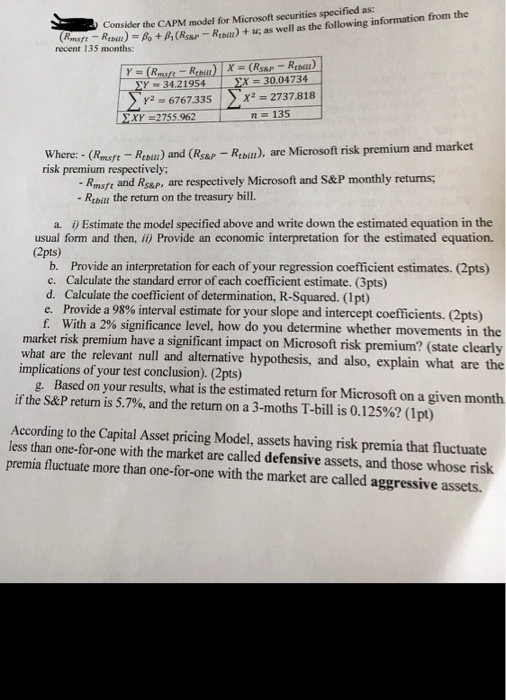

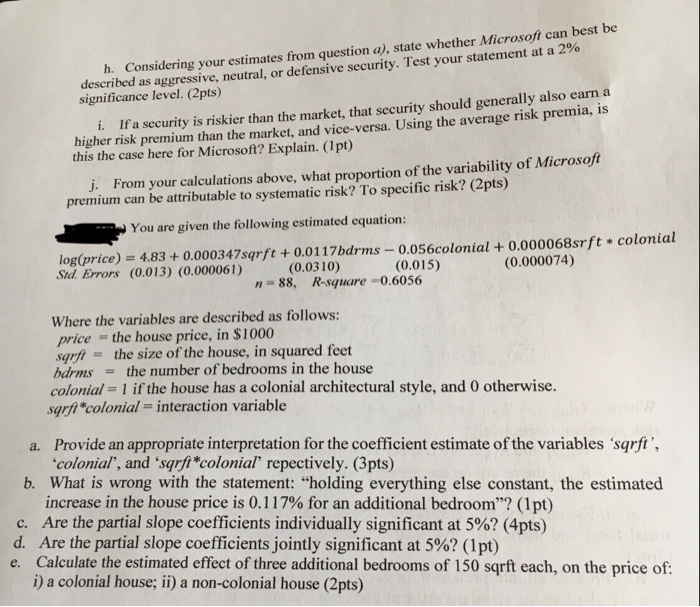

fied as: Consider the CAPM model for Microsoft securities speci (k, rs Resu.) -A +A(Rsur-Rtbin) + u, as well as the following information from the recent 135 months: 34.21954 X30.0475t x = x 2737.818 XY =2755.962 135 here:- (Rmse Reb) and (Rs&P Reb, are Microsoft risk premium and market risk premium respectively; -Rmsfe and Rs&p, are respectively Microsoft and S&P monthly returns; - Rebau the return on the treasury bill. a. i Estimate the model specified above and write down the estimated equation in the usual form and then, ii) Provide an economic interpretation for the estimated equation. (2pts) b. Provide an interpretation for each of your regression coefficient estimates. (2pts) Calculate the standard error of each coefficient estimate. (3pts) c. d. Calculate the coefficient of determination, R-Squared. (1pt) Provide a 98% interval estimate for your slope and intercept coefficients. (2pts) e. f. With a 2% significance level, how do you determine whether movements in the market risk premium have a significant impact on Microsoft risk premium? (state clearly what are the relevant null and alternative hypothesis, and also, explain what are the implications of your test conclusion). (2pts) Based on your results, what is the estimated return for Microsoft on a given month g. if the S&P return is 5.7%, and the return on a 3-moths T-bill is 0.125%? (1pt) According to the Capital Asset pricing Model, assets having risk premia that fluctuate less than one-for-one with the market are called defensive assets, and those whose risk premia fluctuate more than one-for-one with the market are called aggressive assets. h. Considering your estimates from question a), state whether Microsofi can best be described as aggressive, neutral, or defensive security. Test your statement at a 2% significance level. (2pts) i. If higher risk premium than the market, and vice-versa. Using the average risk pre this the case here for Microsoft? Explain. (lpt) a security is riskier than the market, that security should generally also earn a mia, is j. From your calculations above, what proportion of the variability of Microso premium can be attributable to systematic risk? To specific risk? (2pts) You are given the following estimated equation: log(price) = 4.83 + 0.0003 47sqrft + 0.01 17bdrms-0.056colonial + 0.000068srft * colonial Std. Errors (0.013) (0.000061) (0.0310) (0.015) (0.000074) n-88, R-square o.6056 Where the variables are described as follows price the house price, in $1000 sarf the size of the house, in squared feet barns the number of bedrooms in the house colonial- 1 if the house has a colonial architectural style, and 0 otherwise. sarfi "colonial -interaction variable Provide an appropriate interpretation for the coefficient estimate of the variables sarfi', 'colonial', and 'sarfi colonial' repectively. (3pts) a. b. What is wrong with the statement: "holding everything else constant, the estimated increase in the house price is 0.117% for an additional bedroom"? (1pt) c. Are the partial slope coefficients individually significant at 5%? (4pts) d. Are the partial slope coefficients jointly significant at 5%? (1pt) e. Calculate the estimated effect of three additional bedrooms of 150 sqrft each, on the price of: i) a colonial