Question

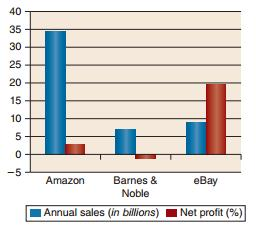

Figure 3.5 illustrates relative profitability and growth for two of the different business models discussed so far. Amazon.com and Barnes and Noble represent the Merchant

Figure 3.5 illustrates relative profitability and growth for two of the different business models discussed so far. Amazon.com and Barnes and Noble represent the Merchant Model, Ebay the Brokerage Model. As can be seen from the figure, just choosing a particular business model is not a guarantee of success. Amazon started as a click-only retailer while Barnes and Noble had to transform its existing brick and mortar operation to compete with online merchants. EBay is able to be more profitable than Amazon by taking advantage of the lower cost structure of the Brokerage model.

Consider Figure 3.5 (pg.74) and the differences in profitability and sales growth between the three firms. Are there any other factors other than those mentioned in the text that explain the differences in profitability and sales growth between these companies? As a consultant, what would you recommend as opportunities for improvement?

40 35 30 25 20 15 10 -5 Amazon Bares&eBay Noble 'Annual sales (in billions) Net profit (%)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started