Question

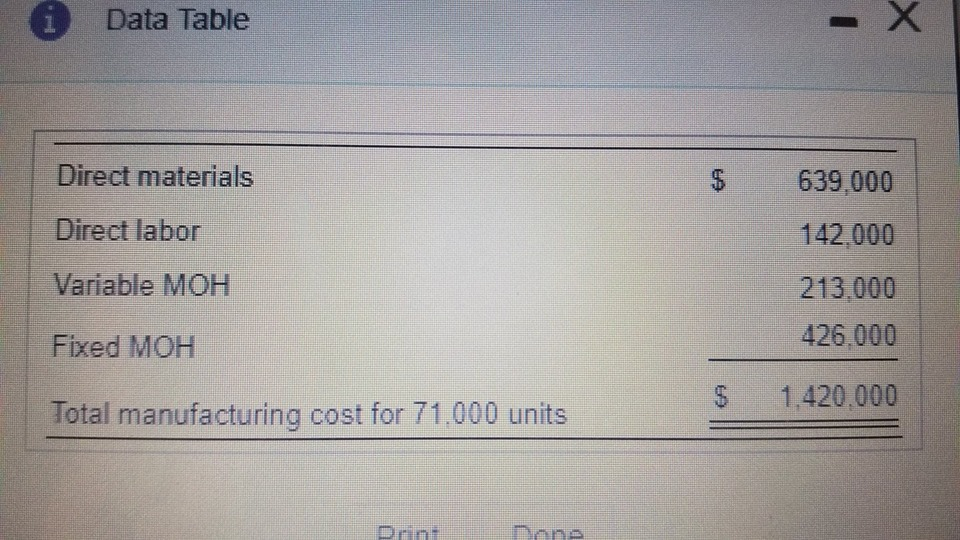

FiberSystems manufacturers an optical switch that it uses in its final product. FiberSystems incurred the following manufacturing costs when it produced 71,000 units last year:

FiberSystems manufacturers an optical switch that it uses in its final product. FiberSystems incurred the following manufacturing costs when it produced 71,000 units last year:

FiberSystems does not yet know how many switches it will need this year; however, another company has offered to sell FiberSystems the switch for $10.50 per unit. If FiberSystems buys the switch from the outside supplier, the manufacturing facilities that will be idle cannot be used for any other purpose, yet none of the fixed costs are avoidable.

Requirements

1. Given the same cost structure, should FiberSystems make or buy the switch? Show your analysis.

2. Now, assume that Fiber Systems can avoid $99,000 of fixed costs a year by outsourcing production. In addition, because sales are increasing, FiberSystems needs 76,000 switches a year rather than 71,000. What should FiberSystems do now?

3. Given the last scenario, what is the most FiberSystems would be willing to pay to outsource the switches?

-------------------------------------------------------------------------------------------------------------------------------

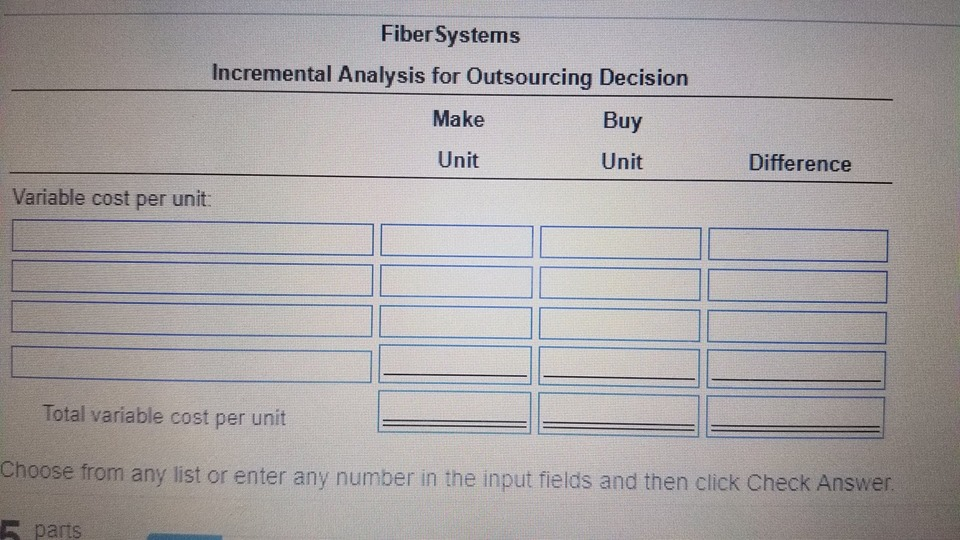

Requirement 1. Given the same cost structure, should FiberSystems make or buy the switch? Show your analysis.

Complete an incremental analysis to show whether FiberSystems should make or buy the switch.? (Enter a? "0" for any zero amounts. Round amounts to the nearest cent. Use a minus sign or parentheses when the cost to buy exceeds the cost to? make.)

PLEASE DO ALL REQUIREMENTS

i Data Table Direct materials Direct labor Variable MOH Fixed MOH Total manufacturing cost for 71.000 units $ 639,000 142,000 213,000 426,000 $ 1,420,000 Drini

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started