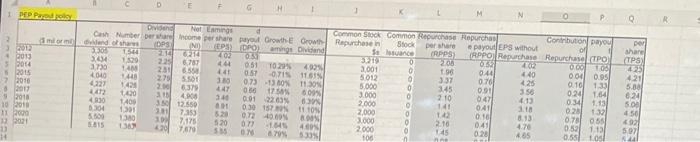

Figure out Repurchases per Share, which is figured by dividing Common Stock Repurchased by Shares Outstanding for each period. Also, figure a Repurchase Payout Ratio, which is Repurchases per Share divided by EPS. Graph the Repurchase Payout Ratio. Is this more volatile than the Dividend Payout Ratio? Would you expect this result based on our discussions of payout policy in class? Include a graph of Shares Outstanding. Is the total number of outstanding shares increasing or decreasing? What does this tell you about share repurchases versus share issuances? 1 PEP Payed policy mi or mi 2 3 2012 4 2013 3 2014 2015 7 2016 2017 2018 10 2018 11 2000 12 2021 (E 14 U 1544 3,434 1,529 3.730 1400 4040 4.227 4.472 4.930 6.304 5.500 5415 1,448 1,428 D 1,420 1,409 1301 1.380 1362 | MA Dividend Not Lamings (DPS Cash Number per share come per share payout Growth-E Growth dvidend of share (EPS) (DPO) amings Dividend 4.02 4.44 3.305 (NI) 2.14 6214 2.25 6,707 2.31 6.558 441 270 5501 2.00 6,379 3.10 4,908 3.50 12.550 3.81 7.353 E F 39 7,175 420 7,879 3.80 447 340 100 G 5.20 5.20 5.55 0.51 0.57 H 10.29% 492% -0.71% 0.73 -13 80% 17.58% 0.91 22.63% 0.30 157.89% 0.72 40.69% 0.77 900 -1.545 6.79% 11.61% 11.30% 6.09% 6.39% 11.10% 8.00% 4.89% 5.33% 1 3.319 3,001 5.012 5.000 Common Stock Common Repurchase Repurchas Repurchase in Stock Selesuance 3.000 2,000 2,000 3,000 2.000 106 0 10 10 0 0 0 0 0 L 0 n per share (RPPS) 2.08 1.96 3.37 3.45 2.10 141 M 1.42 2.16 1.45 hot N 4.02 4.40 4.25 3.56 4.13 3.18 8.13 0 Contribution payou e payout EPS without of (RPPO Repurchase Repurchase (TPO 0.53 0.00 1.00 0.44 0.76 0.91 047 041 0.16 041 0.28 4.76 4.85 P 0.04 0.95 0.10 1.33 0.24 1.64 0.34 1.13 028 132 0.78 055 0.52 1.13 0.55 1.05 Q per share (TPS) 4.25 421 5.80 6.24 5.00 4.50 4.92 5.97 5441 R Figure out Repurchases per Share, which is figured by dividing Common Stock Repurchased by Shares Outstanding for each period. Also, figure a Repurchase Payout Ratio, which is Repurchases per Share divided by EPS. Graph the Repurchase Payout Ratio. Is this more volatile than the Dividend Payout Ratio? Would you expect this result based on our discussions of payout policy in class? Include a graph of Shares Outstanding. Is the total number of outstanding shares increasing or decreasing? What does this tell you about share repurchases versus share issuances? 1 PEP Payed policy mi or mi 2 3 2012 4 2013 3 2014 2015 7 2016 2017 2018 10 2018 11 2000 12 2021 (E 14 U 1544 3,434 1,529 3.730 1400 4040 4.227 4.472 4.930 6.304 5.500 5415 1,448 1,428 D 1,420 1,409 1301 1.380 1362 | MA Dividend Not Lamings (DPS Cash Number per share come per share payout Growth-E Growth dvidend of share (EPS) (DPO) amings Dividend 4.02 4.44 3.305 (NI) 2.14 6214 2.25 6,707 2.31 6.558 441 270 5501 2.00 6,379 3.10 4,908 3.50 12.550 3.81 7.353 E F 39 7,175 420 7,879 3.80 447 340 100 G 5.20 5.20 5.55 0.51 0.57 H 10.29% 492% -0.71% 0.73 -13 80% 17.58% 0.91 22.63% 0.30 157.89% 0.72 40.69% 0.77 900 -1.545 6.79% 11.61% 11.30% 6.09% 6.39% 11.10% 8.00% 4.89% 5.33% 1 3.319 3,001 5.012 5.000 Common Stock Common Repurchase Repurchas Repurchase in Stock Selesuance 3.000 2,000 2,000 3,000 2.000 106 0 10 10 0 0 0 0 0 L 0 n per share (RPPS) 2.08 1.96 3.37 3.45 2.10 141 M 1.42 2.16 1.45 hot N 4.02 4.40 4.25 3.56 4.13 3.18 8.13 0 Contribution payou e payout EPS without of (RPPO Repurchase Repurchase (TPO 0.53 0.00 1.00 0.44 0.76 0.91 047 041 0.16 041 0.28 4.76 4.85 P 0.04 0.95 0.10 1.33 0.24 1.64 0.34 1.13 028 132 0.78 055 0.52 1.13 0.55 1.05 Q per share (TPS) 4.25 421 5.80 6.24 5.00 4.50 4.92 5.97 5441 R