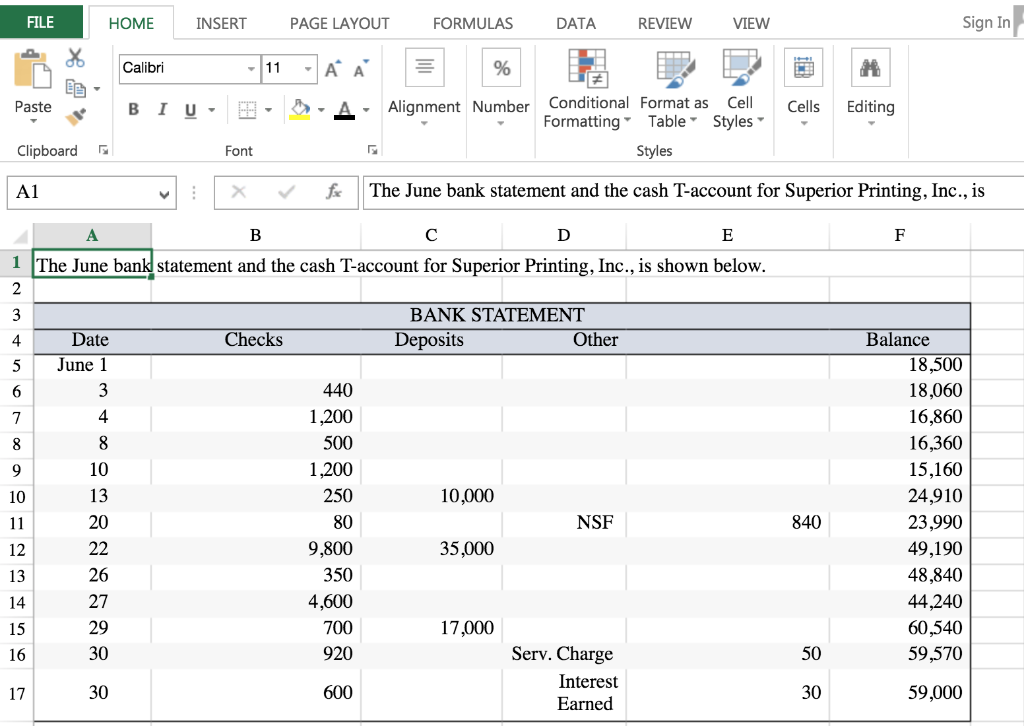

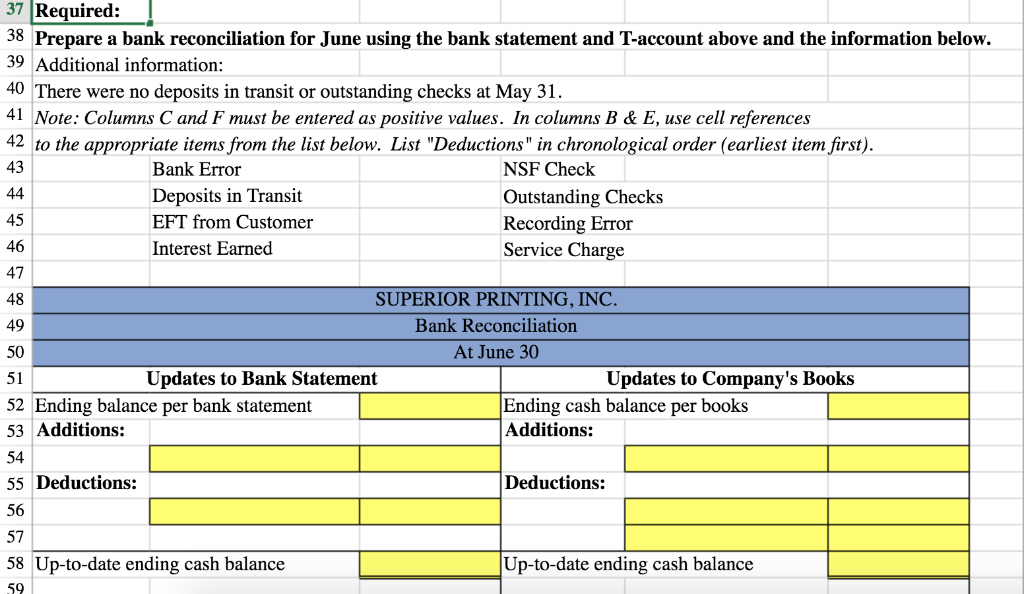

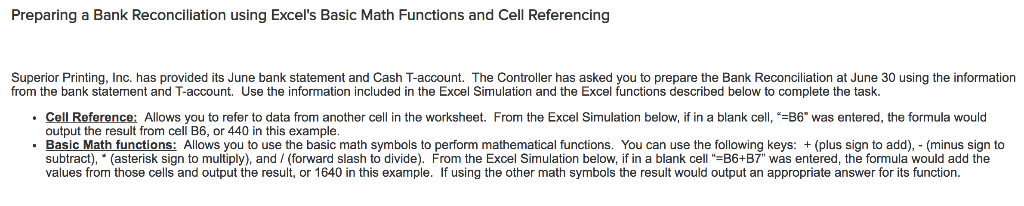

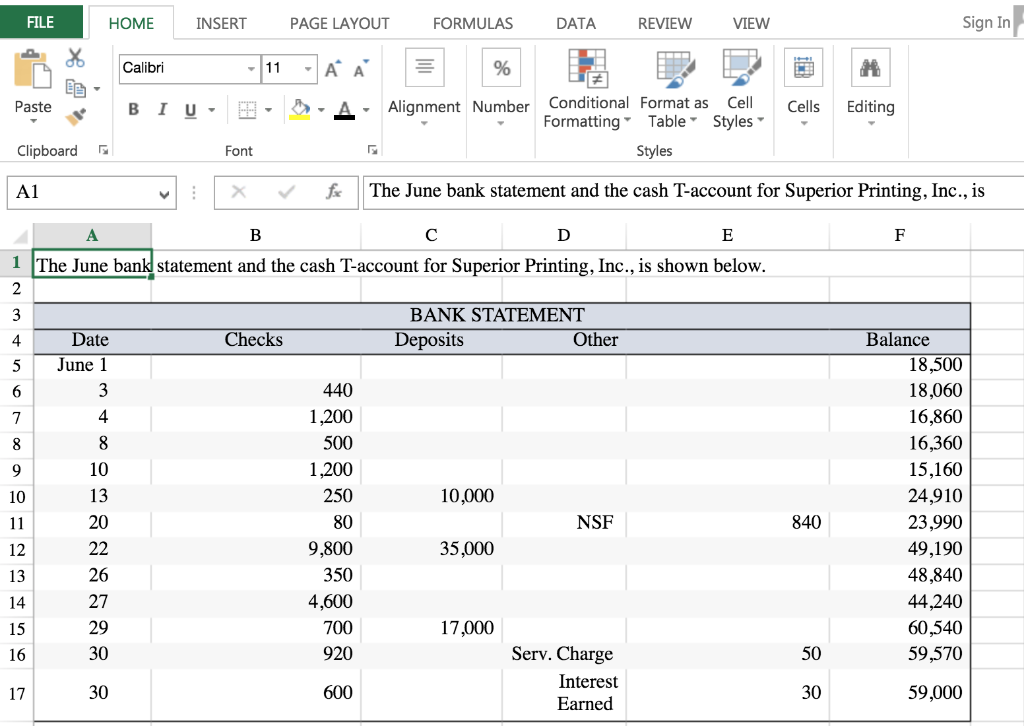

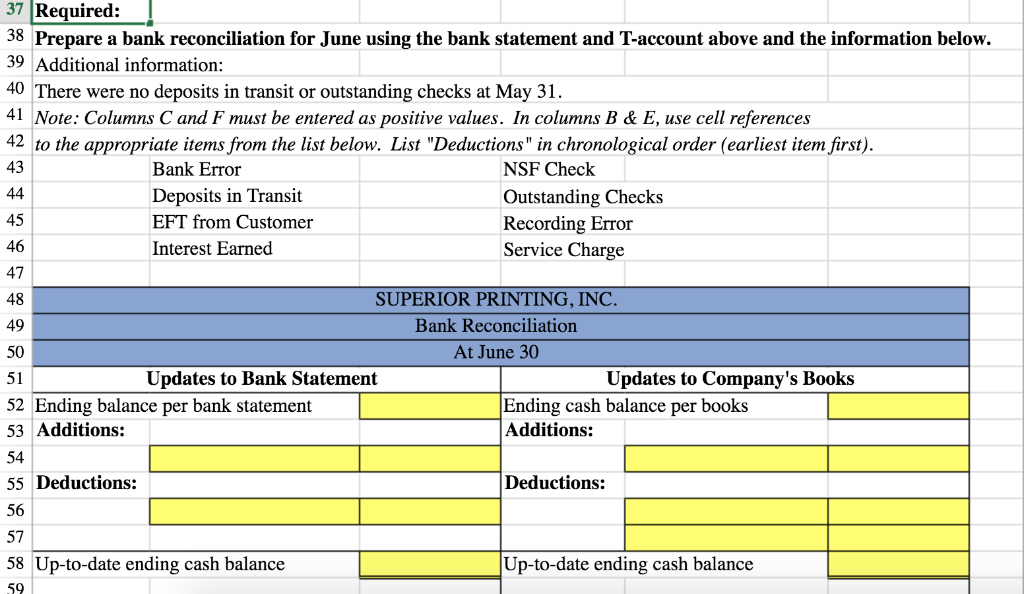

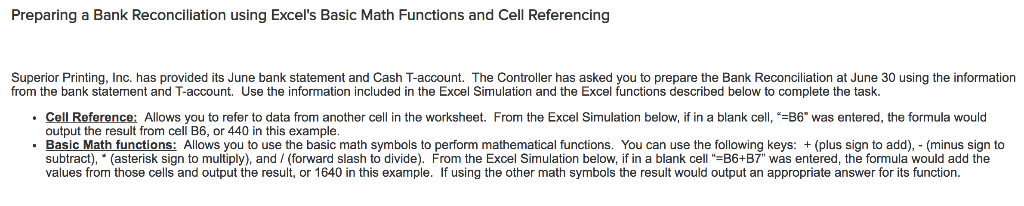

FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri Alignment Number Conditional Format as Cell Paste B 1 u . . Cells Editing . Formatting Table Styles- Clipboard Font Styles The June bank statement and the cash T-account for Superior Printing, Inc., is 1 The June bank statement and the cash T-account for Superior Printing,Inc., is shown below BANK STATEMENT Deposits Date Checks Other Balance 4 5 June 1 1,200 500 1,200 250 80 9,800 350 4,600 700 920 600 18,500 18,060 16,860 16,360 15,160 24,910 23,990 49,190 48,840 44,240 60,540 59,570 4 10 13 20 10,000 NSF 840 35,000 13 14 15 16 26 27 29 30 17,000 Serv. Charge Interest Earned 50 30 30 59,000 37 Required: 38 Prepare a bank reconciliation for June using the bank statement and T-account above and the information below. 39 Additional information: 40 There were no deposits in transit or outstanding checks at May 31. 41 Note: Columns C and F must be entered as positive values. In columns B & E, use cell references 42 to the appropriate items from the list below. List "Deductions" in chronological order (earliest item first) 43 Bank Error Deposits in Transit EFT from Customer Interest Earned NSF Check Outstanding Checks Recording Error Service Charge 45 46 47 48 49 50 51 52 Ending balance per bank statement 53Additions: 54 55 Deductions: 56 57 58 p-to-date ending cash balance 59 SUPERIOR PRINTING, INC Bank Reconciliation At June 30 Updates to Bank Statement Updates to Company's Books Ending cash balance per books Additions: Deductions: Up-to-date ending cash balance Preparing a Bank Reconciliation using Excel's Basic Math Functions and Cell Referencing