Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FIFC LO1, BRIEF EXERCISE 8.1 Smalley Co. purchased items of inventory as follows: 4 Jan. 100 units @ $2.00 23 Jan. 120 units @ $2.25

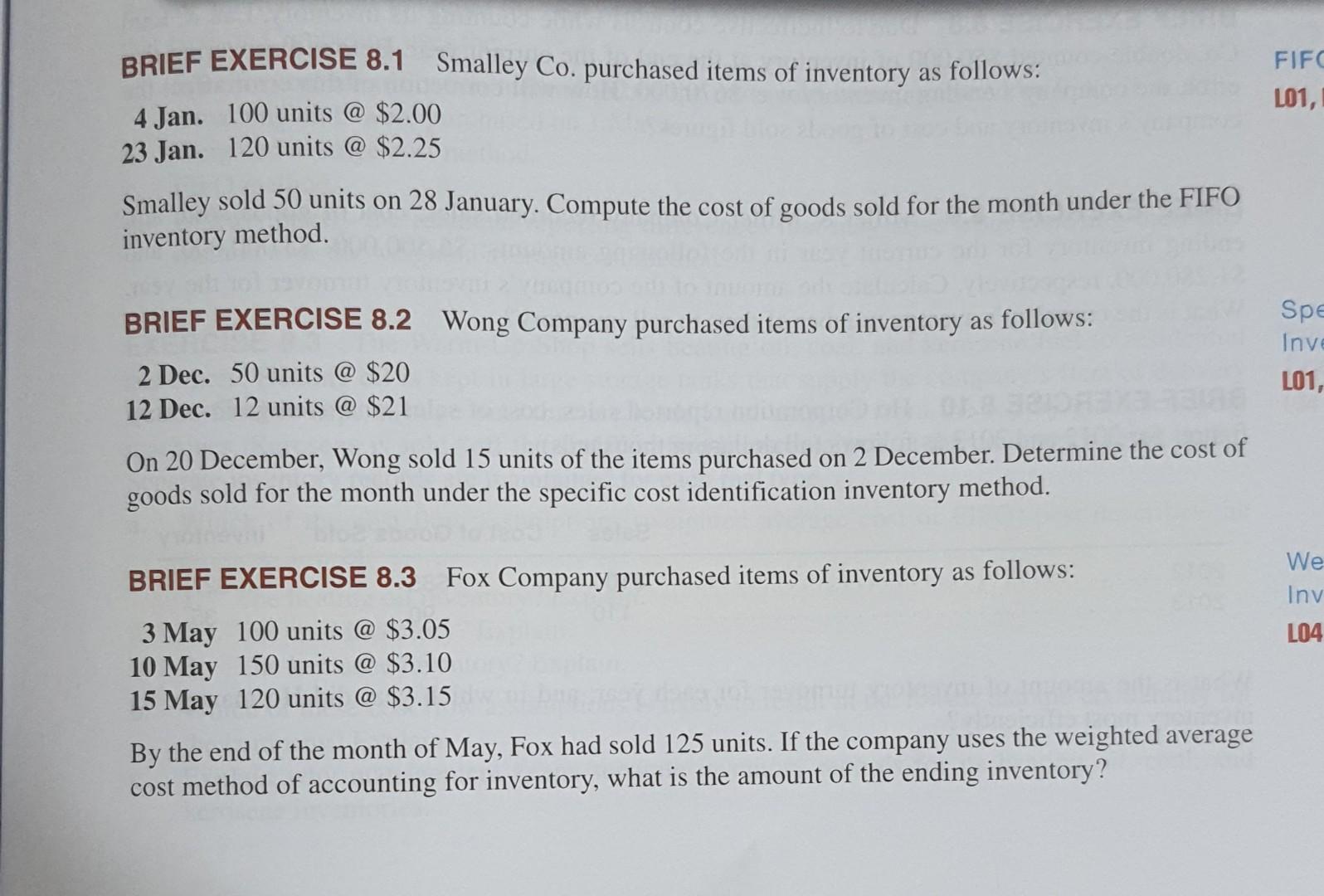

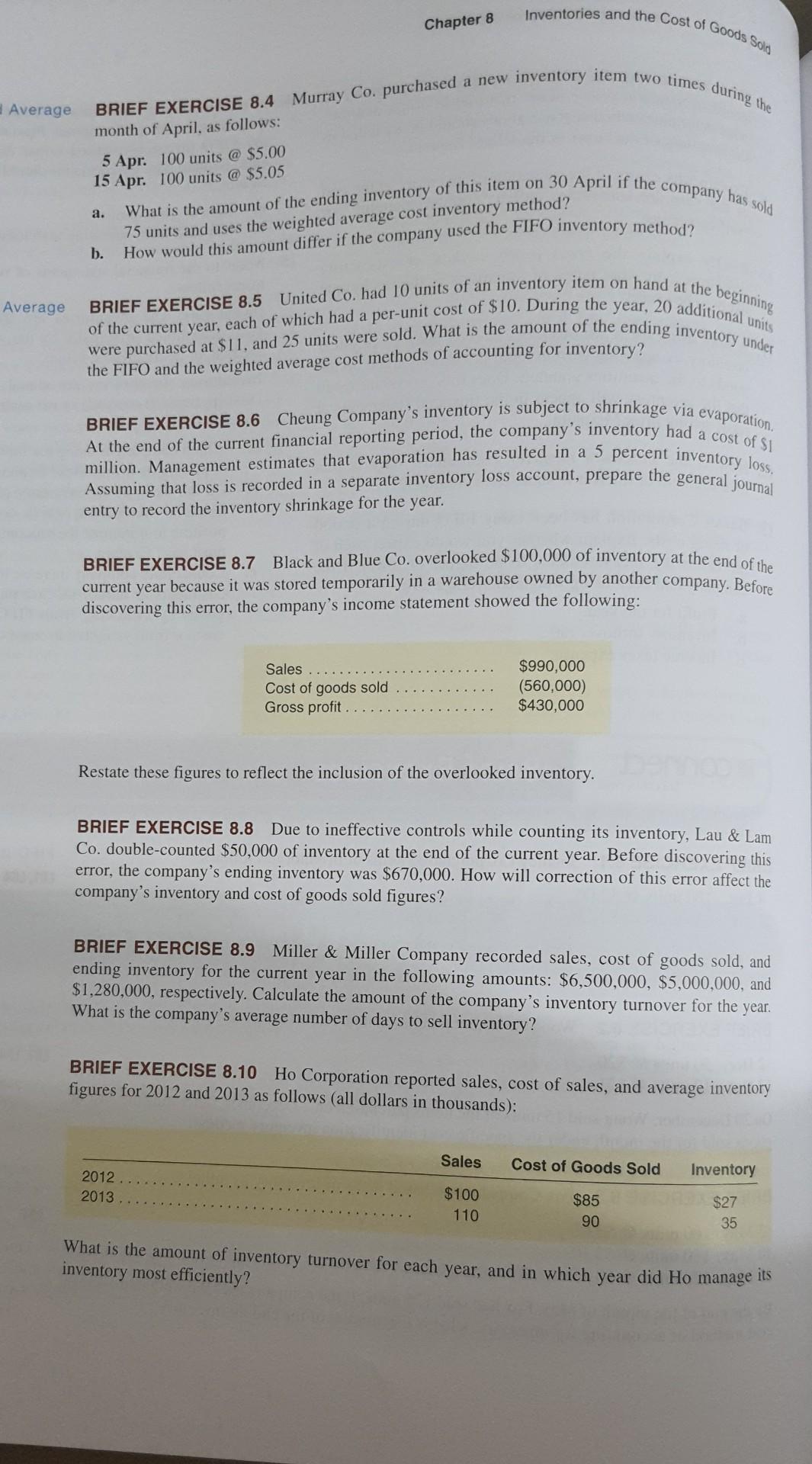

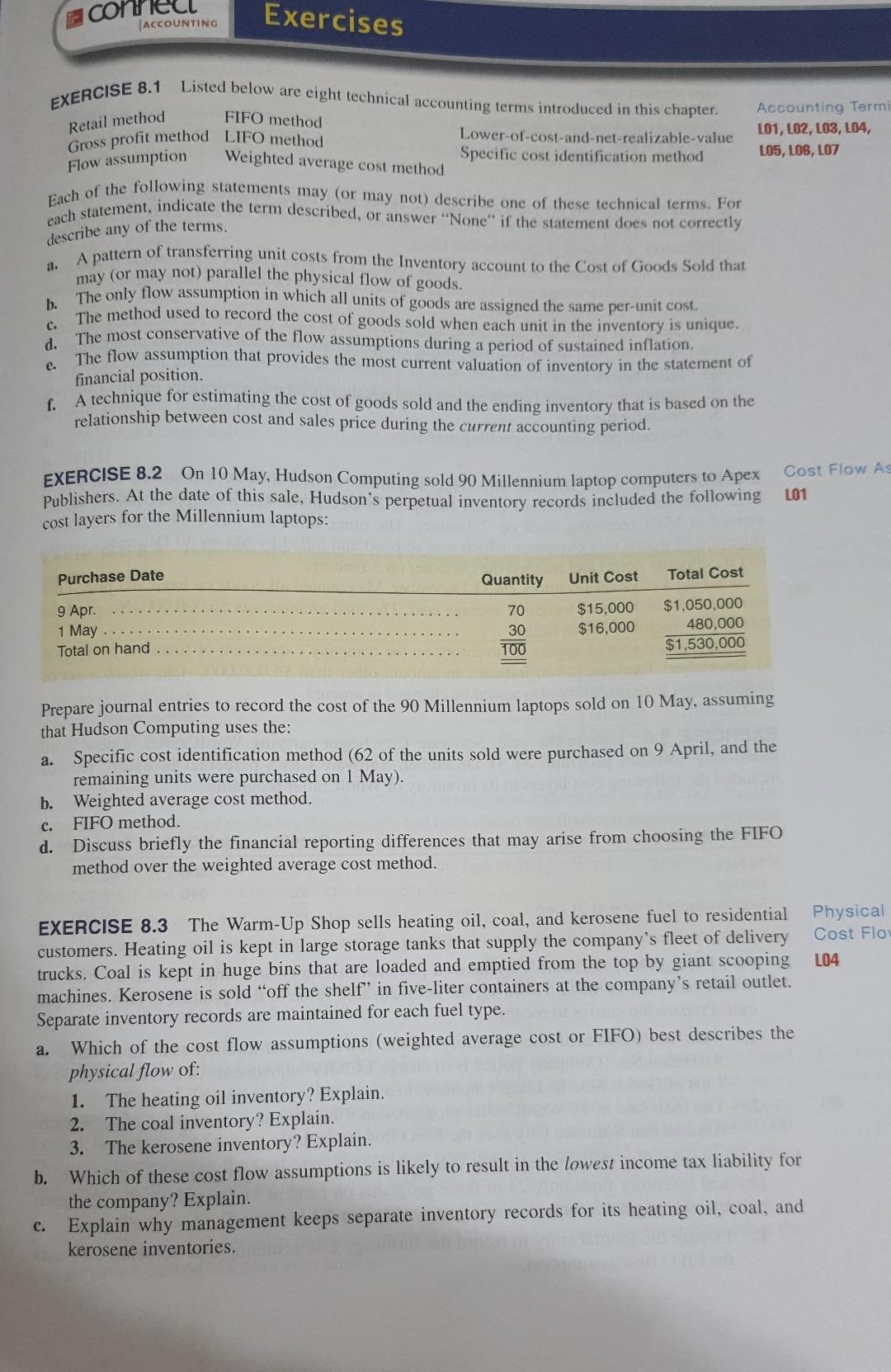

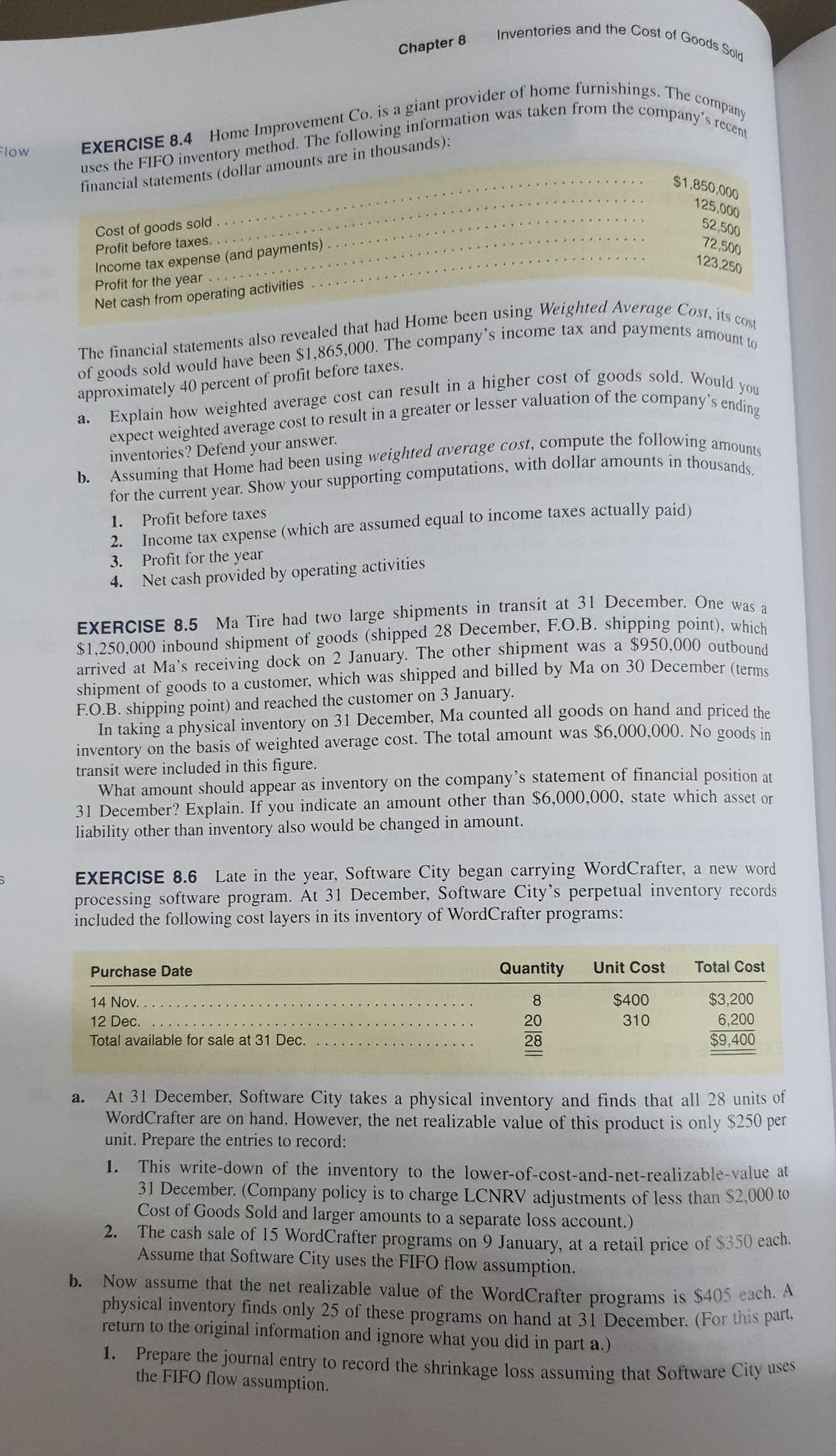

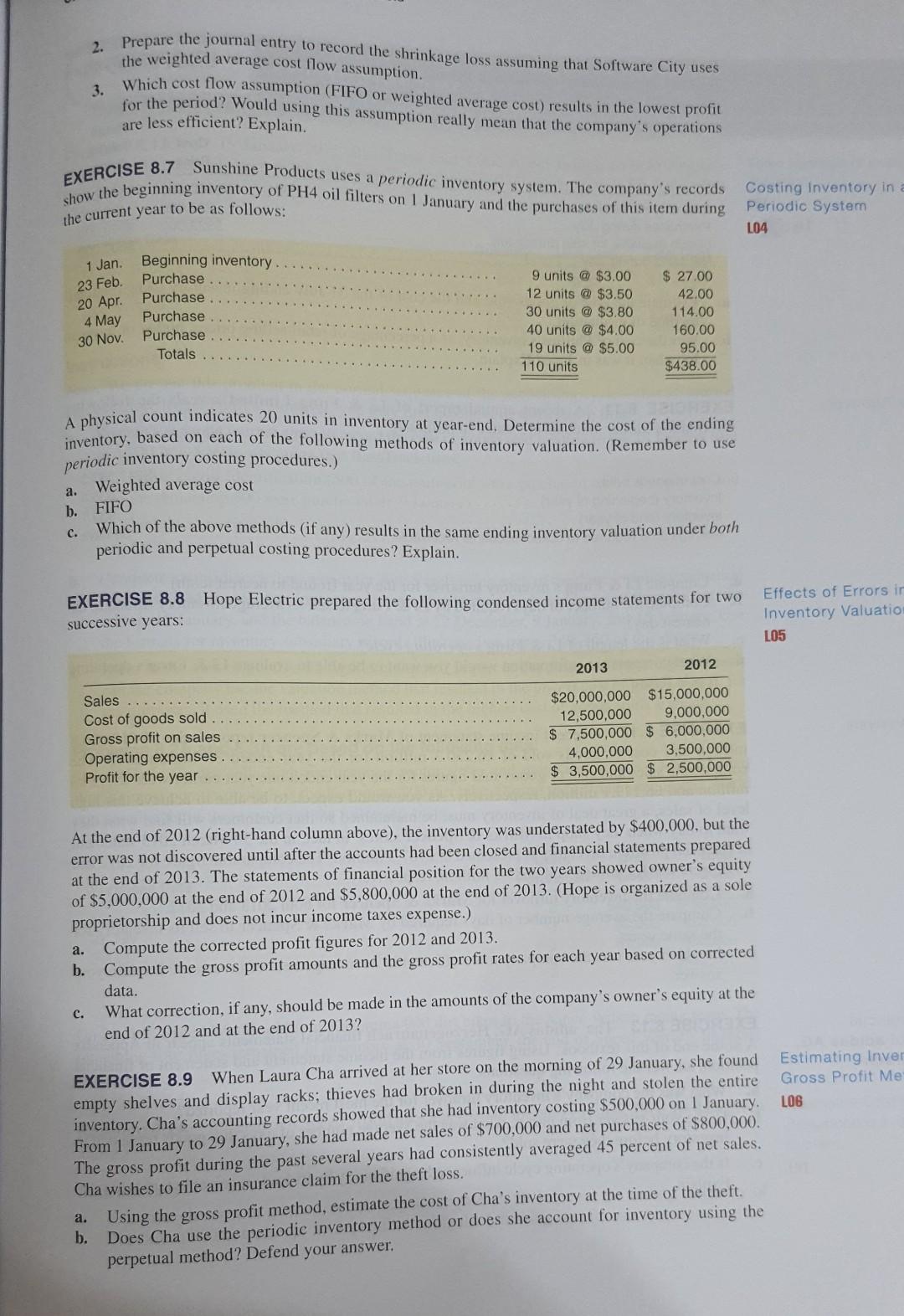

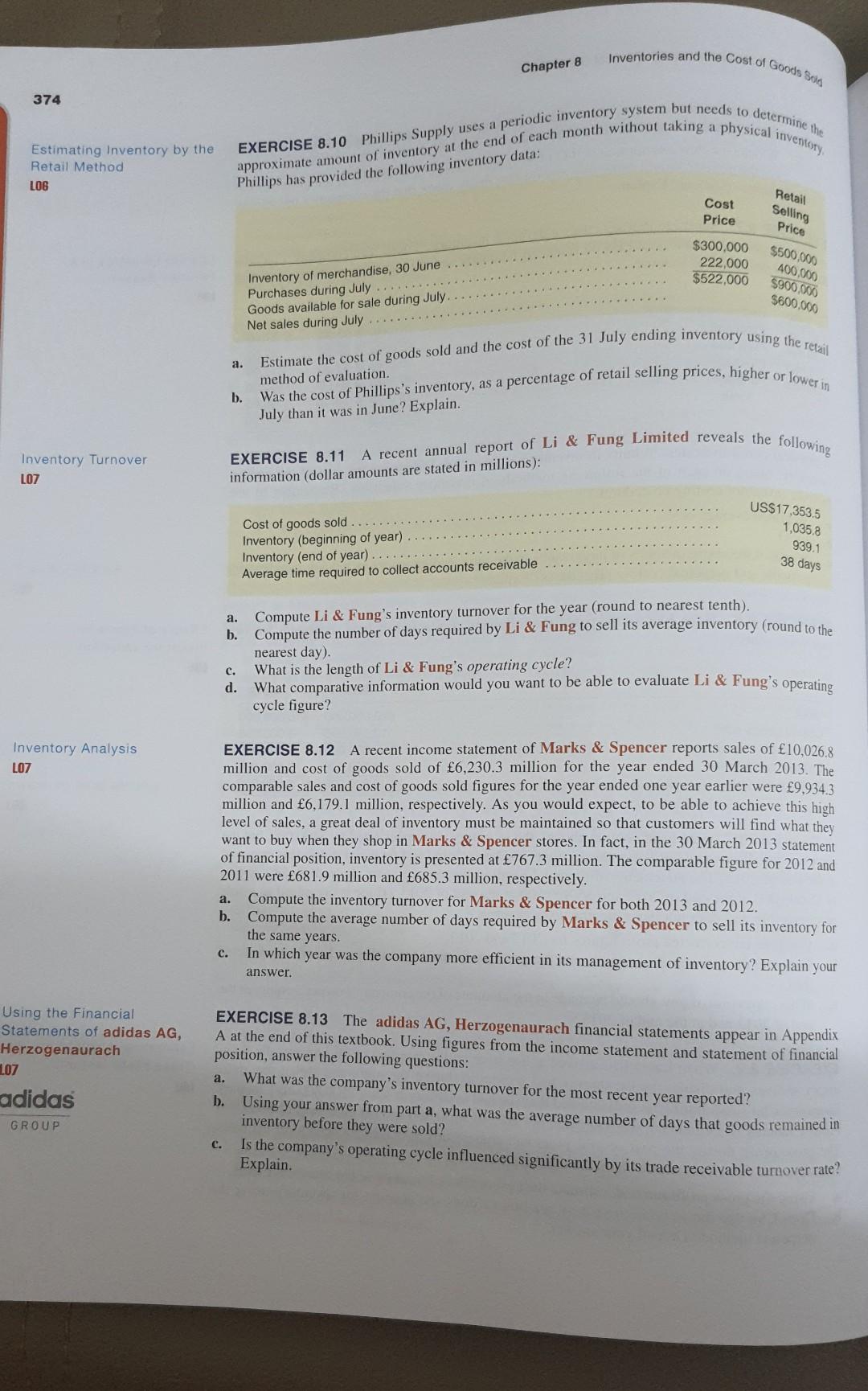

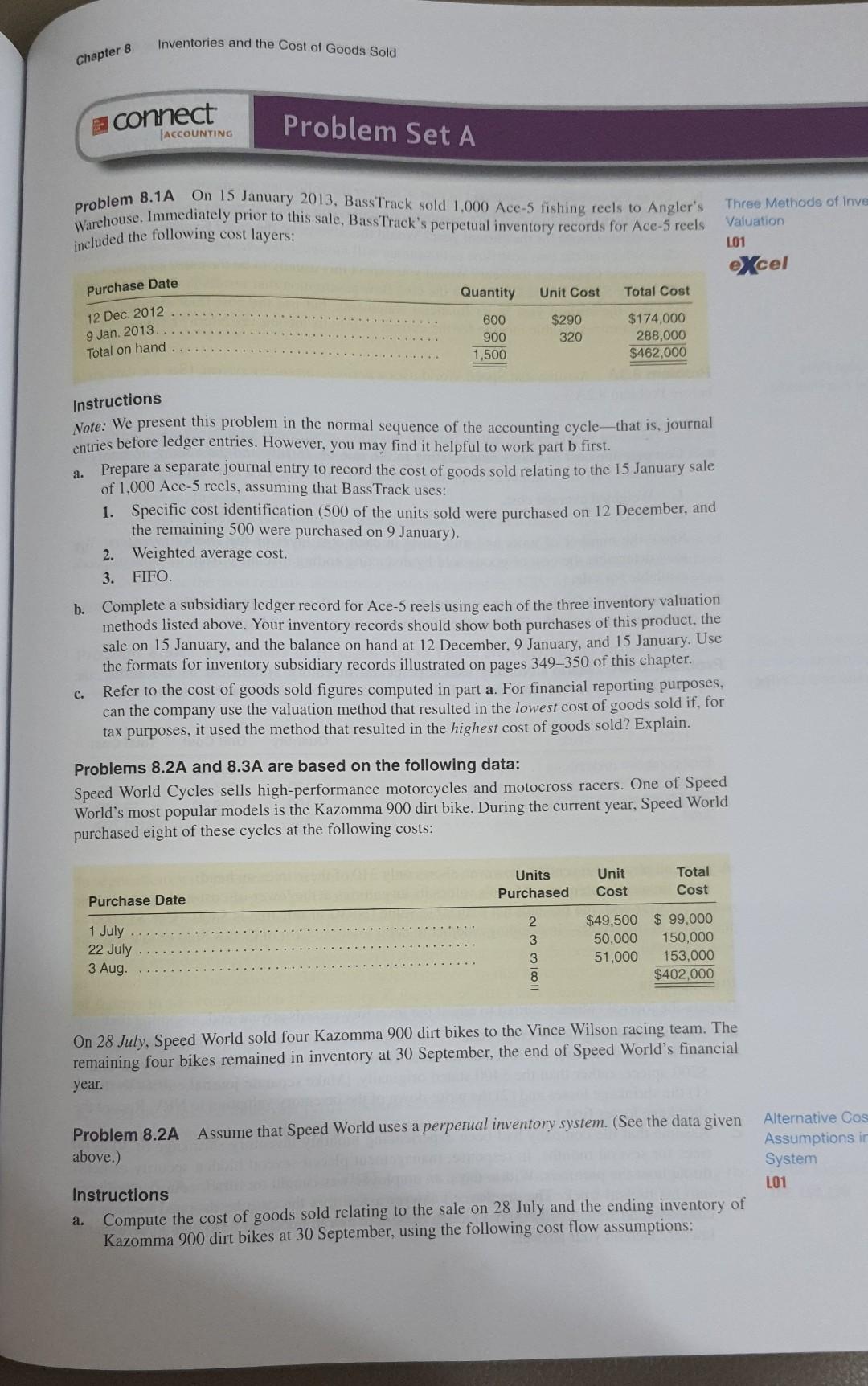

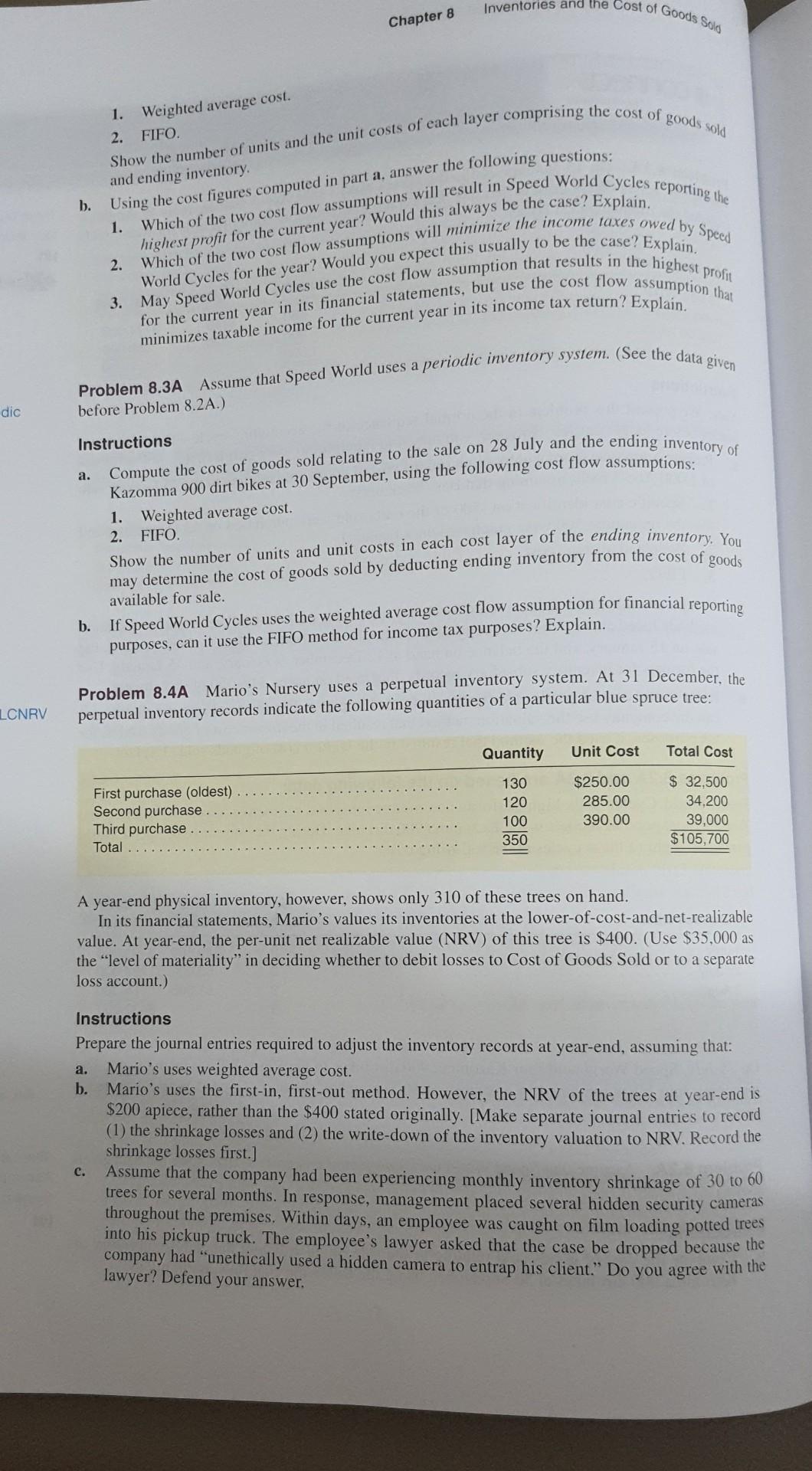

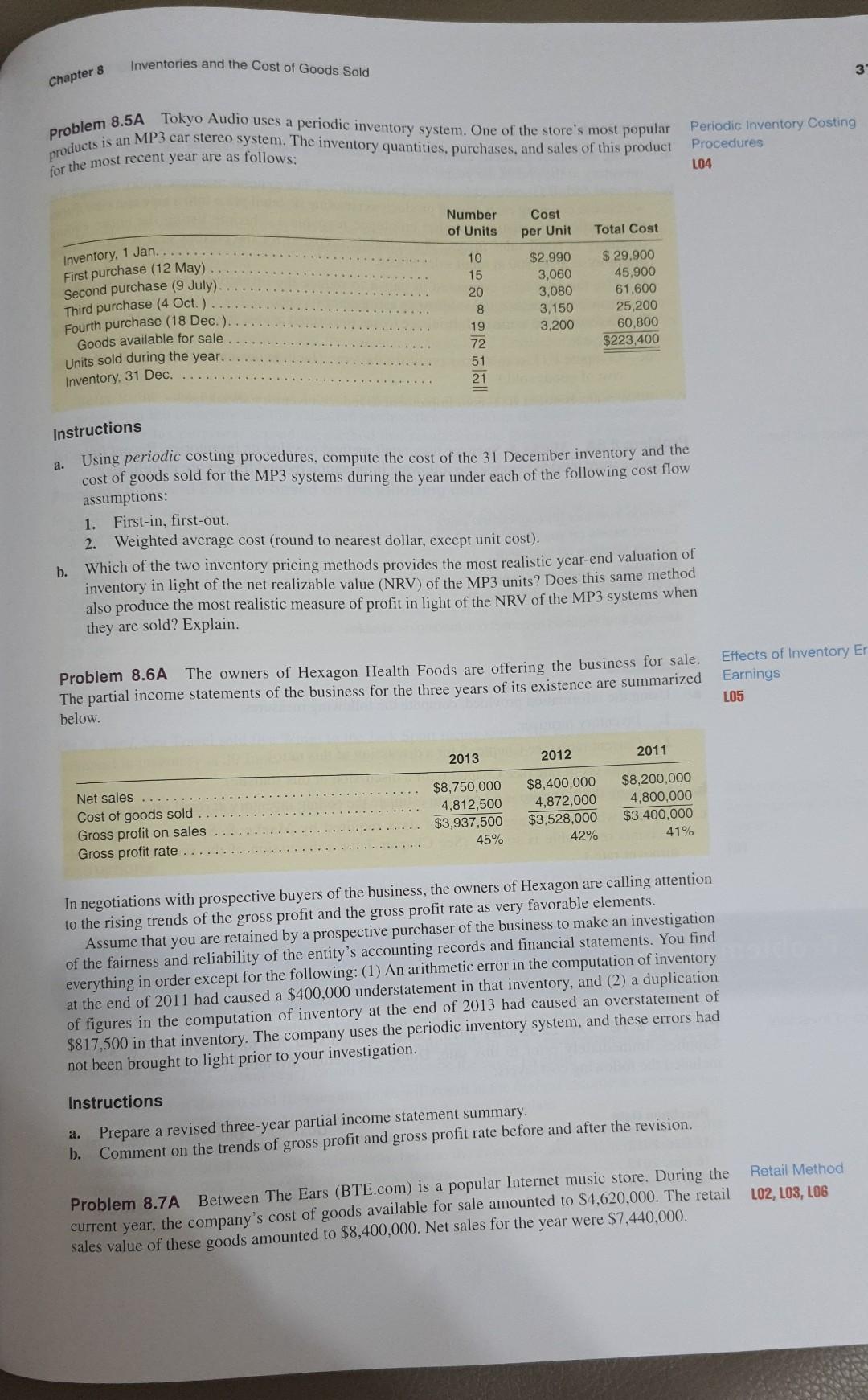

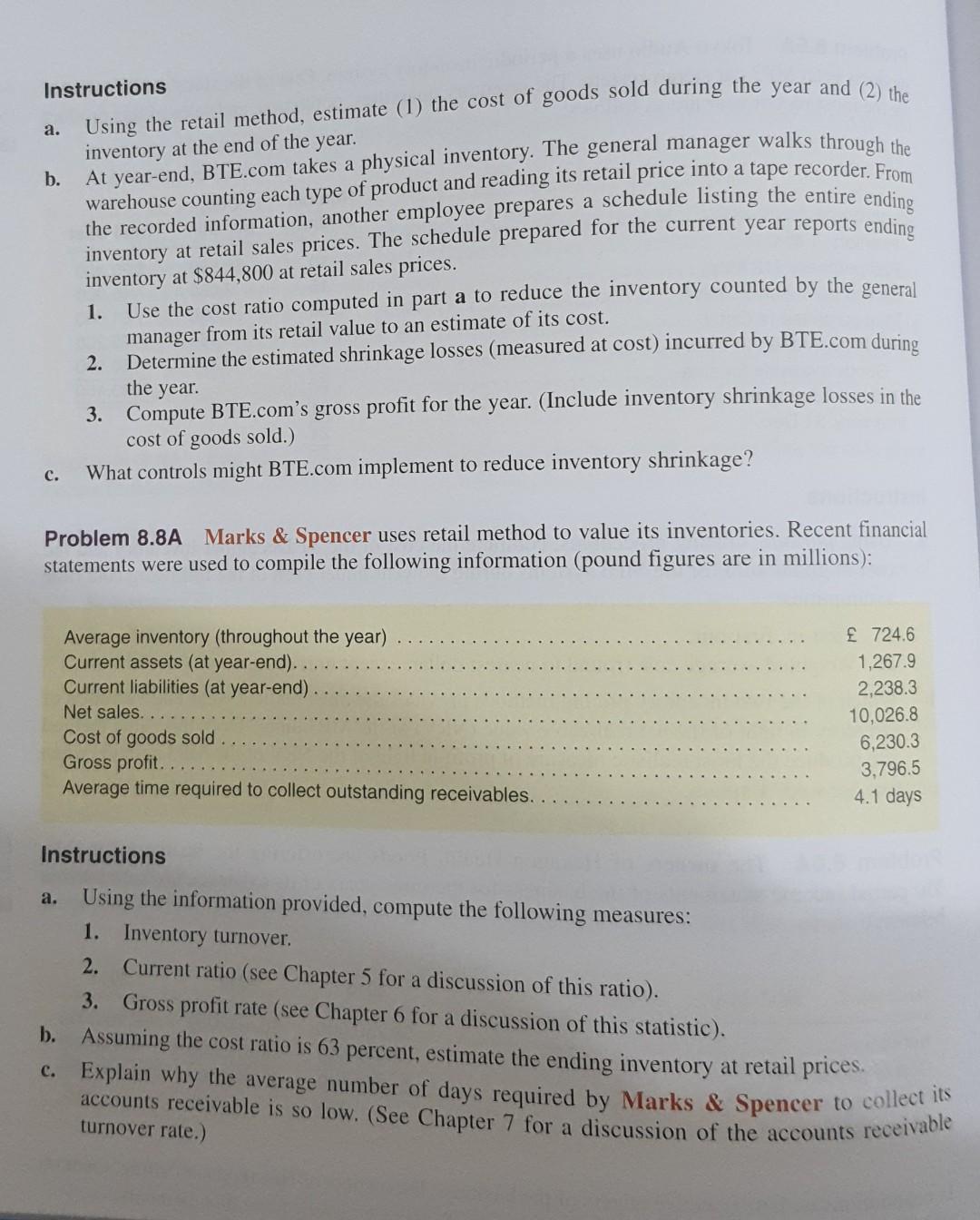

FIFC LO1, BRIEF EXERCISE 8.1 Smalley Co. purchased items of inventory as follows: 4 Jan. 100 units @ $2.00 23 Jan. 120 units @ $2.25 Smalley sold 50 units on 28 January. Compute the cost of goods sold for the month under the FIFO inventory method. Spe Inye LO1, BRIEF EXERCISE 8.2 Wong Company purchased items of inventory as follows: 2 Dec. 50 units @ $20 12 Dec. 12 units @ $21 On 20 December, Wong sold 15 units of the items purchased on 2 December. Determine the cost of goods sold for the month under the specific cost identification inventory method. We Inv L04 BRIEF EXERCISE 8.3 Fox Company purchased items of inventory as follows: 3 May 100 units @ $3.05 10 May 150 units @ $3.10 15 May 120 units @ $3.15 By the end of the month of May, Fox had sold 125 units. If the company uses the weighted average cost method of accounting for inventory, what is the amount of the ending inventory? Inventories and the Cost of Goods Solo Chapter 8 BRIEF EXERCISE 8.4 Murray Co. purchased a new inventory item two times during the Average month of April, as follows: 5 Apr. 100 units @ $5.00 15 Apr. 100 units @ $5.05 What is the amount of the ending inventory of this item on 30 April if the company has sold a. b. 75 units and uses the weighted average cost inventory method? How would this amount differ if the company used the FIFO inventory method? Average BRIEF EXERCISE 8.5 United Co. had 10 units of an inventory item on hand at the beginning of the current year, each of which had a per-unit cost of $10. During the year, 20 additional units were purchased at $11, and 25 units were sold. What is the amount of the ending inventory under the FIFO and the weighted average cost methods of accounting for inventory? BRIEF EXERCISE 8.6 Cheung Company's inventory is subject to shrinkage via evaporation. At the end of the current financial reporting period, the company's inventory had a cost of $1 million. Management estimates that evaporation has resulted in a 5 percent inventory loss. Assuming that loss is recorded in a separate inventory loss account, prepare the general journal entry to record the inventory shrinkage for the year. BRIEF EXERCISE 8.7 Black and Blue Co. overlooked $100,000 of inventory at the end of the current year because it was stored temporarily in a warehouse owned by another company. Before discovering this error, the company's income statement showed the following: Sales Cost of goods sold Gross profit $990,000 (560,000) $430,000 Restate these figures to reflect the inclusion of the overlooked inventory. BRIEF EXERCISE 8.8 Due to ineffective controls while counting its inventory, Lau & Lam Co. double-counted $50,000 of inventory at the end of the current year. Before discovering this error, the company's ending inventory was $670,000. How will correction of this error affect the company's inventory and cost of goods sold