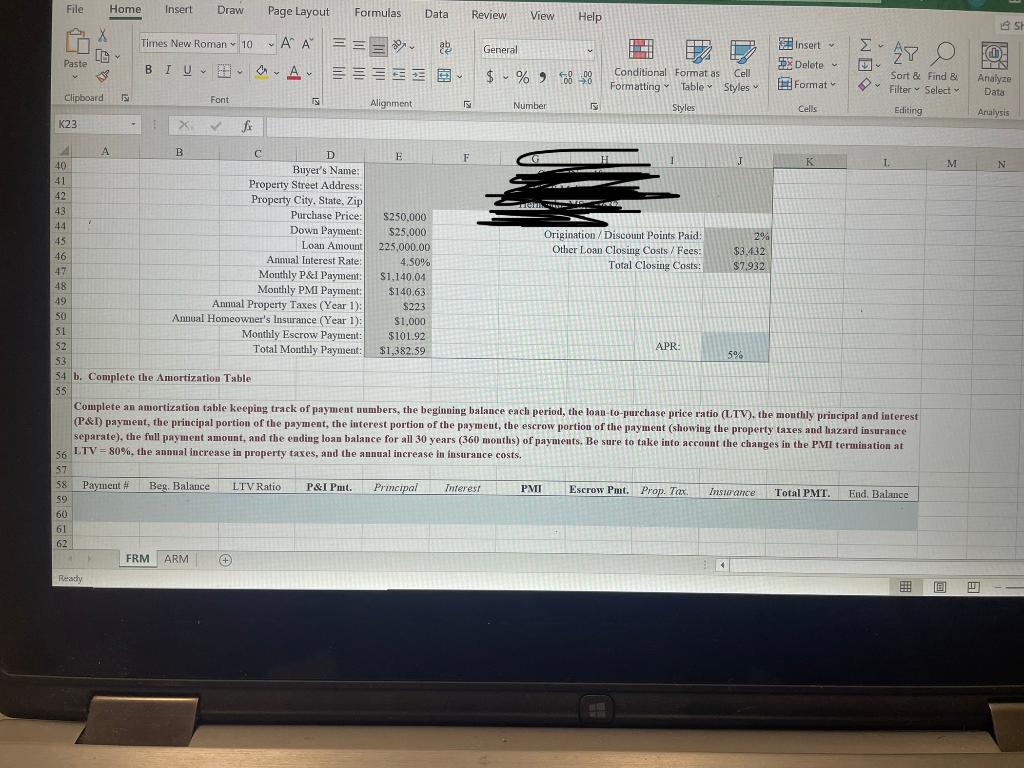

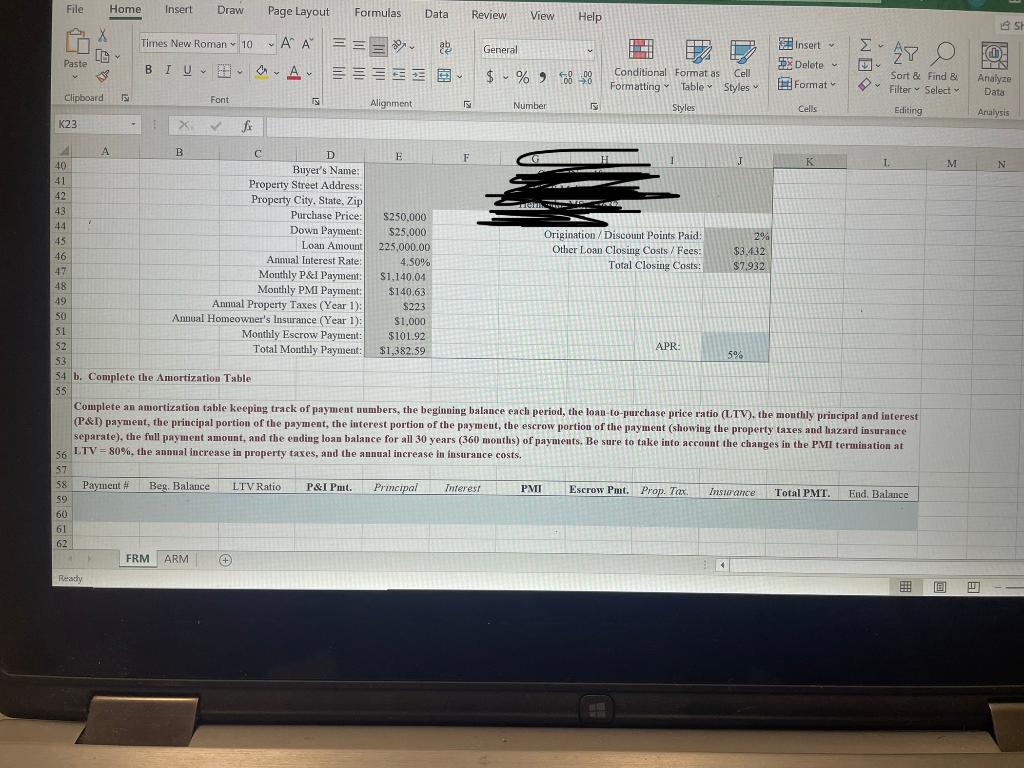

File Home Insert Draw Page Layout Formulas Data Review View Help BSH X LG General Times New Roman - 10-AA== ' ale - - OA A - Insert 5 Delete 27 0 Paste OLIM $ % 98 99 Conditional Format as Cell Formatting Table Styles FO LIS Analyze Data Sort & Find & Filter Select El Format Clipboard Font Is Alignment Number Styles Gells Editing Analysis K23 - Xf J M N A B B D E F K 1. 40 Buyer's Name 41 Property Street Address: 42 Property City State, Zip 43 Purchase Price: S250.000 44 Down Payment: $25.000 Origination / Discount Points Paid: 2% 45 Loan Amount 225,000.00 Other Loan Closing Costs / Fees: $3.432 46 Annual Interest Rate: 4.50% Total Closing Costs: $7.932 47 Monthly P&I Payment: $1.140.04 48 Monthly PMI Payment: $140.63 49 Annual Property Taxes (Year 1): $223 SO Annual Homeowner's Insurance (Year 1): $1.000 51 Monthly Escrow Payment: $101.92 52 APR Total Monthly Payment: $1,382.59 5% 53 54 b. Complete the Amortization Table SS Complete an amortization table keeping track of payment numbers, the beginning balance each period, the loan-to-purchase price ratio (LTV), the monthly principal and interest (P&I) payment, the principal portion of the payment, the interest portion of the payment, the escrow portion of the payment (showing the property taxes and hazard insurance separate), the full payment amount, and the ending loan balance for all 30 years (360 months) of payments. Be sure to take into account the changes in the PMI termination at 56 LTV = 80%, the annual increase in property taxes, and the annual increase in insurance costs. % 57 58 Payment # Beg. Balance LTV Ratio P&I Pmt. Principal interest PMI Escrow Pmt. Prop. Tax Insurance Total