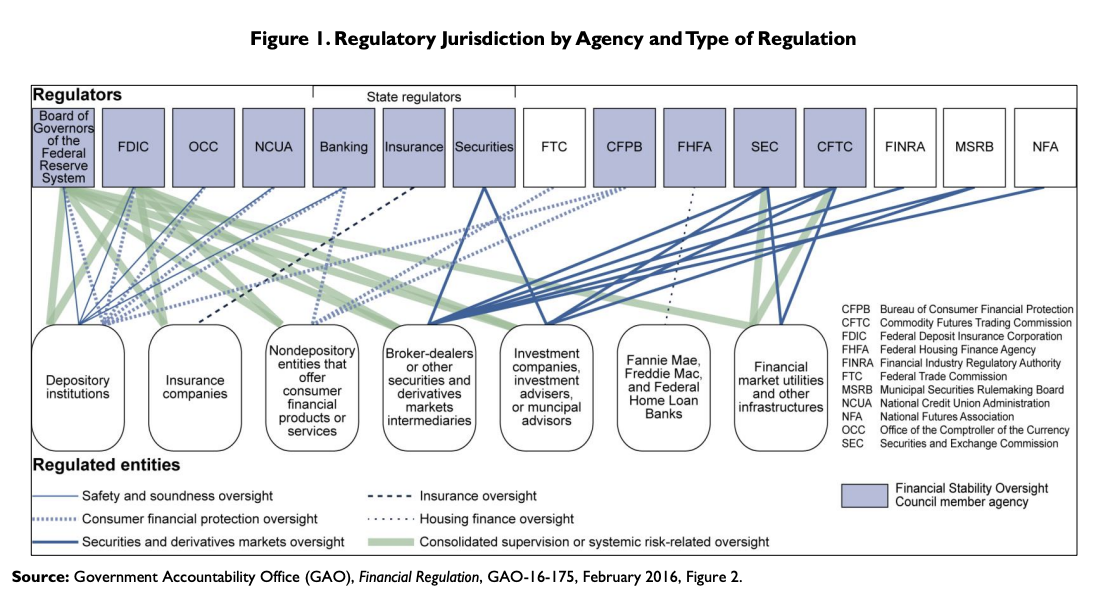

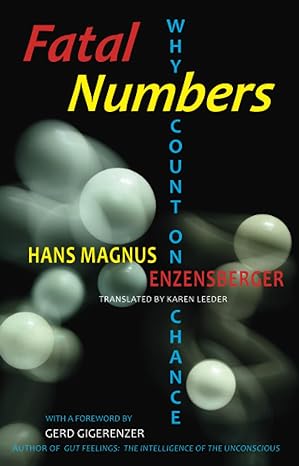

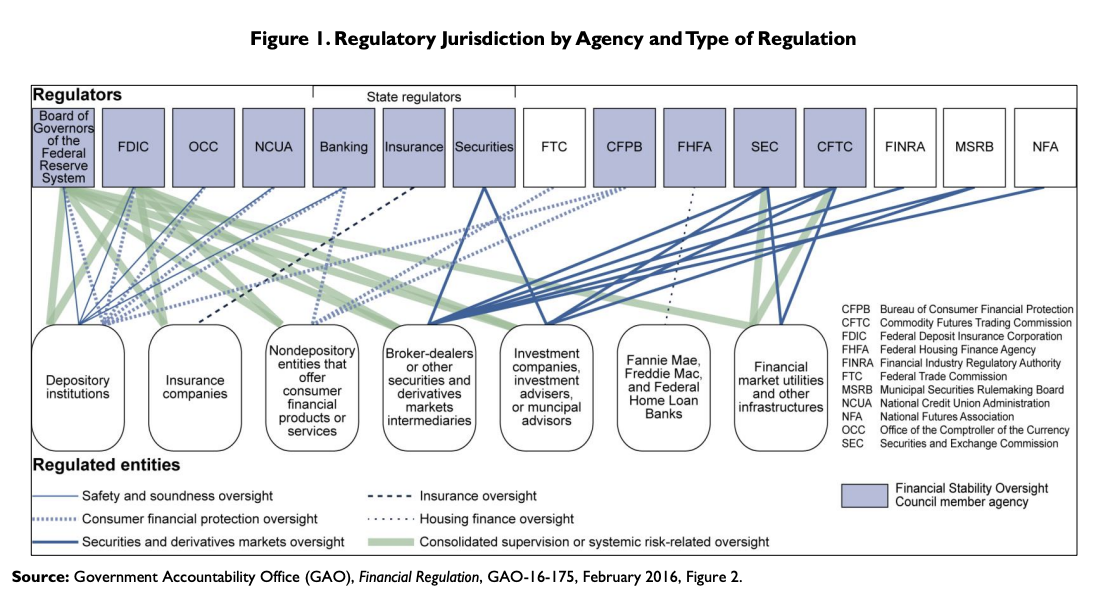

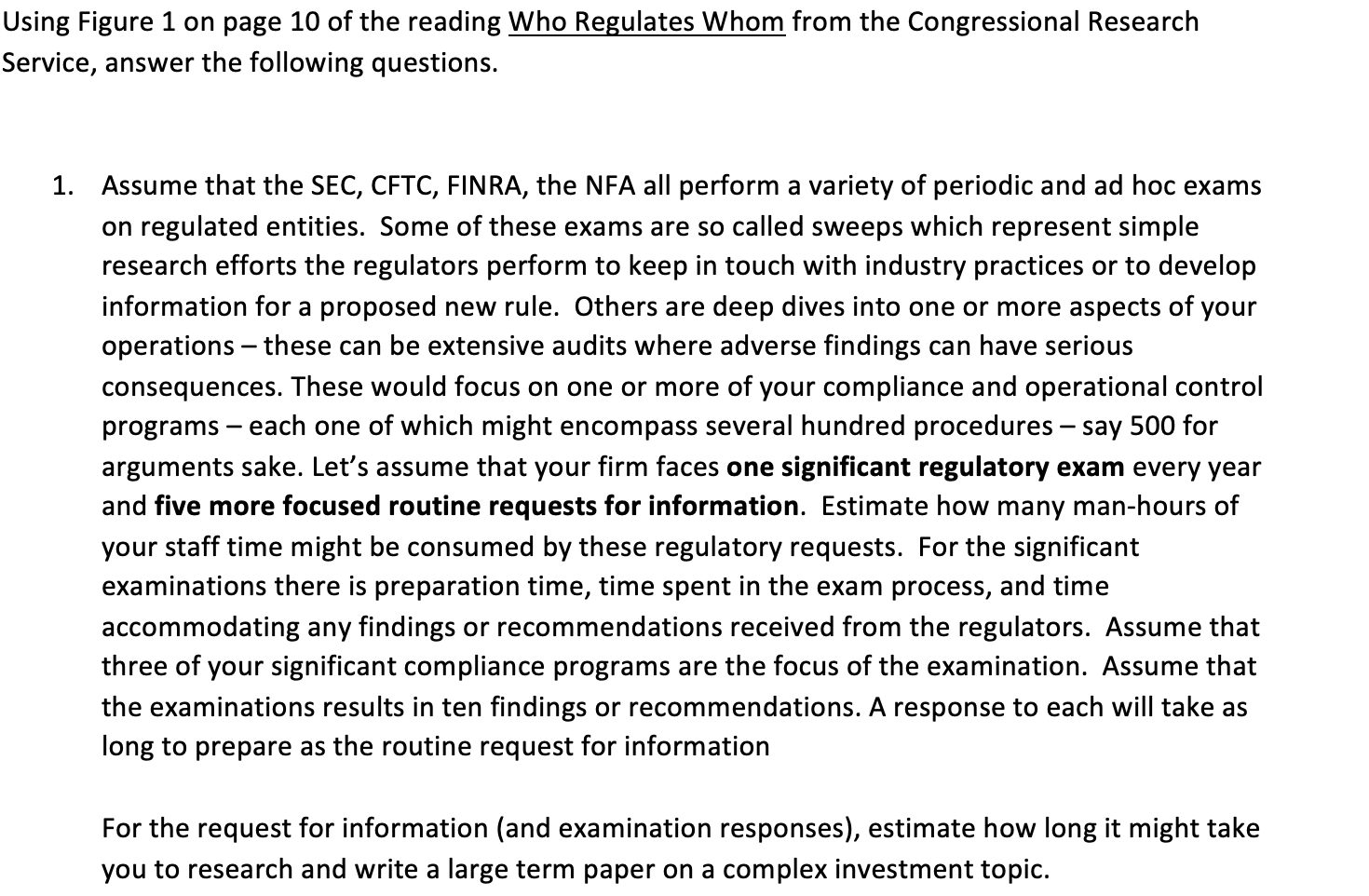

Figure 1. Regulatory Jurisdiction by Agency and Type of Regulation State regulators Regulators Board of Governors of the FDIC Federal Reserve System OCC NCUA Banking Insurance Securities FTC CFPB FHFA SEC CFTC FINRA MSRB NFA Nondepository entities that offer Depository institutions Insurance companies Broker-dealers or other securities and derivatives markets intermediaries consumer financial products or services Investment companies investment advisers, or muncipal advisors Fannie Mae Freddie Mac, and Federal Home Loan Banks CFPB Bureau of Consumer Financial Protection CFTC Commodity Futures Trading Commission FDIC Federal Deposit Insurance Corporation FHFA Federal Housing Finance Agency FINRA Financial Industry Regulatory Authority FTC Federal Trade Commission MSRB Municipal Securities Rulemaking Board NCUA National Credit Union Administration NFA National Futures Association OCC Office of the Comptroller of the Currency SEC Securities and Exchange Commission Financial market utilities and other infrastructures Regulated entities Financial Stability Oversight Council member agency Safety and soundness oversight Consumer financial protection oversight Securities and derivatives markets oversight Insurance oversight Housing finance oversight Consolidated supervision or systemic risk-related oversight Source: Government Accountability Office (GAO), Financial Regulation, GAO-16-175, February 2016, Figure 2. Using Figure 1 on page 10 of the reading Who Regulates Whom from the Congressional Research Service, answer the following questions. 1. Assume that the SEC, CFTC, FINRA, the NFA all perform a variety of periodic and ad hoc exams on regulated entities. Some of these exams are so called sweeps which represent simple research efforts the regulators perform to keep in touch with industry practices or to develop information for a proposed new rule. Others are deep dives into