figures? BRIEF EXERCISE 8.9 Miller & Miller Company recorded sales, cost of goods sold, and ending inventory for the current year in the following amounts: $6,500,000, $5,000,000, and $1,280,000, respectively. Calculate the amount of the company's inventory turnover for the year. What is the company's average number of days to sell inventory? BRIEF EXERCISE 8.10 Ho Corporation reported sales, cost of sales, and average inventory figures for 2012 and 2013 as follows (all dollars in thousands): Sales Cost of Goods Sold Inventory 2012 2013. $100 110 $85 90 $27 35 What is the amount of inventory turnover for each year, and in which year did Ho inventory most efficiently? manage its con Exercises ACCOUNTING EXERCISE 8.1 Retail method Flow assumption describe any of the terms. Listed below are eight technical accounting terms introduced in this chapter. Accounting Termi FIFO method L01, L02, L03, 104, Lower-of-cost-and-net-realizable-value Gross profit method LIFO method LO5, LOB, LO7 Weighted average cost method Specific cost identification method each statement, indicate the term described, or answer 'None" if the statement does not correctly Each of the following statements may or may not) describe one of these technical terms. For A pattern of transferring unit costs from the Inventory account to the Cost of Goods Sold that may or may not) parallel the physical flow of goods. The only flow assumption in which all units of goods are assigned the same per-unit cost. The method used to record the cost of goods sold when each unit in the inventory is unique. The most conservative of the flow assumptions during a period of sustained inflation The flow assumption that provides the most current valuation of inventory in the statement of financial position A technique for estimating the cost of goods sold and the ending inventory that is based on the relationship between cost and sales price during the current accounting period. il. b. d. e. f. EXERCISE 8.2 On 10 May, Hudson Computing sold 90 Millennium laptop computers to Apex Publishers . At the date of this sale, Hudson's perpetual inventory records included the following cost layers for the Millennium laptops: Cost Flow AS LO1 Purchase Date Quantity Unit Cost Total Cost 9 Apr. 1 May.. Total on hand 70 30 100 $15,000 $16,000 $1,050,000 480,000 $1,530,000 Prepare journal entries to record the cost of the 90 Millennium laptops sold on 10 May, assuming that Hudson Computing uses the: a. Specific cost identification method (62 of the units sold were purchased on 9 April, and the remaining units were purchased on 1 May). b. Weighted average cost method. FIFO method. d. Discuss briefly the financial reporting differences that may arise from choosing the FIFO method over the weighted average cost method. c. Physical Cost Flo L04 a. EXERCISE 8.3 The Warm-Up Shop sells heating oil, coal, and kerosene fuel to residential customers. Heating oil is kept in large storage tanks that supply the company's fleet of delivery trucks. Coal is kept in huge bins that are loaded and emptied from the top by giant scooping machines. Kerosene is sold "off the shelf" in five-liter containers at the company's retail outlet. Separate inventory records are maintained for each fuel type. Which of the cost flow assumptions (weighted average cost or FIFO) best describes the physical flow of: 1. The heating oil inventory? Explain. 2. The coal inventory? Explain. 