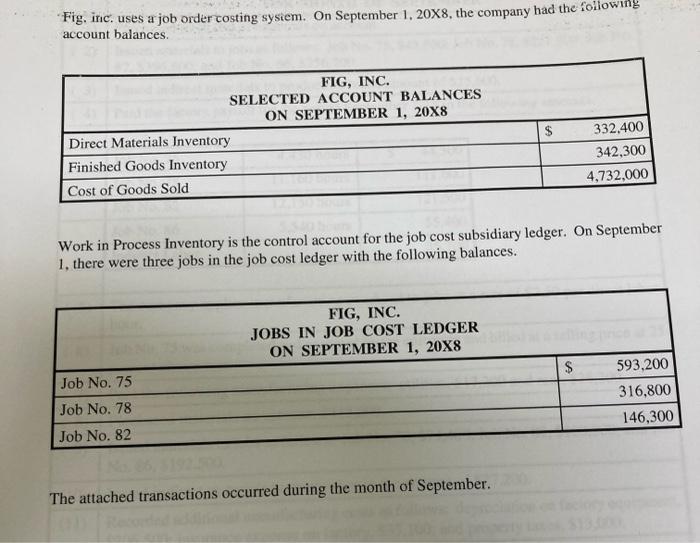

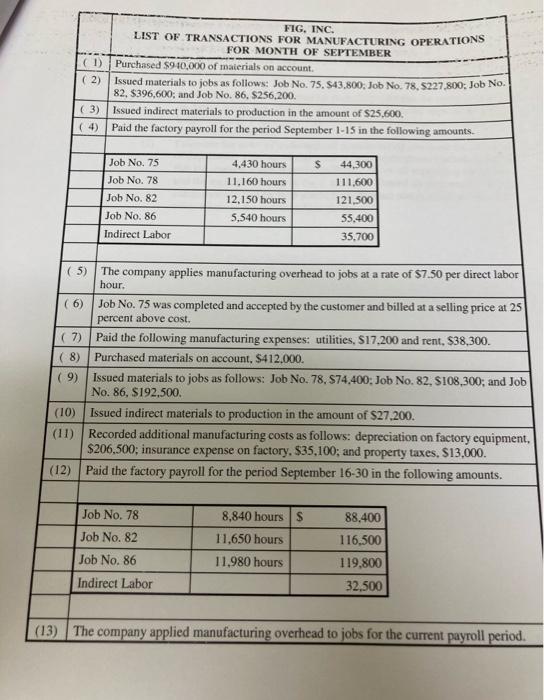

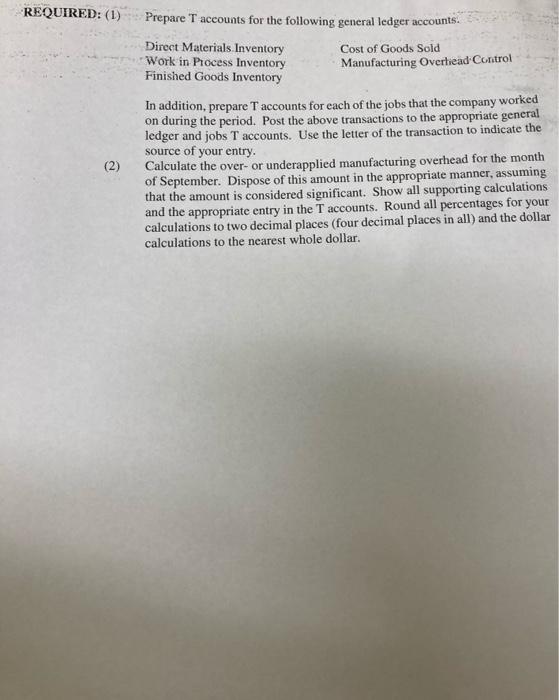

"Fig, inc. uses a job order costing system. On September 1, 20X8, the company had the foll account balances FIG, INC. SELECTED ACCOUNT BALANCES ON SEPTEMBER 1, 20X8 Direct Materials Inventory Finished Goods Inventory Cost of Goods Sold 332.400 342,300 4,732,000 Work in Process Inventory is the control account for the job cost subsidiary ledger. On September 1, there were three jobs in the job cost ledger with the following balances. FIG, INC. JOBS IN JOB COST LEDGER ON SEPTEMBER 1, 20X8 $ Job No. 75 593,200 316,800 146,300 Job No. 78 Job No. 82 The attached transactions occurred during the month of September. FIG. INC. LIST OF TRANSACTIONS FOR MANUFACTURING OPERATIONS FOR MONTH OF SEPTEMBER Purchased 59 10,000 of materials on account (2) Issued materials to jobs as follows: Job No. 75, $43,800. Job No. 78, 5227,800: Job No. 82, $396,600; and Job No. 86, 8256,200. (3) Issued indirect materials to production in the amount of $25.600 (4) Paid the factory payroll for the period September 1-15 in the following amounts $ Job No. 75 Job No. 78 Job No. 82 Job No. 86 Indirect Labor 4,430 hours 11.160 hours 12.150 hours 5,540 hours 44,300 111,600 121,500 55.400 35.700 (5) The company applies manufacturing overhead to jobs at a rate of $7.50 per direct labor hour. (6) Job No. 75 was completed and accepted by the customer and billed at a selling price at 25 percent above cost. (7) Paid the following manufacturing expenses: utilities, $17.200 and rent, $38,300. (8) Purchased materials on account, $412,000. (9) Issued materials to jobs as follows: Job No. 78, 574,400: Job No. 82. S108,300; and Job No. 86, S192,500. (10) Issued indirect materials to production in the amount of $27.200. (11) Recorded additional manufacturing costs as follows: depreciation on factory equipment, $206,500; insurance expense on factory, $35,100; and property taxes. $13,000. (12) Paid the factory payroll for the period September 16-30 in the following amounts. Job No. 78 Job No. 82 Job No. 86 Indirect Labor 8,840 hours 11,650 hours 11.980 hours 88.400 116,500 119,800 32,500 (13) The company applied manufacturing overhead to jobs for the current payroll period, REQUIRED: (1) Prepare Taceounts for the following general ledger accounts: Direct Materials Inventory Work in Process Inventory Finished Goods Inventory Cost of Goods Sold Manufacturing Overhead Control (2) In addition, prepare T accounts for each of the jobs that the company worked on during the period. Post the above transactions to the appropriate general ledger and jobs T accounts. Use the letter of the transaction to indicate the source of your entry. Calculate the over- or underapplied manufacturing overhead for the month of September. Dispose of this amount in the appropriate manner, assuming that the amount is considered significant. Show all supporting calculations and the appropriate entry in the T accounts. Round all percentages for your calculations to two decimal places (four decimal places