Answered step by step

Verified Expert Solution

Question

1 Approved Answer

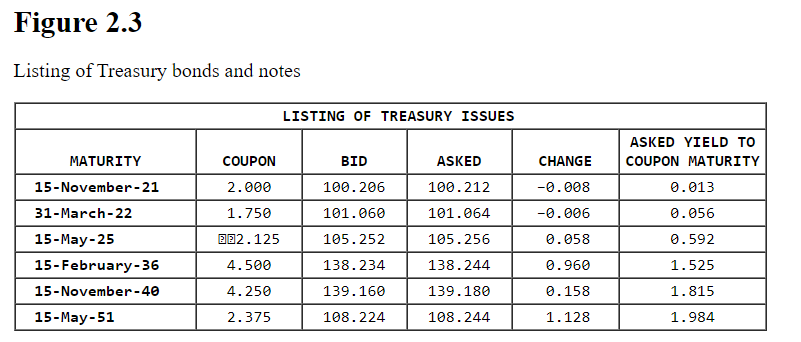

Figure 2.3 Listing of Treasury bonds and notes LISTING OF TREASURY ISSUES ASKED YIELD TO MATURITY COUPON BID ASKED CHANGE COUPON MATURITY 15-November-21 2.000

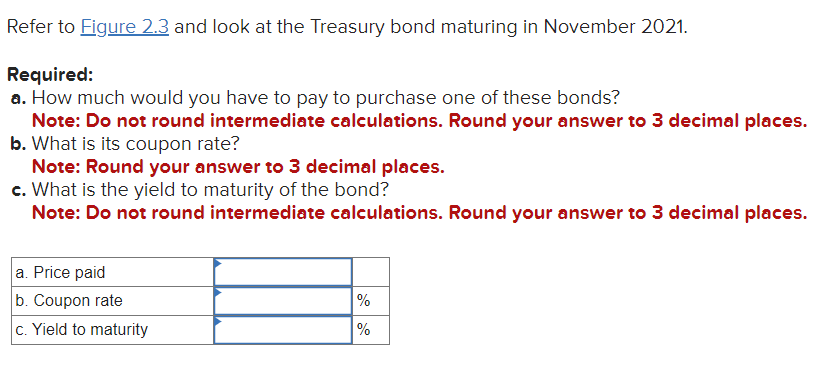

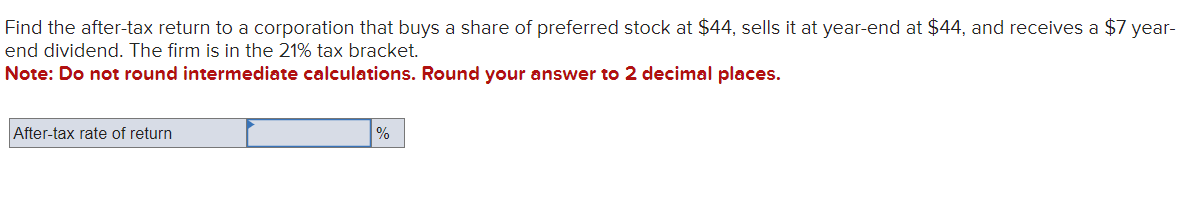

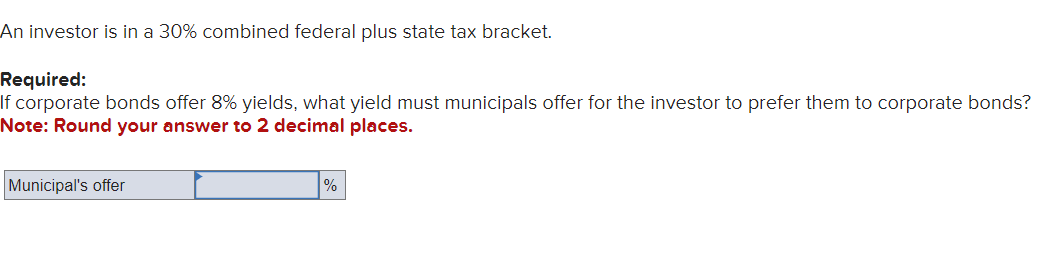

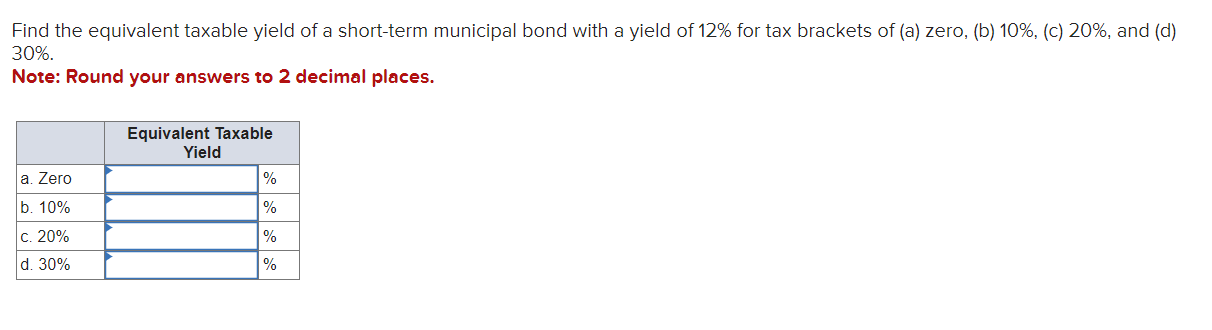

Figure 2.3 Listing of Treasury bonds and notes LISTING OF TREASURY ISSUES ASKED YIELD TO MATURITY COUPON BID ASKED CHANGE COUPON MATURITY 15-November-21 2.000 100.206 100.212 -0.008 0.013 31-March-22 1.750 101.060 101.064 -0.006 0.056 15-May-25 ??2.125 105.252 105.256 0.058 0.592 15-February-36 4.500 138.234 138.244 0.960 1.525 15-November-40 4.250 139.160 139.180 0.158 1.815 15-May-51 2.375 108.224 108.244 1.128 1.984 Refer to Figure 2.3 and look at the Treasury bond maturing in November 2021. Required: a. How much would you have to pay to purchase one of these bonds? Note: Do not round intermediate calculations. Round your answer to 3 decimal places. b. What is its coupon rate? Note: Round your answer to 3 decimal places. c. What is the yield to maturity of the bond? Note: Do not round intermediate calculations. Round your answer to 3 decimal places. a. Price paid b. Coupon rate c. Yield to maturity % % Find the after-tax return to a corporation that buys a share of preferred stock at $44, sells it at year-end at $44, and receives a $7 year- end dividend. The firm is in the 21% tax bracket. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. After-tax rate of return % An investor is in a 30% combined federal plus state tax bracket. Required: If corporate bonds offer 8% yields, what yield must municipals offer for the investor to prefer them to corporate bonds? Note: Round your answer to 2 decimal places. Municipal's offer % Find the equivalent taxable yield of a short-term municipal bond with a yield of 12% for tax brackets of (a) zero, (b) 10%, (c) 20 %, and (d) 30%. Note: Round your answers to 2 decimal places. Equivalent Taxable Yield a. Zero % b. 10% % c. 20% % d. 30% %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started