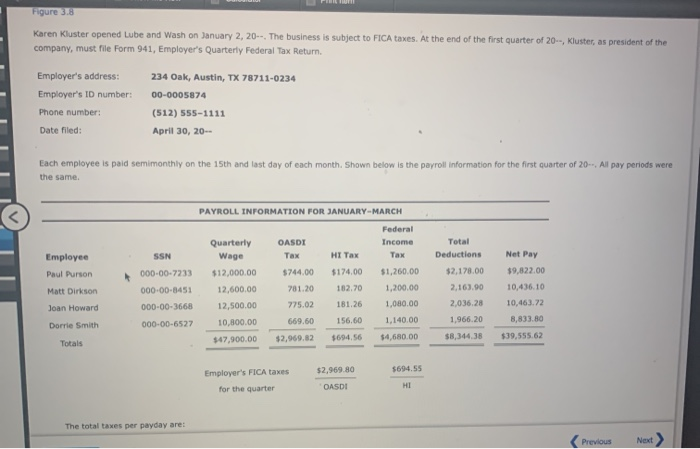

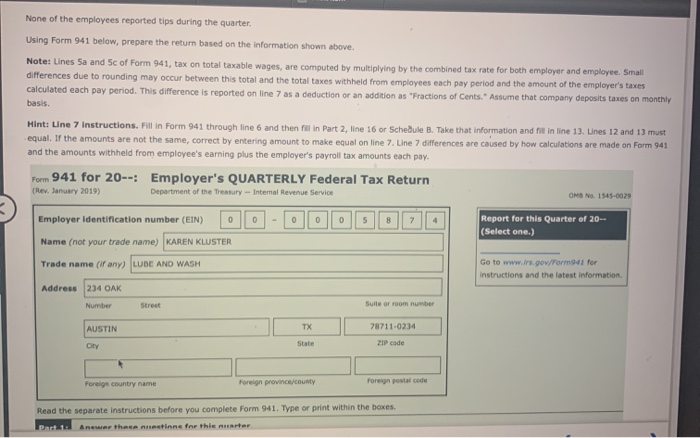

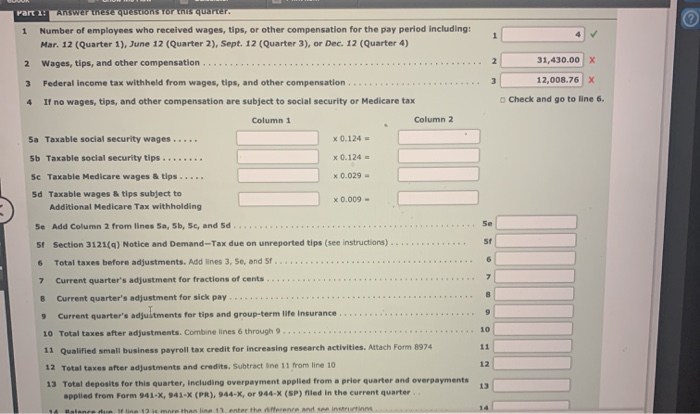

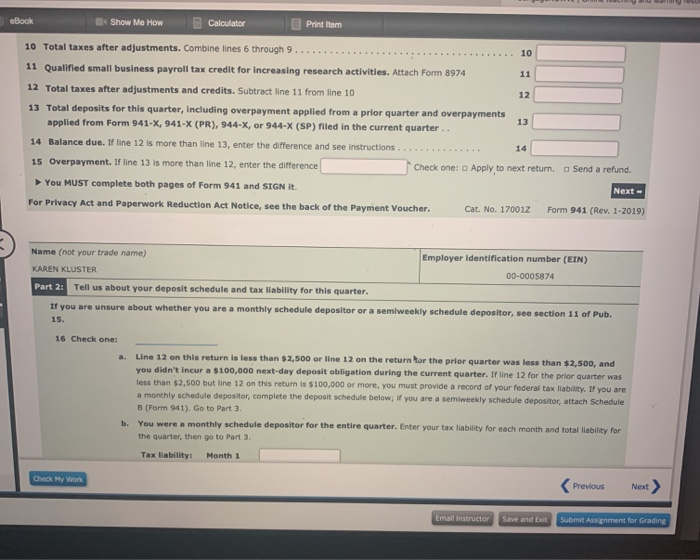

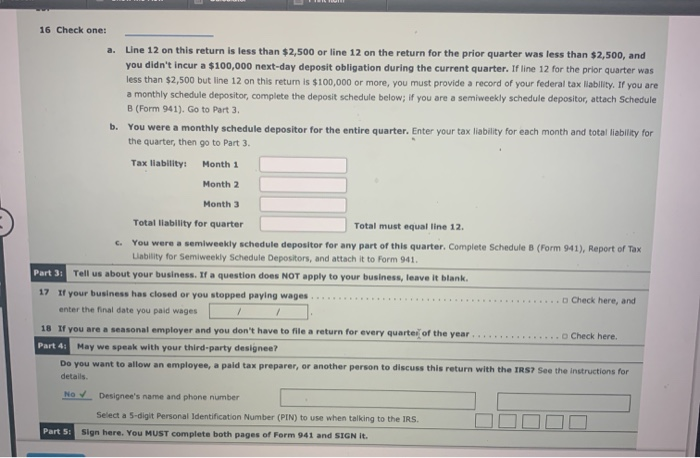

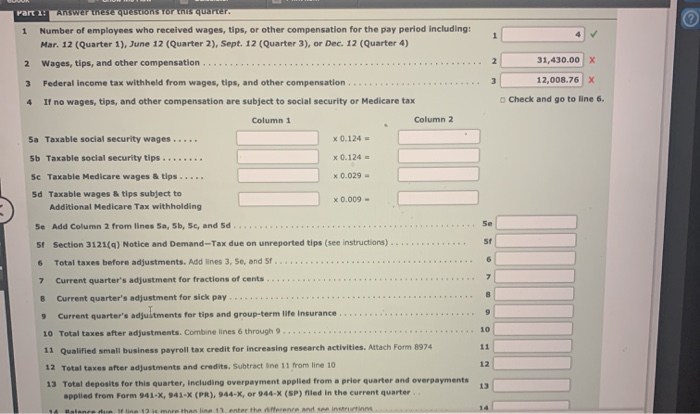

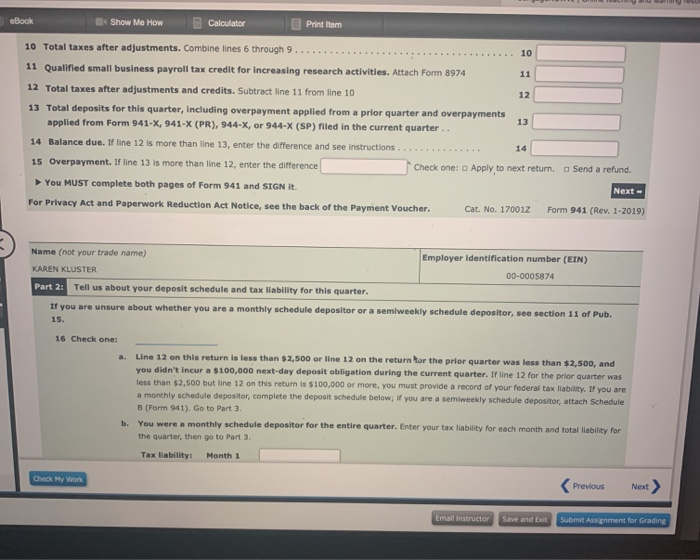

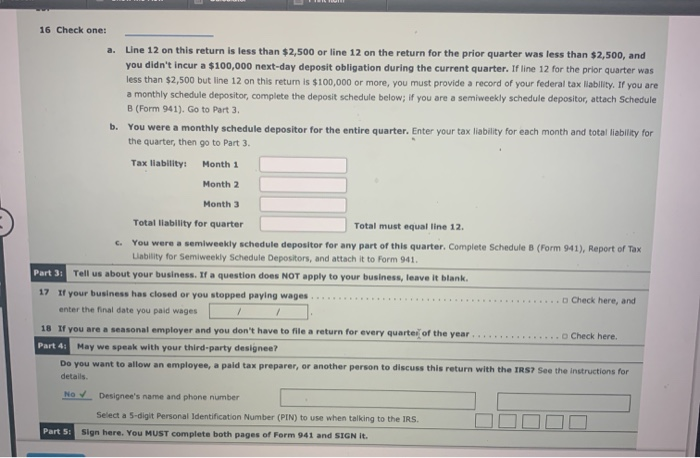

Figure 3.8 Karen Kluster opened Lube and Wash on January 2, 20- The business is subject to FICA taxes. At the end of the first quarter of 20-, Kluster, as president of the company, must file Form 941, Employer's Quarterly Federal Tax Return Employer's address: Employer's ID number: Phone number: Date filed: 234 Oak, Austin, TX 78711-0234 00-0005874 (512) 555-1111 April 30, 20- Each employee is paid semimonthly on the 15th and last day of each month. Shown below is the payroll information for the first quarter of 20--. All pay periods were the same PAYROLL INFORMATION FOR JANUARY-MARCH OASDI Tax Federal Income Tax SSN HI Tax Employee Paul Purson Matt Dirkson 000-00-7233 000-00-3451 000-00-3668 Quarterly Wage $12,000.00 12,600.00 12,500.00 10,800.00 $47,900.00 $744.00 781.20 Total Deductions $2,178.00 2.163.90 2,036.28 $174.00 182.70 181.26 156.60 $694.56 Joan Howard Net Pay $9,822.00 10,436.10 10,463.72 8,833.80 $39.555.62 $1,260.00 1,200.00 1,080.00 1,140.00 $4,680.00 775.02 000-00-6527 669.60 Dorrie Smith 1,966.20 $2,969.82 $8,344.38 Totals $694.55 Employer's FICA taxes $2,969.80 DASDI HI for the quarter The total taxes per payday are: Previous Next None of the employees reported tips during the quarter. Using Form 941 below, prepare the return based on the information shown above. Note: Lines Sa and 5c of Form 941, tax on total taxable wages, are computed by multiplying by the combined tax rate for both employer and employee. Small differences due to rounding may occur between this total and the total taxes withheld from employees each pay period and the amount of the employer's taxes calculated each pay period. This difference is reported on line 7 as a deduction or an addition as "Fractions of Cents. Assume that company deposits taxes on monthly basis. Hint: Line 7 Instructions. Fill in Form 941 through line 6 and then fill in Part 2, line 16 or Schedule B. Take that information and fill in line 13. Lines 12 and 13 must equal. If the amounts are not the same, correct by entering amount to make equal on line 7. Line 7 differences are caused by how calculations are made on Form 941 and the amounts withheld from employee's earning plus the employer's payroll tax amounts each pay. Form 941 for 20-- Employer's QUARTERLY Federal Tax Return (Rev. January 2019) Department of the Treasury - Internal Revenue Service OMSN 1545-0029 0 0 0 0 5 8 7 Report for this Quarter of 20 (Select