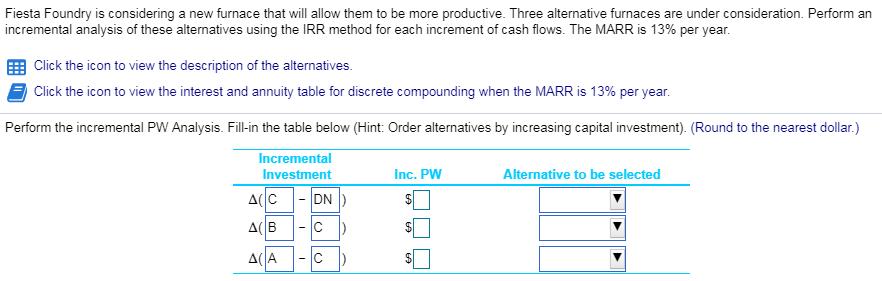

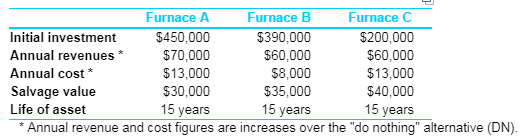

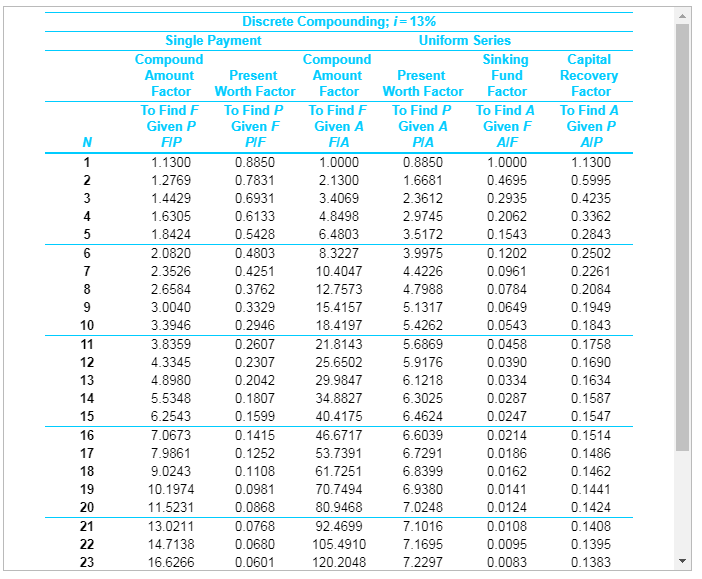

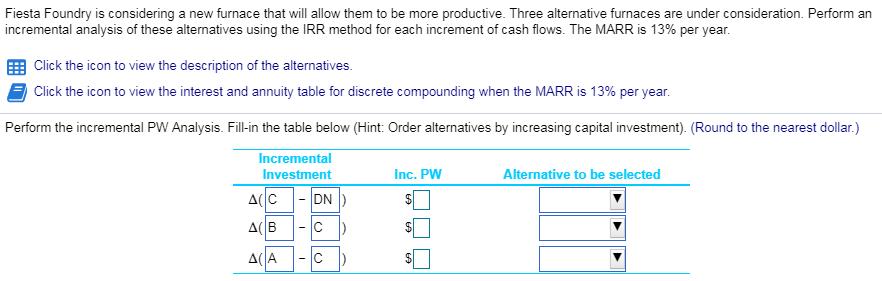

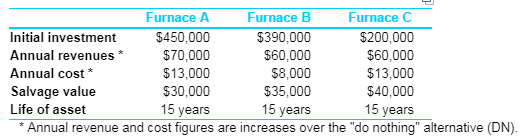

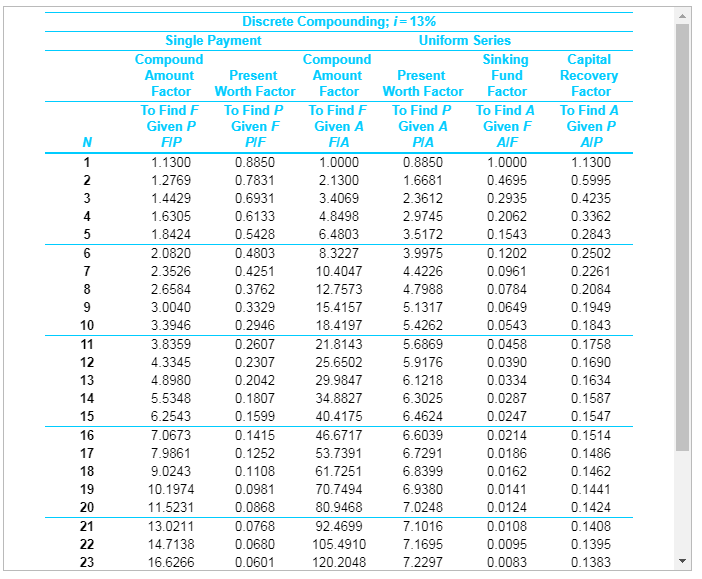

Fiesta Foundry is considering incremental analysis of these alternatives using the IRR method for each increment of cash flows. The MARR is 13% per year a new furnace that will allow them to be more productive. Three alternative furnaces are under consideration. Perform an Click the icon to view the description of the alternatives. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 13% per year. Perform the incremental PW Analysis. Fil-in the table below (Hint: Order alternatives by increasing capital investment). (Round to the nearest dollar.) Incremental Inc. PW Investment Alternative to be selected ( 1C DN A B C AA Furnace A Furnace B Furnace C Initial investment $200,000 $60,000 $13,000 $40,000 15 years are increases over the "do nothing" alternative (DN). $390,000 $60,000 $8,000 $35,000 15 years $450,000 $70,000 Annual revenues Annual cost $13,000 $30,000 15 years Annual revenue and cost figures Salvage value Life of asset Discrete Compounding; i 13% Single Payment Uniform Series Sinking Fund Capital Recovery