Answered step by step

Verified Expert Solution

Question

1 Approved Answer

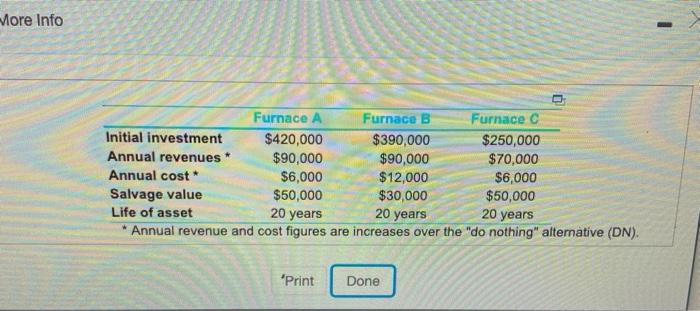

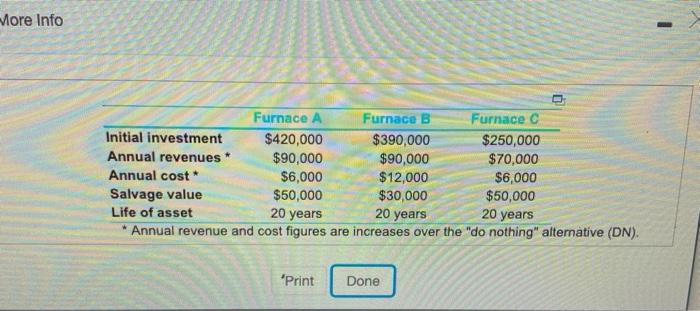

Fiesta Foundry is considering a new furnace that will allow them to be more productive . Three alternative fumaces are under consideration Perform an incremental

Fiesta Foundry is considering a new furnace that will allow them to be more productive . Three alternative fumaces are under consideration Perform an incremental analyss of these alternatives using the IRR method for each increment of cash flows . The MARR is 10 % per year .

