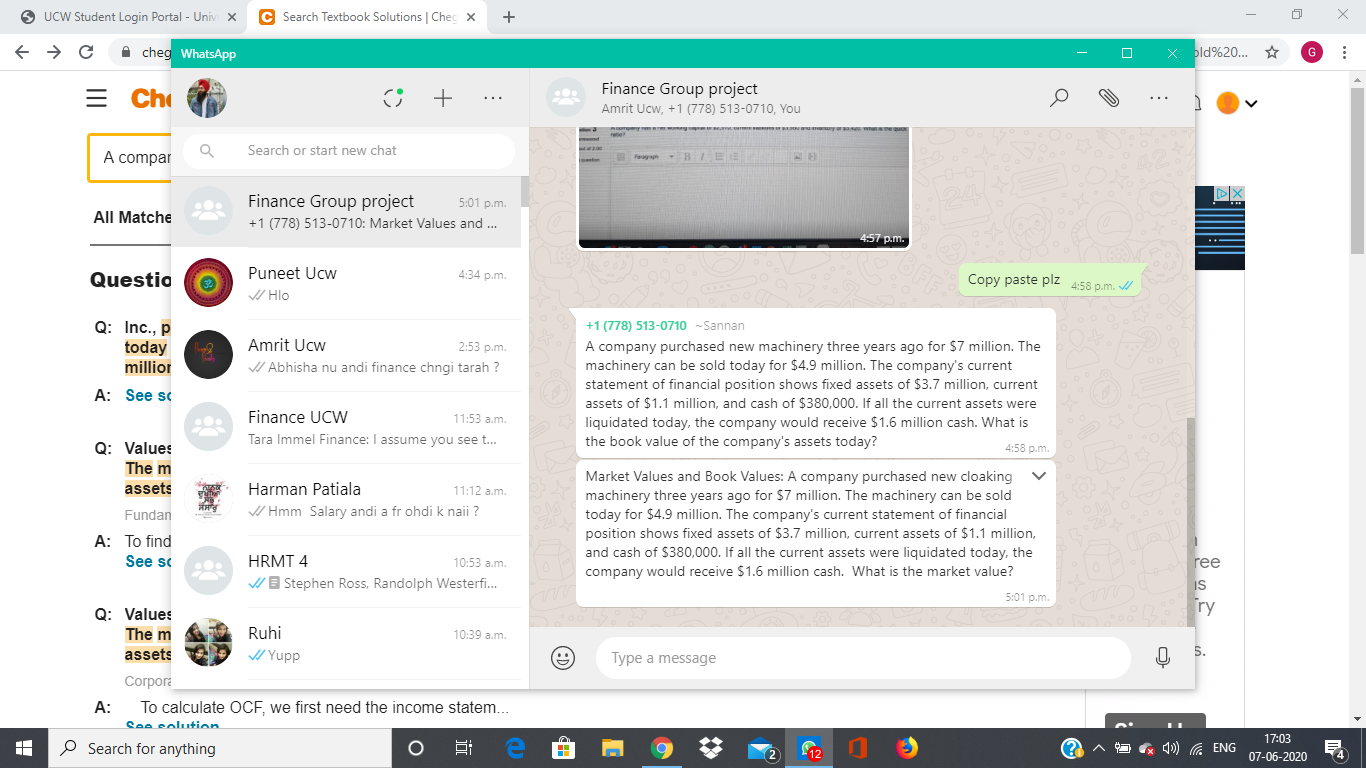

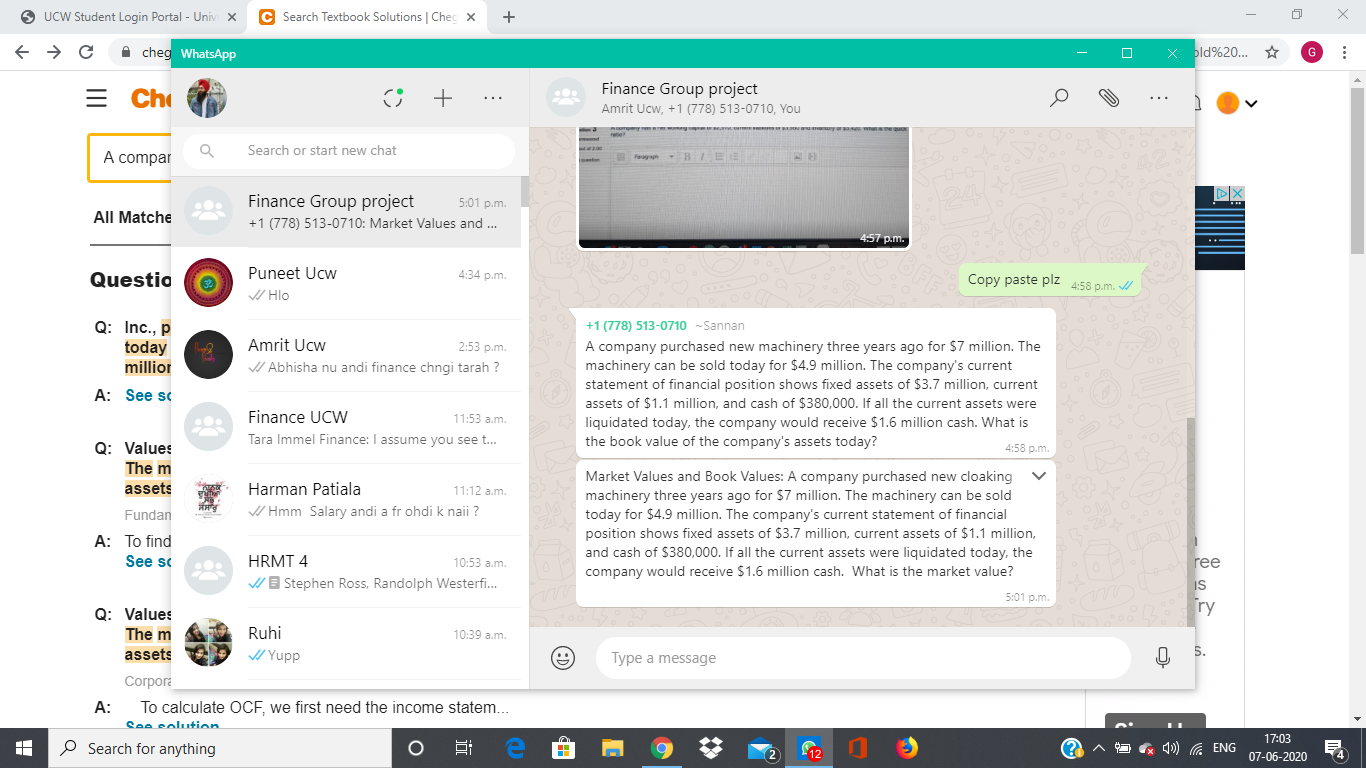

UCW Student Login Portal - Univ x C Search Textbook Solutions | Che X + fe cheg WhatsApp X bld%20... G *** Cho G + Finance Group project Amrit Ucw, +1 (778) 513-0710, You Q Search or start new chat A compar All Matche DE Finance Group project 5:01 pm +1 (778) 513-0710: Market Values and ... 4:57 p.m. Questio 4:34 p.m. Puneet Ucw / Hlo Copy paste plz 4:58 p.m. W Q: Inc., p today Amrit Ucw 2:53 p.m. V/ Abhisha nu andi finance chngi tarah? millior A: See sc Finance UCW 11:53 a.m. Tara Immel Finance: I assume you see t... Q: Values The m assets +1 (778) 513-0710 Sannan A company purchased new machinery three years ago for $7 million. The machinery can be sold today for $4.9 million. The company's current statement of financial position shows fixed assets of $3.7 million, current assets of $1.1 million, and cash of $380,000. If all the current assets were liquidated today, the company would receive $1.6 million cash. What is the book value of the company's assets today? 4:58p.m. Market Values and Book Values: A company purchased new cloaking machinery three years ago for $7 million. The machinery can be sold today for $4.9 million. The company's current statement of financial position shows fixed assets of $3.7 million, current assets of $1.1 million, and cash of $380,000. If all the current assets were liquidated today, the company would receive $1.6 million cash. What is the market value? Harman Patiala 11:12 am Salary andi afrohdi k naii? Fundan A: To find See se HRMT 4 10:53 a.m. Stephen Ross, Randolph Westerfi... ree IS ry 5:01 pm Yupp Type a message Q: Values The m Ruhi 10:39 am assets Corpora A: To calculate OCF, we first need the income statem... Ceo solution Search for anything o T 12 ^ Ex () ENG 17:03 07-06-2020 E 4 UCW Student Login Portal - Univ x C Search Textbook Solutions | Che X + fe cheg WhatsApp X bld%20... G *** Cho G + Finance Group project Amrit Ucw, +1 (778) 513-0710, You Q Search or start new chat A compar All Matche DE Finance Group project 5:01 pm +1 (778) 513-0710: Market Values and ... 4:57 p.m. Questio 4:34 p.m. Puneet Ucw / Hlo Copy paste plz 4:58 p.m. W Q: Inc., p today Amrit Ucw 2:53 p.m. V/ Abhisha nu andi finance chngi tarah? millior A: See sc Finance UCW 11:53 a.m. Tara Immel Finance: I assume you see t... Q: Values The m assets +1 (778) 513-0710 Sannan A company purchased new machinery three years ago for $7 million. The machinery can be sold today for $4.9 million. The company's current statement of financial position shows fixed assets of $3.7 million, current assets of $1.1 million, and cash of $380,000. If all the current assets were liquidated today, the company would receive $1.6 million cash. What is the book value of the company's assets today? 4:58p.m. Market Values and Book Values: A company purchased new cloaking machinery three years ago for $7 million. The machinery can be sold today for $4.9 million. The company's current statement of financial position shows fixed assets of $3.7 million, current assets of $1.1 million, and cash of $380,000. If all the current assets were liquidated today, the company would receive $1.6 million cash. What is the market value? Harman Patiala 11:12 am Salary andi afrohdi k naii? Fundan A: To find See se HRMT 4 10:53 a.m. Stephen Ross, Randolph Westerfi... ree IS ry 5:01 pm Yupp Type a message Q: Values The m Ruhi 10:39 am assets Corpora A: To calculate OCF, we first need the income statem... Ceo solution Search for anything o T 12 ^ Ex () ENG 17:03 07-06-2020 E 4

FFinance

FFinance