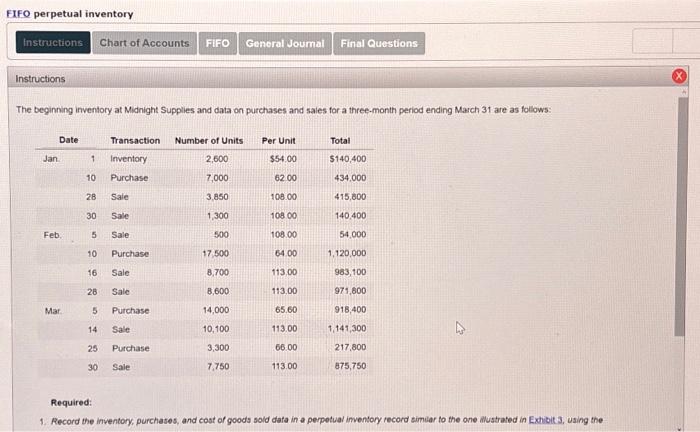

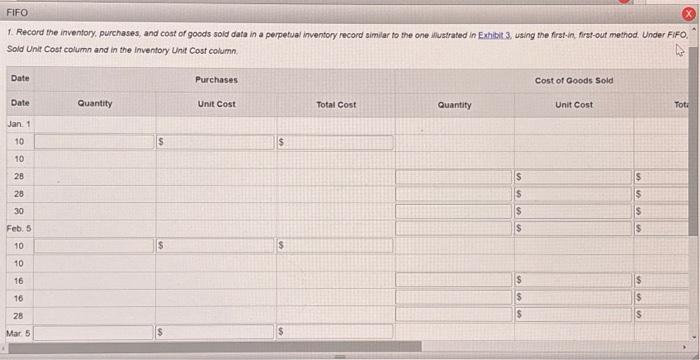

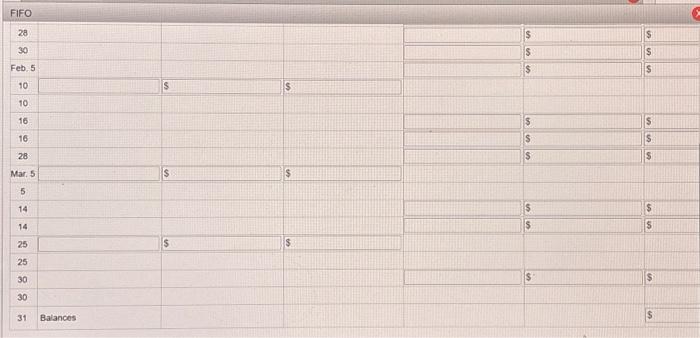

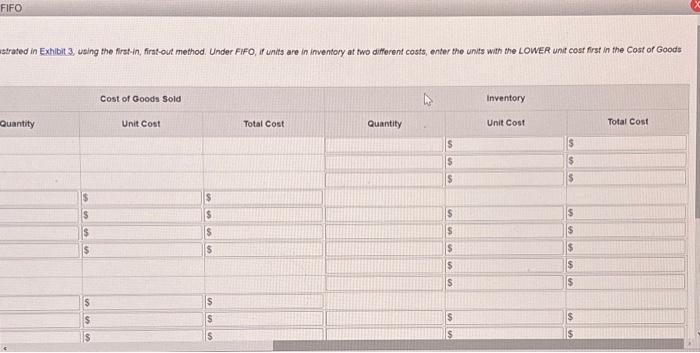

FIFO perpetual inventory Instructions Chart of Accounts FIFO General Journal Final Questions Instructions The beginning inventory at Midnight Supplies and data on purchases and sales for a three-month period ending March 31 are as follows: Date Jan. Feb. Mar. 1 Inventory Purchase 10 28 30 5 10 16 28 14 Transaction Number of Units 2,600 7,000 3,850 1,300 25 30 Sale Sale Sale Purchase 5 Purchase Sale Sale Sale Purchase Sale 500 17,500 8,700 8,600 14,000 10,100 3,300 7,750 Per Unit $54.00 62.00 108.00 108.00 108.00 64.00 113.00 113.00 65.60 113.00 66.00 113.00 Total $140,400 434,000 415,800 140,400 54,000 1,120,000 983,100 971,800 918,400 1,141,300 217,800 875,750 Required: 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 3, using the