one.) Employer identification number (EIN) 0 Name (not your trade name) KAREN KLUSTER Trade name (if any) LUBE AND WASH Go to www.irs.gov/Former for Instructions and the latest information Address 234 OAK Number Street Suite or room number AUSTIN TX 78711-0234 Cty State ZIP code + Foreign country name Foreign province/COUNTY Foren postal code Read the separate instructions before you complete Form 941. Type or print within the boxes. Answer these nestinne for thieter 4 2 31,430.00 x 3 12,008.76 X Check and go to line 6. Part 1: Answer these questions for this quarter. 1 Number of employees who received wages, tips, or other compensation for the pay period Including: Mar. 12 (Quarter 1), June 12 (Quarter 2), Sept. 12 (Quarter 3), or Dec. 12 (Quarter 4) 2 Wages, tips, and other compensation. 3 Federal income tax withheld from wages, tips, and other compensation .. 4 If no wages, tips, and other compensation are subject to social security or Medicare tax Column 1 Column 2 5a Taxable social security wages... x 0.124 Sb Taxable social security tips ... x 0.124 Sc Taxable Medicare wages & tips. x 0.029 Sd Taxable wages & tips subject to Additional Medicare Tax withholding x 0.009 - Se Add Column 2 from Iines Sa, 5b, 5c, and 5d 5f Section 3121(9) Notice and Demand-Tax due on unreported tips (see instructions) 6 Total taxes before adjustments. Add lines 3, 5e, and st. Current quarter's adjustment for fractions of cents B Current quarter's adjustment for sick pay Current quarter's adjuktments for tips and group-term life insurance 10 Total taxes after adjustments. Combine lines 6 through 9. 11 Qualified small business payroll tax credit for increasing research activities. Attach Form 1974 12 Total taxes after adjustments and credits. Subtract line 11 from line 10 13 Total deposits for this quarter, including overpayment applied from a prier quarter and overpayments applied from Form 941-X, 941-X (PR), 944-X, or 944-X (SP) nied in the current quarter 14 aurelin 13 lemon than enter the difference and can instruction 5e Sf 6 7 7 8 9 9 10 11 12 13 10 11 eBook Show Me How Calculator Print Item 10 Total taxes after adjustments. Combine lines 6 through 9 11 Qualified small business payroll tax credit for increasing research activities. Attach Form 8974 12 Total taxes after adjustments and credits. Subtract line 11 from line 10 12 13 Total deposits for this quarter, including overpayment applied from a prior quarter and overpayments 13 applied from Form 941-X, 941-X (PR), 944-X, or 944-X (SP) filed in the current quarter.. 