Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fiancee Company records sales return during the year as a credit to accounts receivable. However, at the end of the accounting period, the entity

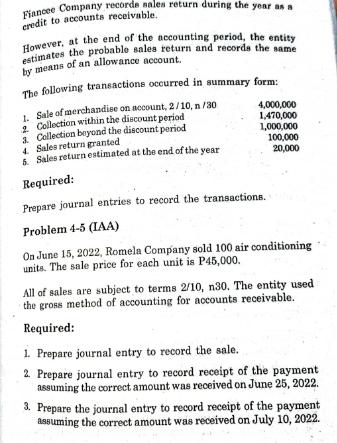

Fiancee Company records sales return during the year as a credit to accounts receivable. However, at the end of the accounting period, the entity estimates the probable sales return and records the same by means of an allowance account. The following transactions occurred in summary form: 1. Sale of merchandise on account, 2/10, n/30 2 Collection within the discount period a Collection beyond the discount period 4. Sales return granted 5. Sales return estimated at the end of the year Required: 4,000,000 1,470,000 1,000,000 100,000 20,000 Prepare journal entries to record the transactions. Problem 4-5 (IAA) On June 15, 2022, Romela Company sold 100 air conditioning units. The sale price for each unit is P45,000. All of sales are subject to terms 2/10, n30. The entity used the gross method of accounting for accounts receivable. Required: 1. Prepare journal entry to record the sale. 2. Prepare journal entry to record receipt of the payment assuming the correct amount was received on June 25, 2022. 3. Prepare the journal entry to record receipt of the payment assuming the correct amount was received on July 10, 2022.

Step by Step Solution

★★★★★

3.58 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

The journal entries for the transactions are a Sale of merchandise on account 210 n30 The total sale amount is 4000000 with a credit term of 210 n30 T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started