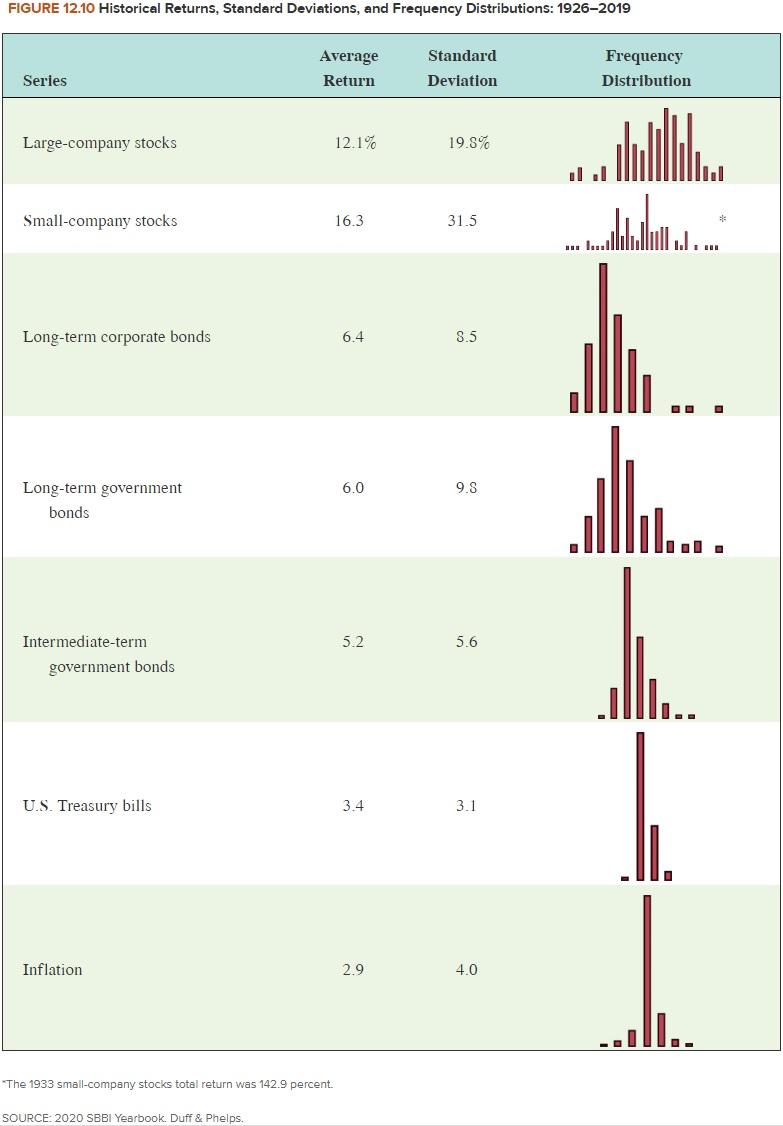

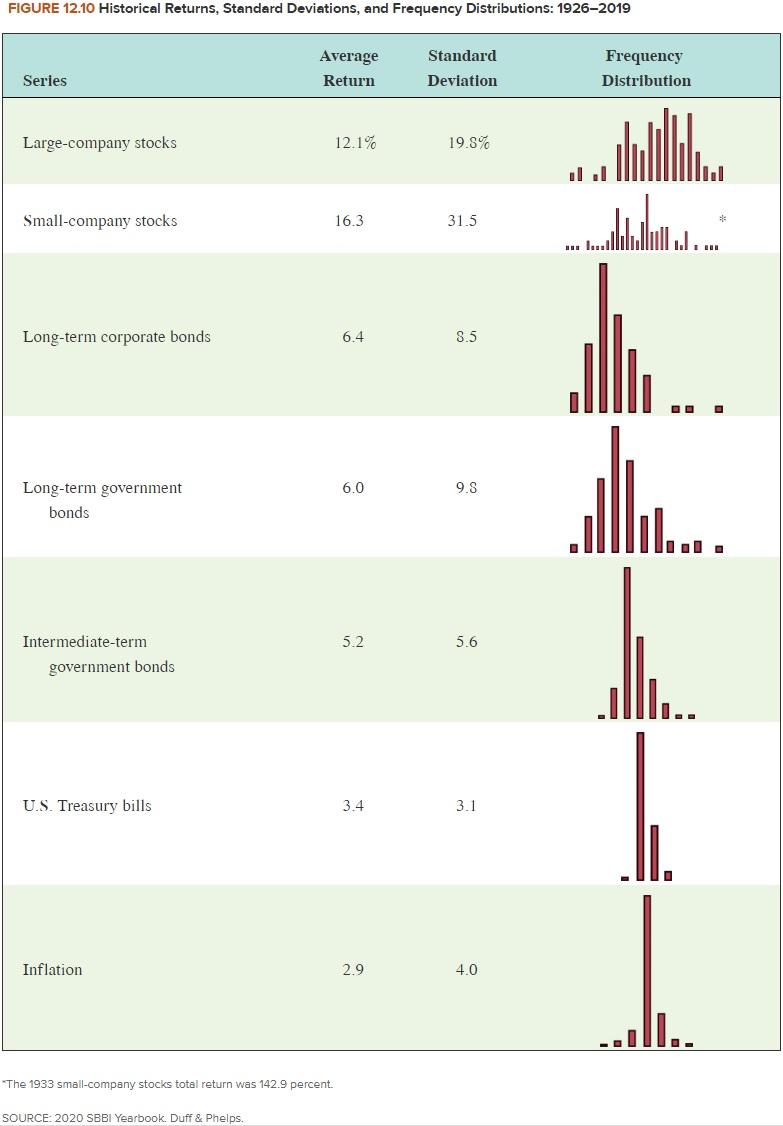

Figure 12.10

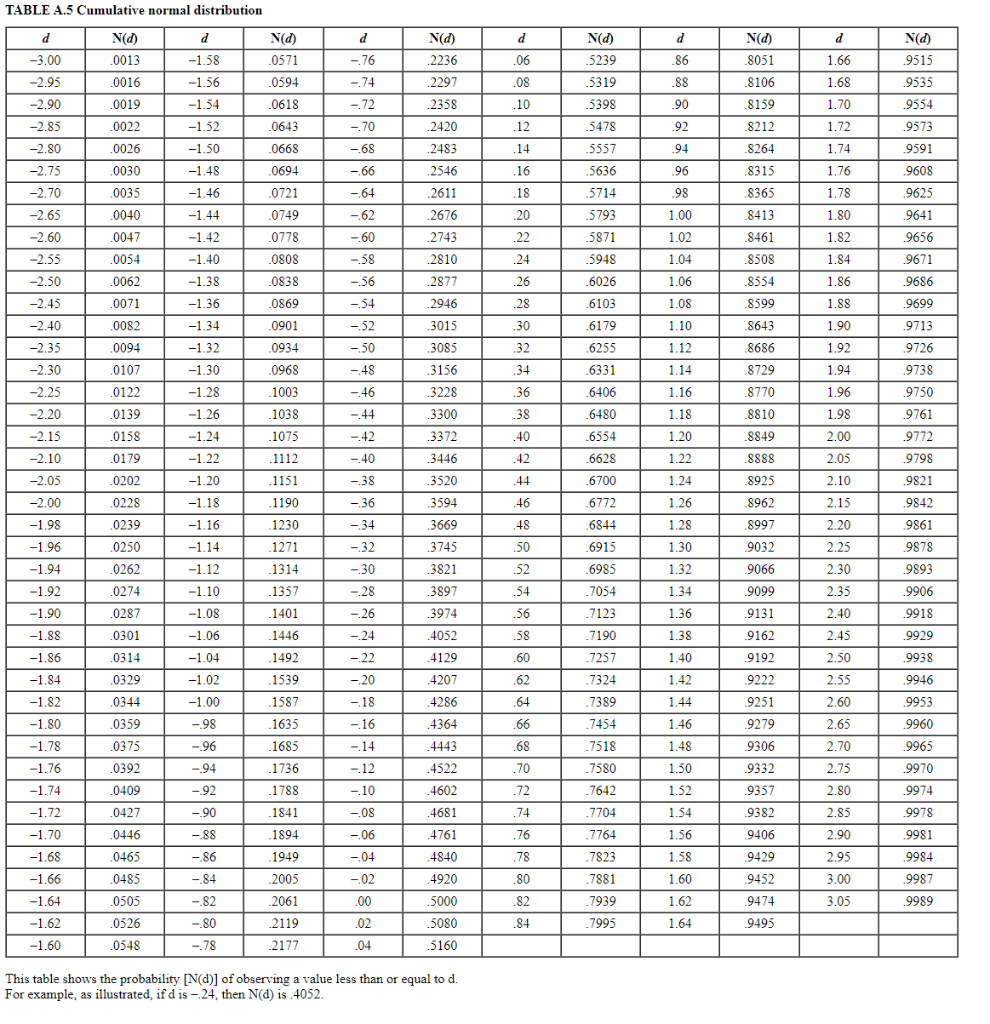

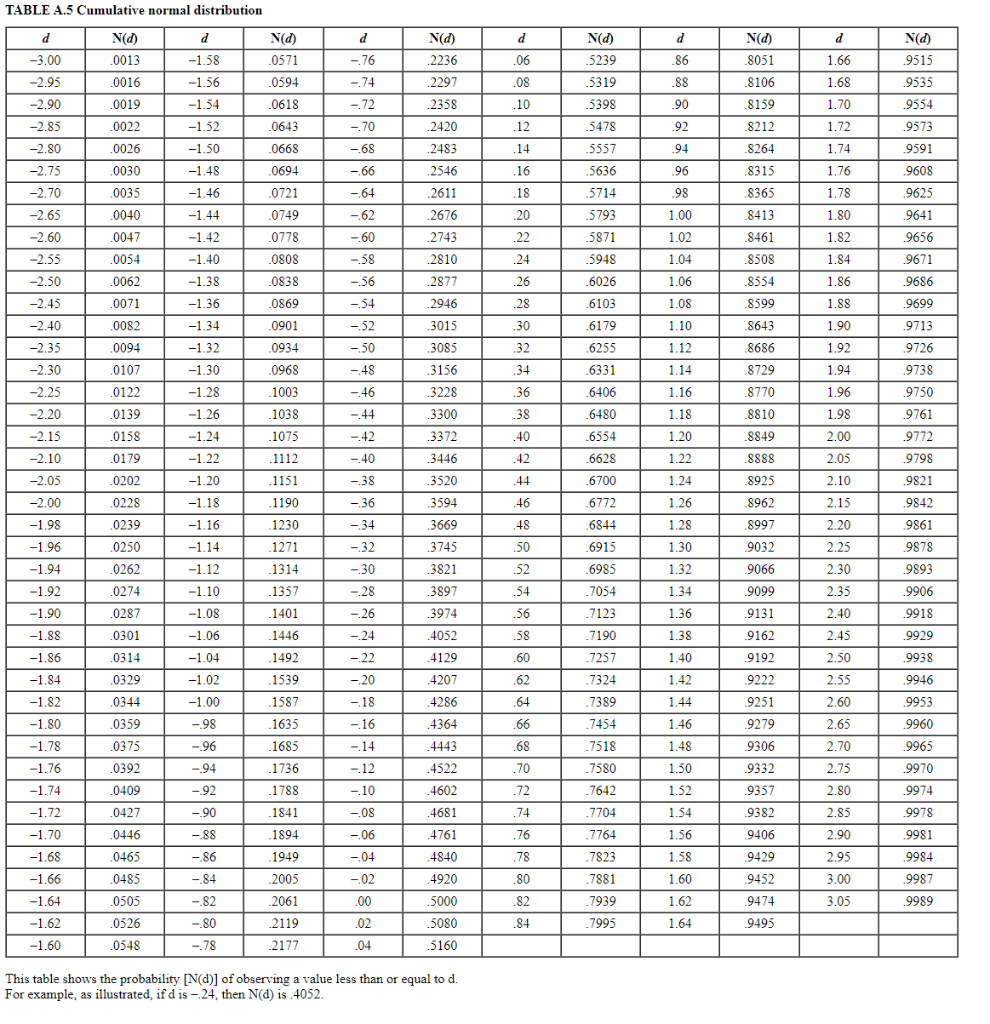

Table A.5

Assume that the returns from holding small-company stocks are normally distributed. Refer to Figure 12.10 and Table A.5. a. What is the approximate probability that your money will double in value in a single year? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What about triple in value? (Do not round intermediate calculations and enter your answer as a percent rounded to 7 decimal places, e.g., .1616161.) a. Probabliity of doubling b. Probability of tripling % % FIGURE 12.10 Historical Returns, Standard Deviations, and Frequency Distributions: 1926-2019 Average Return Standard Deviation Frequency Distribution Series Large-company stocks 12.19% 19.5% Small-company stocks 16.3 31.5 ..... un lanaill Long-term corporate bonds 6.4 8.5 DO 6.0 9.8 Long-term government bonds