14 Balance due. If line 12 is more than line 13, enter the difference and see instructions 15 Overpayment. If line 13 is more than line 12, enter the difference Check one: Apply to next return. Send a refund. You MUST complete both pages of Form 941 and SIGN it. Next- For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. Form 941 (Rev. 1-2019) 14 Cat. No. 170012 Name (not your trade name) Employer identification number (EIN) KAREN KLUSTER 00-0005874 Part 2: Tell us about your deposit schedule and tax liability for this quarter. If you are unsure about whether you are a monthly schedule depositor or a semiweekly schedule depositor, see section 11 of Pub. 15. 16 Check one: a. Line 12 on this return is less than $2,500 or line 12 on the return for the prior quarter was less than $2,500, and you didn't incur a $100,000 next-day deposit obligation during the current quarter. If line 12 for the prior quarter was less than $2,500 but line 12 on this return is $100,000 or more, you must provide a record of your federal tax liability. If you are a monthly schedule depositor, complete the deposit schedule below, if you are a semiweekly schedule depositor, attach Schedule B (Form 941). Go to Part 3 b. You were a monthly schedule depositor for the entire quarter. Enter your tax liability for each month and total liability for the qual then go to Part 3 Tax liability: Month 1 Previous Next > Check My Work Email Instructor Save and Exit Submit Assignment for Grading a. 16 Check one: Line 12 on this return is less than $2,500 or line 12 on the return for the prior quarter was less than $2,500, and you didn't incur a $100,000 next day deposit obligation during the current quarter. If line 12 for the prior quarter was less than $2,500 but line 12 on this return is $100,000 or more, you must provide a record of your federal tax liability. If you are a monthly schedule depositor, complete the deposit schedule below; If you are a semiweekly schedule depositor, attach Schedule B (Form 941). Go to Part 3 b. You were a monthly schedule depositor for the entire quarter. Enter your tax liability for each month and total liability for the quarter, then go to Part 3. Tax liability: Month 1 Month 2 Month 3 Total liability for quarter Total must equal line 12 c. You were a semiweekly schedule depositor for any part of this quarter. Complete Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors, and attach it to Form 941. Part 3: Tell us about your business. It a question does NOT apply to your business, leave it blank. 17 your business has closed or you stopped paying wages Check here, and enter the final date you paid wages 18 If you are a seasonal employer and you don't have to file a return for every quarter of the year Check here. Part 4: May we speak with your third-party designee? Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the TRS? See the instructions for details NO Designee's name and phone number Select a 5-digit Personal Identification Number (PIN) to use when talking to the IRS Part Si Sign here. You MUST complete both pages of Form 941 and SIGN It. Figure 3.8 Karen Kluster opened Lube and Wash on January 2, 20- The business is subject to FICA taxes. At the end of the first quarter of 20-, Kluster, as president of the company, must file Form 941, Employer's Quarterly Federal Tax Return Employer's address: Employer's ID number: Phone number: Date filed: 234 Oak, Austin, TX 78711-0234 00-0005874 (512) 555-1111 April 30, 20- Each employee is paid semimonthly on the 15th and last day of each month. Shown below is the payroll information for the first quarter of 20--. All pay periods were the same PAYROLL INFORMATION FOR JANUARY-MARCH OASDI Tax Federal Income Tax SSN HI Tax Employee Paul Purson Matt Dirkson 000-00-7233 000-00-3451 000-00-3668 Quarterly Wage $12,000.00 12,600.00 12,500.00 10,800.00 $47,900.00 $744.00 781.20 Total Deductions $2,178.00 2.163.90 2,036.28 $174.00 182.70 181.26 156.60 $694.56 Joan Howard Net Pay $9,822.00 10,436.10 10,463.72 8,833.80 $39.555.62 $1,260.00 1,200.00 1,080.00 1,140.00 $4,680.00 775.02 000-00-6527 669.60 Dorrie Smith 1,966.20 $2,969.82 $8,344.38 Totals $694.55 Employer's FICA taxes $2,969.80 DASDI HI for the quarter The total taxes per payday are: Previous Next None of the employees reported tips during the quarter. Using Form 941 below, prepare the return based on the information shown above. Note: Lines Sa and 5c of Form 941, tax on total taxable wages, are computed by multiplying by the combined tax rate for both employer and employee. Small differences due to rounding may occur between this total and the total taxes withheld from employees each pay period and the amount of the employer's taxes calculated each pay period. This difference is reported on line 7 as a deduction or an addition as "Fractions of Cents. Assume that company deposits taxes on monthly basis. Hint: Line 7 Instructions. Fill in Form 941 through line 6 and then fill in Part 2, line 16 or Schedule B. Take that information and fill in line 13. Lines 12 and 13 must equal. If the amounts are not the same, correct by entering amount to make equal on line 7. Line 7 differences are caused by how calculations are made on Form 941 and the amounts withheld from employee's earning plus the employer's payroll tax amounts each pay. Form 941 for 20-- Employer's QUARTERLY Federal Tax Return (Rev. January 2019) Department of the Treasury - Internal Revenue Service OMSN 1545-0029 0 0 0 0 5 8 7 Report for this Quarter of 20 (Select one.) Employer identification number (EIN) 0 Name (not your trade name) KAREN KLUSTER Trade name (if any) LUBE AND WASH Go to www.irs.gov/Former for Instructions and the latest information Address 234 OAK Number Street Suite or room number AUSTIN TX 78711-0234 Cty State ZIP code + Foreign country name Foreign province/COUNTY Foren postal code Read the separate instructions before you complete Form 941. Type or print within the boxes. Answer these nestinne for thieter 4 2 31,430.00 x 3 12,008.76 X Check and go to line 6. Part 1: Answer these questions for this quarter. 