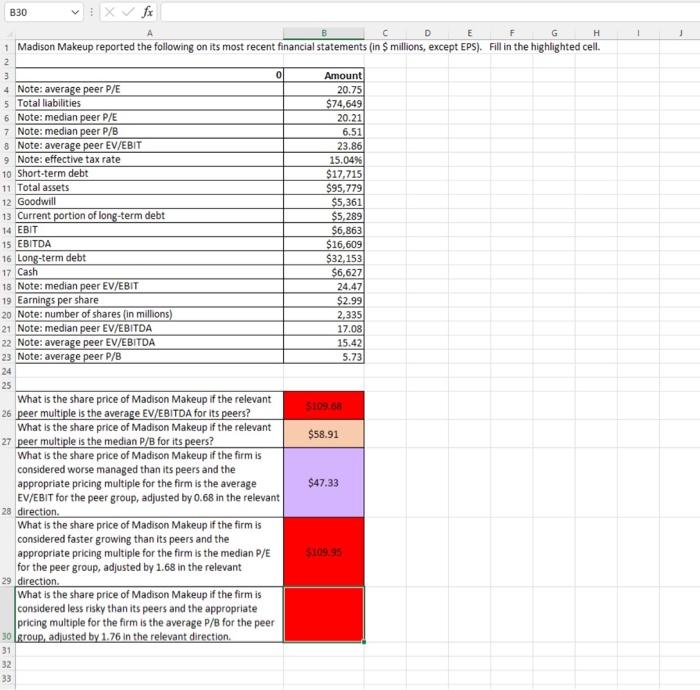

File Home Insert Draw Page Layout Formulas De X Calibri ~ 12 - A A Paste BIU a. A Undo Clipboard 5 Font H28 B Madison Moreported the following on its most recent financial sements in million 0 No. Torsbles Nopter DE Amount 2025 $74649 Noe average EVERT secte Semdb 7 dan 2 50X $575 1973 123 portion long-term de BI EELTON Long term.debt Cash med EET mirghe Northwest Neden DA NEWS 1626 $5.503 $528 $65 34 ge 25 TO 154 20 TU wells the EVED TOA for pride Month Wha Die Moon onth Fm and the WEBT thum Warecen fangst onde fora PO edit dre long for Produit 9 D A D 1 1 0 B30 fx E F G 1 Madison Makeup reported the following on its most recent financial statements (in $ millions, except EPS). Fill in the highlighted cell. 2 3 Amount 4 Note: average peer P/E 20.75 5 Total liabilities $74,649 6 Note: median peer P/E 20.21 7 Note: median peer P/B 6.51 8 Note: average peer EV/EBIT 23.86 9 Note: effective tax rate 15.04% 10 Short-term debt $17,715 11 Total assets $95,779 12 Goodwill $5,361 13 Current portion of long-term debt $5,289 14 EBIT $6,863 15 EBITDA $16,609 16 Long-term debt $32,153 17 Cash $6,627 18 Note: median peer EV/EBIT 24,47 19 Earnings per share $2.99 20 Note: number of shares (in millions) 2,335 21 Note: median peer EV/EBITDA 17.08 22 Note: average peer EV/EBITDA 15.42 23 Note: average peer P/B 5.73 24 25 What is the share price of Madison Makeup if the relevant $109.68 26 peer multiple is the average EV/EBITDA for its peers? What is the share price of Madison Makeup if the relevant $58.91 27 peer multiple is the median P/B for its peers? What is the share price of Madison Makeup if the firm is considered worse managed than its peers and the appropriate pricing multiple for the firm is the average $47.33 EV/EBIT for the peer group, adjusted by 0.68 in the relevant 28 direction. What is the share price of Madison Makeup if the firm is considered faster growing than its peers and the appropriate pricing multiple for the firm is the median P/E $109.95 for the peer group, adjusted by 1.68 in the relevant 29 direction What is the share price of Madison Makeup if the firm is considered less risky than its peers and the appropriate pricing multiple for the firm is the average P/B for the peer so group, adjusted by 1.76 In the relevant direction 31 32 33 a File Home Insert Draw Page Layout Formulas De X Calibri ~ 12 - A A Paste BIU a. A Undo Clipboard 5 Font H28 B Madison Moreported the following on its most recent financial sements in million 0 No. Torsbles Nopter DE Amount 2025 $74649 Noe average EVERT secte Semdb 7 dan 2 50X $575 1973 123 portion long-term de BI EELTON Long term.debt Cash med EET mirghe Northwest Neden DA NEWS 1626 $5.503 $528 $65 34 ge 25 TO 154 20 TU wells the EVED TOA for pride Month Wha Die Moon onth Fm and the WEBT thum Warecen fangst onde fora PO edit dre long for Produit 9 D A D 1 1 0 B30 fx E F G 1 Madison Makeup reported the following on its most recent financial statements (in $ millions, except EPS). Fill in the highlighted cell. 2 3 Amount 4 Note: average peer P/E 20.75 5 Total liabilities $74,649 6 Note: median peer P/E 20.21 7 Note: median peer P/B 6.51 8 Note: average peer EV/EBIT 23.86 9 Note: effective tax rate 15.04% 10 Short-term debt $17,715 11 Total assets $95,779 12 Goodwill $5,361 13 Current portion of long-term debt $5,289 14 EBIT $6,863 15 EBITDA $16,609 16 Long-term debt $32,153 17 Cash $6,627 18 Note: median peer EV/EBIT 24,47 19 Earnings per share $2.99 20 Note: number of shares (in millions) 2,335 21 Note: median peer EV/EBITDA 17.08 22 Note: average peer EV/EBITDA 15.42 23 Note: average peer P/B 5.73 24 25 What is the share price of Madison Makeup if the relevant $109.68 26 peer multiple is the average EV/EBITDA for its peers? What is the share price of Madison Makeup if the relevant $58.91 27 peer multiple is the median P/B for its peers? What is the share price of Madison Makeup if the firm is considered worse managed than its peers and the appropriate pricing multiple for the firm is the average $47.33 EV/EBIT for the peer group, adjusted by 0.68 in the relevant 28 direction. What is the share price of Madison Makeup if the firm is considered faster growing than its peers and the appropriate pricing multiple for the firm is the median P/E $109.95 for the peer group, adjusted by 1.68 in the relevant 29 direction What is the share price of Madison Makeup if the firm is considered less risky than its peers and the appropriate pricing multiple for the firm is the average P/B for the peer so group, adjusted by 1.76 In the relevant direction 31 32 33 a