Answered step by step

Verified Expert Solution

Question

1 Approved Answer

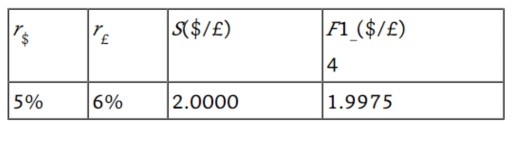

FI ($/E) 4 1.9975 5% 16% 2.0000 where: re-annual interest rate on three-month US dollar commercial paper re-annual interest on three-month British-pound commercial paper S($/E)-number

FI ($/E) 4 1.9975 5% 16% 2.0000 where: re-annual interest rate on three-month US dollar commercial paper re-annual interest on three-month British-pound commercial paper S($/E)-number of dollars per pound, spot (umber of dollars per pound, three months forward On the basis of the precise criteria: a. In which commercial paper would you invest? b. In which currency would you borrow? c. How would you arbitrage? d. What is the profit from interest arbitrage per dollar borrowed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started