house; ii) a non-colonial house (2pts) fied as: Consider the CAPM model for Microsoft securities speci (k, rs Resu.) -A +A(Rsur-Rtbin) + u, as well as the following information from the recent 135 months: 34.21954 X30.0475t x = x 2737.818 XY =2755.962 135 here:- (Rmse Reb) and (Rs&P Reb, are Microsoft risk premium and market risk premium respectively; -Rmsfe and Rs&p, are respectively Microsoft and S&P monthly returns; - Rebau the return on the treasury bill. a. i Estimate the model specified above and write down the estimated equation in the usual form and then, ii) Provide an economic interpretation for the estimated equation. (2pts) b. Provide an interpretation for each of your regression coefficient estimates. (2pts) Calculate the standard error of each coefficient estimate. (3pts) c. d. Calculate the coefficient of determination, R-Squared. (1pt) Provide a 98% interval estimate for your slope and intercept coefficients. (2pts) e. f. With a 2% significance level, how do you determine whether movements in the market risk premium have a significant impact on Microsoft risk premium? (state clearly what are the relevant null and alternative hypothesis, and also, explain what are the implications of your test conclusion). (2pts) Based on your results, what is the estimated return for Microsoft on a given month g. if the S&P return is 5.7%, and the return on a 3-moths T-bill is 0.125%? (1pt) According to the Capital Asset pricing Model, assets having risk premia that fluctuate less than one-for-one with the market are called defensive assets, and those whose risk premia fluctuate more than one-for-one with the market are called aggressive assets. h. Considering your estimates from question a), state whether Microsofi can best be described as aggressive, neutral, or defensive security. Test your statement at a 2% significance level. (2pts) i. If higher risk premium than the market, and vice-versa. Using the average risk pre this the case here for Microsoft? Explain. (lpt) a security is riskier than the market, that security should generally also earn a mia, is j. From your calculations above, what proportion of the variability of Microso premium can be attributable to systematic risk? To specific risk? (2pts) You are given the following estimated equation: log(price) = 4.83 + 0.0003 47sqrft + 0.01 17bdrms-0.056colonial + 0.000068srft * colonial Std. Errors (0.013) (0.000061) (0.0310) (0.015) (0.000074) n-88, R-square o.6056 Where the variables are described as follows price the house price, in $1000 sarf the size of the house, in squared feet barns the number of bedrooms in the house colonial- 1 if the house has a colonial architectural style, and 0 otherwise. sarfi "colonial -interaction variable Provide an appropriate interpretation for the coefficient estimate of the variables sarfi', 'colonial', and 'sarfi colonial' repectively. (3pts) a. b. What is wrong with the statement: "holding everything else constant, the estimated increase in the house price is 0.117% for an additional bedroom"? (1pt) c. Are the partial slope coefficients individually significant at 5%? (4pts) d. Are the partial slope coefficients jointly significant at 5%? (1pt) e. Calculate the estimated effect of three additional bedrooms of 150 sqrft each, on the price of: i) a colonial house; ii) a non-colonial house (2pts)