in all) and the dollar calculations to the nearest whole dollar. "Fig, inc. uses a job order costing system. On September 1, 20X8, the company had the foll account balances FIG, INC. SELECTED ACCOUNT BALANCES ON SEPTEMBER 1, 20X8 Direct Materials Inventory Finished Goods Inventory Cost of Goods Sold 332.400 342,300 4,732,000 Work in Process Inventory is the control account for the job cost subsidiary ledger. On September 1, there were three jobs in the job cost ledger with the following balances. FIG, INC. JOBS IN JOB COST LEDGER ON SEPTEMBER 1, 20X8 $ Job No. 75 593,200 316,800 146,300 Job No. 78 Job No. 82 The attached transactions occurred during the month of September. FIG. INC. LIST OF TRANSACTIONS FOR MANUFACTURING OPERATIONS FOR MONTH OF SEPTEMBER Purchased 59 10,000 of materials on account (2) Issued materials to jobs as follows: Job No. 75, $43,800. Job No. 78, 5227,800: Job No. 82, $396,600; and Job No. 86, 8256,200. (3) Issued indirect materials to production in the amount of $25.600 (4) Paid the factory payroll for the period September 1-15 in the following amounts $ Job No. 75 Job No. 78 Job No. 82 Job No. 86 Indirect Labor 4,430 hours 11.160 hours 12.150 hours 5,540 hours 44,300 111,600 121,500 55.400 35.700 (5) The company applies manufacturing overhead to jobs at a rate of $7.50 per direct labor hour. (6) Job No. 75 was completed and accepted by the customer and billed at a selling price at 25 percent above cost. (7) Paid the following manufacturing expenses: utilities, $17.200 and rent, $38,300. (8) Purchased materials on account, $412,000. (9) Issued materials to jobs as follows: Job No. 78, 574,400: Job No. 82. S108,300; and Job No. 86, S192,500. (10) Issued indirect materials to production in the amount of $27.200. (11) Recorded additional manufacturing costs as follows: depreciation on factory equipment, $206,500; insurance expense on factory, $35,100; and property taxes. $13,000. (12) Paid the factory payroll for the period September 16-30 in the following amounts. Job No. 78 Job No. 82 Job No. 86 Indirect Labor 8,840 hours 11,650 hours 11.980 hours 88.400 116,500 119,800 32,500 (13) The company applied manufacturing overhead to jobs for the current payroll period, REQUIRED: (1) Prepare Taceounts for the following general ledger accounts: Direct Materials Inventory Work in Process Inventory Finished Goods Inventory Cost of Goods Sold Manufacturing Overhead Control (2) In addition, prepare T accounts for each of the jobs that the company worked on during the period. Post the above transactions to the appropriate general ledger and jobs T accounts. Use the letter of the transaction to indicate the source of your entry. Calculate the over- or underapplied manufacturing overhead for the month of September. Dispose of this amount in the appropriate manner, assuming that the amount is considered significant. Show all supporting calculations and the appropriate entry in the T accounts. Round all percentages for your calculations to two decimal places (four decimal places in all) and the dollar calculations to the nearest whole dollar