1 Number of employees who received wages, tips, or other compensation for the pay period Including: Mar. 12 (Quarter 1), June 12 (Quarter 2), Sept. 12 (Quarter 3), or Dec. 12 (Quarter 4) 2 Wages, tips, and other compensation. 3 Federal income tax withheld from wages, tips, and other compensation .. 4 If no wages, tips, and other compensation are subject to social security or Medicare tax Column 1 Column 2 5a Taxable social security wages... x 0.124 Sb Taxable social security tips ... x 0.124 Sc Taxable Medicare wages & tips. x 0.029 Sd Taxable wages & tips subject to Additional Medicare Tax withholding x 0.009 - Se Add Column 2 from Iines Sa, 5b, 5c, and 5d 5f Section 3121(9) Notice and Demand-Tax due on unreported tips (see instructions) 6 Total taxes before adjustments. Add lines 3, 5e, and st. Current quarter's adjustment for fractions of cents B Current quarter's adjustment for sick pay Current quarter's adjuktments for tips and group-term life insurance 10 Total taxes after adjustments. Combine lines 6 through 9. 11 Qualified small business payroll tax credit for increasing research activities. Attach Form 1974 12 Total taxes after adjustments and credits. Subtract line 11 from line 10 13 Total deposits for this quarter, including overpayment applied from a prier quarter and overpayments applied from Form 941-X, 941-X (PR), 944-X, or 944-X (SP) nied in the current quarter 14 aurelin 13 lemon than enter the difference and can instruction 5e Sf 6 7 7 8 9 9 10 11 12 13 10 11 eBook Show Me How Calculator Print Item 10 Total taxes after adjustments. Combine lines 6 through 9 11 Qualified small business payroll tax credit for increasing research activities. Attach Form 8974 12 Total taxes after adjustments and credits. Subtract line 11 from line 10 12 13 Total deposits for this quarter, including overpayment applied from a prior quarter and overpayments 13 applied from Form 941-X, 941-X (PR), 944-X, or 944-X (SP) filed in the current quarter.. 14 Balance due. If line 12 is more than line 13, enter the difference and see instructions 15 Overpayment. If line 13 is more than line 12, enter the difference Check one: Apply to next return. Send a refund. You MUST complete both pages of Form 941 and SIGN it. Next- For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. Form 941 (Rev. 1-2019) 14 Cat. No. 170012 Name (not your trade name) Employer identification number (EIN) KAREN KLUSTER 00-0005874 Part 2: Tell us about your deposit schedule and tax liability for this quarter. If you are unsure about whether you are a monthly schedule depositor or a semiweekly schedule depositor, see section 11 of Pub. 15. 