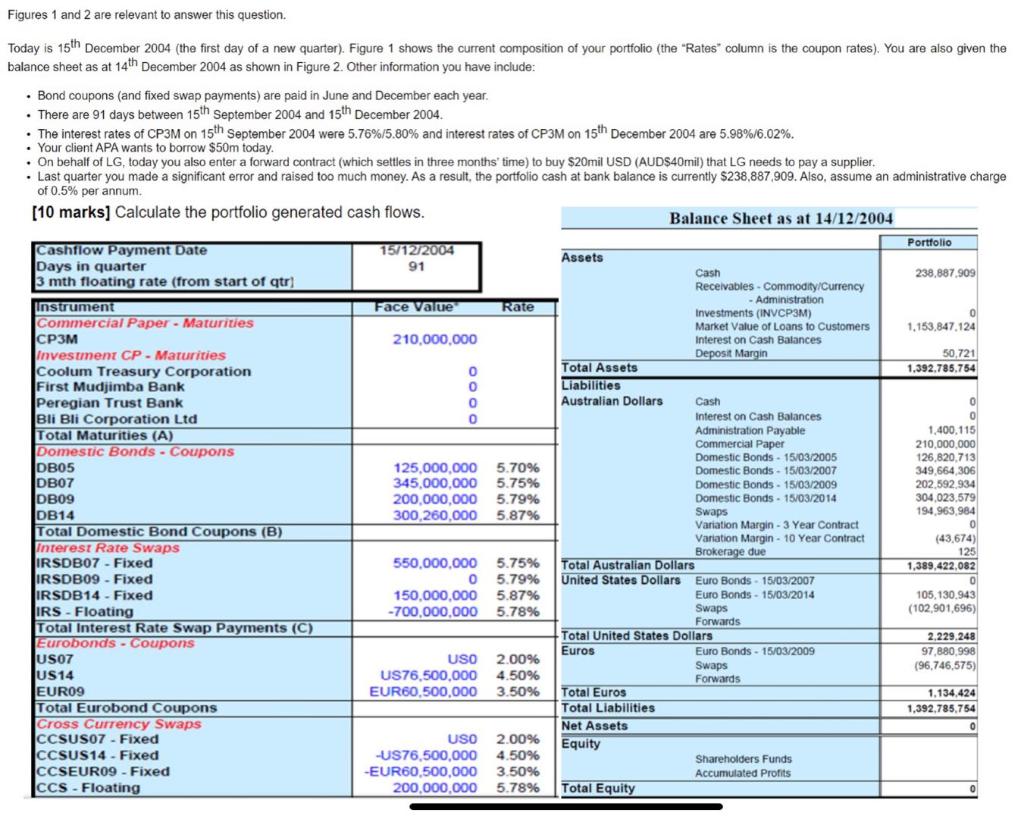

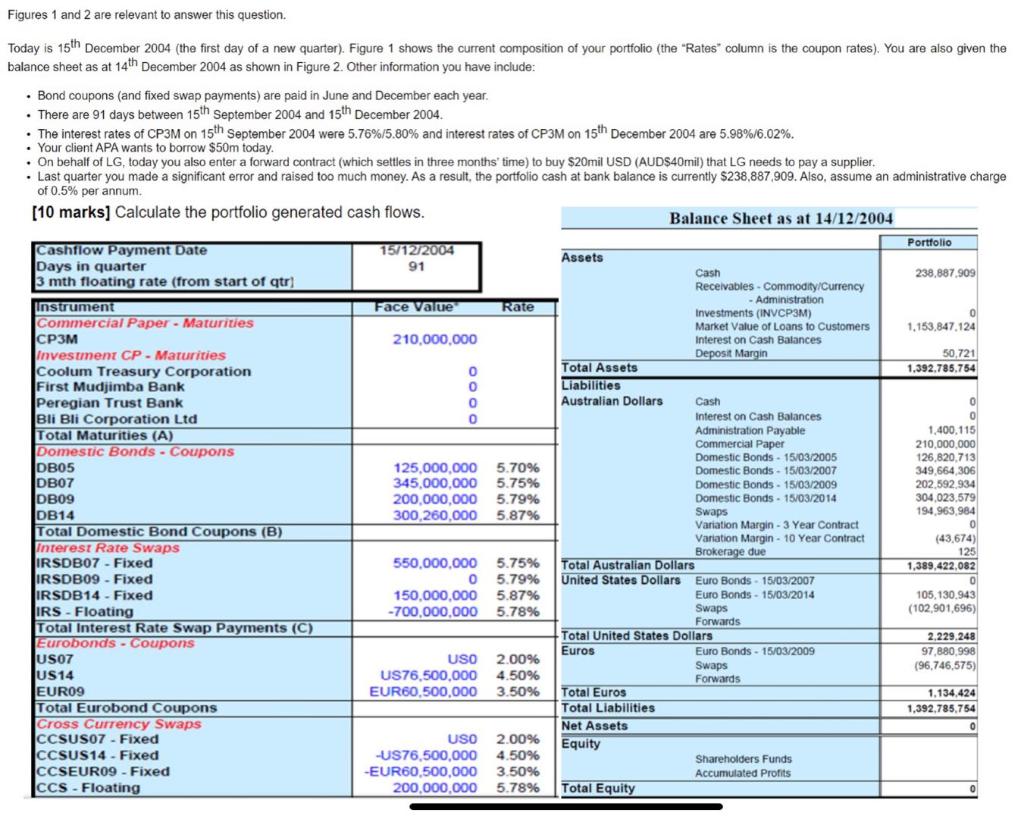

Figures 1 and 2 are relevant to answer this question. Today is 15th December 2004 (the first day of a new quarter). Figure 1 shows the current composition of your portfolio (the "Rates" column is the coupon rates). You are also given the balance sheet as at 14th December 2004 as shown in Figure 2. Other information you have include: Bond coupons and fixed swap payments) are paid in June and December each year. . There are 91 days between 15th September 2004 and 15th December 2004 The interest rates of CP3M on 15th September 2004 were 5.76%/5.80% and interest rates of CP3M on 15th December 2004 are 5.98%/6.02%. . Your client APA wants to borrow $50m today. . On behalf of LG, today you also enter a forward contract (which settles in three months' time) to buy $20mil USD (AUD$40mil) that LG needs to pay a supplier. Last quarter you made a significant error and raised too much money. As a result, the portfolio cash at bank balance is currently $238,887,909. Also, assume an administrative charge of 0.5% per annum. [10 marks] Calculate the portfolio generated cash flows. Balance Sheet as at 14/12/2004 Portfolio 15/12/2004 91 Assets 238,887,909 Cashflow Payment Date Days in quarter 3 mth floating rate (from start of qtr instrument Commercial Paper - Maturities Face value Rate 0 1.153,847,124 CP3M 210.000.000 50,721 1,392.785,754 0 0 0 investment CP-Maturities Coolum Treasury Corporation First Mudjimba Bank Peregian Trust Bank Bli Bli Corporation Ltd Total Maturities (A) Domestic Bonds - Coupons DB05 DB07 DB09 DB14 Total Domestic Bond Coupons (B) Interest Rate Swaps IRSDB07 - Fixed IRSDB09 - Fixed IRSDB14 - Fixed IRS - Floating Total Interest Rate Swap Payments (C) Eurobonds - Coupons USO7 US14 125,000,000 5.70% 345,000,000 5.75% 200,000,000 5.79% 300,260,000 5.87% Cash Receivables - Commodity/Currency Administration Investments (INVCP3M) Market value of Loans to Customers Interest on Cash Balances Deposit Margin Total Assets Liabilities Australian Dollars Cash Interest on Cash Balances Administration Payable Commercial Paper Domestic Bonds - 15/03/2005 Domestic Bonds. 