Intermediate-term 5.2 5.6 government bonds U.S. Treasury bills 3.4 3.1 Inflation 2.9 4.0 II.. "The 1933 small-company stocks total return was 142.9 percent. SOURCE: 2020 SBBI Yearbook Duff & Phelps. TABLE A.5 Cumulative normal distribution d Nd) d d d N(d) d d Nd) 0571 Nd) 2236 -3.00 .0013 .0016 -.76 -.74 .06 .08 .86 .88 N(d) .8051 .8106 1.66 1.68 .2297 -2.95 -2.90 -2.85 -1.58 -1.56 -1.54 -1.52 .0594 .0618 .0643 2358 .10 .0019 .0022 90 -.72 -.70 .8159 .8212 1.70 1.72 .2420 .12 92 0026 -1.50 -68 .14 94 .8264 -2.80 -2.75 .0668 0694 .2483 2546 1.74 1.76 Nd 9515 9535 9554 9573 .9591 9608 9625 9641 9656 9671 -1.48 16 96 8315 .18 8365 .0030 0035 .0040 .0047 .0054 -1.46 -1.44 -1.42 .0721 .0749 .0778 -66 -64 -62 -60 .2611 .2676 2743 5239 .5319 .5398 5478 5557 .5636 .5714 .5793 5871 5948 .6026 .6103 .6179 .6255 .6331 20 .8413 .8461 1.78 1.80 1.82 .22 .98 1.00 1.02 1.04 1.06 1.08 .24 -1.40 -1.38 -1.36 .0808 .0838 .2810 2877 2946 .0062 0071 .0082 .26 .8508 .8554 8599 1.84 1.86 