3. The kerosene inventory? Explain. b. Which of these cost flow assumptions is likely to result in the lowest income tax liability for the company? Explain. c. Explain why management keeps separate inventory records for its heating oil, coal, and kerosene inventories. Inventories and the Cost of Goods Sold Chapter 8 Flow uses the FIFO inventory method. The following information was taken from the company's recent EXERCISE 8.4 Home Improvement Co. is a giant provider of home furnishings. The company financial statements (dollar amounts are in thousands): $1,850,000 125,000 52,500 72,500 123,250 Cost of goods sold Profit before taxes. Income tax expense (and payments) Profit for the year Net cash from operating activities approximately 40 percent of profit before taxes. a. The financial statements also revealed that had Home been using Weighted Average Cost, its cost of goods sold would have been $1,865,000. The company's income tax and payments amount to Explain how weighted average cost can result in a higher cost of goods sold. Would you expect weighted average cost to result in a greater or lesser valuation of the company's ending b. Assuming that Home had been using weighted average cost, compute the following amounts for the current year. Show your supporting computations, with dollar amounts in thousands. 1. Profit before taxes 2. Income tax expense (which are assumed equal to income taxes actually paid) 3. Profit for the year 4. Net cash provided by operating activities inventories? Defend your answer. EXERCISE 8.5 Ma Tire had two large shipments in transit at 31 December. One was a $1,250,000 inbound shipment of goods (shipped 28 December, F.O.B. shipping point), which arrived at Ma's receiving dock on 2 January. The other shipment was a $950,000 outbound shipment of goods to a customer, which was shipped and billed by Ma on 30 December (terms F.O.B. shipping point) and reached the customer on 3 January. In taking a physical inventory on 31 December, Ma counted all goods on hand and priced the inventory on the basis of weighted average cost. The total amount was $6,000,000. No goods in transit were included in this figure. What amount should appear as inventory on the company's statement of financial position at 31 December? Explain. If you indicate an amount other than $6,000,000, state which asset or liability other than inventory also would be changed in amount. 5 EXERCISE 8.6 Late in the year, Software City began carrying WordCrafter, a new word processing software program. At 31 December, Software City's perpetual inventory records included the following cost layers in its inventory of WordCrafter programs: Purchase Date Quantity Unit Cost Total Cost 14 Nov. 12 Dec. Total available for sale at 31 Dec. 8 20 28 $400 310 $3,200 6,200 $9,400 a. At 31 December, Software City takes a physical inventory and finds that all 28 units of WordCrafter are on hand. However, the net realizable value of this product is only $250 per unit. Prepare the entries to record: 1. This write-down of the inventory to the lower-of-cost-and-net-realizable-value at 31 December. (Company policy is to charge LCNRV adjustments of less than $2,000 to Cost of Goods Sold and larger amounts to a separate loss account.) 