Answered step by step

Verified Expert Solution

Question

1 Approved Answer

File Form 1 0 4 0 Roy Scherer and Doris Kappelhoff are married to each other and will file a joint 2 0 2 3

File Form

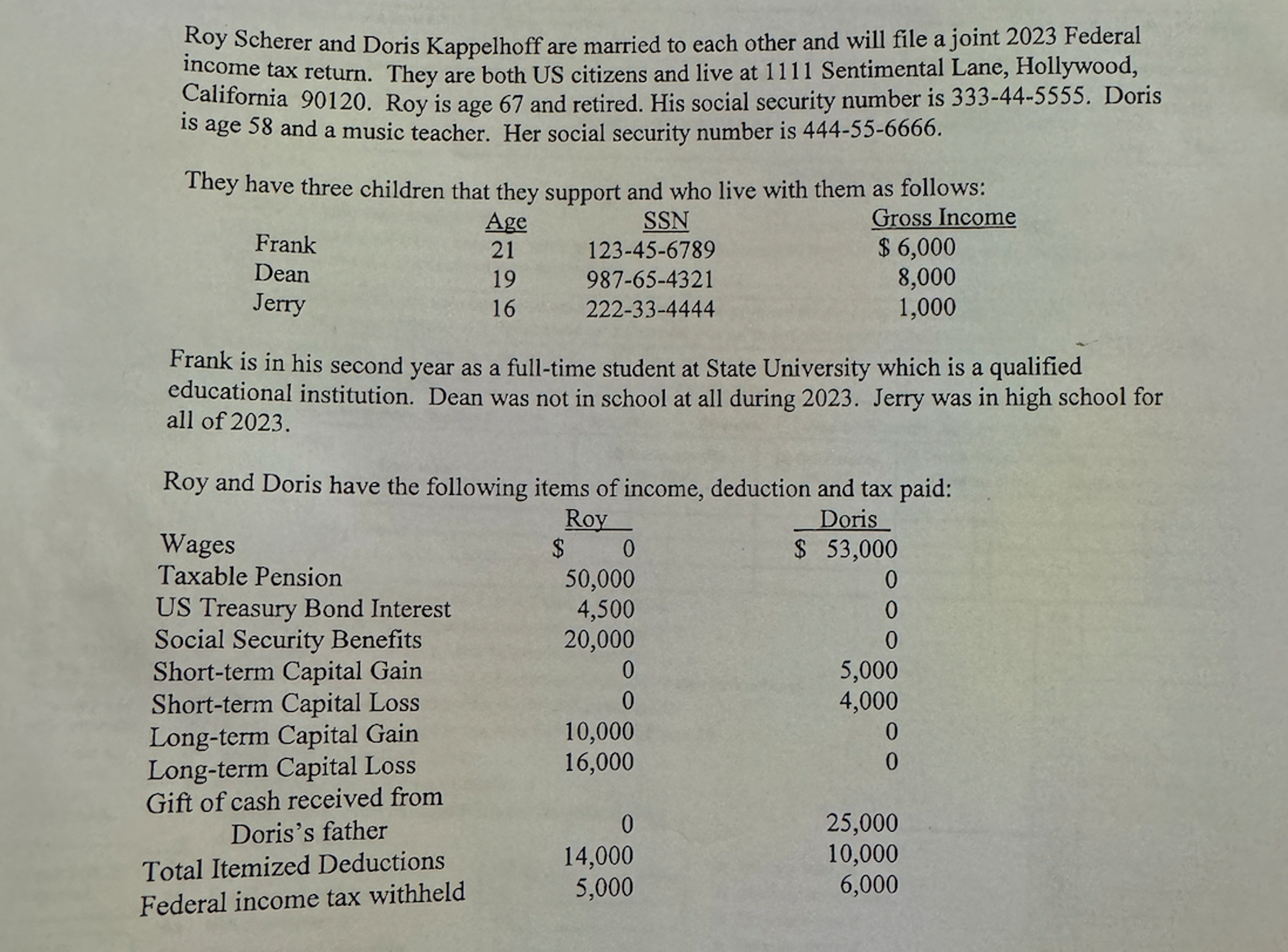

Roy Scherer and Doris Kappelhoff are married to each other and will file a joint Federal

income tax return. They are both US citizens and live at Sentimental Lane, Hollywood,

California Roy is age and retired. His social security number is Doris

is age and a music teacher. Her social security number is

They have three children that they support and who live with them as follows:

Frank is in his second year as a fulltime student at State University which is a qualified

educational institution. Dean was not in school at all during Jerry was in high school for

all of

Roy and Doris have the following items of income, deduction and tax paid:

Wages

Taxable Pension

US Treasury Bond Interest

Social Security Benefits

Shortterm Capital Gain

Shortterm Capital Loss

Longterm Capital Gain

Longterm Capital Loss

Gift of cash received from

Doris's father

Total Itemized Deductions

Federal income tax withheld

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started