filed as Single

salary 46,391

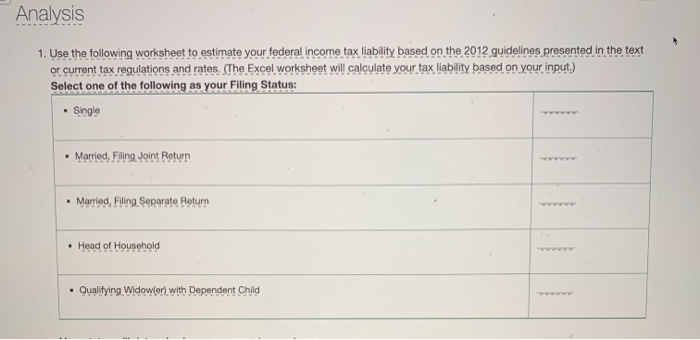

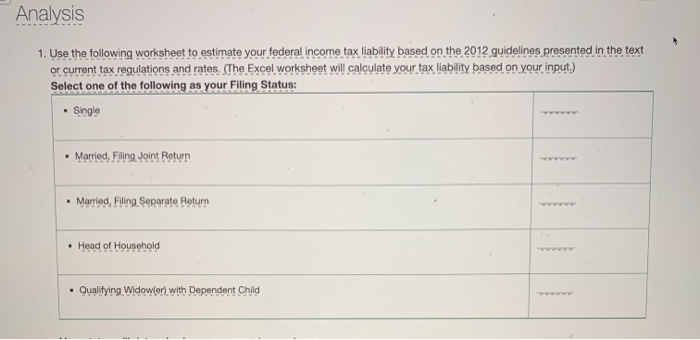

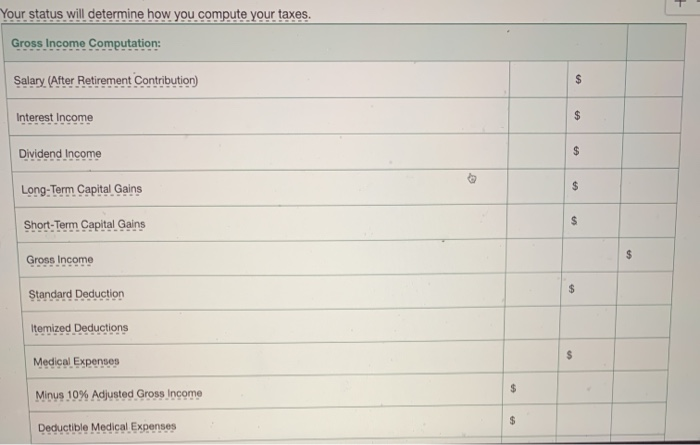

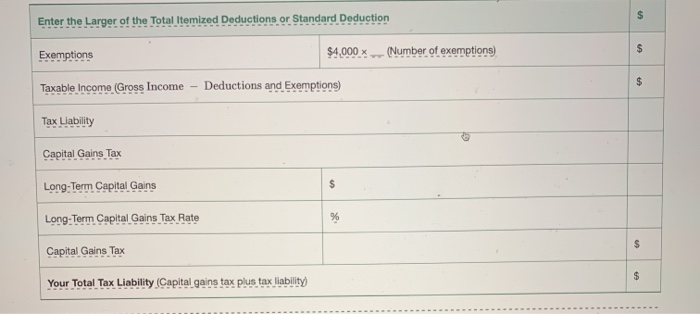

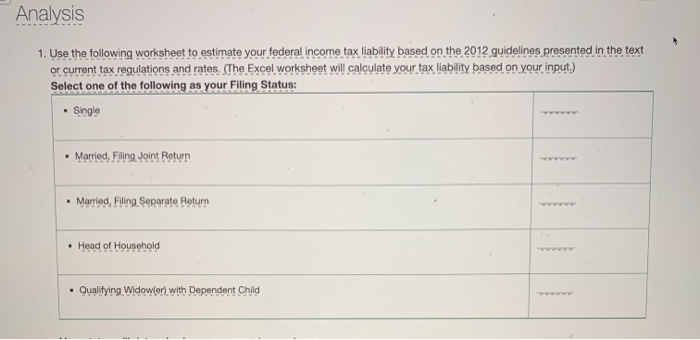

Analysis 1. Use the following worksheet to estimate your federal income tax liability based on the 2012 guidelines presented in the text or current tax regulations and rates. (The Excel worksheet will calculate your tax liability based on your input.) Select one of the following as your Filing Status: Single Married, Fling Joint Return . Married, Filling Separate Return Head of Household . Qualifying Widower with Dependent Child Your status will determine how you compute your taxes. Gross Income Computation: Salary(After Retirement Contribution) $ Interest Income $ Dividend Income $ D Long-Term Capital Gains $ Short-Term Capital Gains $ $ Gross Income $ Standard Deduction itemized Deductions $ Medical Expenses $ Minus 10% Adjusted Gross Income $ Deductible Medical Expenses $ Enter the Larger of the Total Itemized Deductions or Standard Deduction Exemptions $4,000 $ (Number of exemptions) Taxable income (Gross Income Deductions and Exemptions) $ Tax Liability Capital Gains Tax Long-Term Capital Gains $ Long-Term Capital Gains Tax Rate $ Capital Gains Tax $ Your Total Tax Liability Capital gains tax plus tax liability Analysis 1. Use the following worksheet to estimate your federal income tax liability based on the 2012 guidelines presented in the text or current tax regulations and rates. (The Excel worksheet will calculate your tax liability based on your input.) Select one of the following as your Filing Status: Single Married, Fling Joint Return . Married, Filling Separate Return Head of Household . Qualifying Widower with Dependent Child Your status will determine how you compute your taxes. Gross Income Computation: Salary(After Retirement Contribution) $ Interest Income $ Dividend Income $ D Long-Term Capital Gains $ Short-Term Capital Gains $ $ Gross Income $ Standard Deduction itemized Deductions $ Medical Expenses $ Minus 10% Adjusted Gross Income $ Deductible Medical Expenses $ Enter the Larger of the Total Itemized Deductions or Standard Deduction Exemptions $4,000 $ (Number of exemptions) Taxable income (Gross Income Deductions and Exemptions) $ Tax Liability Capital Gains Tax Long-Term Capital Gains $ Long-Term Capital Gains Tax Rate $ Capital Gains Tax $ Your Total Tax Liability Capital gains tax plus tax liability