2. The cash sale of 15 WordCrafter programs on 9 January, at a retail price of $350 each. Assume that Software City uses the FIFO flow assumption. b. Now assume that the net realizable value of the WordCrafter programs is $405 each. A physical inventory finds only 25 of these programs on hand at 31 December. (For this part, return to the original information and ignore what you did in part a.) 1. Prepare the journal entry to record the shrinkage loss assuming that Software City uses the FIFO flow assumption. 2. Prepare the journal entry to record the shrinkage loss assuming that Software City uses the weighted average cost flow assumption. Which cost flow assumption (FIFO or weighted average cost) results in the lowest profit for the period? Would using this assumption really mean that the company's operations are less efficient? Explain. 3. EXERCISE 8.7 Sunshine Products uses a periodic inventory system. The company's records how the beginning inventory of PH4 oil filters on 1 January and the purchases of this item during the current year to be as follows: Costing Inventory in Periodic System LO4 1 Jan. 23 Feb. 20 Apr. 4 May 30 Nov. Beginning inventory Purchase Purchase Purchase Purchase Totals 9 units @ $3.00 12 units @ $3.50 30 units @ $3.80 40 units @ $4.00 19 units @ $5.00 110 units $ 27.00 42.00 114.00 160.00 95.00 $438.00 A physical count indicates 20 units in inventory at year-end. Determine the cost of the ending inventory, based on each of the following methods of inventory valuation. (Remember to use periodic inventory costing procedures.) Weighted average cost a. b. FIFO c. Which of the above methods (if any) results in the same ending inventory valuation under both periodic and perpetual costing procedures? Explain. EXERCISE 8.8 Hope Electric prepared the following condensed income statements for two successive years: Effects of Errors ir Inventory Valuatio L05 2013 2012 Sales Cost of goods sold Gross profit on sales Operating expenses. Profit for the year $20,000,000 $15,000,000 12,500,000 9,000,000 $ 7,500,000 $ 6,000,000 4,000.000 3,500,000 $ 3,500,000 $ 2,500,000 At the end of 2012 (right-hand column above), the inventory was understated by $400,000, but the error was not discovered until after the accounts had been closed and financial statements prepared at the end of 2013. The statements of financial position for the two years showed owner's equity of $5,000,000 at the end of 2012 and $5,800,000 at the end of 2013. (Hope is organized as a sole proprietorship and does not incur income taxes expense.) Compute the corrected profit figures for 2012 and 2013. b. Compute the gross profit amounts and the gross profit rates for each year based on corrected data. What correction, if any, should be made in the amounts of the company's owner's equity at the end of 2012 and at the end of 2013? a. c. Estimating Inver Gross Profit Me LOG EXERCISE 8.9 When Laura Cha arrived at her store on the morning of 29 January, she found empty shelves and display racks; thieves had broken in during the night and stolen the entire inventory. Cha's accounting records showed that she had inventory costing $500,000 on 1 January. From 1 January to 29 January, she had made net sales of $700,000 and net purchases of $800,000. The gross profit during the past several years had consistently averaged 45 percent of net sales. Cha wishes to file an insurance claim for the theft loss. a. Using the gross profit method, estimate the cost of Cha's inventory at the time of the theft. b. Does Cha use the periodic inventory method or does she account for inventory using the perpetual method? Defend your answer. Inventories and the Cost of Goods Chapter 8 374 Estimating Inventory by the