one or more aspects of your operations these can be extensive audits where adverse findings can have serious consequences. These would focus on one or more of your compliance and operational control programs each one of which might encompass several hundred procedures say 500 for arguments sake. Let's assume that your firm faces one significant regulatory exam every year and five more focused routine requests for information. Estimate how many man-hours of your staff time might be consumed by these regulatory requests. For the significant examinations there is preparation time, time spent in the exam process, and time accommodating any findings or recommendations received from the regulators. Assume that three of your significant compliance programs are the focus of the examination. Assume that the examinations results in ten findings or recommendations. A response to each will take as long to prepare as the routine request for information For the request for information (and examination responses), estimate how long it might take you to research and write a large term paper on a complex investment topic. Figure 1. Regulatory Jurisdiction by Agency and Type of Regulation State regulators Regulators Board of Governors of the FDIC Federal Reserve System OCC NCUA Banking Insurance Securities FTC CFPB FHFA SEC CFTC FINRA MSRB NFA Nondepository entities that offer Depository institutions Insurance companies Broker-dealers or other securities and derivatives markets intermediaries consumer financial products or services Investment companies investment advisers, or muncipal advisors Fannie Mae Freddie Mac, and Federal Home Loan Banks CFPB Bureau of Consumer Financial Protection CFTC Commodity Futures Trading Commission FDIC Federal Deposit Insurance Corporation FHFA Federal Housing Finance Agency FINRA Financial Industry Regulatory Authority FTC Federal Trade Commission MSRB Municipal Securities Rulemaking Board NCUA National Credit Union Administration NFA National Futures Association OCC Office of the Comptroller of the Currency SEC Securities