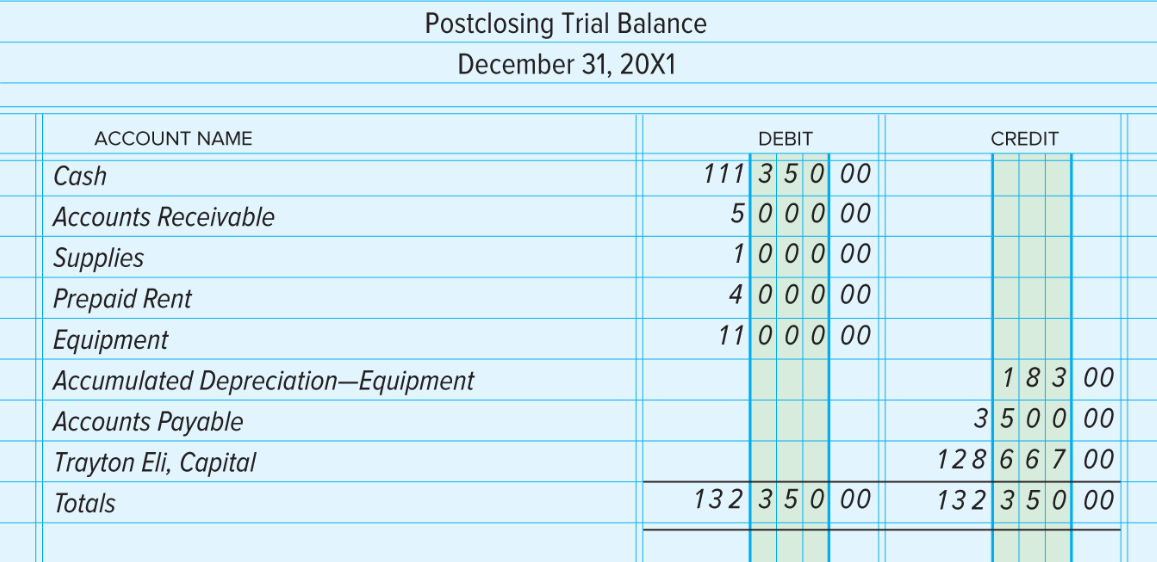

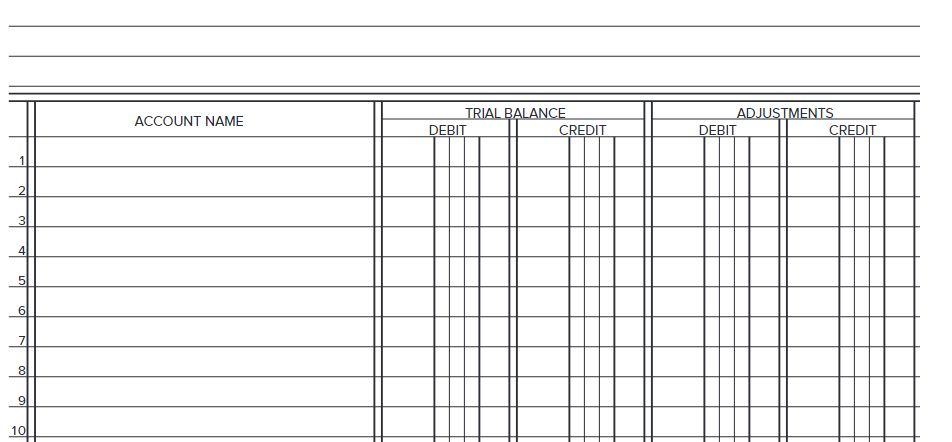

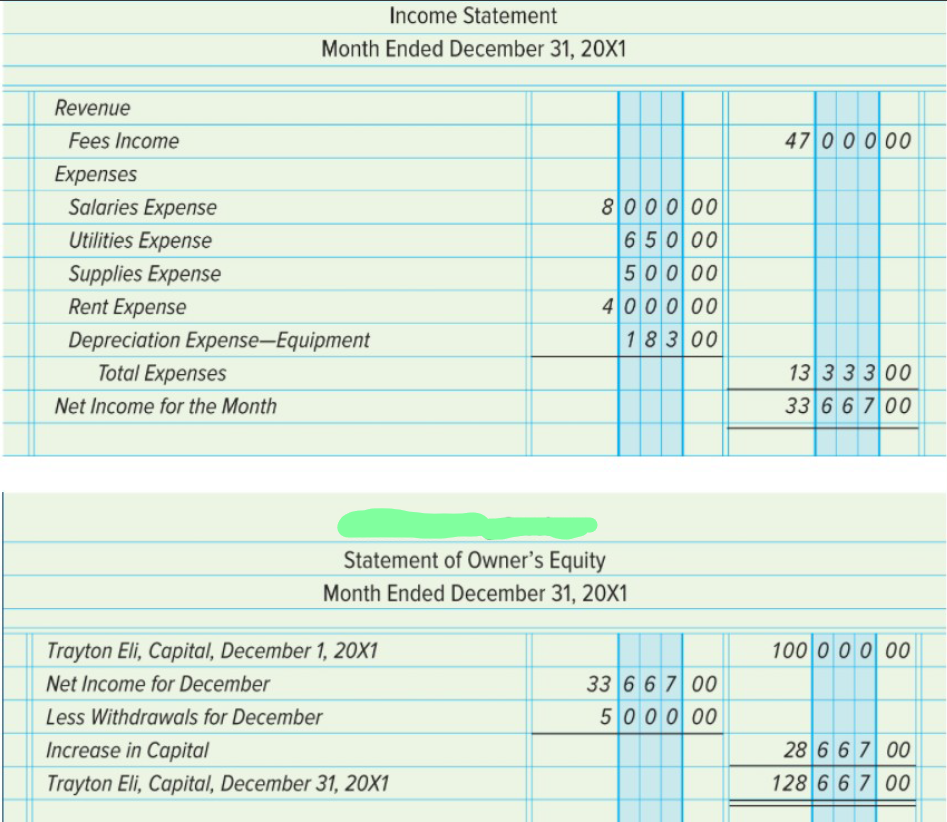

FIGURE 6.3

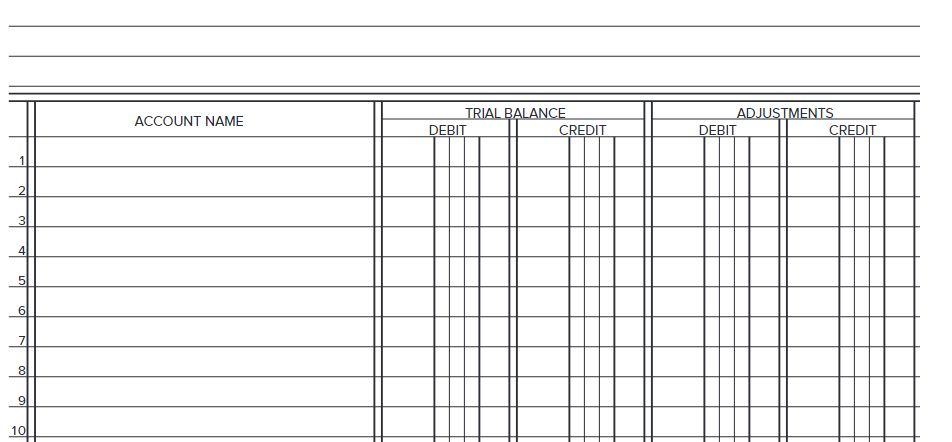

