Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Firm A is considering the acquisition of Firm B. For Firm A, PV = $2,000 and N = 100. For Firm B, PV =

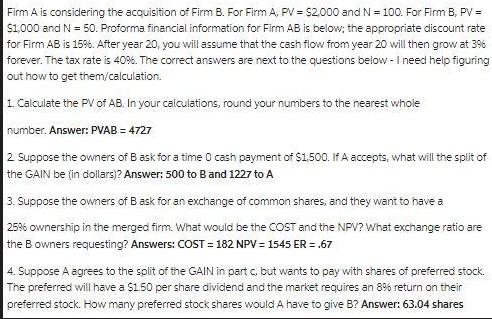

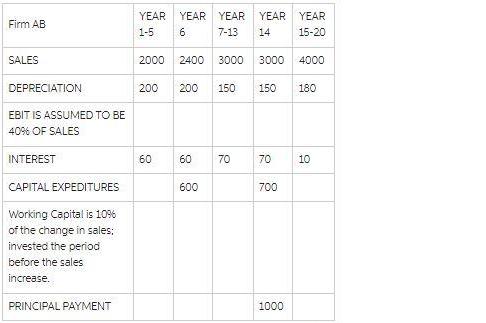

Firm A is considering the acquisition of Firm B. For Firm A, PV = $2,000 and N = 100. For Firm B, PV = $1,000 and N = 50. Proforma financial information for Firm AB is below; the appropriate discount rate for Firm AB is 15%. After year 20, you will assume that the cash flow from year 20 will then grow at 3% forever. The tax rate is 40%. The correct answers are next to the questions below - I need help figuring out how to get them/calculation. 1. Calculate the PV of AB. In your calculations, round your numbers to the nearest whole number. Answer: PVAB = 4727 2. Suppose the owners of B ask for a time 0 cash payment of $1,500. If A accepts, what will the split of the GAIN be (in dollars)? Answer: 500 to B and 1227 to A 3. Suppose the owners of B ask for an exchange of common shares, and they want to have a 25% ownership in the merged firm. What would be the COST and the NPV? What exchange ratio are the B owners requesting? Answers: COST=182 NPV = 1545 ER = .67 4. Suppose A agrees to the split of the GAIN in part c, but wants to pay with shares of preferred stock. The preferred will have a $1.50 per share dividend and the market requires an 8% return on their preferred stock. How many preferred stock shares would A have to give B? Answer: 63.04 shares Firm AB SALES DEPRECIATION EBIT IS ASSUMED TO BE 40% OF SALES INTEREST CAPITAL EXPEDITURES Working Capital is 10% of the change in sales: invested the period before the sales increase. PRINCIPAL PAYMENT YEAR YEAR YEAR YEAR YEAR 7-13 14 15-20 1-5 6 2000 200 60 2400 200 60 600 3000 3000 150 70 150 700 4000 70 10 1000 180

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started