Answered step by step

Verified Expert Solution

Question

1 Approved Answer

File Home Insert Draw Page Layout Formulas Data Review View Help Precision Tree Calibri Paste BIU 14 ' General Conditional ormatting %9 Format as

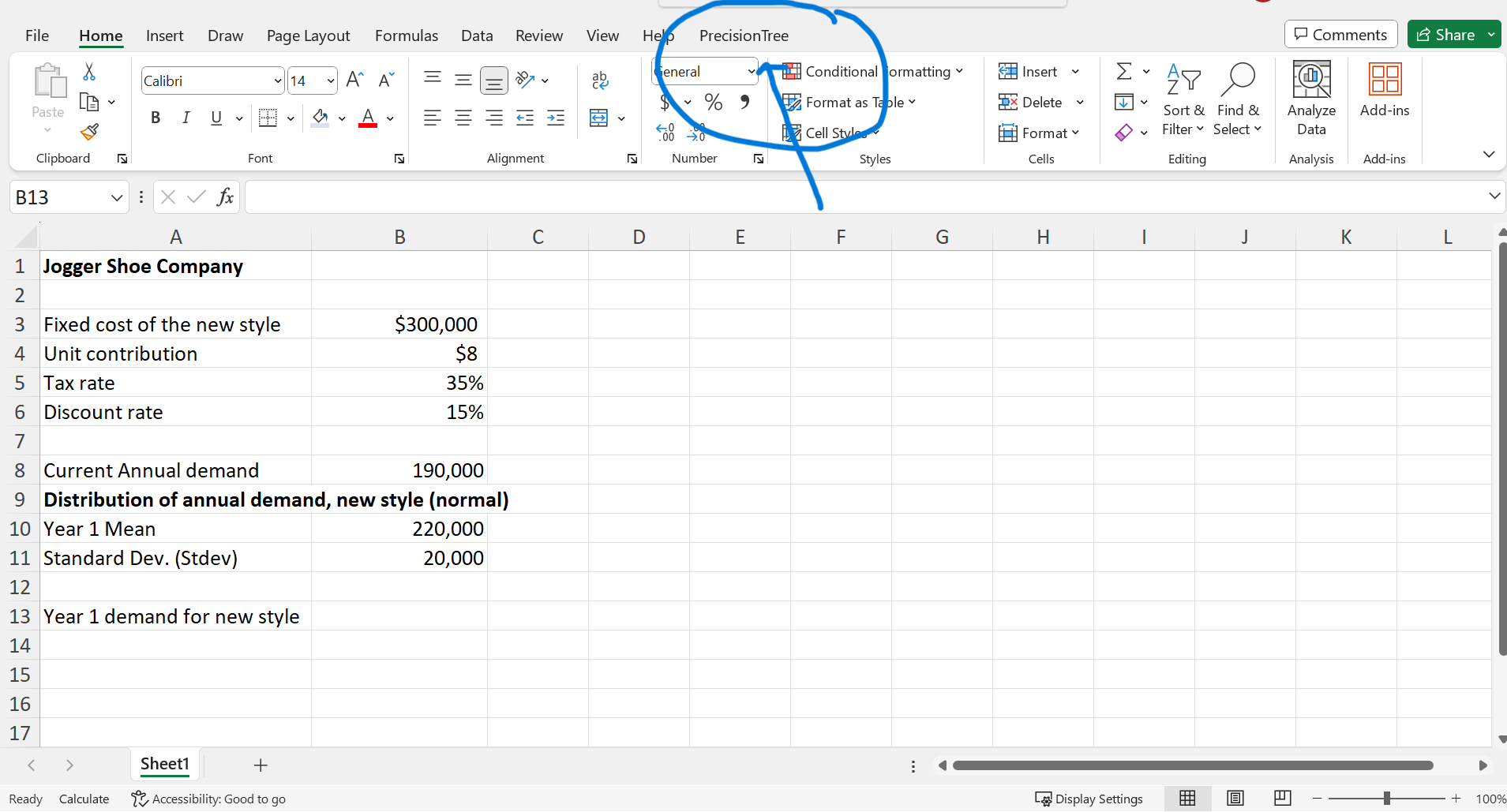

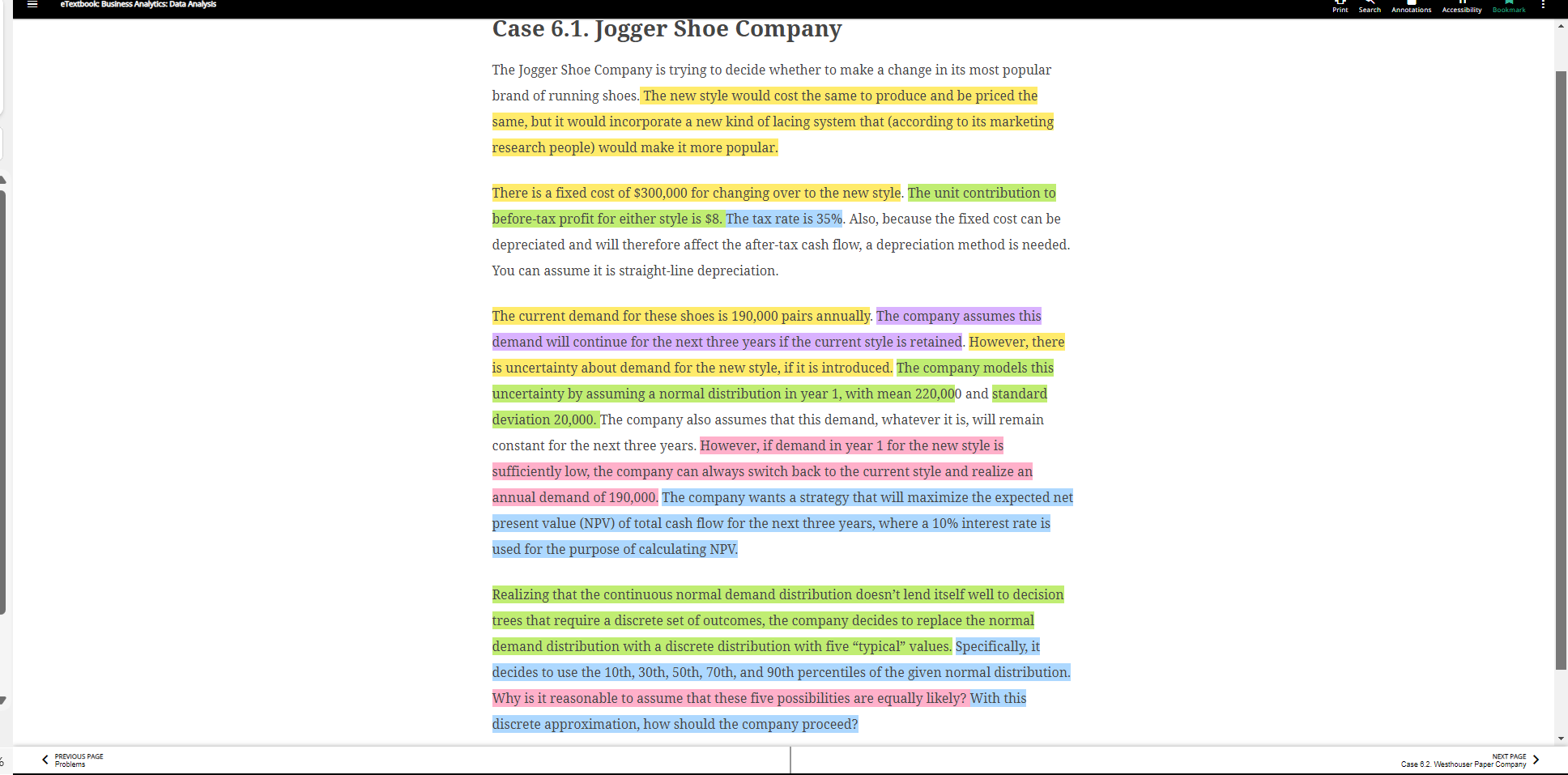

File Home Insert Draw Page Layout Formulas Data Review View Help Precision Tree Calibri Paste BIU 14 ' General Conditional ormatting %9 Format as Table IMI v Clipboard Font Alignment 0 Number Cell Style Styles B13 fx A 1 Jogger Shoe Company 2 3 Fixed cost of the new style 5 Tax rate 4 Unit contribution 6 Discount rate 7 8 Current Annual demand Comments Share Insert x Delete Format Cells Sort & Find & Filter Select Analyze Add-ins Data Editing Analysis Add-ins B D E F G H $300,000 $8 35% 15% 190,000 9 Distribution of annual demand, new style (normal) 10 Year 1 Mean 11 Standard Dev. (Stdev) 12 13 Year 1 demand for new style 14 15 16 17 Ready Calculate Sheet1 + Accessibility: Good to go 220,000 20,000 Display Settings J K L m A + 100% eTextbook Business Analytics: Data Analysis 5. PREVIOUS PAGE Problems Case 6.1. Jogger Shoe Company The Jogger Shoe Company is trying to decide whether to make a change in its most popular brand of running shoes. The new style would cost the same to produce and be priced the same, but it would incorporate a new kind of lacing system that (according to its marketing research people) would make it more popular. There is a fixed cost of $300,000 for changing over to the new style. The unit contribution to before-tax profit for either style is $8. The tax rate is 35%. Also, because the fixed cost can be depreciated and will therefore affect the after-tax cash flow, a depreciation method is needed. You can assume it is straight-line depreciation. The current demand for these shoes is 190,000 pairs annually. The company assumes this demand will continue for the next three years if the current style is retained. However, there is uncertainty about demand for the new style, if it is introduced. The company models this uncertainty by assuming a normal distribution in year 1, with mean 220,000 and standard deviation 20,000. The company also assumes that this demand, whatever it is, will remain constant for the next three years. However, if demand in year 1 for the new style is sufficiently low, the company can always switch back to the current style and realize an annual demand of 190,000. The company wants a strategy that will maximize the expected net present value (NPV) of total cash flow for the next three years, where a 10% interest rate is used for the purpose of calculating NPV. Realizing that the continuous normal demand distribution doesn't lend itself well to decision trees that require a discrete set of outcomes, the company decides to replace the normal demand distribution with a discrete distribution with five "typical" values. Specifically, it decides to use the 10th, 30th, 50th, 70th, and 90th percentiles of the given normal distribution. Why is it reasonable to assume that these five possibilities are equally likely? With this discrete approximation, how should the company proceed? Print Search Annotations Accessibility Bookmark NEXT PAGE Case 6.2. Westhouser Paper Company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started