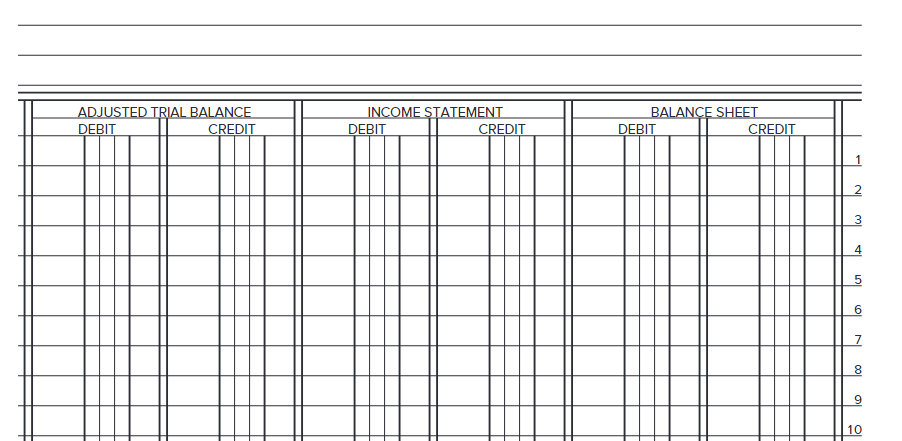

TRIAL BALANCE

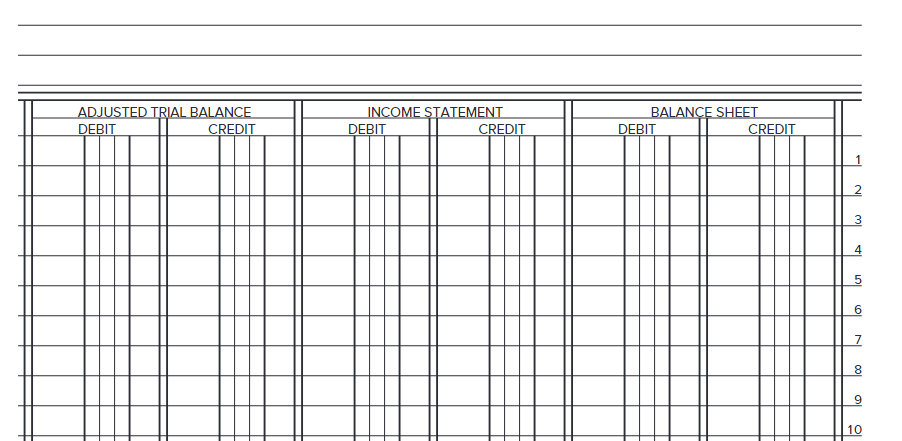

FIGURE 6.4

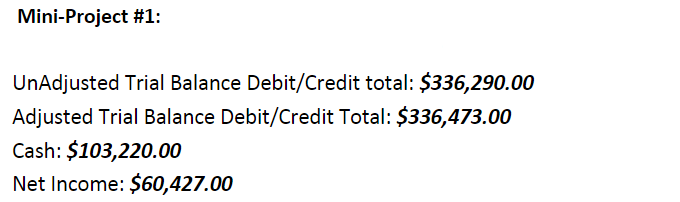

HELPFUL!!! FINAL BALANCE OR STATEMENT AMOUNTS (answers):

