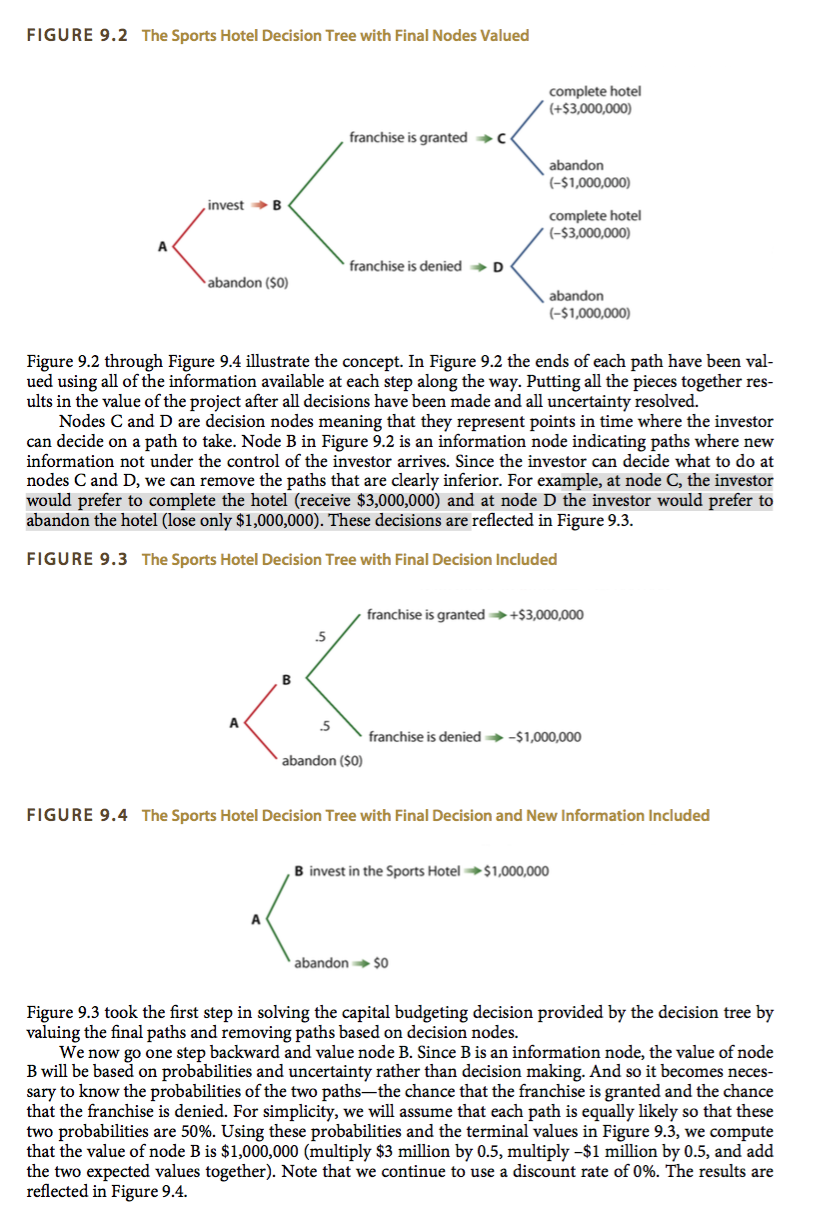

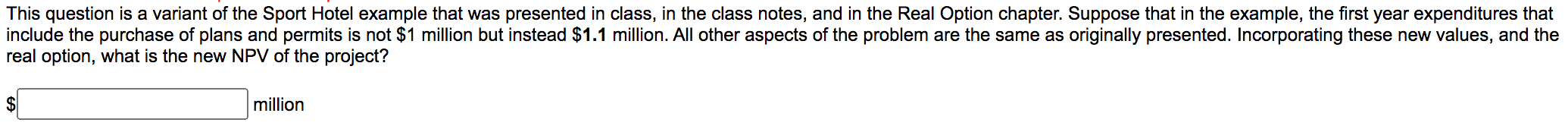

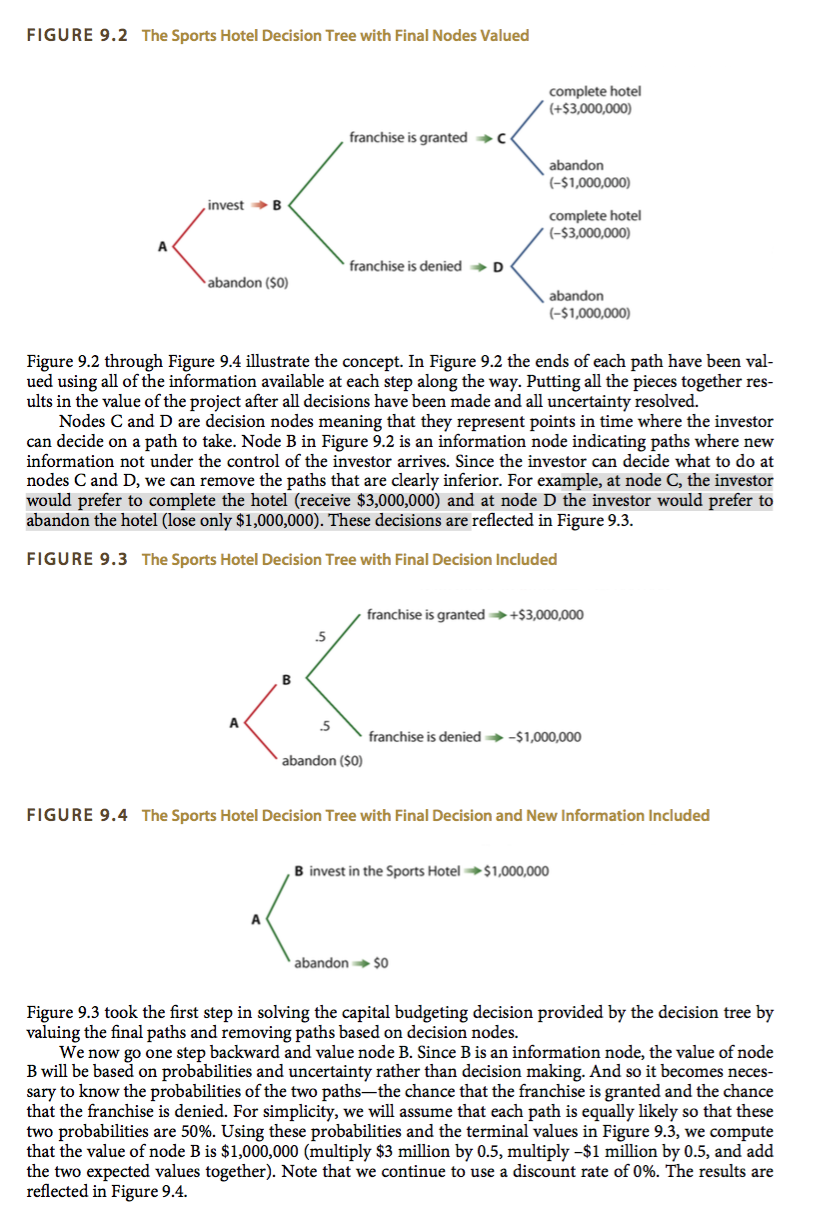

FIGURE 9.2 The Sports Hotel Decision Tree with Final Nodes Valued complete hotel (+$3,000,000) franchise is granted abandon (-$1,000,000) invest B complete hotel (-$3,000,000) A franchise is denied D abandon (50) abandon (-$1,000,000) Figure 9.2 through Figure 9.4 illustrate the concept. In Figure 9.2 the ends of each path have been val- ued using all of the information available at each step along the way. Putting all the pieces together res- ults in the value of the project after all decisions have been made and all uncertainty resolved. Nodes C and D are decision nodes meaning that they represent points in time where the investor can decide on a path to take. Node B in Figure 9.2 is an information node indicating paths where new information not under the control of the investor arrives. Since the investor decide what to do at nodes C and D, we can remove the paths that are clearly inferior. For example, at node C, the investor would prefer to complete the hotel (receive $3,000,000) and at node D the investor would prefer to abandon the hotel (lose only $1,000,000). These decisions are reflected in Figure 9.3. FIGURE 9.3 The Sports Hotel Decision Tree with Final Decision Included franchise is granted +$3,000,000 B A .5 franchise is denied -$1,000,000 abandon (50) FIGURE 9.4 The Sports Hotel Decision Tree with Final Decision and New Information Included B invest in the Sports Hotel $1,000,000 abandon $0 Figure 9.3 took the first step in solving the capital budgeting decision provided by the decision tree by valuing the final paths and removing paths based on decision nodes. We now go one step backward and value node B. Since B is an information node, the value of node B will be based on probabilities and uncertainty rather than decision making. And so it becomes neces- sary to know the probabilities of the two pathsthe chance that the franchise is granted and the chance that the franchise is denied. For simplicity, we will assume that each path is equally likely so that these two probabilities are 50%. Using these probabilities and the terminal values in Figure 9.3, we compute that the value of node B is $1,000,000 (multiply $3 million by 0.5, multiply -$1 million by 0.5, and add the two expected values together). Note that we continue to use a discount rate of 0%. The results are reflected in Figure 9.4. This question is a variant of the Sport Hotel example that was presented in class, in the class notes, and in the Real Option chapter. Suppose that in the example, the first year expenditures that include the purchase of plans and permits is not $ 1 million but instead $1.1 million. All other aspects of the problem are the same as originally presented. Incorporating these new values, and the real option, what is the new NPV of the project? $ million