Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FIFO and LIFO Costs Under Perpetual Inventory System The following units of an item were available for sale during the year: Beginning inventory Sale First

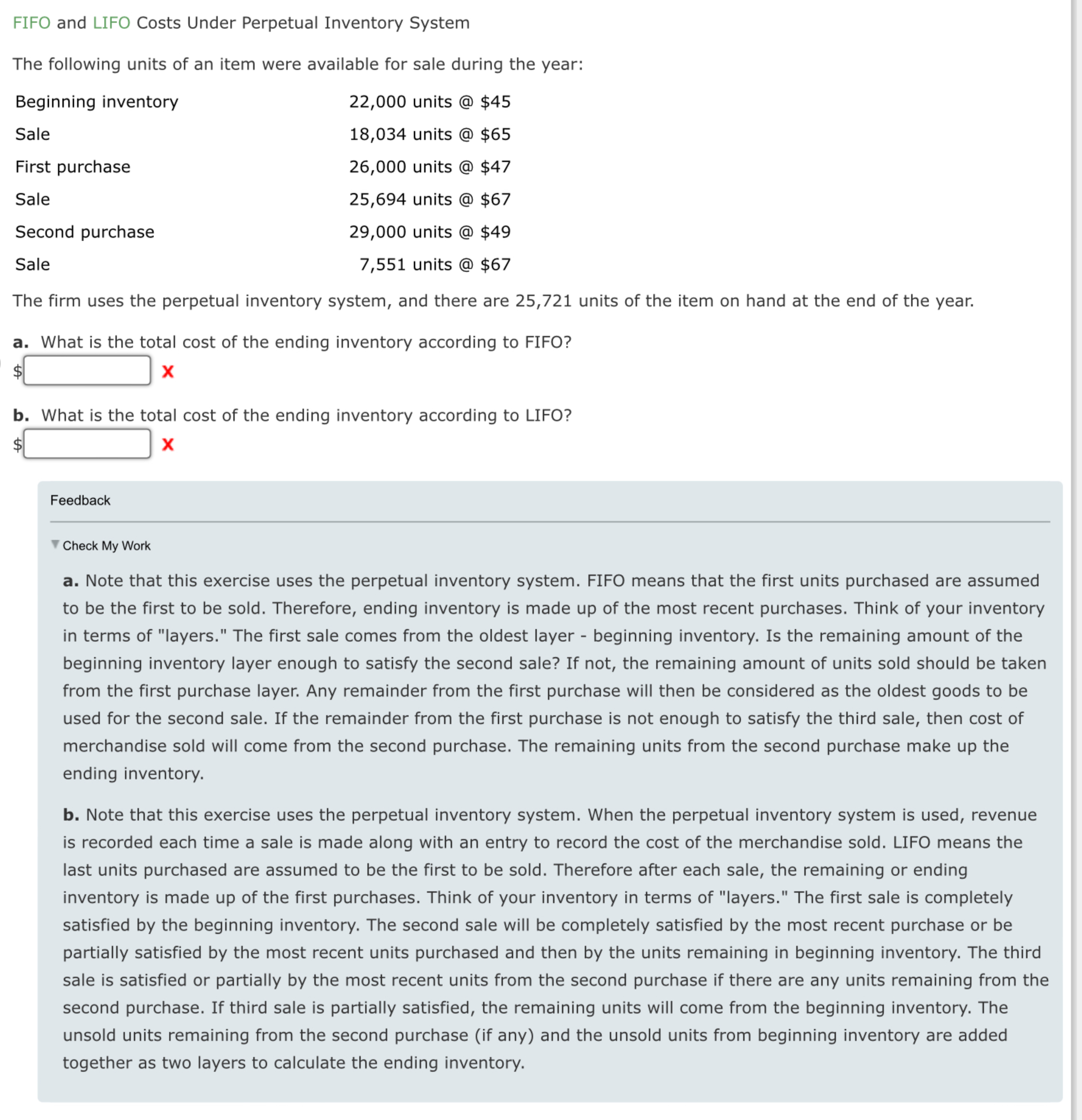

FIFO and LIFO Costs Under Perpetual Inventory System

The following units of an item were available for sale during the year:

Beginning inventory

Sale

First purchase

Sale

Second purchase

Sale

units @ $

units @ $

units @ $

units @ $

units @ $

units @ $

The firm uses the perpetual inventory system, and there are units of the item on hand at the end of the year.

a What is the total cost of the ending inventory according to FIFO?

$

b What is the total cost of the ending inventory according to LIFO?

$

Check My Work

a Note that this exercise uses the perpetual inventory system. FIFO means that the first units purchased are assumed

to be the first to be sold. Therefore, ending inventory is made up of the most recent purchases. Think of your inventory

in terms of "layers." The first sale comes from the oldest layer beginning inventory. Is the remaining amount of the

beginning inventory layer enough to satisfy the second sale? If not, the remaining amount of units sold should be taken

from the first purchase layer. Any remainder from the first purchase will then be considered as the oldest goods to be

used for the second sale. If the remainder from the first purchase is not enough to satisfy the third sale, then cost of

merchandise sold will come from the second purchase. The remaining units from the second purchase make up the

ending inventory.

b Note that this exercise uses the perpetual inventory system. When the perpetual inventory system is used, revenue

is recorded each time a sale is made along with an entry to record the cost of the merchandise sold. LIFO means the

last units purchased are assumed to be the first to be sold. Therefore after each sale, the remaining or ending

inventory is made up of the first purchases. Think of your inventory in terms of "layers." The first sale is completely

satisfied by the beginning inventory. The second sale will be completely satisfied by the most recent purchase or be

partially satisfied by the most recent units purchased and then by the units remaining in beginning inventory. The third

sale is satisfied or partially by the most recent units from the second purchase if there are any units remaining from the

second purchase. If third sale is partially satisfied, the remaining units will come from the beginning inventory. The

unsold units remaining from the second purchase if any and the unsold units from beginning inventory are added

together as two layers to calculate the ending inventory.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started