PMT. End. Balance 59 60 61 62 FRM ARM + Ready e File Home Insert Draw Page Layout Formulas Data Review View Help BSH X LG General Times New Roman - 10-AA== ' ale - - OA A - Insert 5 Delete 27 0 Paste OLIM $ % 98 99 Conditional Format as Cell Formatting Table Styles FO LIS Analyze Data Sort & Find & Filter Select El Format Clipboard Font Is Alignment Number Styles Gells Editing Analysis K23 - Xf J M N A B B D E F K 1. 40 Buyer's Name 41 Property Street Address: 42 Property City State, Zip 43 Purchase Price: S250.000 44 Down Payment: $25.000 Origination / Discount Points Paid: 2% 45 Loan Amount 225,000.00 Other Loan Closing Costs / Fees: $3.432 46 Annual Interest Rate: 4.50% Total Closing Costs: $7.932 47 Monthly P&I Payment: $1.140.04 48 Monthly PMI Payment: $140.63 49 Annual Property Taxes (Year 1): $223 SO Annual Homeowner's Insurance (Year 1): $1.000 51 Monthly Escrow Payment: $101.92 52 APR Total Monthly Payment: $1,382.59 5% 53 54 b. Complete the Amortization Table SS Complete an amortization table keeping track of payment numbers, the beginning balance each period, the loan-to-purchase price ratio (LTV), the monthly principal and interest (P&I) payment, the principal portion of the payment, the interest portion of the payment, the escrow portion of the payment (showing the property taxes and hazard insurance separate), the full payment amount, and the ending loan balance for all 30 years (360 months) of payments. Be sure to take into account the changes in the PMI termination at 56 LTV = 80%, the annual increase in property taxes, and the annual increase in insurance costs. % 57 58 Payment # Beg. Balance LTV Ratio P&I Pmt. Principal interest PMI Escrow Pmt. Prop. Tax Insurance Total PMT. End. Balance 59 60 61 62 FRM ARM + Ready e