Superior Printing, Inc. has provided its June bank statement and Cash T-account. The Controller has asked you to prepare the Bank Reconciliation at June 30 using the information from the bank statement and T-account. Use the information included in the Excel Simulation and the Excel functions described below to complete the task Cell Reference: Allows you to refer to data from another cell in the worksheet. From the Excel Simulation below, if in a blank cell, -B6" was entered, the formula would output the result from cell B6, or 440 in this example Basic Math functions: Allows you to use the basic math symbols to perform mathematical functions. You can use the following keys: (plus sign to add), (minus sign to subtract), "(asterisk sign to multiply), and / (forward slash to divide). From the Excel Simulation below, if in a blank cell "-B6+B7" was entered, the formula would add the values from those cells and output the result, or 1640 in this example. If using the other math symbols the result would output an appropriate answer for its function FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri Alignment Number Conditional Format as Cell Paste B 1 u . . Cells Editing . Formatting Table Styles- Clipboard Font Styles The June bank statement and the cash T-account for Superior Printing, Inc., is 1 The June bank statement and the cash T-account for Superior Printing,Inc., is shown below BANK STATEMENT Deposits Date Checks Other Balance 4 5 June 1 1,200 500 1,200 250 80 9,800 350 4,600 700 920 600 18,500 18,060 16,860 16,360 15,160 24,910 23,990 49,190 48,840 44,240 60,540 59,570 4 10 13 20 10,000 NSF 840 35,000 13 14 15 16 26 27 29 30 17,000 Serv. Charge Interest Earned 50 30 30 59,000 37 Required: 38 Prepare a bank reconciliation for June using the bank statement and T-account above and the information below. 