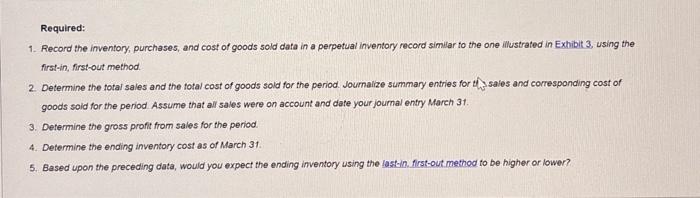

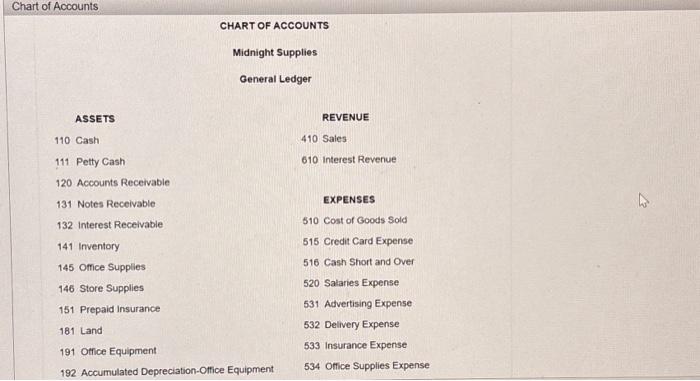

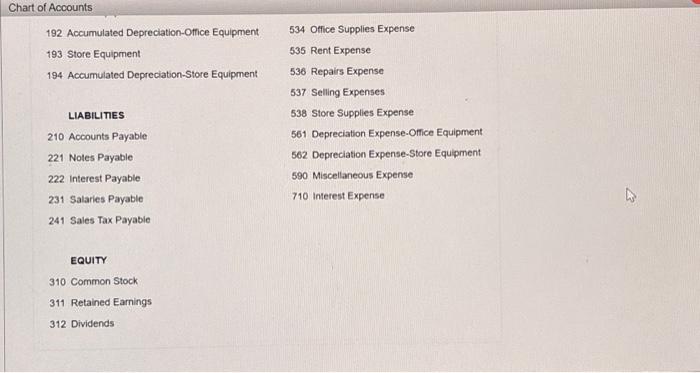

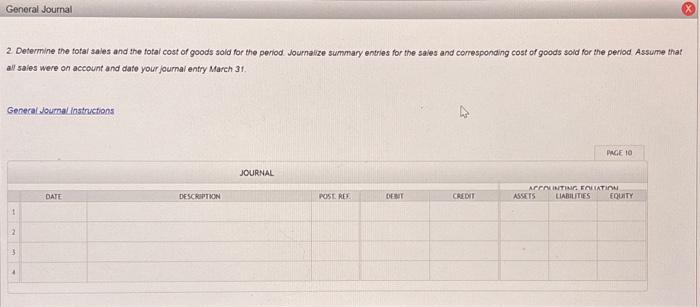

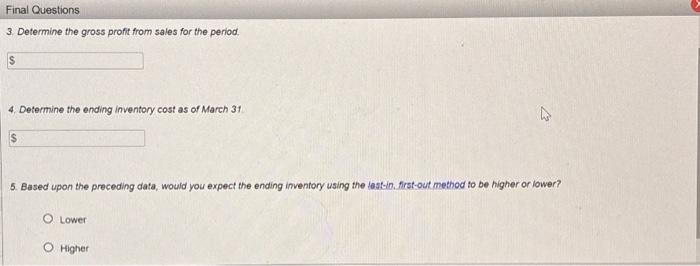

Chart of Accounts 192 Accumulated Depreciation-Office Equipment 193 Store Equipment 194 Accumulated Depreciation-Store Equipment LIABILITIES 210 Accounts Payable 221 Noles Payable 222 Interest Payable 231 Salarles Payable 241 Sales Tax Payabie 534 Office Supplies Expense 535 Rent Expense 536 Repairs Expense 537 Selling Expenses 538 Store Supplies Expense 561 Depreciation Expense-Orfice Equipment 562 Depreciation Expense-Store Equipment 590 Miscellaneous Expense 710 Interest Expense EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends The beginning inventory at Midnight Supplies and data on purchases and sales for a three-month period ending March 31 are as follows: Required: 1. Record the inventory, purchases, and cost of goods sold dafa in a perpetual imventory record similar to the one alustrated in Extibit 3, using the 2. Determine the foral sales and the fotal cost of goods sold for the period. Journalze summary entries for the sales and corresponding cost of goods sold for the period Assume the all sales were on account and date your journal entry March 3f. Required: 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventary record similar to the one illustrated in Exhibit 3 , using the first-in, first-out method. 2. Determine the fotal sales and the fotal cost of goods sold for the period. Joumalize summary entries for ths sales and corresponding cost of goods soid for the period. Assume that all sales were on account and date your journal entry March 31. 3. Determine the gross profit from sales for the period. 4. Determine the ending inventory cost as of March 31 . 5. Based upon the preceding data, would you expect the ending inventory using the last-in. first-out method to be higher or lower? Chart of Accounts CHART OF ACCOUNTS Midnight Supplies General Ledger ASSETS 110 Cash 111 Petty Cash 120 Accounts Receivable 131 Notes Receivable 132 interest Receivable 141 Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid insurance 181 Land 191 Otfice Equipment 192 Accumulated Depreciation-Office Equipment REVENUE 410 Sales 610 interest Revenue EXPENSES 510 Cost of Goods Sold 515 Credit Card Expense 516 Cash Short and Over 520 Salaries Expense 531 Advertising Expense 532 Delivery Expense 533 Insurance Expense 534 Office Supplies Expense FIFO 1. Record the inventory, purchases, and cost of gocds sold data in a perpetual inventory record similar to the one ilustrated in Exhibit. 3, using the first-in, first-out method. Under FifO. Sold Unir Cost column and in the inventory Unit Cost column. 3. Determine the gross profit from sales for the period. 4. Determine the ending inventory cost as of March 3 t 5. Based upon the preceding data, would you expect the ending inventory using the last-in, first-out method to be higher or lower? Lower Higher strated in Exhibit 3, using the first-in, first-out method. Under FIFO, if units are in inventory at two ditferent costs, enter the units with the LOWER uni cost first in the Cost of Goods