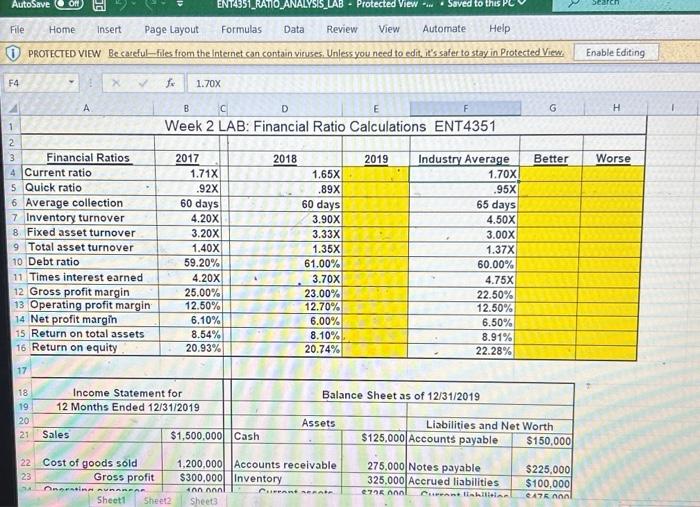

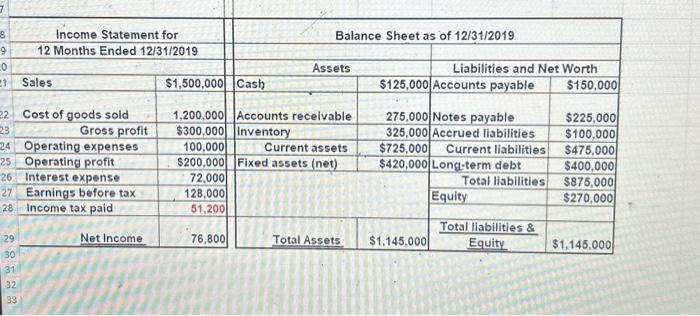

File Home insert Page Layout formulas Data Review View Automate Help (i) PROTECTED VIEW Becareful-files from the internet can contain viruses. Unlessyou need to edit, it's safer to stay in Protected View. Enable Editing F4 f. 1.70x A B C D E G Week 2 LAB: Financial Ratio Calculations ENT4351 \begin{tabular}{|c|c|c|c|c|c|c|} \hline 2 & & & & & & \\ \hline 3 & Financial Ratios & 2017 & 2018 & 2019 & Industry Average & Better \\ \hline 4 & Current ratio & 1.71X & 1.65X & + & 1.70X & \\ \hline 5 & Quick ratio & .92X & .89X & & .95X & \\ \hline 6 & Average collection & 60 days & 60 days & & 65 days & \\ \hline 7 & Inventory turnover & 4.20X & 3.90X & & 4.50x & \\ \hline 8 & Fixed asset turnover & 3.20X & 3.33X & & 3.00X & \\ \hline 9 & Total asset turnover & 1.40X & +2 & + & 1.37X & \\ \hline 10 & Debt ratio & 59.20% & 61.00% & +2 & 60.00% & \\ \hline 11 & Times interest earned & 4.20X & + & & 4.75X & \\ \hline 12 & Gross profit margin & 25.00% & 23.00% & & 22.50% & \\ \hline 13 & Operating profit margin & 12.50% & 12.70% & & 12.50% & \\ \hline 14 & 4 Net profit margin & 6.10% & 6.00% & & 6.50% & \\ \hline 15 & 5 Return on total assets & 8.54% & 8.10% & & 8.91% & \\ \hline 16 & 6 Return on equity & 20.93% & 20.74% & & 22.28% & \\ \hline \multicolumn{7}{|l|}{17} \\ \hline 18 & \multicolumn{2}{|c|}{ Income Statement for } & \multicolumn{4}{|c|}{ Balance Sheet as of 12/31/2019} \\ \hline 19 & \multicolumn{2}{|c|}{12 Months Ended 12/31/2019 } & , & & & \\ \hline 20 & +2 & & Assets & & \multicolumn{2}{|c|}{ Lisbilities and Net Worth } \\ \hline 21 & Sales & $1,500,000 & Cash & $125,000 & Accounts payable & $150,000 \\ \hline & 22 Cost of goods sold & 1,200,000 & Accounts receivable & 275.000 & Notes payable & $225,000 \\ \hline & Gross profit & $300,000 & Inventory & 325.000 & Accrued liabilities & $100,000 \\ \hline & & lnnn & & exas an & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multirow{3}{*}{\multicolumn{3}{|c|}{\begin{tabular}{|l} Income Statement for \\ 12 Months Ended 12/31/2019 \\ 0 \end{tabular}}} & \multicolumn{4}{|c|}{ Balance Sheet as of 12/31/2019} \\ \hline & & & & & & \\ \hline & & & \multicolumn{2}{|l|}{ Assets } & \multicolumn{2}{|c|}{ Liabilities and Net Worth } \\ \hline 1 & Sales & $1,500,000 & Cash & $125,000 & Accounts payable & $150,000 \\ \hline 2. & Cost of goods sold & 1,200,000 & Accounts receivable & 275,000 & Notes payable & $225,000 \\ \hline 3. & Gross profit & $300,000 & Inventory & 325,000 & Accrued liabilities & $100,000 \\ \hline 24 & Operating expenses & 100,000 & Current assets & $725,000 & Current liabilities & $475,000 \\ \hline 5 & Operating profit & $200,000 & Fixed assets (net) & $420,000 & Long-term debt & $400,000 \\ \hline 26 & Interest expense & 72,000 & & & Total liabilities & $875,000 \\ \hline 27 & Earnings before tax & 128,000 & & & Equity & $270,000 \\ \hline & Income tax paid & 51.200 & & & & \\ \hline & Net Income & 76,800 & Total Assets & $1,145,000 & EquityTotalliabilities& & $1,145,000 \\ \hline \end{tabular}