39 Additional information: 40 There were no deposits in transit or outstanding checks at May 31. 41 Note: Columns C and F must be entered as positive values. In columns B & E, use cell references 42 to the appropriate items from the list below. List "Deductions" in chronological order (earliest item first) 43 Bank Error Deposits in Transit EFT from Customer Interest Earned NSF Check Outstanding Checks Recording Error Service Charge 45 46 47 48 49 50 51 52 Ending balance per bank statement 53Additions: 54 55 Deductions: 56 57 58 p-to-date ending cash balance 59 SUPERIOR PRINTING, INC Bank Reconciliation At June 30 Updates to Bank Statement Updates to Company's Books Ending cash balance per books Additions: Deductions: Up-to-date ending cash balance Preparing a Bank Reconciliation using Excel's Basic Math Functions and Cell Referencing Superior Printing, Inc. has provided its June bank statement and Cash T-account. The Controller has asked you to prepare the Bank Reconciliation at June 30 using the information from the bank statement and T-account. Use the information included in the Excel Simulation and the Excel functions described below to complete the task Cell Reference: Allows you to refer to data from another cell in the worksheet. From the Excel Simulation below, if in a blank cell, -B6" was entered, the formula would output the result from cell B6, or 440 in this example Basic Math functions: Allows you to use the basic math symbols to perform mathematical functions. You can use the following keys: (plus sign to add), (minus sign to subtract), "(asterisk sign to multiply), and / (forward slash to divide). From the Excel Simulation below, if in a blank cell "-B6+B7" was entered, the formula would add the values from those cells and output the result, or 1640 in this example. If using the other math symbols the result would output an appropriate answer for its function