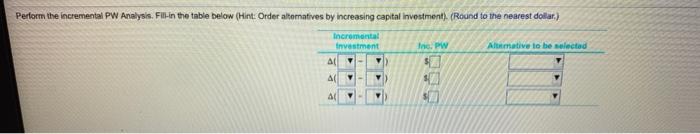

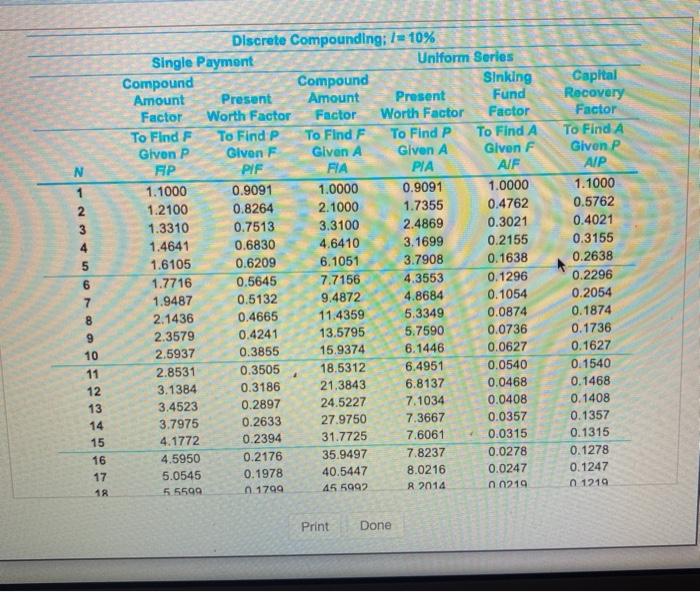

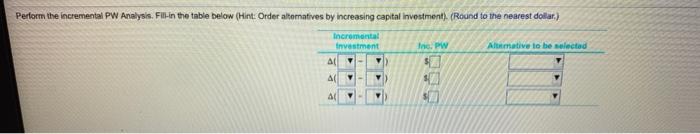

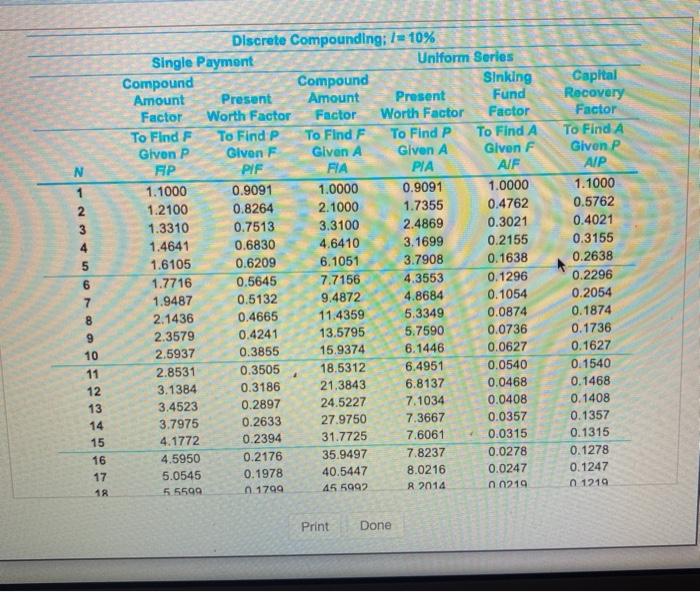

Perform the incremental PW Analysis. Fl-in the table below (Hint: Order alternatives by increasing capital investment). (Round to the nearest doilar.) nie. PW Alative to be selected Incremental Investment AL AL More Info Furnace A Furnace B Furnace C Initial investment $420,000 $390,000 $250,000 Annual revenues $90,000 $90,000 $70,000 Annual cost * $6,000 $12,000 $6,000 Salvage value $50,000 $30,000 $50,000 Life of asset 20 years 20 years Annual revenue and cost figures are increases over the "do nothing" alternative (DN). 20 years "Print Done AWN-2 5 Discrete Compounding; I= 10% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Glvon P Glvon F Glven A Glven A Given F FP PIF FIA PIA AlF 1.1000 0.9091 1.0000 0.9091 1.0000 1.2100 0.8264 2.1000 1.7355 0.4762 1.3310 0.7513 3.3100 2.4869 0.3021 1.4641 0.6830 4.6410 3.1699 0.2155 1.6105 0.6209 6.1051 3.7908 0.1638 1.7716 0.5645 7.7156 4.3553 0.1296 1.9487 0.5132 9.4872 4.8684 0.1054 2.1436 0.4665 11.4359 5.3349 0.0874 2.3579 0.4241 13.5795 5.7590 0.0736 2.5937 0.3855 15.9374 6.1446 0.0627 2.8531 0.3505 18.5312 6.4951 0.0540 3.1384 0.3186 21.3843 6.8137 0.0468 3.4523 0.2897 24.5227 7.1034 0.0408 3.7975 0.2633 27.9750 7.3667 0.0357 4.1772 0.2394 31.7725 7.6061 0.0315 4.5950 0.2176 35.9497 7.8237 0.0278 5.0545 0.1978 40.5447 8.0216 0.0247 5.5599 n. 1799 45.5992 R 2014 n0219 Capital Recovery Factor To Find A Given P AIP 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627 0.1540 0.1468 0.1408 0.1357 0.1315 0.1278 0.1247 0 1219 6 7 8 9 10 11 12 13 14 15 16 17 18 Print Done Perform the incremental PW Analysis. Fl-in the table below (Hint: Order alternatives by increasing capital investment). (Round to the nearest doilar.) nie. PW Alative to be selected Incremental Investment AL AL More Info Furnace A Furnace B Furnace C Initial investment $420,000 $390,000 $250,000 Annual revenues $90,000 $90,000 $70,000 Annual cost * $6,000 $12,000 $6,000 Salvage value $50,000 $30,000 $50,000 Life of asset 20 years 20 years Annual revenue and cost figures are increases over the "do nothing" alternative (DN). 20 years "Print Done AWN-2 5 Discrete Compounding; I= 10% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Glvon P Glvon F Glven A Glven A Given F FP PIF FIA PIA AlF 1.1000 0.9091 1.0000 0.9091 1.0000 1.2100 0.8264 2.1000 1.7355 0.4762 1.3310 0.7513 3.3100 2.4869 0.3021 1.4641 0.6830 4.6410 3.1699 0.2155 1.6105 0.6209 6.1051 3.7908 0.1638 1.7716 0.5645 7.7156 4.3553 0.1296 1.9487 0.5132 9.4872 4.8684 0.1054 2.1436 0.4665 11.4359 5.3349 0.0874 2.3579 0.4241 13.5795 5.7590 0.0736 2.5937 0.3855 15.9374 6.1446 0.0627 2.8531 0.3505 18.5312 6.4951 0.0540 3.1384 0.3186 21.3843 6.8137 0.0468 3.4523 0.2897 24.5227 7.1034 0.0408 3.7975 0.2633 27.9750 7.3667 0.0357 4.1772 0.2394 31.7725 7.6061 0.0315 4.5950 0.2176 35.9497 7.8237 0.0278 5.0545 0.1978 40.5447 8.0216 0.0247 5.5599 n. 1799 45.5992 R 2014 n0219 Capital Recovery Factor To Find A Given P AIP 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627 0.1540 0.1468 0.1408 0.1357 0.1315 0.1278 0.1247 0 1219 6 7 8 9 10 11 12 13 14 15 16 17 18 Print Done Perform the incremental PW Analysis . Fil - in the table below ( Hint : Orderaternatives by increasing capital investment ) . ( Round to the nearest dollar )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started