Factor Compound Amount Compound Amount Present Present Factor Worth Factor Factor Worth Factor Factor To Find F Given A To Find P Given A To Find A To Find P To Find F To Find A Given P Given F Given F Given P FIP PIF FIA PIA AIF AIP 0.8850 1 1.1300 1.0000 0.8850 1.0000 1.1300 2 1.2769 0.7831 2.1300 1.6681 0.4695 0.5995 2.3612 3 1.4429 0.6931 3.4069 0.2935 0.4235 4 1.6305 0.3362 0.6133 4.8498 2.9745 0.2062 1.8424 2.0820 0.1543 5 0.5428 6.4803 3.5172 0.2843 6 0.4803 8.3227 3.9975 0.1202 0.2502 2.3526 0.4251 7 10.4047 4.4226 0.0961 0.2261 8 2.6584 0.3762 12.7573 4.7988 0.0784 0.2084 0.3329 0.1949 9 3.0040 15.4157 5.1317 0.0649 3.3946 0.2946 0.1843 10 18.4197 5.4262 0.0543 0.2607 0.1758 11 3.8359 21.8143 5.6869 0.0458 25.6502 0.0390 12 4.3345 0.2307 5.9176 0.1690 4.8980 29.9847 0.0334 13 0.2042 6.1218 0.1634 5.5348 14 0.1807 34.8827 6.3025 0.0287 0.1587 0.1547 15 6.2543 0.1599 40.4175 6.4624 0.0247 6.6039 16 7.0673 0.1415 46.6717 0.0214 0.1514 0.1252 53.7391 0.0186 17 7.9861 6.7291 0.1486 18 9.0243 0.1108 61.7251 6.8399 0.0162 0.1462 19 0.0141 10.1974 0.0981 70.7494 6.9380 0.1441 7.0248 0.0124 0.1424 20 11.5231 0.0868 80.9468 92.4699 21 13.0211 0.0768 7.1016 0.0108 0.1408 22 14.7138 0.0680 105.4910 7.1695 0.0095 0.1395 23 16.6266 0.0601 120.2048 7.2297 0.0083 0.1383