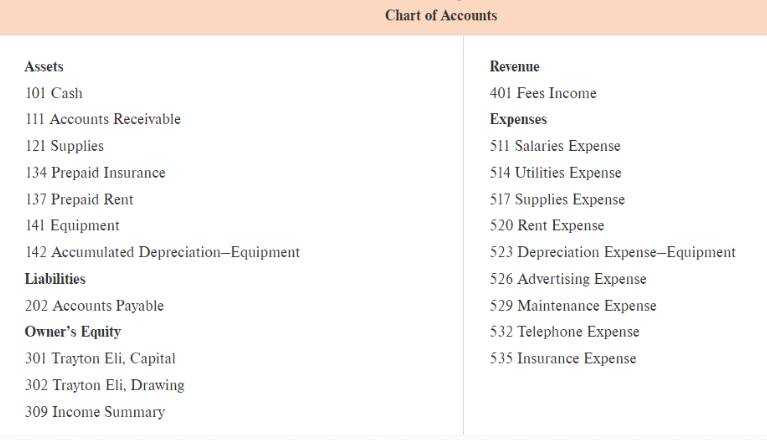

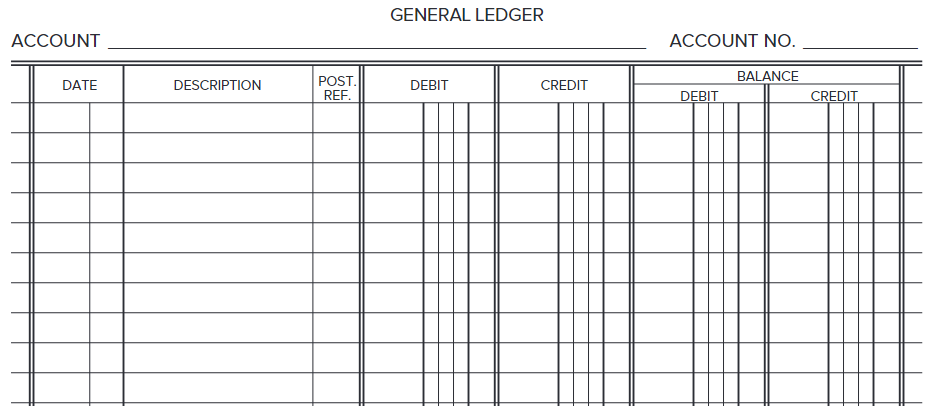

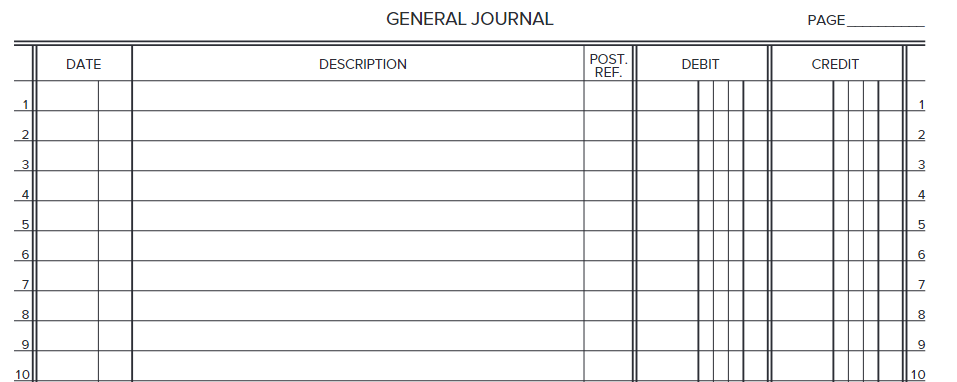

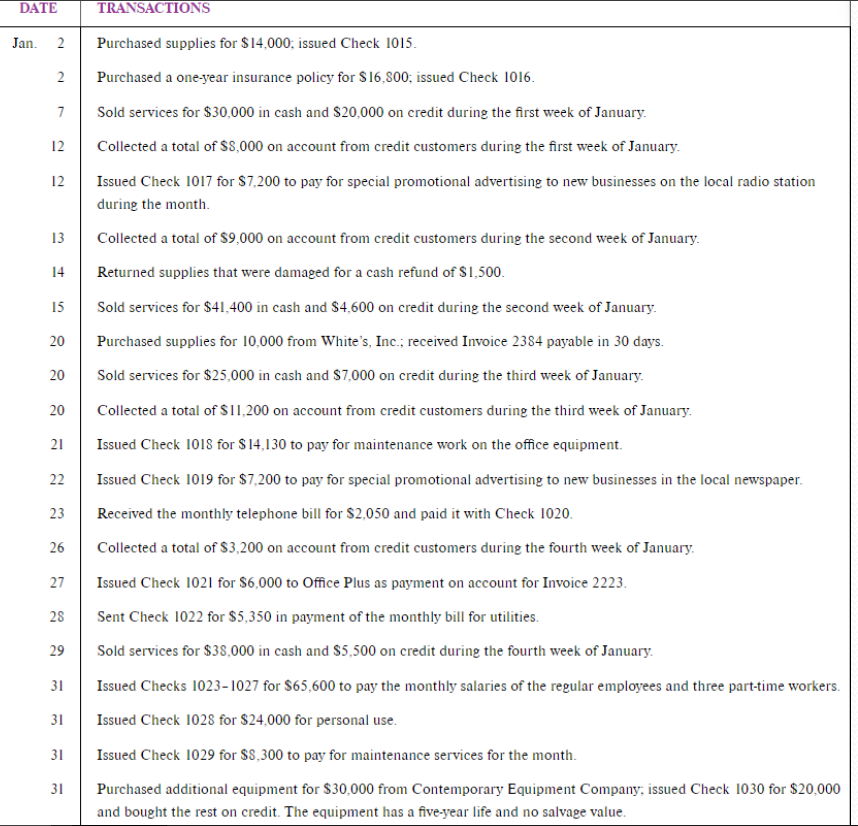

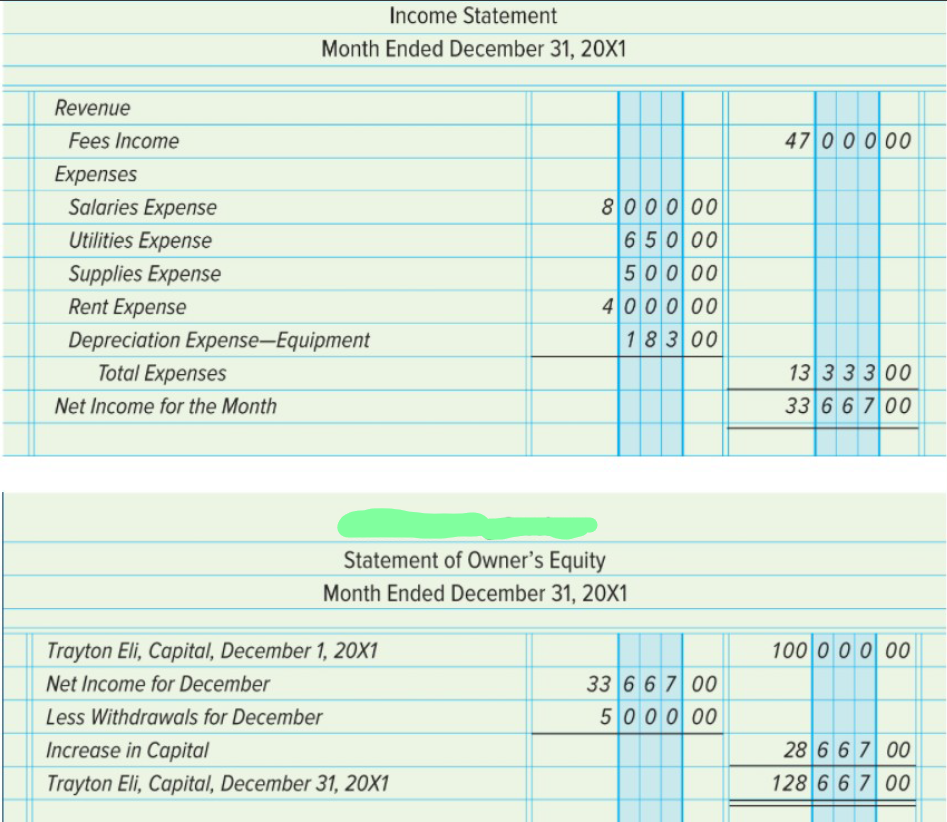

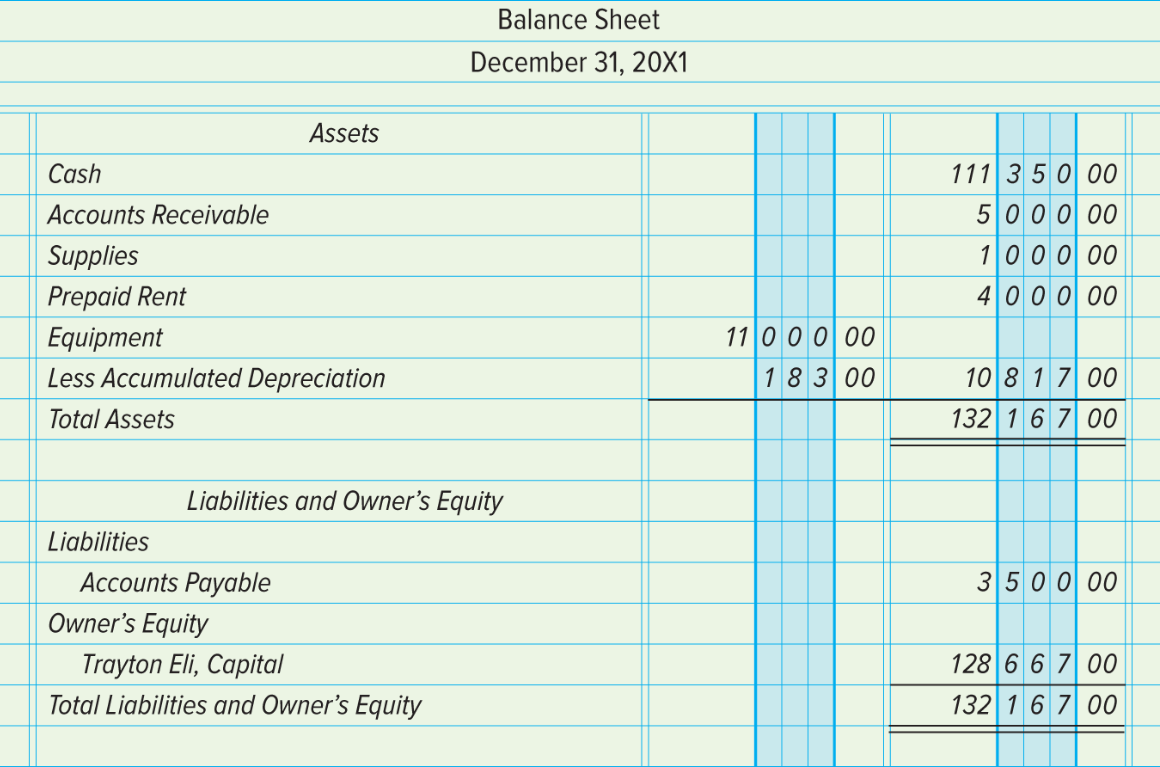

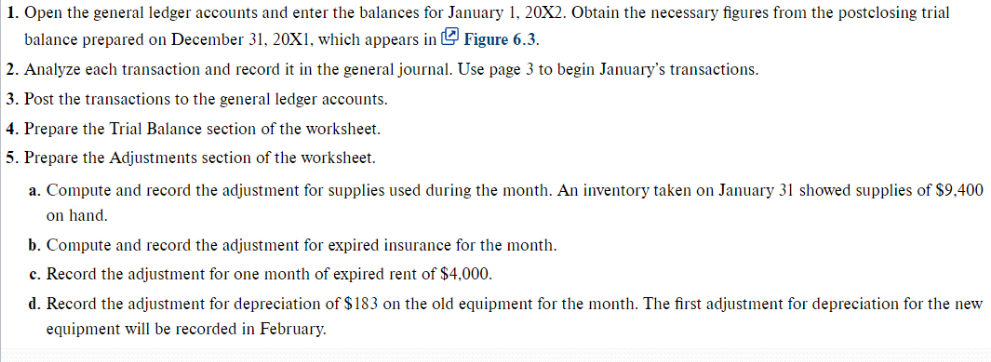

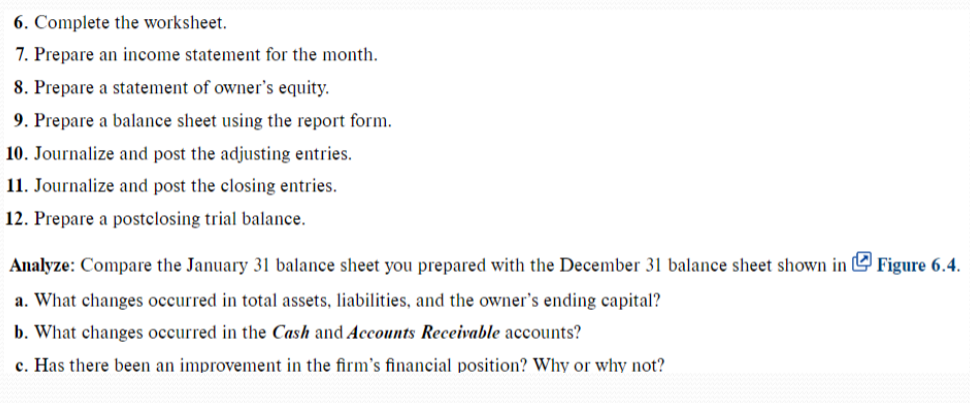

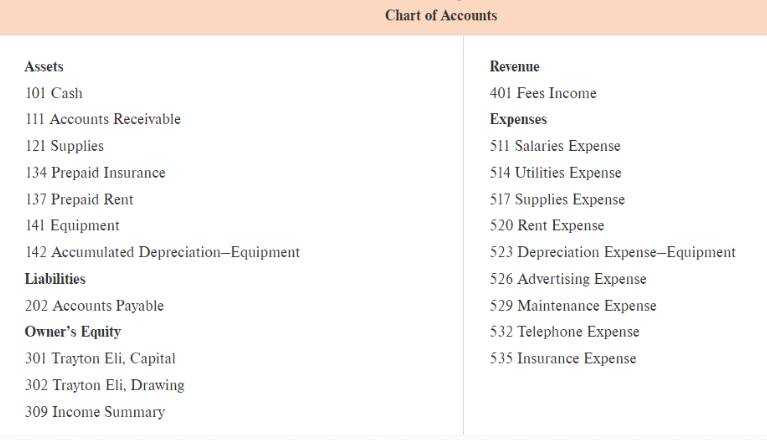

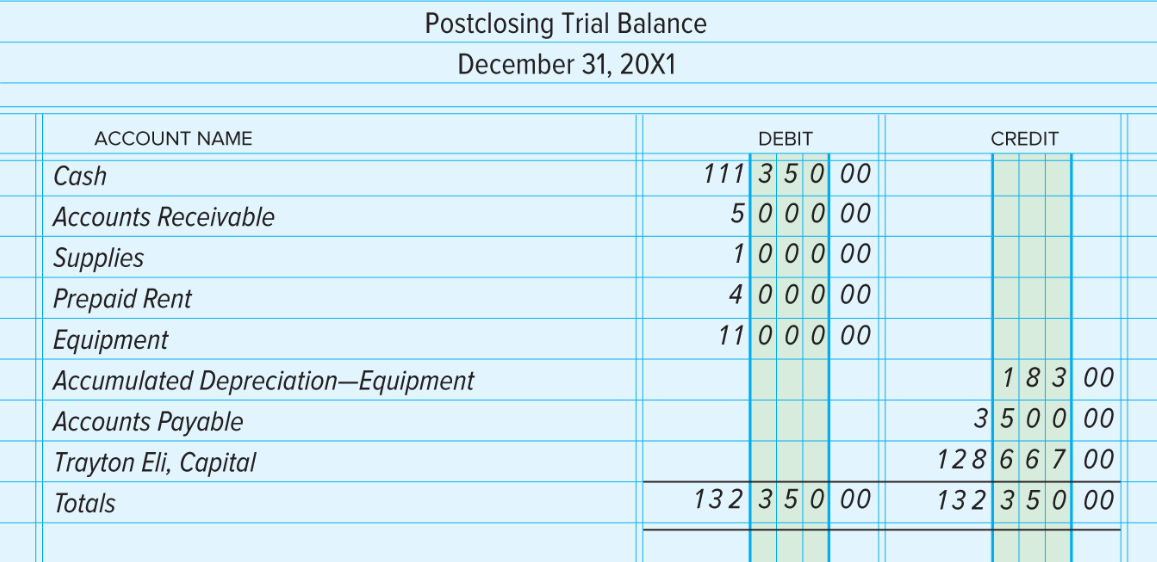

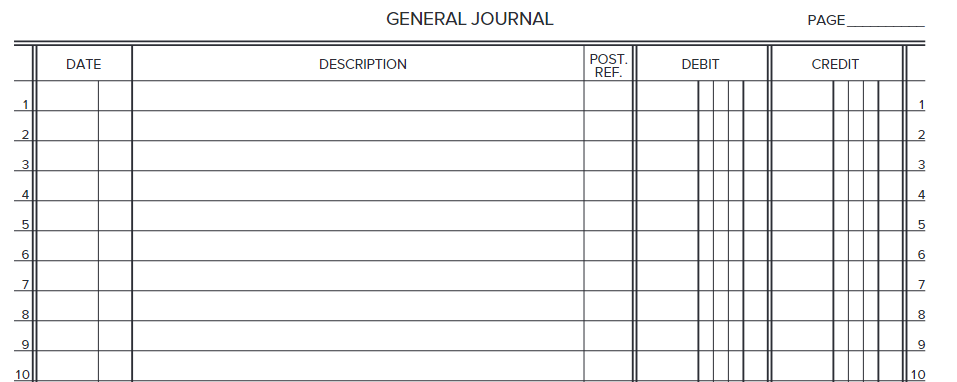

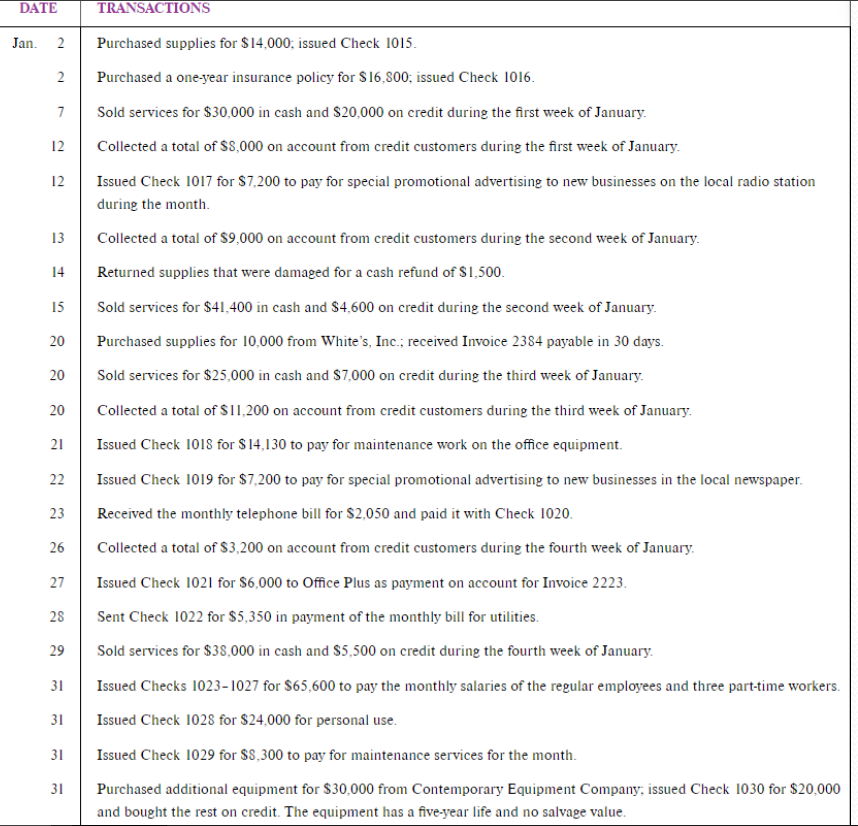

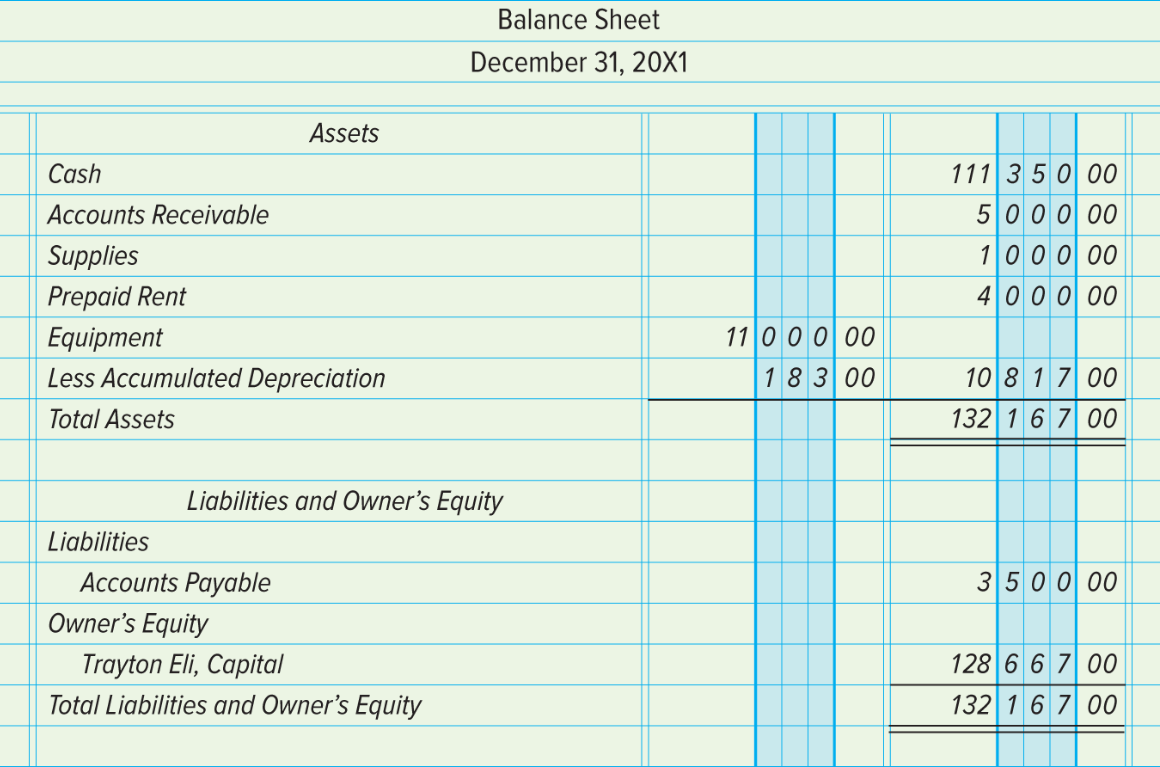

balance prepared on December 31, 20X1, which appears in Figure 6.3. 2. Analyze each transaction and record it in the general journal. Use page 3 to begin January's transactions. 3. Post the transactions to the general ledger accounts. 4. Prepare the Trial Balance section of the worksheet. 5. Prepare the Adjustments section of the worksheet. a. Compute and record the adjustment for supplies used during the month. An inventory taken on January 31 showed supplies of $9,40 on hand. b. Compute and record the adjustment for expired insurance for the month. c. Record the adjustment for one month of expired rent $4,000. d. Record the adjustment for depreciation of $183 on the old equipment for the month. The first adjustment for depreciation for the ne equipment will be recorded in February. 6. Complete the worksheet. 7. Prepare an income statement for the month. 8. Prepare a statement of owner's equity. 9. Prepare a balance sheet using the report form. 10. Journalize and post the adjusting entries. 