and Exchange Commission Financial market utilities and other infrastructures Regulated entities Financial Stability Oversight Council member agency Safety and soundness oversight Consumer financial protection oversight Securities and derivatives markets oversight Insurance oversight Housing finance oversight Consolidated supervision or systemic risk-related oversight Source: Government Accountability Office (GAO), Financial Regulation, GAO-16-175, February 2016, Figure 2. Using Figure 1 on page 10 of the reading Who Regulates Whom from the Congressional Research Service, answer the following questions. 1. Assume that the SEC, CFTC, FINRA, the NFA all perform a variety of periodic and ad hoc exams on regulated entities. Some of these exams are so called sweeps which represent simple research efforts the regulators perform to keep in touch with industry practices or to develop information for a proposed new rule. Others are deep dives into one or more aspects of your operations these can be extensive audits where adverse findings can have serious consequences. These would focus on one or more of your compliance and operational control programs each one of which might encompass several hundred procedures say 500 for arguments sake. Let's assume that your firm faces one significant regulatory exam every year and five more focused routine requests for information. Estimate how many man-hours of your staff time might be consumed by these regulatory requests. For the significant examinations there is preparation time, time spent in the exam process, and time accommodating any findings or recommendations received from the regulators. Assume that three of your significant compliance programs are the focus of the examination. Assume that the examinations results in ten findings or recommendations. A response to each will take as long to prepare as the routine request for information For the request for information (and examination responses), estimate how long it might take you to research and write a large term paper on a complex investment topic