Answered step by step

Verified Expert Solution

Question

1 Approved Answer

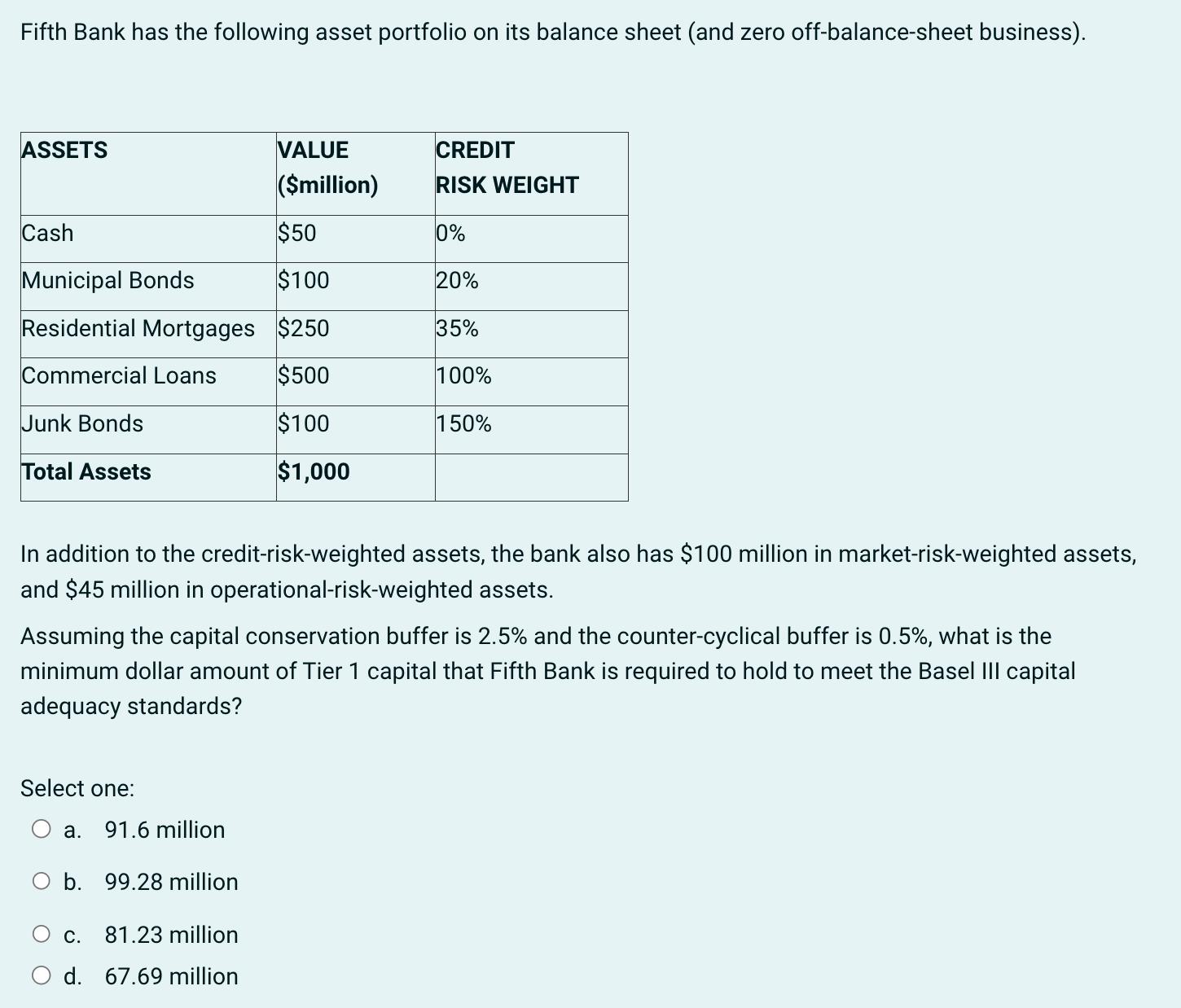

Fifth Bank has the following asset portfolio on its balance sheet (and zero off-balance-sheet business). ASSETS Cash $50 Municipal Bonds $100 Residential Mortgages $250

Fifth Bank has the following asset portfolio on its balance sheet (and zero off-balance-sheet business). ASSETS Cash $50 Municipal Bonds $100 Residential Mortgages $250 Commercial Loans $500 $100 $1,000 Junk Bonds Total Assets VALUE ($million) In addition to the credit-risk-weighted assets, the bank also has $100 million in market-risk-weighted assets, and $45 million in operational-risk-weighted assets. Select one: Assuming the capital conservation buffer is 2.5% and the counter-cyclical buffer is 0.5%, what is the minimum dollar amount of Tier 1 capital that Fifth Bank is required to hold to meet the Basel III capital adequacy standards? a. 91.6 million CREDIT RISK WEIGHT 0% 20% 35% 100% 150% O b. 99.28 million O c. 81.23 million d. 67.69 million

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below To calculate the minimum dollar amount of Tier 1 capital required to meet the Basel III c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started