11. Journalize and post the closing entries. 12. Prepare a postclosing trial balance. Analyze: Compare the January 31 balance sheet you prepared with the December 31 balance sheet shown in Figure 6.4. a. What changes occurred in total assets, liabilities, and the owner's ending capital? b. What changes occurred in the Cash and Accounts Receivable accounts? c. Has there been an improvement in the firm's financial position? Why or why not? a) What was the dollar amount and percentage of the changes? What is the impact to the business from the balance sheet? b) What was the dollar amount and percentage of the changes? What is the impact to the business from cash and account receivable? Chart of Accounts GENERAL LEDGER ACCOUNT NO. Postclosing Trial Balance December 31, 20X1 GENERAL JOURNAL 2 Purchased supplies for $14,000; issued Check 1015. 2 Purchased a one-year insurance policy for $16,800; issued Check 1016 . 7 Sold services for $30,000 in cash and $20,000 on credit during the first week of January. 12 Collected a total of $,000 on account from credit customers during the first week of January. during the month. Collected a total of $9,000 on account from credit customers during the second week of Janu Returned supplies that were damaged for a cash refund of $1,500. Sold services for $41,400 in cash and $4,600 on credit during the second week of January. Purchased supplies for 10,000 from White's, Inc.; received Invoice 2384 payable in 30 days. Sold services for $25,000 in cash and $7,000 on credit during the third week of January. Collected a total of $11,200 on account from credit customers during the third week of January. Issued Check 1018 for $14,130 to pay for maintenance work on the office equipment. Issued Check 1019 for $7,200 to pay for special promotional advertising to new businesses in the local newspaper. Received the monthly telephone bill for $2,050 and paid it with Check 1020. Collected a total of $3,200 on account from credit customers during the fourth week of January. Issued Check 1021 for $6,000 to Office Plus as payment on account for Invoice 2223. Sent Check 1022 for $5,350 in payment of the monthly bill for utilities. Sold services for $38,000 in cash and $5,500 on credit during the fourth week of January. Issued Checks 1023-1027 for $65,600 to pay the monthly salaries of the regular employees and three part-time workers Issued Check 1028 for $24,000 for personal use. Issued Check 1029 for $8,300 to pay for maintenance services for the month. Purchased additional equipment for $30,000 from Contemporary Equipment Company; issued Check 1030 for $20,000 and bought the rest on credit. The equipment has a five-year life and no salvage value. Income Statement Month Ended December 31, 20X1 Statement of Owner's Equity Month Ended December 31, 20X1 \begin{tabular}{|l|r|r|r|r||r|r|r|r|r|r|} \hline Trayton Eli, Capital, December 1, 20X1 & & & & 100 & 0 & 0 & 0 & 00 \\ \hline Net Income for December & 33 & 6 & 6 & 7 & 00 & & & & & \\ \hline Less Withdrawals for December & 5 & 0 & 0 & 0 & 00 & & & & & \\ \hline Increase in Capital & & & & & & 28 & 6 & 6 & 7 & 00 \\ \hline Trayton