16 Check one: a. Line 12 on this return is less than $2,500 or line 12 on the return for the prior quarter was less than $2,500, and you didn't incur a $100,000 next-day deposit obligation during the current quarter. If line 12 for the prior quarter was less than $2,500 but line 12 on this return is $100,000 or more, you must provide a record of your federal tax liability. If you are a monthly schedule depositor, complete the deposit schedule below, if you are a semiweekly schedule depositor, attach Schedule B (Form 941). Go to Part 3 b. You were a monthly schedule depositor for the entire quarter. Enter your tax liability for each month and total liability for the qual then go to Part 3 Tax liability: Month 1 Previous Next > Check My Work Email Instructor Save and Exit Submit Assignment for Grading a. 16 Check one: Line 12 on this return is less than $2,500 or line 12 on the return for the prior quarter was less than $2,500, and you didn't incur a $100,000 next day deposit obligation during the current quarter. If line 12 for the prior quarter was less than $2,500 but line 12 on this return is $100,000 or more, you must provide a record of your federal tax liability. If you are a monthly schedule depositor, complete the deposit schedule below; If you are a semiweekly schedule depositor, attach Schedule B (Form 941). Go to Part 3 b. You were a monthly schedule depositor for the entire quarter. Enter your tax liability for each month and total liability for the quarter, then go to Part 3. Tax liability: Month 1 Month 2 Month 3 Total liability for quarter Total must equal line 12 c. You were a semiweekly schedule depositor for any part of this quarter. Complete Schedule B (Form 941), Report of Tax Liability for Semiweekly Schedule Depositors, and attach it to Form 941. Part 3: Tell us about your business. It a question does NOT apply to your business, leave it blank. 17 your business has closed or you stopped paying wages Check here, and enter the final date you paid wages 18 If you are a seasonal employer and you don't have to file a return for every quarter of the year Check here. Part 4: May we speak with your third-party designee? Do you want to allow an employee, a paid tax preparer, or another person to discuss this return with the TRS? See the instructions for details NO Designee's name and phone number Select a 5-digit Personal Identification Number (PIN) to use when talking to the IRS Part Si Sign here. You MUST complete both pages of Form 941 and SIGN It