Answered step by step

Verified Expert Solution

Question

1 Approved Answer

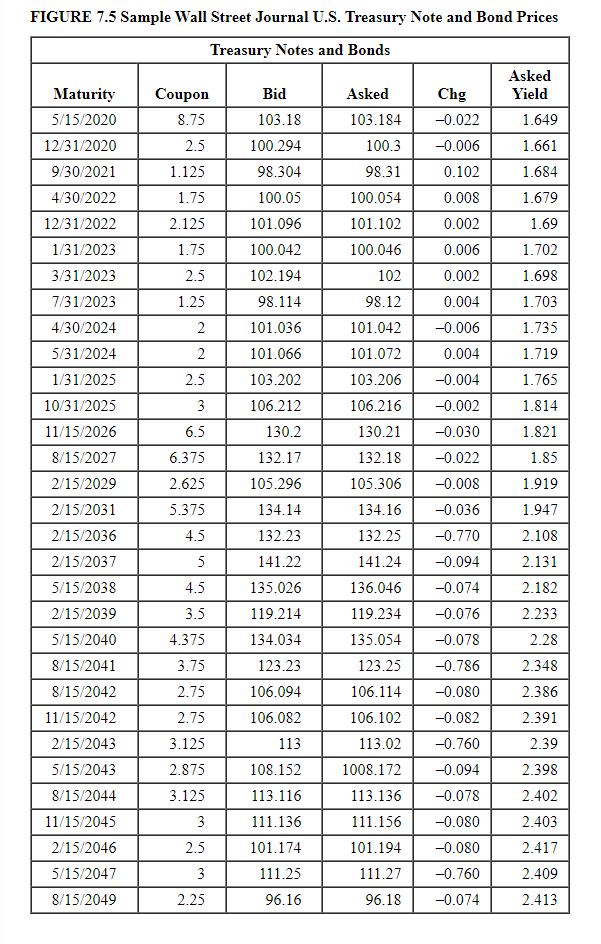

FIGURE 7.5 Sample Wall Street Journal U.S. Treasury Note and Bond Prices begin{tabular}{|c|c|c|c|c|c|} hline multicolumn{6}{|c|}{ Treasury Notes and Bonds } hline Maturity & Coupon

FIGURE 7.5 Sample Wall Street Journal U.S. Treasury Note and Bond Prices \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Treasury Notes and Bonds } \\ \hline Maturity & Coupon & Bid & Asked & Chg & AskedYield \\ \hline 5/15/2020 & 8.75 & 103.18 & 103.184 & -0.022 & 1.649 \\ \hline 12/31/2020 & 2.5 & 100.294 & 100.3 & -0.006 & 1.661 \\ \hline 9/30/2021 & 1.125 & 98.304 & 98.31 & 0.102 & 1.684 \\ \hline 4/30/2022 & 1.75 & 100.05 & 100.054 & 0.008 & 1.679 \\ \hline 12/31/2022 & 2.125 & 101.096 & 101.102 & 0.002 & 1.69 \\ \hline 1/31/2023 & 1.75 & 100.042 & 100.046 & 0.006 & 1.702 \\ \hline 3/31/2023 & 2.5 & 102.194 & 102 & 0.002 & 1.698 \\ \hline 7/31/2023 & 1.25 & 98.114 & 98.12 & 0.004 & 1.703 \\ \hline 4/30/2024 & 2 & 101.036 & 101.042 & -0.006 & 1.735 \\ \hline 5/31/2024 & 2 & 101.066 & 101.072 & 0.004 & 1.719 \\ \hline 1/31/2025 & 2.5 & 103.202 & 103.206 & -0.004 & 1.765 \\ \hline 10/31/2025 & 3 & 106.212 & 106.216 & -0.002 & 1.814 \\ \hline 11/15/2026 & 6.5 & 130.2 & 130.21 & -0.030 & 1.821 \\ \hline 8/15/2027 & 6.375 & 132.17 & 132.18 & -0.022 & 1.85 \\ \hline 2/15/2029 & 2.625 & 105.296 & 105.306 & -0.008 & 1.919 \\ \hline 2/15/2031 & 5.375 & 134.14 & 134.16 & -0.036 & 1.947 \\ \hline 2/15/2036 & 4.5 & 132.23 & 132.25 & -0.770 & 2.108 \\ \hline 2/15/2037 & 5 & 141.22 & 141.24 & -0.094 & 2.131 \\ \hline 5/15/2038 & 4.5 & 135.026 & 136.046 & -0.074 & 2.182 \\ \hline 2/15/2039 & 3.5 & 119.214 & 119.234 & -0.076 & 2.233 \\ \hline 5/15/2040 & 4.375 & 134.034 & 135.054 & -0.078 & 2.28 \\ \hline 8/15/2041 & 3.75 & 123.23 & 123.25 & -0.786 & 2.348 \\ \hline 8/15/2042 & 2.75 & 106.094 & 106.114 & -0.080 & 2.386 \\ \hline 11/15/2042 & 2.75 & 106.082 & 106.102 & -0.082 & 2.391 \\ \hline 2/15/2043 & 3.125 & 113 & 113.02 & -0.760 & 2.39 \\ \hline 5/15/2043 & 2.875 & 108.152 & 1008.172 & -0.094 & 2.398 \\ \hline 8/15/2044 & 3.125 & 113.116 & 113.136 & -0.078 & 2.402 \\ \hline 11/15/2045 & 3 & 111.136 & 111.156 & -0.080 & 2.403 \\ \hline 2/15/2046 & 2.5 & 101.174 & 101.194 & -0.080 & 2.417 \\ \hline 5/15/2047 & 3 & 111.25 & 111.27 & -0.760 & 2.409 \\ \hline 8/15/2049 & 2.25 & 96.16 & 96.18 & -0.074 & 2.413 \\ \hline \end{tabular} Locate the Treasury issue in Figure 7.5 maturing in February 2029. Assume a par value of $10,000. a. What is its coupon rate? (Enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.) b. What is its bid price in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What was the previous day's asked price in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

