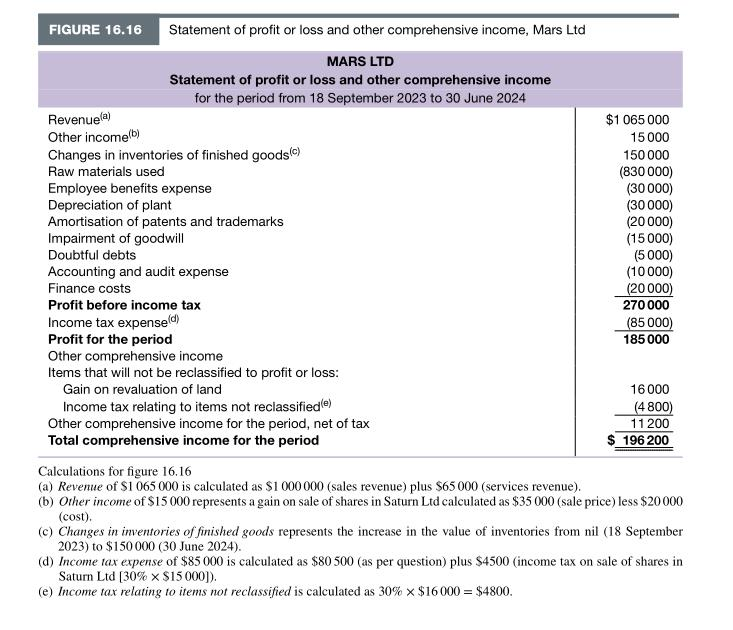

FIGURE 16.16 Statement of profit or loss and other comprehensive income, Mars Ltd MARS LTD Statement of profit or loss and other comprehensive income for the period from 18 September 2023 to 30 June 2024 Revenuela) Other incomeb) Changes in inventories of finished goods) Raw materials used Employee benefits expense Depreciation of plant Amortisation of patents and trademarks Impairment of goodwill Doubtful debts Accounting and audit expense Finance costs Profit before income tax Income tax expensed) Profit for the period Other comprehensive income Items that will not be reclassified to profit or loss: Gain on revaluation of land Income tax relating to items not reclassified Other comprehensive income for the period, net of tax Total comprehensive income for the period $1 065 000 15 000 150 000 (830 000) (30 000) (30000) (20 000) (15000) (5000) (10 000) (20 000) 270 000 (85000) 185000 16 000 (4800) 11200 $ 196 200 Calculations for figure 16.16 (a) Revenue of S1 065 000 is calculated as $ 1 000 000 (sales revenue) plus $65 000 (services revenue). (b) Other income of $15000 represents a gain on sale of shares in Saturn Ltd calculated as $35 000 (sale price) less $20000 (cost). (c) Changes in inventories of finished goods represents the increase in the value of inventories from nil (18 September 2023) to $150 000 (30 June 2024). (d) Income tax expense of $85 000 is calculated as $80 500 (as per question) plus $4500 (income tax on sale of shares in Saturn Ltd [30% x $15 000]). (e) Income tax relating to items not reclassified is calculated as 30% x $16000 = $4800. FIGURE 16.16 Statement of profit or loss and other comprehensive income, Mars Ltd MARS LTD Statement of profit or loss and other comprehensive income for the period from 18 September 2023 to 30 June 2024 Revenuela) Other incomeb) Changes in inventories of finished goods) Raw materials used Employee benefits expense Depreciation of plant Amortisation of patents and trademarks Impairment of goodwill Doubtful debts Accounting and audit expense Finance costs Profit before income tax Income tax expensed) Profit for the period Other comprehensive income Items that will not be reclassified to profit or loss: Gain on revaluation of land Income tax relating to items not reclassified Other comprehensive income for the period, net of tax Total comprehensive income for the period $1 065 000 15 000 150 000 (830 000) (30 000) (30000) (20 000) (15000) (5000) (10 000) (20 000) 270 000 (85000) 185000 16 000 (4800) 11200 $ 196 200 Calculations for figure 16.16 (a) Revenue of S1 065 000 is calculated as $ 1 000 000 (sales revenue) plus $65 000 (services revenue). (b) Other income of $15000 represents a gain on sale of shares in Saturn Ltd calculated as $35 000 (sale price) less $20000 (cost). (c) Changes in inventories of finished goods represents the increase in the value of inventories from nil (18 September 2023) to $150 000 (30 June 2024). (d) Income tax expense of $85 000 is calculated as $80 500 (as per question) plus $4500 (income tax on sale of shares in Saturn Ltd [30% x $15 000]). (e) Income tax relating to items not reclassified is calculated as 30% x $16000 = $4800