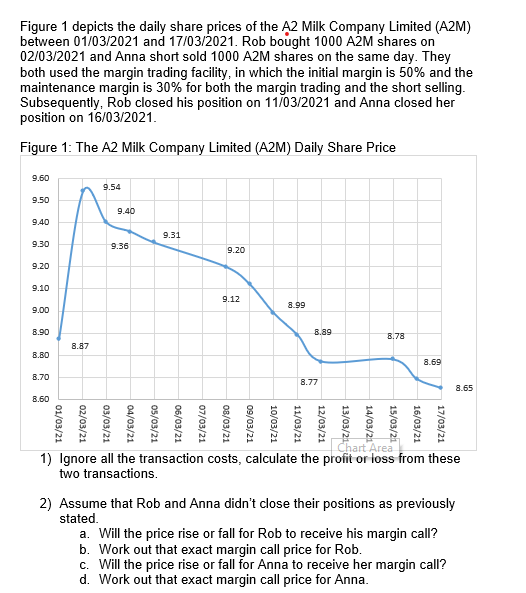

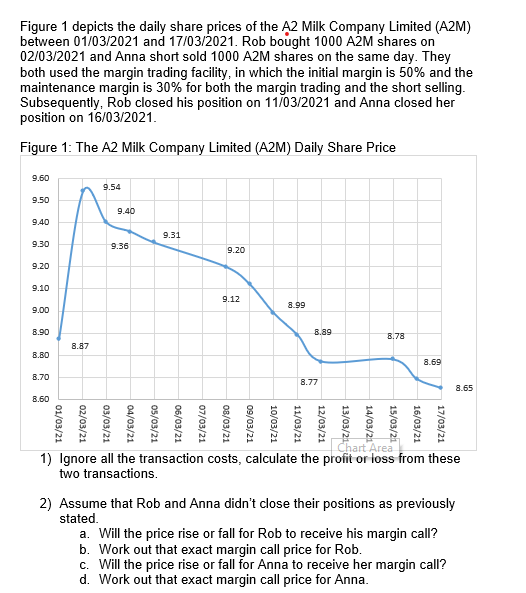

Figure 1 depicts the daily share prices of the A2 Milk Company Limited (A2M) between 01/03/2021 and 17/03/2021. Rob bought 1000 A2M shares on 02/03/2021 and Anna short sold 1000 A2M shares on the same day. They both used the margin trading facility, in which the initial margin is 50% and the maintenance margin is 30% for both the margin trading and the short selling. Subsequently, Rob closed his position on 11703/2021 and Anna closed her position on 16/03/2021. Figure 1: The A2 Milk Company Limited (A2M) Daily Share Price 9.60 9.54 9.50 9.40 9.40 9.31 9.30 9.36 9.20 9.20 9.10 9.12 8.99 9.00 8.90 8.89 8.78 8.87 B.BO 8.69 8.70 8.77 8.65 8.60 01/03/21 02/03/21 03/03/21 04/03/21 05/03/21 06/03/21 07/03/21 08/03/21 09/03/21 10/03/21 11/03/21 12/03/21 13/03/21 14/03/21 15/03/21 16/03/21 17/03/21 Chart Area 1) Ignore all the transaction costs, calculate the profit or loss from these two transactions. 2) Assume that Rob and Anna didn't close their positions as previously stated. a. Will the price rise or fall for Rob to receive his margin call? b. Work out that exact margin call price for Rob. c. Will the price rise or fall for Anna to receive her margin call? d. Work out that exact margin call price for Anna. Figure 1 depicts the daily share prices of the A2 Milk Company Limited (A2M) between 01/03/2021 and 17/03/2021. Rob bought 1000 A2M shares on 02/03/2021 and Anna short sold 1000 A2M shares on the same day. They both used the margin trading facility, in which the initial margin is 50% and the maintenance margin is 30% for both the margin trading and the short selling. Subsequently, Rob closed his position on 11703/2021 and Anna closed her position on 16/03/2021. Figure 1: The A2 Milk Company Limited (A2M) Daily Share Price 9.60 9.54 9.50 9.40 9.40 9.31 9.30 9.36 9.20 9.20 9.10 9.12 8.99 9.00 8.90 8.89 8.78 8.87 B.BO 8.69 8.70 8.77 8.65 8.60 01/03/21 02/03/21 03/03/21 04/03/21 05/03/21 06/03/21 07/03/21 08/03/21 09/03/21 10/03/21 11/03/21 12/03/21 13/03/21 14/03/21 15/03/21 16/03/21 17/03/21 Chart Area 1) Ignore all the transaction costs, calculate the profit or loss from these two transactions. 2) Assume that Rob and Anna didn't close their positions as previously stated. a. Will the price rise or fall for Rob to receive his margin call? b. Work out that exact margin call price for Rob. c. Will the price rise or fall for Anna to receive her margin call? d. Work out that exact margin call price for Anna