FIGURE 7.5 Sample Wall Street Journal U.S. Treasury Note and Bond Prices \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Treasury Notes and Bonds } \\ \hline Maturity & Coupon & Bid & Asked & Chg & AskedYield \\ \hline 5/15/2020 & 8.75 & 103.18 & 103.184 & -0.022 & 1.649 \\ \hline 12/31/2020 & 2.5 & 100.294 & 100.3 & -0.006 & 1.661 \\ \hline 9/30/2021 & 1.125 & 98.304 & 98.31 & 0.102 & 1.684 \\ \hline 4/30/2022 & 1.75 & 100.05 & 100.054 & 0.008 & 1.679 \\ \hline 12/31/2022 & 2.125 & 101.096 & 101.102 & 0.002 & 1.69 \\ \hline 1/31/2023 & 1.75 & 100.042 & 100.046 & 0.006 & 1.702 \\ \hline 3/31/2023 & 2.5 & 102.194 & 102 & 0.002 & 1.698 \\ \hline 7/31/2023 & 1.25 & 98.114 & 98.12 & 0.004 & 1.703 \\ \hline 4/30/2024 & 2 & 101.036 & 101.042 & -0.006 & 1.735 \\ \hline 5/31/2024 & 2 & 101.066 & 101.072 & 0.004 & 1.719 \\ \hline 1/31/2025 & 2.5 & 103.202 & 103.206 & -0.004 & 1.765 \\ \hline 10/31/2025 & 3 & 106.212 & 106.216 & -0.002 & 1.814 \\ \hline 11/15/2026 & 6.5 & 130.2 & 130.21 & -0.030 & 1.821 \\ \hline 8/15/2027 & 6.375 & 132.17 & 132.18 & -0.022 & 1.85 \\ \hline 2/15/2029 & 2.625 & 105.296 & 105.306 & -0.008 & 1.919 \\ \hline 2/15/2031 & 5.375 & 134.14 & 134.16 & -0.036 & 1.947 \\ \hline 2/15/2036 & 4.5 & 132.23 & 132.25 & -0.770 & 2.108 \\ \hline 2/15/2037 & 5 & 141.22 & 141.24 & -0.094 & 2.131 \\ \hline 5/15/2038 & 4.5 & 135.026 & 136.046 & -0.074 & 2.182 \\ \hline 2/15/2039 & 3.5 & 119.214 & 119.234 & -0.076 & 2.233 \\ \hline 5/15/2040 & 4.375 & 134.034 & 135.054 & -0.078 & 2.28 \\ \hline 8/15/2041 & 3.75 & 123.23 & 123.25 & -0.786 & 2.348 \\ \hline 8/15/2042 & 2.75 & 106.094 & 106.114 & -0.080 & 2.386 \\ \hline 11/15/2042 & 2.75 & 106.082 & 106.102 & -0.082 & 2.391 \\ \hline 2/15/2043 & 3.125 & 113 & 113.02 & -0.760 & 2.39 \\ \hline 5/15/2043 & 2.875 & 108.152 & 1008.172 & -0.094 & 2.398 \\ \hline 8/15/2044 & 3.125 & 113.116 & 113.136 & -0.078 & 2.402 \\ \hline 11/15/2045 & 3 & 111.136 & 111.156 & -0.080 & 2.403 \\ \hline 2/15/2046 & 2.5 & 101.174 & 101.194 & -0.080 & 2.417 \\ \hline 5/15/2047 & 3 & 111.25 & 111.27 & -0.760 & 2.409 \\ \hline 8/15/2049 & 2.25 & 96.16 & 96.18 & -0.074 & 2.413 \\ \hline \end{tabular} Locate the Treasury issue in Figure 7.5 maturing in February 2029. Assume a par value of $10,000. a. What is its coupon rate? (Enter your answer as a percent rounded to 3 decimal places, e.g., 32.161.) b. What is its bid price in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What was the previous day's asked price in dollars? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started