15/03/2007 Domestic Bonds - 15/03/2009 Domestic Bonds - 15/03/2014 Swaps Variation Margin - 3 Year Contract Variation Margin - 10 Year Contract Brokerage due Total Australian Dollars United States Dollars Euro Bonds - 15/03/2007 Euro Bonds - 15/03/2014 Swaps Forwards Total United States Dollars Euros Euro Bonds - 15/03/2009 Swaps Forwards Total Euros Total Liabilities Net Assets Equity Shareholders Funds Accumulated Profits Total Equity ol 0 1,400.115 210,000,000 126.620.713 349,664 306 202,592934 304,023.579 194.963,984 0 (43,674) 125 1,389,422,082 0 105,130.943 (102,901,696) 550.000.000 5.75% 0 5.79% 150,000,000 5.87% -700,000,000 5.78% 2.229.248 97,880.998 (96.746,575) USO 2.00% US76,500,000 4.50% EUR60,500,000 3.50% EUR09 1.134,424 1,392,785,764 0 Total Eurobond Coupons Cross Currency Swaps CCSUS07 - Fixed CCSUS14 - Fixed CCSEUR09 - Fixed CCS - Floating USO 2.00% -US76,500,000 4.50% -EUR60,500,000 3.50% 200,000,000 5.78% Figures 1 and 2 are relevant to answer this question. Today is 15th December 2004 (the first day of a new quarter). Figure 1 shows the current composition of your portfolio (the "Rates" column is the coupon rates). You are also given the balance sheet as at 14th December 2004 as shown in Figure 2. Other information you have include: Bond coupons and fixed swap payments) are paid in June and December each year. . There are 91 days between 15th September 2004 and 15th December 2004 The interest rates of CP3M on 15th September 2004 were 5.76%/5.80% and interest rates of CP3M on 15th December 2004 are 5.98%/6.02%. . Your client APA wants to borrow $50m today. . On behalf of LG, today you also enter a forward contract (which settles in three months' time) to buy $20mil USD (AUD$40mil) that LG needs to pay a supplier. Last quarter you made a significant error and raised too much money. As a result, the portfolio cash at bank balance is currently $238,887,909. Also, assume an