Retail Method LOG EXERCISE 8.10 Phillips Supply uses a periodic inventory system but needs to determine the approximate amount of inventory at the end of each month without taking a physical inventory Phillips has provided the following inventory data: Cost Price Retail Selling Price $300,000 222,000 $522,000 Inventory of merchandise, 30 June Purchases during July Goods available for sale during July Net sales during July $500.000 400,000 $900.000 $600.000 a. Estimate the cost of goods sold and the cost of the 31 July ending inventory using the retail Was the cost of Phillips's inventory, as a percentage of retail selling prices, higher or lower in method of evaluation. b. July than it was in June? Explain Inventory Turnover LOZ EXERCISE 8.11 A recent annual report of Li & Fung Limited reveals the following information (dollar amounts are stated in millions): Cost of goods sold Inventory (beginning of year) Inventory (end of year) Average time required to collect accounts receivable US$17.353.5 1,035.8 939.1 38 days a. Compute Li & Fung's inventory turnover for the year (round to nearest tenth). b. Compute the number of days required by Li & Fung to sell its average inventory (round to the nearest day). What is the length of Li & Fung's operating cycle? d. What comparative information would you want to be able to evaluate cycle figure? C. & Fung's operating Inventory Analysis LO7 EXERCISE 8.12 A recent income statement of Marks & Spencer reports sales of 10,026.8 million and cost of goods sold of 6,230.3 million for the year ended 30 March 2013. The comparable sales and cost of goods sold figures for the year ended one year earlier were 9.934.3 million and 6.179.1 million, respectively. As you would expect, to be able to achieve this high level of sales, a great deal of inventory must be maintained so that customers will find what they want to buy when they shop in Marks & Spencer stores. In fact, in the 30 March 2013 statement of financial position, inventory is presented at 767.3 million. The comparable figure for 2012 and 2011 were 681.9 million and 685.3 million, respectively. a. Compute the inventory turnover for Marks & Spencer for both 2013 and 2012. b. Compute the average number of days required by Marks & Spencer to sell its inventory for the same years. In which year was the company more efficient in its management of inventory? Explain your c. answer. Using the Financial Statements of adidas AG, Herzogenaurach LO7 adidas GROUP a. EXERCISE 8.13 The adidas AG, Herzogenaurach financial statements appear in Appendix A at the end of this textbook. Using figures from the income statement and statement of financial position, answer the following questions: What was the company's inventory turnover for the most recent year reported? b. Using your answer from part a, what was the average number of days that goods remained in inventory before they were sold? Is the company's operating cycle influenced significantly by its trade receivable turnover rate? Explain. c. Inventories and the Cost of Goods Sold Chapter 8 connect Problem Set A ACCOUNTING Problem 8.1A On 15 January 2013, Bass Track sold 1,000 Ace-5 fishing reels to Angler's Warehouse. Immediately prior to this sale, Bass Track's perpetual inventory records for Ace-5 reels included the following cost layers: Three Methods of Inve Valuation L01 excel Purchase Date Quantity Unit Cost Total Cost 12 Dec. 2012 9 Jan. 2013 Total on hand 600 900 1,500 $290 320 $174,000 288,000 $462,000 Instructions 2. Note: We present this problem in the normal sequence of the accounting cycle-that is, journal entries before ledger entries. However, you may find it helpful to work part b first. a. Prepare a separate journal entry to record the cost of goods sold relating to the 15 January sale of 1,000 Ace-5 reels, assuming that BassTrack uses: 1. Specific cost identification (500 of the units sold were purchased on 12 December, and the remaining 500 were purchased on 9 January). Weighted average cost. 3. FIFO. b. Complete a subsidiary ledger record for Ace-5 reels using each of the three inventory valuation methods listed above. Your inventory records should show both purchases of this product, the sale on 15 January, and the balance on hand at 12 December, 9 January, and 15 January. Use the formats for inventory subsidiary records illustrated on pages 349350 of this chapter. Refer to the cost of goods sold figures computed in part a. For financial reporting purposes, can the company use the valuation method that resulted in the lowest cost of goods sold if, for tax purposes, it used the method that resulted in the highest cost of goods sold? Explain. c. Problems 8.2A and 8.3A are based on the following data: Speed World Cycles sells high-performance motorcycles and motocross racers. One of Speed World's most popular models is the Kazomma 900 dirt bike. During the current year, Speed World purchased eight of these cycles at the following costs: Units Purchased Unit Cost Total Cost Purchase Date 1 July 22 July 3 Aug 2 3 3 8 $49,500 $ 99,000 50,000 150,000 51,000 153,000 $402,000 100 11 On 28 July, Speed World sold four Kazomma 900 dirt bikes to the Vince Wilson racing team. The remaining four bikes remained in inventory at 30 September, the end of Speed World's financial year. Assume that Speed World uses a perpetual inventory system. (See the data given Problem 8.2A above.) Alternative Cos Assumptions in System L01 Instructions a. Compute the cost of goods sold relating to the sale on 28 July and the ending inventory of Kazomma 900 dirt bikes at 30 September, using the following cost flow assumptions: Inventories and the Cost of Goods Solo Chapter 8 1. Weighted average cost. 2. FIFO. Show the number of units and the unit costs of each layer comprising the cost of goods sold and ending inventory. b. Using the cost figures computed in part a, answer the following questions: 1. Which of the two cost flow assumptions will result in Speed World Cycles reporting the Which of the two cost flow assumptions will minimize the income taxes owed by Speed highest profit for the current year? Would this always be the case? Explain. 2. World Cycles for the year? Would you expect this usually to be the case? Explain. 3. May Speed World Cycles use the cost flow assumption that results in the highest profit for the current year in its financial statements, but use the cost flow assumption that minimizes taxable income for the current year in its income tax return? Explain. Problem 8.3A Assume that Speed World uses a periodic inventory system. (See the data given dic before Problem 8.2A.) Instructions a. Compute the cost of goods sold relating to the sale on 28 July and the ending inventory of Kazomma 900 dirt bikes at 30 September, using the following cost flow assumptions: 1. Weighted average cost. 2. FIFO. Show the number of units and unit costs in each cost layer of the ending inventory. You may