Eli, Capital, December 31,20X1 & & & & & 128 & 6 & 6 & 7 & 00 \\ \hline \end{tabular} Balance Sheet December 31, 20X1 UnAdjusted Trial Balance Debit/Credit total: \$336,290.00 Adjusted Trial Balance Debit/Credit Total: $336,473.00 Cash: $103,220.00 Net Income: $60,427.00 balance prepared on December 31, 20X1, which appears in Figure 6.3. 2. Analyze each transaction and record it in the general journal. Use page 3 to begin January's transactions. 3. Post the transactions to the general ledger accounts. 4. Prepare the Trial Balance section of the worksheet. 5. Prepare the Adjustments section of the worksheet. a. Compute and record the adjustment for supplies used during the month. An inventory taken on January 31 showed supplies of $9,40 on hand. b. Compute and record the adjustment for expired insurance for the month. c. Record the adjustment for one month of expired rent $4,000. d. Record the adjustment for depreciation of $183 on the old equipment for the month. The first adjustment for depreciation for the ne equipment will be recorded in February. 6. Complete the worksheet. 7. Prepare an income statement for the month. 8. Prepare a statement of owner's equity. 9. Prepare a balance sheet using the report form. 10. Journalize and post the adjusting entries. 11. Journalize and post the closing entries. 12. Prepare a postclosing trial balance. Analyze: Compare the January 31 balance sheet you prepared with the December 31 balance sheet shown in Figure 6.4. a. What changes occurred in total assets, liabilities, and the owner's ending