administrative charge of 0.5% per annum. [10 marks] Calculate the portfolio generated cash flows. Balance Sheet as at 14/12/2004 Portfolio 15/12/2004 91 Assets 238,887,909 Cashflow Payment Date Days in quarter 3 mth floating rate (from start of qtr instrument Commercial Paper - Maturities Face value Rate 0 1.153,847,124 CP3M 210.000.000 50,721 1,392.785,754 0 0 0 investment CP-Maturities Coolum Treasury Corporation First Mudjimba Bank Peregian Trust Bank Bli Bli Corporation Ltd Total Maturities (A) Domestic Bonds - Coupons DB05 DB07 DB09 DB14 Total Domestic Bond Coupons (B) Interest Rate Swaps IRSDB07 - Fixed IRSDB09 - Fixed IRSDB14 - Fixed IRS - Floating Total Interest Rate Swap Payments (C) Eurobonds - Coupons USO7 US14 125,000,000 5.70% 345,000,000 5.75% 200,000,000 5.79% 300,260,000 5.87% Cash Receivables - Commodity/Currency Administration Investments (INVCP3M) Market value of Loans to Customers Interest on Cash Balances Deposit Margin Total Assets Liabilities Australian Dollars Cash Interest on Cash Balances Administration Payable Commercial Paper Domestic Bonds - 15/03/2005 Domestic Bonds. 15/03/2007 Domestic Bonds - 15/03/2009 Domestic Bonds - 15/03/2014 Swaps Variation Margin - 3 Year Contract Variation Margin - 10 Year Contract Brokerage due Total Australian Dollars United States Dollars Euro Bonds - 15/03/2007 Euro Bonds - 15/03/2014 Swaps Forwards Total United States Dollars Euros Euro Bonds - 15/03/2009 Swaps Forwards Total Euros Total Liabilities Net Assets Equity Shareholders Funds Accumulated Profits Total Equity ol 0 1,400.115 210,000,000 126.620.713 349,664 306 202,592934 304,023.579 194.963,984 0 (43,674) 125 1,389,422,082 0 105,130.943 (102,901,696) 550.000.000 5.75% 0 5.79% 150,000,000 5.87% -700,000,000 5.78% 2.229.248 97,880.998 (96.746,575) USO 2.00% US76,500,000 4.50% EUR60,500,000 3.50% EUR09 1.134,424 1,392,785,764 0 Total Eurobond Coupons Cross Currency Swaps CCSUS07 - Fixed CCSUS14 - Fixed CCSEUR09 - Fixed CCS - Floating USO 2.00% -US76,500,000 4.50% -EUR60,500,000 3.50% 200,000,000 5.78%