determine the cost of goods sold by deducting ending inventory from the cost of goods If Speed World Cycles uses the weighted average cost flow assumption for financial reporting purposes, can it use the FIFO method for income tax purposes? Explain. available for sale. b. Problem 8.4A Mario's Nursery uses a perpetual inventory system. At 31 December, the perpetual inventory records indicate the following quantities of a particular blue spruce tree: LCNRV Quantity Unit Cost Total Cost First purchase (oldest) Second purchase Third purchase Total 130 120 100 350 $250.00 285.00 390.00 $ 32,500 34.200 39,000 $105,700 A year-end physical inventory, however, shows only 310 of these trees on hand. In its financial statements, Mario's values its inventories at the lower-of-cost-and-net-realizable value. At year-end, the per-unit net realizable value (NRV) of this tree is $400. (Use $35,000 as the "level of materiality" in deciding whether to debit losses to Cost of Goods Sold or to a separate loss account.) a. Instructions Prepare the journal entries required to adjust the inventory records at year-end, assuming that: Mario's uses weighted average cost. b. Mario's uses the first-in, first-out method. However, the NRV of the trees at year-end is $200 apiece, rather than the $400 stated originally. [Make separate journal entries to record (1) the shrinkage losses and (2) the write-down of the inventory valuation to NRV. Record the shrinkage losses first.] Assume that the company had been experiencing monthly inventory shrinkage of 30 to 60 trees for several months. In response, management placed several hidden security cameras throughout the premises. Within days, an employee was caught on film loading potted trees into his pickup truck. The employee's lawyer asked that the case be dropped because the company had "unethically used a hidden camera to entrap his client." Do you agree with the lawyer? Defend your answer. c. Inventories and the Cost of Goods Sold 3 Chapter 8 Problem 8.5A Tokyo Audio uses a periodic inventory system. One of the store's most popular products is an MP3 car stereo system. The inventory quantities, purchases, and sales of this product for the most recent year are as follows: Periodic Inventory Costing Procedures L04 Number of Units Cost per Unit Total Cost Inventory, 1 Jan. First purchase (12 May) Second purchase (9 July). Third purchase (4 Oct.) Fourth purchase (18 Dec.). Goods available for sale Units sold during the year. Inventory, 31 Dec. 10 15 20 8 19 72 51 21 $2,990 3,060 3,080 3,150 3,200 $ 29,900 45,900 61.600 25,200 60,800 $223,400 Instructions a. Using periodic costing procedures, compute the cost of the 31 December inventory and the cost of goods sold for the MP3 systems during the year under each of the following cost flow assumptions: 1. First-in, first-out. 2. Weighted average cost (round to nearest dollar, except unit cost). b. Which of the two inventory pricing methods provides the most realistic year-end valuation of inventory in light of the net realizable value (NRV) of the MP3 units? Does this same method also produce the most realistic measure of profit in light of the NRV of the MP3 systems when they are sold? Explain. Problem 8.64 The owners of Hexagon Health Foods are offering the business for sale. The partial income statements of the business for the three years of its existence are summarized below. Effects of Inventory Er Earnings L05 2013 2012 2011 Net sales Cost of goods