Answered step by step

Verified Expert Solution

Question

1 Approved Answer

File AutoSave off Week 1 4 FinalExamination _ Question 5 - Protected.. Saved to this PC Search Insert Page Layout Formulas Data Review View Help

File

AutoSave

off

WeekFinalExaminationQuestion Protected..

Saved to this PC

Search

Insert Page Layout Formulas Data Review View Help Acrobat

B

vdots

A

B

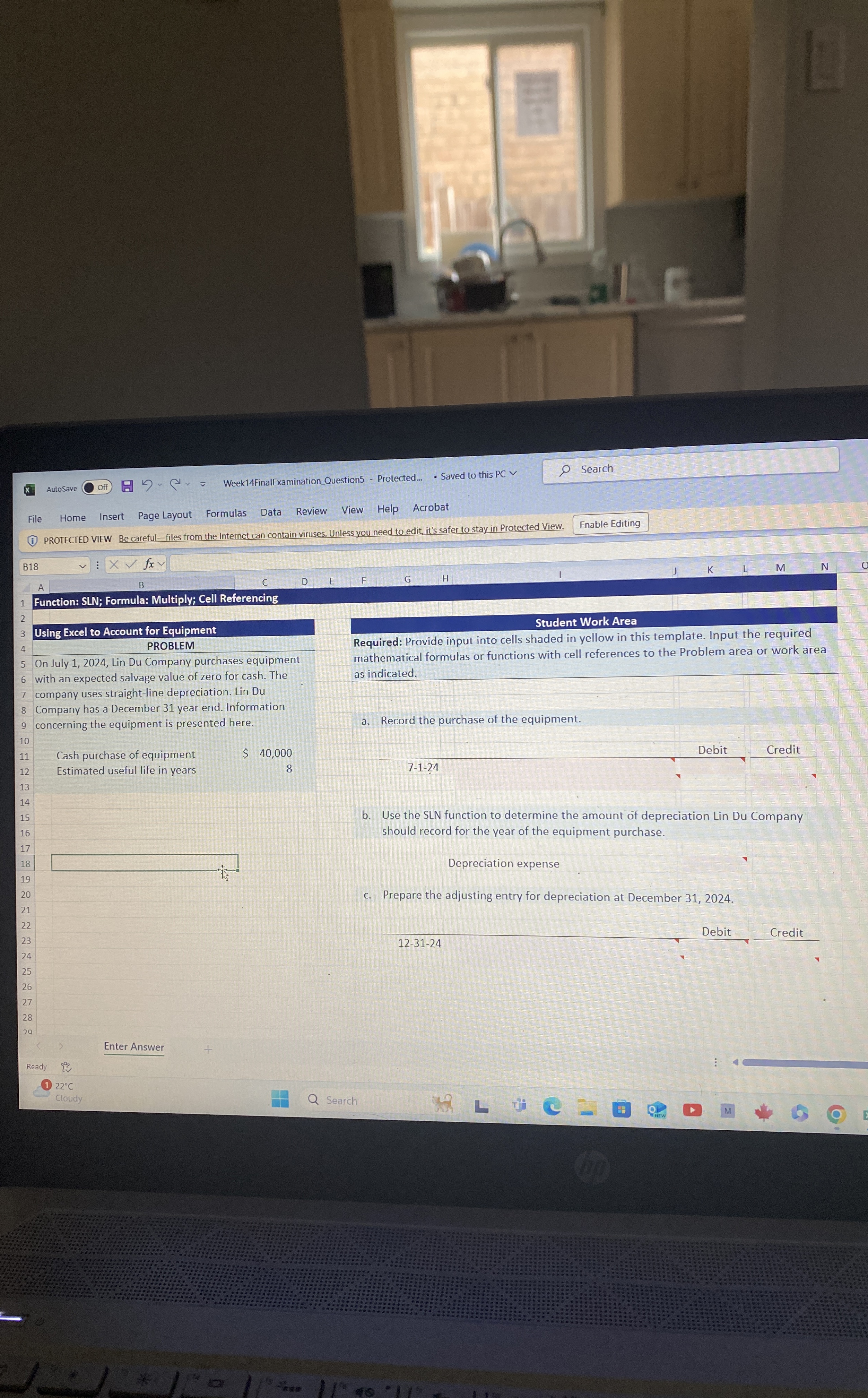

Function: SLN; Formula: Multiply; Cell Referencing

Using Excel to Account for Equipment PROBLEM

Student Work Area

On July Lin Du Company purchases equipment with an expected salvage value of zero for cash. The company uses straightline depreciation. Lin Du Company has a December year end. Information concerning the equipment is presented here.

a Record the purchase of the equipment.

Cash purchase of equipment

$ Credit Required: Provide input into cells shaded in yellow in this template. Input the required mathematical formulas or functions with cell references to the Problem area or work area as indicated.

Estimated useful life in years

J

K

M

N

N

b Use the SLN function to determine the amount of depreciation Lin Du Company should record for the year of the equipment purchase.

Depreciation expense

c Prepare the adjusting entry for depreciation at December

Enter Answer

Cloudy

Search

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started