1.88 .9686 .0869 .28 -1.34 30 .8643 0901 .0934 -58 -56 -.54 -52 - 50 -48 -.46 -44 1.10 1.12 0094 -2.70 -2.65 -2.60 -2.55 -2.50 -2.45 -2.40 -2.35 -2.30 -2.25 -2.20 -2.15 -2.10 -2.05 -2.00 -1.98 -1.96 -1.94 -1.92 .8686 .8729 0107 1.90 1.92 1.94 3015 3085 3156 3228 3300 .32 .34 36 -1.32 -1.30 -1.28 -1.26 -1.24 -1.22 -1.20 .0968 .1003 .1038 0122 0139 .6406 .6480 1.14 1.16 1.18 .8770 .8810 1.96 1.98 9699 9713 9726 9738 9750 9761 9772 9798 9821 9842 38 .1075 .40 .8849 2.00 -.42 -40 .6554 .6628 1112 .42 1.20 1.22 1.24 .8888 .0158 0179 .0202 0228 2.05 -38 44 .6700 2.10 2.15 -1.18 3372 3446 .3520 3594 .3669 3745 3821 46 .6772 1.26 -1.16 .48 .1151 .1190 .1230 .1271 .1314 .1357 -36 -34 -32 -30 .6844 .6915 .6985 9861 9878 .50 0239 0250 0262 0274 0287 0301 -1.14 -1.12 -1.10 -1.08 52 .8925 .8962 .8997 9032 9066 9099 9131 9162 1.28 1.30 1.32 1.34 1.36 1.38 2.20 2.25 2.30 2.35 9893 9906 3897 3974 54 .56 -1.90 2.40 9918 9929 -1.88 -1.06 4052 58 .7054 .7123 .7190 .7257 .7324 2.45 -1.86 0314 1401 .1446 .1492 .1539 .1587 -1.04 .60 1.40 9192 2.50 9938 0329 .62 1.42 9222 .64 .4129 4207 4286 .4364 4443 .7389 0344 0359 1.44 -1.02 -1.00 -98 -96 1.46 1.48 9251 9279 9306 .1635 .1685 .1736 .1788 .66 .68 .70 0375 2.55 2.60 2.65 2.70 2.75 2.80 .7454 .7518 .7580 .7642 -28 - 26 - 24 -22 - 20 -18 --16 -14 -12 -10 -.08 -.06 -04 -02 .00 .02 .04 9946 .9953 9960 9965 9970 9974 -94 9332 .4522 .4602 1.50 1.52 -92 72 -1.84 -1.82 -1.80 -1.78 -1.76 -1.74 -1.72 -1.70 -1.68 -1.66 -1.64 -1.62 9357 -90 .74 .7704 1.54 9382 .1841 .1894 -.88 .76 7764 .0392 0409 0427 0446 .0465 .0485 0505 0526 0548 9406 .4681 4761 4840 .4920 5000 9978 9981 9984 .78 -.86 -.84 9429 .1949 .2005 2061 2.85 2.90 2.95 3.00 3.05 1.56 1.58 1.60 1.62 7823 .7881 .7939 .7995 80 9452 9987 9989 .82 --82 -.80 -.78 9474 9495 5080 .84 1.64 2119 2177 -1.60 5160 This table shows the probability [N(d)] of observing a value less than or equal to d. For example, as illustrated, if d is -24, then N(d) is. 4052