sold Gross profit on sales Gross profit rate $8,750,000 4,812,500 $3,937,500 45% $8,400,000 4,872,000 $3,528,000 42% $8,200,000 4,800,000 $3,400,000 41% In negotiations with prospective buyers of the business, the owners of Hexagon are calling attention to the rising trends of the gross profit and the gross profit rate as very favorable elements. Assume that you are retained by a prospective purchaser of the business to make an investigation of the fairness and reliability of the entity's accounting records and financial statements. You find everything in order except for the following: (1) An arithmetic error in the computation of inventory at the end of 2011 had caused a $400,000 understatement in that inventory, and (2) a duplication of figures in the computation of inventory at the end of 2013 had caused an overstatement of $817,500 in that inventory. The company uses the periodic inventory system, and these errors had not been brought to light prior to your investigation. a Instructions a. b. Prepare a revised three-year partial income statement summary. Comment on the trends of gross profit and gross profit rate before and after the revision. Retail Method LO2, LO3, LOS Problem 8.74 Between The Ears (BTE.com) is a popular Internet music store. During the current year, the company's cost of goods available for sale amounted to $4,620,000. The retail sales value of these goods amounted to $8,400,000. Net sales for the year were $7,440,000. Instructions a. b. Using the retail method, estimate (1) the cost of goods sold during the year and (2) the inventory at the end of the year. At year-end, BTE.com takes a physical inventory. The general manager walks through the warehouse counting each type of product and reading its retail price into a tape recorder. From the recorded information, another employee prepares a schedule listing the entire ending inventory at retail sales prices. The schedule prepared for the current year reports ending inventory at $844,800 at retail sales prices. Use the cost ratio computed in part a to reduce the inventory counted by the general manager from its retail value to an estimate of its cost. Determine the estimated shrinkage losses (measured at cost) incurred by BTE.com during 1. 2. the year. 3. Compute BTE.com's gross profit for the year. (Include inventory shrinkage losses in the cost of goods sold.) What controls might BTE.com implement to reduce inventory shrinkage? c. Problem 8.84 Marks & Spencer uses retail method to value its inventories. Recent financial statements were used to compile the following information (pound figures are in millions): Average inventory (throughout the year) Current assets (at year-end). Current liabilities (at year-end) Net sales.. Cost of goods sold Gross profit Average time required to collect outstanding receivables. 724.6 1,267.9 2,238.3 10,026.8 6,230.3 3,796.5 4.1 days Instructions a. Using the information provided, compute the following measures: 1. Inventory turnover. 2. Current ratio (see Chapter 5 for a discussion of this ratio). 3. Gross profit rate (see Chapter 6 for a discussion of this statistic). b. Assuming the cost ratio is 63 percent, estimate the ending inventory at retail prices. c. Explain why the average number of days required by Marks & Spencer to collectifs accounts receivable is so low. (See Chapter 7 for a discussion of the accounts receivable turnover rate.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started