Question

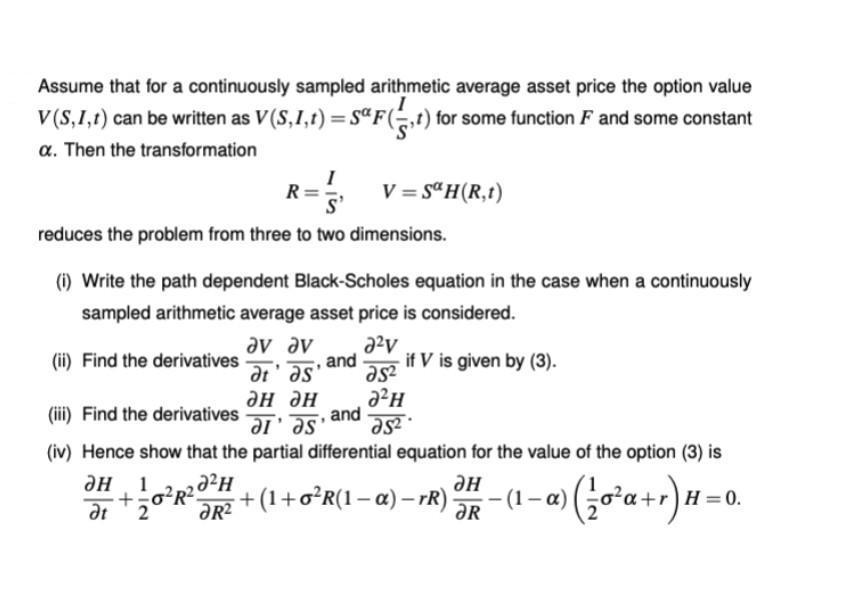

Assume that for a continuously sampled arithmetic average asset price the option value V(S,1,1) can be written as V(S,1,1)=SF(t) for some function F and

Assume that for a continuously sampled arithmetic average asset price the option value V(S,1,1) can be written as V(S,1,1)=SF(t) for some function F and some constant a. Then the transformation R= = reduces the problem from three to two dimensions. I 1 +0R5 2 t V = SaH(R,t) (i) Write the path dependent Black-Scholes equation in the case when a continuously sampled arithmetic average asset price is considered. 2v (ii) Find the derivatives av av and if V is given by (3). dat as' 25 2 and d'as' 25 (iii) Find the derivatives (iv) Hence show that the partial differential equation for the value of the option (3) is (1-a) ( oa+r) H=0. - R H H - + (1 + oR(1 a) rR) JR -

Step by Step Solution

3.51 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Materials Science and Engineering An Introduction

Authors: William D. Callister Jr., David G. Rethwisch

8th edition

470419970, 978-0470419977

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App