Answered step by step

Verified Expert Solution

Question

1 Approved Answer

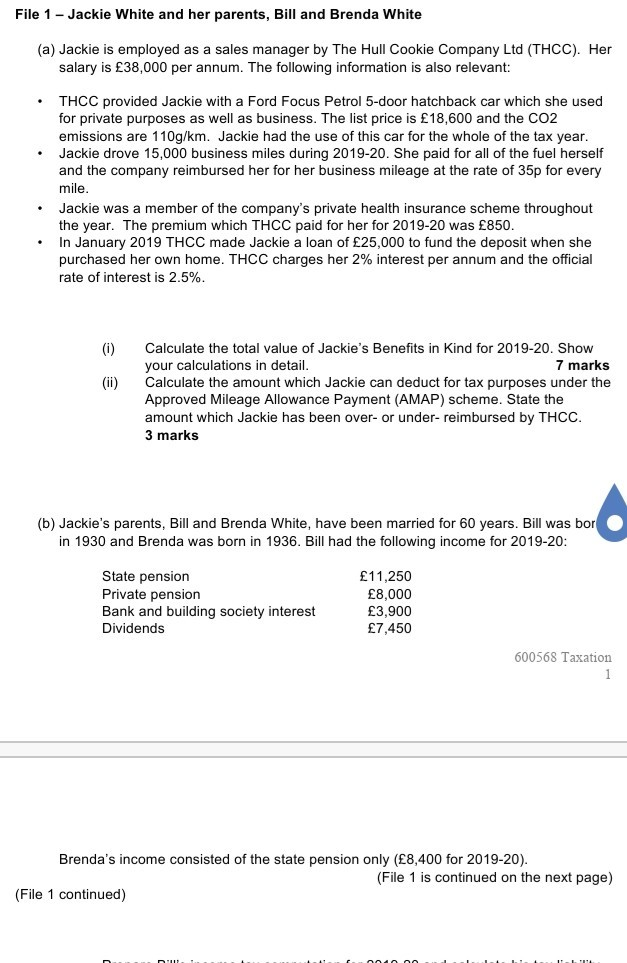

File 1 - Jackie White and her parents, Bill and Brenda White (a) Jackie is employed as a sales manager by The Hull Cookie Company

File 1 - Jackie White and her parents, Bill and Brenda White (a) Jackie is employed as a sales manager by The Hull Cookie Company Ltd (THCC). Her salary is 38,000 per annum. The following information is also relevant: THCC provided Jackie with a Ford Focus Petrol 5-door hatchback car which she used for private purposes as well as business. The list price is 18,600 and the CO2 emissions are 110g/km. Jackie had the use of this car for the whole of the tax year. Jackie drove 15,000 business miles during 2019-20. She paid for all of the fuel herself and the company reimbursed her for her business mileage at the rate of 35p for every mile. Jackie was a member of the company's private health insurance scheme throughout the year. The premium which THCC paid for her for 2019-20 was 850. In January 2019 THCC made Jackie a loan of 25,000 to fund the deposit when she purchased her own home. THCC charges her 2% interest per annum and the official rate of interest is 2.5%. (1) (ii) Calculate the total value of Jackie's Benefits in Kind for 2019-20. Show your calculations in detail. 7 marks Calculate the amount which Jackie can deduct for tax purposes under the Approved Mileage Allowance Payment (AMAP) scheme. State the amount which Jackie has been over- or under-reimbursed by THCC. 3 marks (b) Jackie's parents, Bill and Brenda White, have been married for 60 years. Bill was bor in 1930 and Brenda was born in 1936. Bill had the following income for 2019-20: State pension Private pension Bank and building society interest Dividends 11,250 8,000 3,900 7,450 600568 Taxation 1 Brenda's income consisted of the state pension only (8,400 for 2019-20). (File 1 is continued on the next page) (File 1 continued) File 1 - Jackie White and her parents, Bill and Brenda White (a) Jackie is employed as a sales manager by The Hull Cookie Company Ltd (THCC). Her salary is 38,000 per annum. The following information is also relevant: THCC provided Jackie with a Ford Focus Petrol 5-door hatchback car which she used for private purposes as well as business. The list price is 18,600 and the CO2 emissions are 110g/km. Jackie had the use of this car for the whole of the tax year. Jackie drove 15,000 business miles during 2019-20. She paid for all of the fuel herself and the company reimbursed her for her business mileage at the rate of 35p for every mile. Jackie was a member of the company's private health insurance scheme throughout the year. The premium which THCC paid for her for 2019-20 was 850. In January 2019 THCC made Jackie a loan of 25,000 to fund the deposit when she purchased her own home. THCC charges her 2% interest per annum and the official rate of interest is 2.5%. (1) (ii) Calculate the total value of Jackie's Benefits in Kind for 2019-20. Show your calculations in detail. 7 marks Calculate the amount which Jackie can deduct for tax purposes under the Approved Mileage Allowance Payment (AMAP) scheme. State the amount which Jackie has been over- or under-reimbursed by THCC. 3 marks (b) Jackie's parents, Bill and Brenda White, have been married for 60 years. Bill was bor in 1930 and Brenda was born in 1936. Bill had the following income for 2019-20: State pension Private pension Bank and building society interest Dividends 11,250 8,000 3,900 7,450 600568 Taxation 1 Brenda's income consisted of the state pension only (8,400 for 2019-20). (File 1 is continued on the next page) (File 1 continued)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started