capital? b. What changes occurred in the Cash and Accounts Receivable accounts? c. Has there been an improvement in the firm's financial position? Why or why not? a) What was the dollar amount and percentage of the changes? What is the impact to the business from the balance sheet? b) What was the dollar amount and percentage of the changes? What is the impact to the business from cash and account receivable? Chart of Accounts GENERAL LEDGER ACCOUNT NO. Postclosing Trial Balance December 31, 20X1 GENERAL JOURNAL 2 Purchased supplies for $14,000; issued Check 1015. 2 Purchased a one-year insurance policy for $16,800; issued Check 1016 . 7 Sold services for $30,000 in cash and $20,000 on credit during the first week of January. 12 Collected a total of $,000 on account from credit customers during the first week of January. during the month. Collected a total of $9,000 on account from credit customers during the second week of Janu Returned supplies that were damaged for a cash refund of $1,500. Sold services for $41,400 in cash and $4,600 on credit during the second week of January. Purchased supplies for 10,000 from White's, Inc.; received Invoice 2384 payable in 30 days. Sold services for $25,000 in cash and $7,000 on credit during the third week of January. Collected a total of $11,200 on account from credit customers during the third week of January. Issued Check 1018 for $14,130 to pay for maintenance work on the office equipment. Issued Check 1019 for $7,200 to pay for special promotional advertising to new businesses in the local newspaper. Received the monthly telephone bill for $2,050 and paid it with Check 1020. Collected a total of $3,200 on account from credit customers during the fourth week of January. Issued Check 1021 for $6,000 to Office Plus as payment on account for Invoice 2223. Sent Check 1022 for $5,350 in payment of the monthly bill for utilities. Sold services for $38,000 in cash and $5,500 on credit during the fourth week of January. Issued Checks 1023-1027 for $65,600 to pay the monthly salaries of the regular employees and three part-time workers Issued Check 1028 for $24,000 for personal use. Issued Check 1029 for $8,300 to pay for maintenance services for the month. Purchased additional equipment for $30,000 from Contemporary Equipment Company; issued Check 1030 for $20,000 and bought the rest on credit. The equipment has a five-year life and no salvage value. Income Statement Month Ended December 31, 20X1 Statement of Owner's Equity Month Ended December 31, 20X1 \begin{tabular}{|l|r|r|r|r||r|r|r|r|r|r|} \hline Trayton Eli, Capital, December 1, 20X1 & & & & 100 & 0 & 0 & 0 & 00 \\ \hline Net Income for December & 33 & 6 & 6 & 7 & 00 & & & & & \\ \hline Less Withdrawals for December & 5 & 0 & 0 & 0 & 00 & & & & & \\ \hline Increase in Capital & & & & & & 28 & 6 & 6 & 7 & 00 \\ \hline Trayton Eli, Capital, December 31,20X1 & & & & & 128 & 6 & 6 & 7 & 00 \\ \hline \end{tabular} Balance Sheet December 31, 20X1 UnAdjusted Trial Balance Debit/Credit total: \$336,290.00 Adjusted Trial Balance Debit/Credit Total: $336,473.00 Cash: $103,220.00 Net Income: $60,427.00